CoinDesk Indices, BNB, Binance, Coin burn, Bnb chain, Crypto Long & Short, CoinDesk Indices, Opinion Many traders dismiss BNB as merely “the Binance coin,” however that designation fails to acknowledge the potential arising from its broader worth unlock, says Osprey Funds’ Matt Gerics.

Many traders dismiss BNB as merely “the Binance coin,” however that designation fails to acknowledge its broader worth unlocks. While BNB was initially launched because the native token of the Binance Chain (now the BNB Smart Chain), and its early token burns have been tied to Binance’s quarterly income, BNB is evolving right into a decentralized asset with a number of use circumstances and causes for financial worth.

While BNB could take pleasure in some worth accrual from the enlargement of Binance, its token provide mannequin and the event of the BNB Chain provide two unbiased sources of worth. First, BNB serves as a retailer of worth by means of quarterly and fixed-ratio BNB burning mechanisms. Second, it powers good contract performance through the BNB Smart Chain, which has change into a rising hub for DeFi and gaming functions.

You’re studying Crypto Long & Short, our weekly e-newsletter that includes insights, information and evaluation for the skilled investor. Sign up here to get it in your inbox each Wednesday.

Deflationary retailer of worth

BNB’s burn mechanism differentiates it from virtually each different cryptocurrency. Let’s examine BNB to BTC, ETH and SOL:

BTC: Inflationary, however with a capped provide.

ETH: Inflationary or deflationary, resulting from unpredictable burn charges tied to community exercise.

SOL: Inflationary, beginning at 8% and reducing over time.

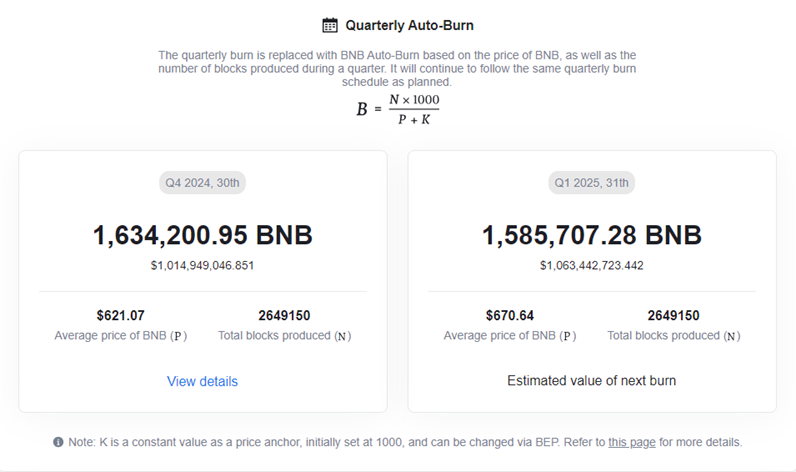

BNB’s burn course of is exclusive; it removes tokens from circulation primarily based on the variety of blocks produced and common value every quarter, in addition to having a set ratio of the fuel charges amassed in every block. Nearly 60 million BNB (~$35 billion at present costs) has been burned up to now, decreasing the circulating provide to 142 million. The final quarterly burn alone wiped $1 billion price of BNB from existence — a 4.6% annualized deflation price!

Bitcoin at present instructions probably the most consideration as a retailer of worth asset due to its first mover benefit, market cap and a strong, decentralized community of miners. Any change within the Bitcoin code (i.e., altering the goal provide) would should be agreed upon by nearly all of the community, which might show exceedingly troublesome with bitcoin’s stage of decentralization. Investors ought to word that the BNB burn has already been modified from its authentic whitepaper so there isn’t a assure it received’t be modified additional. This is the tradeoff with an aggressive token burning technique.

Source: bnbburn.info

BNB Chain – a modular L1 ecosystem

BNB’s subsequent evolution is the BNB One Chain Initiative, which goals to unify a multichain ecosystem constructed for Web3 interoperability:

BNB Smart Chain (BSC): A quick, low-cost, EVM-compatible DeFi hub.

BNB Greenfield: A decentralized storage community for real-time, monetizable information.

opBNB: An ultra-low-fee (sub-$0.0001 per transaction) high-throughput rollup, constructed for on-chain gaming and high-demand dApps.

With a number of headwinds going through Ethereum (specifically layer 2 fragmentation and inflationary considerations), BNB’s One Chain Initiative offers a viable different to builders and web3 functions.

Now, it isn’t all rainbows and butterflies with BNB. Investors ought to nonetheless take into account the chance that their decentralization push is barely a advertising stunt, in addition to the continuing regulatory battles over Binance’s know-your-customer (KYC) coverage and different points.

With Richard Teng now at the helm of the exchange, Binance and BNB’s subsequent chapter will probably be centered on compliance and dealing with regulators/exchanges to extend entry for the BNB token. With BNB largely unavailable on U.S. exchanges, the token has nonetheless achieved a ~$100B market cap with worldwide help alone. As U.S. crypto rules ease, BNB’s re-entry into U.S. markets may very well be a major catalyst for additional progress.

Disclosures:

Osprey Funds manages the Osprey BNB Chain Trust (OBNB), a single-asset Trust offering publicity to BNB and publicly quoted on the OTCQX Market. Investors can be taught extra and browse the Trust prospectus at ospreyfunds.io. Matt doesn’t personal any BNB or OBNB.

CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data Read More