Markets, Securitize, apollo world administration, Tokenized Assets, News The providing goals to make real-world asset tokens aggressive with stablecoins for DeFi yield methods, Securitize’s Reid Simon mentioned.

DUBAI, UAE — Tokenization agency Securitize and decentralized finance (DeFi) specialist Gauntlet are planning to deliver a tokenized model of Apollo’s credit score fund to DeFi, a notable step in embedding real-world belongings into the crypto ecosystem.

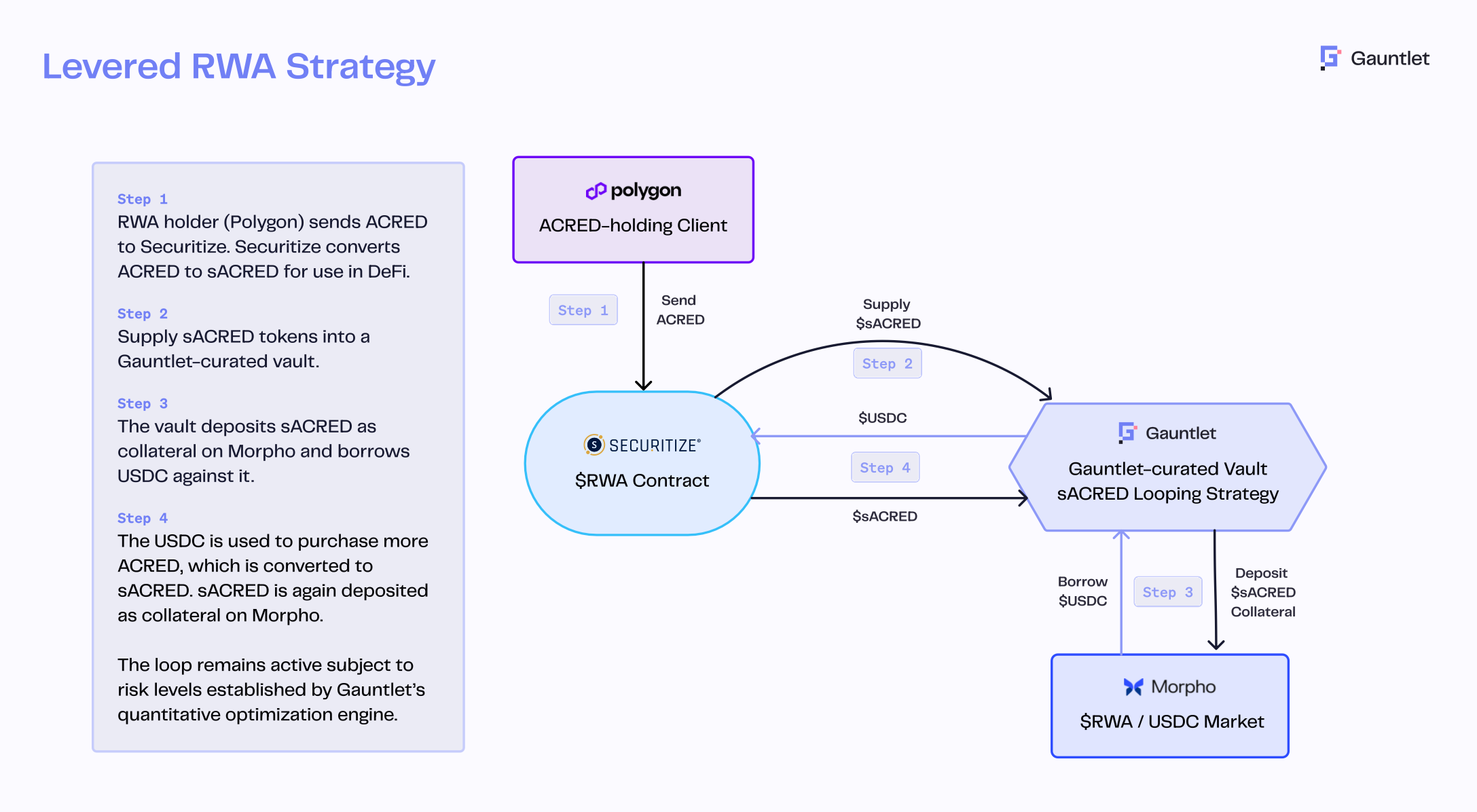

The two companies are unveiling Wednesday a leveraged-yield technique providing centered on the Apollo Diversified Credit Securitize Fund (ACRED), a tokenized feeder fund that debuted in January and invests in Apollo’s $1 billion Diversified Credit Fund. The technique will run on Compound Blue, a lending protocol powered by Morpho,

The providing, known as Levered RWA Strategy, will likely be first accessible on Polygon (POL). It is anticipated to broaden to the Ethereum mainnet and different blockchains after a pilot part.

“The idea behind the product is we want our securities to be plug and play competitive with stablecoin strategies writ large,” Reid Simon, head of DeFi and credit score options at Securitize, mentioned in an interview with CoinDesk.

DeFi technique constructed on tokenized asset

The introduction comes as tokenized RWAs — funds, bonds, credit score merchandise — achieve traction amongst conventional finance giants. BlackRock, HSBC, and Franklin Templeton are among the many companies exploring blockchain-based asset issuance and settlement. Tokenized U.S. Treasuries alone have pulled in over $6 billion, based on information from RWA.xyz.

While establishments are experimenting with tokenization, the subsequent problem is making these belongings usable throughout DeFi functions. That contains enabling their use as collateral for loans, margin buying and selling or constructing funding methods not potential on legacy rails.

The technique employs a DeFi-native yield-optimization method known as “looping”, through which ACRED tokens deposited right into a vault are used as collateral to borrow USDC, which is then used to buy extra ACRED. The course of repeats recursively to boost yield, with publicity adjusted dynamically based mostly on real-time borrowing and lending charges.

All trades are automated utilizing good contracts, lowering the necessity for handbook oversight. Risk is actively managed by Gauntlet’s threat engine, which displays leverage ratios and might unwind positions in risky market circumstances to guard customers.

“This is expected to deliver the institutional-grade DeFi that our industry has promised for years,” Morpho CEO and cofounder Paul Frambot mentioned. “This use case uniquely demonstrates how DeFi permits buyers in funds like ACRED to entry monetary composability that’s merely not potential on conventional rails.”

The vault can also be one of many first makes use of of Securitize’s new sToken instrument, which permits accredited token holders to take care of compliance and investor protections inside decentralized networks. In this case, ACRED buyers first mint sACRED that they will use for broader DeFi methods with out breaking regulatory guidelines.

“This is a robust instance of the institutional-grade DeFi we’ve been working to construct: making tokenized securities not solely accessible, however compelling to crypto-native buyers searching for methods that objectively outpace their conventional counterparts,” Securitize CEO Carlos Domingo mentioned in an announcement.

CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data Read More