Policy A fast recap of all of the SEC circumstances which were dropped and paused over the previous two months.

The U.S. Securities and Exchange Commission has dropped or paused over a dozen ongoing circumstances (and misplaced one) since U.S. President Donald Trump retook workplace simply over two months in the past and appointed Commissioner Mark Uyeda as appearing chair.

You’re studying State of Crypto, a CoinDesk publication wanting on the intersection of cryptocurrency and authorities. Click here to join future editions.

One left?

The narrative

The U.S. Securities and Exchange Commission seems to have closed virtually all of its excellent crypto-related circumstances — not less than the publicly disclosed ones — within the final two months since Mark Uyeda took over as appearing chair of the company. In most of the courtroom filings, the SEC argued that it wants to tug these circumstances whereas the regulator’s new crypto process pressure reassesses how precisely it applies securities legal guidelines to digital property, although in not less than a few of these circumstances the SEC is leaving itself no recourse to sue once more ought to it discover some cryptos from beforehand lively fits are certainly securities.

Why it issues

TKTK

Breaking it down

Ripple: Ripple introduced it had reached an settlement with the SEC to drop each the SEC’s attraction of a federal decide’s 2023 ruling and RIpple’s cross-appeal. Ripple will obtain again $75 million of the $125 million high quality it was assessed by a federal decide. The settlement doesn’t but look like on the general public courtroom docket.

Coinbase: Coinbase introduced final month it had reached an settlement with the SEC to drop the regulator’s ongoing case in opposition to it. The SEC filed to withdraw the case with prejudice — that means it can not carry the identical costs once more — and a decide signed off on the withdrawal on the finish of February. The SEC alleged that Solana (SOL), Cardano (ADA), Polygon (MATIC), Sandbox (SAND), Filecoin (FIL), Axie Infinity (AXS), Chiliz (CHZ), Flow (FLOW), Internet Computer (ICP), Near (NEAR), Voyager (VGX), Dash (DASH) and Nexo (NEXO) all gave the impression to be traded as securities in its preliminary lawsuit.

ConsenSys: The SEC mentioned it will drop its case in opposition to ConsenSys over the MetaMask pockets, CEO Joe Lubin mentioned final month, and a joint stipulation dismissing the case with prejudice was filed on March 27. A courtroom docket entry dated March 28 mentioned the civil case was terminated.

Kraken: The SEC instructed Kraken it will drop its case in opposition to the change alleging it violated securities legal guidelines and commingled buyer and company funds earlier this month. A joint stipulation dismissing the case was filed on March 27, although a decide doesn’t seem to have signed off simply but.

Cumberland DRW: The SEC instructed Cumberland DRW it will drop its case alleging it was appearing as an unregistered securities supplier earlier this month. The SEC and Cumberland filed a motion to stay proceedings on March 18, saying “the parties have agreed in principle to dismiss this litigation with prejudice” however wanted three weeks to work out the small print. The decide overseeing the case granted the movement, ordering the events to file a joint standing report by April 8 until the dismissal submitting is on the docket by then.

Pulsechain: A federal decide dismissed the SEC’s swimsuit in opposition to Pulsechain and HEX, saying the company didn’t plausibly present that the undertaking focused U.S. traders and that it had jurisdiction over the case. The SEC has until April 21 to file an amended criticism.

Immutable: The SEC instructed Immutable Labs it closed its investigation into the Web3 gaming agency, it mentioned earlier this week.

Yuga Labs: The SEC closed its investigation into Yuga Labs, the NFT agency mentioned earlier this month.

Robinhood: The SEC instructed buying and selling platform Robinhood it closed its investigation into the corporate, it mentioned late final month.

OpenSea: The SEC closed its investigation into OpenSea, the NFT market’s CEO mentioned late final month.

Uniswap: The SEC closed its investigation into Uniswap Labs, the agency introduced final month.

Gemini: The SEC closed its investigation into Gemini, co-founder Cameron Winklevoss mentioned final month.

Binance: The SEC and Binance (alongside the assorted affiliated events/co-defendants) filed to pause the regulator’s case for 60 days in early February. The decide overseeing the case paused the case until April 14, ordering the events to file a joint standing report by then. The SEC alleged commingling violations alongside securities regulation violations, in addition to permitting U.S. individuals to commerce on the worldwide platform.

Tron Foundation: The SEC and the Tron Foundation (alongside the assorted affiliated events/co-defendants named) filed to pause the SEC’s case for 60 days in late February. The decide overseeing the case granted the motion, which ought to carry the brand new deadline to round April 27 (a Sunday). The SEC alleged market manipulation and fraud, alongside securities law-related registration violations.

