Markets, Bitcoin, Volatility Market contributors anticipate heightened exercise, influenced by international financial traits.

In case you have not seemed, it is Tuesday. For bitcoin merchants, that might imply some massive worth swings.

According to Amberdata, Tuesdays have been probably the most unstable day of the week to this point in 2025, significantly over the previous month, the place realized volatility has averaged 82.

Realized volatility measures the usual deviation of returns from the market’s imply return, reflecting previous worth fluctuations. In distinction, implied volatility represents the market’s expectations of future worth swings.

Amberdata additionally checked out month-to-month volatility and because the begin of 2024, March has had the best at 67.

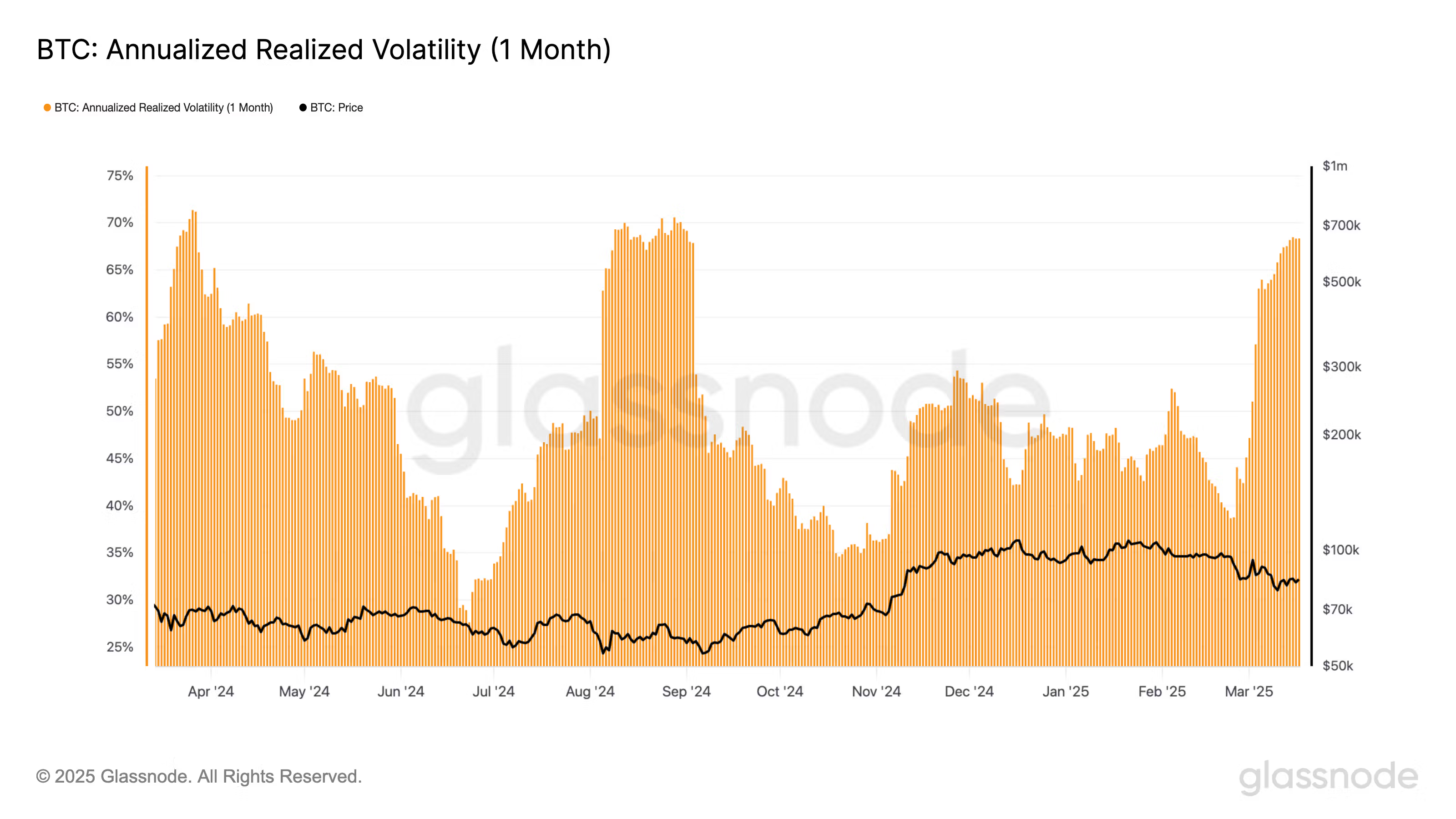

Amid bitcoin’s current 30% drawdown from its all-time excessive, its one-month annualized each day realized volatility practically hit 70 versus a median of about 50. The solely two different situations of comparable volatility spikes occurred in March 2024, following one other run to a report excessive (then $73,000), and in August 2024, through the yen carry commerce unwind, in accordance with Glassnode information.

Disclaimer: Parts of this text have been generated with the help from AI instruments and reviewed by our editorial workforce to make sure accuracy and adherence to our standards. For extra data, see CoinDesk’s full AI Policy.

CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data Read More