Crypto.com: Crypto.com introduced on March 27 that the SEC had closed its case into the crypto change and wouldn’t take any enforcement motion. Trump Media, the corporate behind Truth Social, is also partnering with the exchange to situation exchange-traded merchandise.

Unicoin: Unicoin seems to be the one publicly-disclosed ongoing investigation by the SEC, although its CEO has requested the company to shut that investigation as properly.

HAWK: On Thursday, Haliey Welch, whose “HAWK” token appeared to pump and dump (falling from a $491 million market cap to below $100 million inside minutes) when it launched final yr, told TMZ that the SEC had closed its investigation into her as properly.

Stories you might have missed

Trump-Backed World Liberty Financial Confirms Dollar Stablecoin Plans With BitGo: World Liberty Financial is launching USD1, a stablecoin, on the Ethereum and BNB Chain networks.

Trump Media Wants to Partner with Crypto.Com for ETP Issuance: Trump Media, the corporate behind the Truth Social social community, needs to launch crypto exchange-traded merchandise with Crypto.com.

U.S. House Stablecoin Bill Poised to Go Public, Lawmaker Atop Crypto Panel Says: The House’s newest stablecoin invoice draft extra intently aligns with the Senate’s GENIUS Bill, which handed out of committee already, Rep. Bryan Steil mentioned on the Digital Chamber’s annual convention.

Trump-Tied World Liberty Financial Pitches Its Stablecoin in Washington With Don Jr.: Donald Trump Jr. and different World Liberty Financial leaders promoted its new stablecoin on the Chamber occasion.

SEC Drops Investigation into Web3 Gaming Firm Immutable: The U.S. Securities and Exchange Commission has dropped one other investigation, this time into Immutable.

Shuttered Russian Crypto Exchange Garantex Rebrands as Grinex, Global Ledger Finds: Garantex is an change sanctioned by the U.S. and seized by worldwide regulation enforcement officers. That doesn’t seem to have stopped a few of its operators from rebranding it as Grinex and launching anew, primarily based on on-chain and off-chain knowledge.

Crypto Bill to Combat Illicit Activity Gets New Push After Passing U.S. House in 2024: Reps. Zach Nunn and Jim Himes have reintroduced the Financial Technology Protection Act.

President Trump Pardons Arthur Hayes, 2 Other BitMEX Co-Founders: U.S. President Donald Trump pardoned Arthur Hayes, Ben Delo and Sam Reed, the co-founders of BitMEX. The three had all beforehand pleaded responsible to Bank Secrecy Act violations and have been sentenced to parole.

Sei Foundation Explores Buying 23andMe to Put Genetic Data on Blockchain: This headline is self-explanatory, although I’d like to know extra about what it will imply to place people’ genetic knowledge on an immutable public ledger.

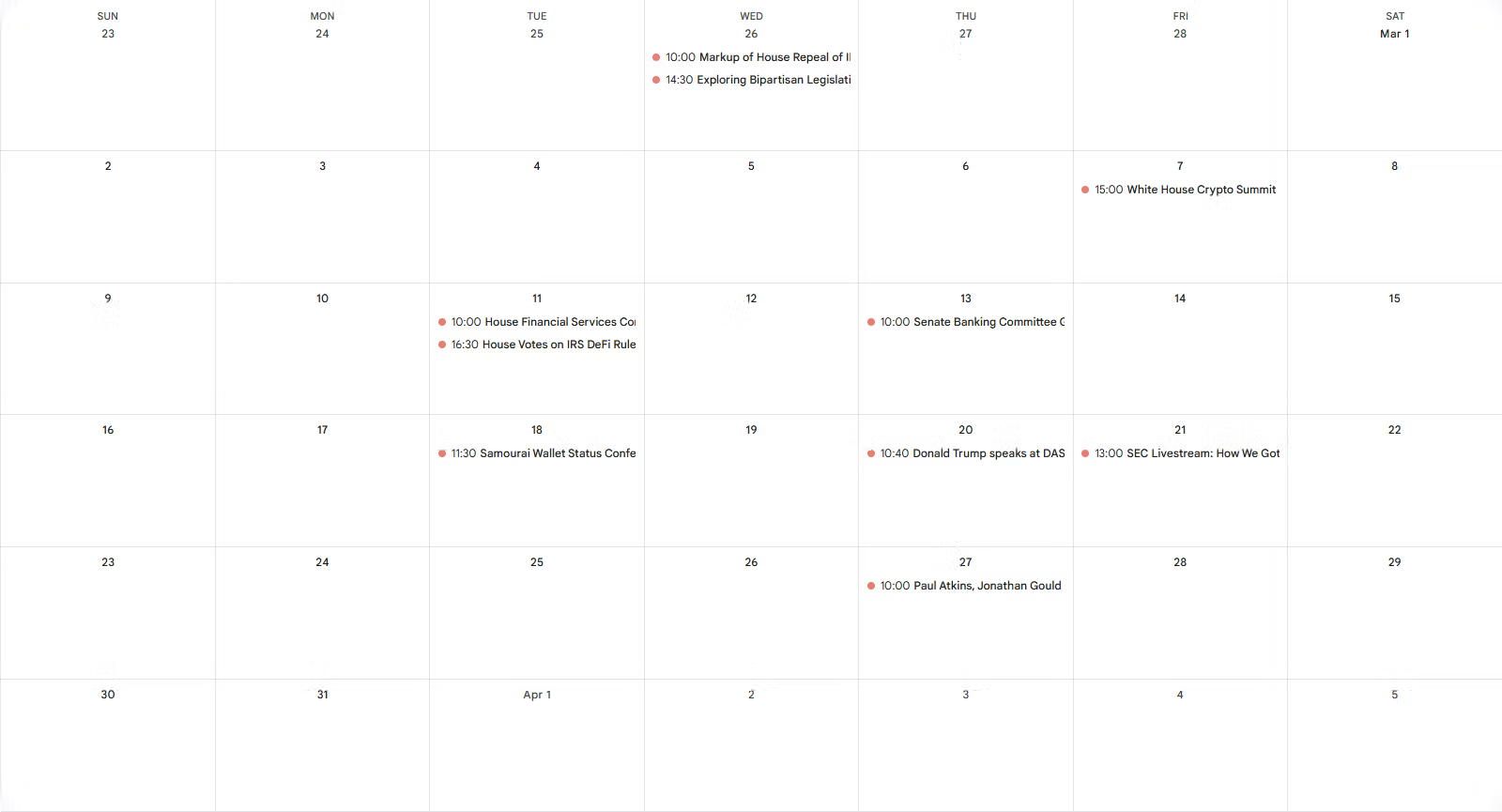

This week

Thursday

14:00 UTC (10:00 a.m. ET) Paul Atkins and Jonathan Gould (amongst others) confronted the Senate Banking Committee for his or her affirmation listening to. Outside of Sen. John Kennedy (R-La.) asking questions on Sam Bankman-Fried’s mother and father (and some different passing references to FTX’s collapse), there were no crypto-related questions.

Elsewhere:

(The Atlantic) Jeffrey Goldberg, the editor-in-chief of The Atlantic, mentioned he was inadvertently added to a Signal group chat by National Security Advisor Michael Waltz, which contained different key figures within the Trump Administration and the place Defense Secretary Pete Hegseth shared particulars about an imminent strike on Yemen hours earlier than it occurred. Middle East envoy (and World Liberty Financial investor) Steve Witkoff confirmed that he was a part of the group via considered one of his “personal devices,” fairly than his government-issued safe cellphone. Tulsi Gabbard, the director of nationwide intelligence and John Ratcliffe, the director of the CIA, said the messages were not classified, and The Atlantic published them.

(Wired) A Venmo account named “Michael Waltz” that Wired stories was “connected to accounts bearing the names of people closely associated with him” left its transactions public till after the information group reached out about it.

(The Verge) U.S. President Donald Trump fired Federal Trade Commissioners Alvaro Bedoya and Rebecca Slaughter, each Democrats, reportedly in violation of a Supreme Court precedent. Both have since sued Trump contesting the firings.

(The Washington Post) The IRS is projecting it can gather $500 billion much less in 2025 than 2024, the Post reported.

(The New York Times) “SpaceX is positioning itself to see billions of dollars in new federal contracts or other support,” the Times reported.

(The Washington Post) Plainclothes officers arrested Tufts University Ph.D pupil Rumeysa Ozturk and relocated her to a Louisiana facility. The Department of Homeland Security mentioned she “engaged in activities in support of Hamas,” however has not revealed any proof supporting the declare. Secretary of State Marco Rubio mentioned he canceled Ozturk’s visa as a result of she was “creating a ruckus,” however doesn’t seem to allege she dedicated any crimes.

If you’ve obtained ideas or questions on what I ought to talk about subsequent week or another suggestions you’d wish to share, be happy to electronic mail me at nik@coindesk.com or discover me on Bluesky @nikhileshde.bsky.social.

You also can be a part of the group dialog on Telegram.

See ya’ll subsequent week!

CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data Read More