Policy, SEC The SEC’s Crypto Task Force held a roundtable Friday to air out the problems with how the crypto world interacts with securities legal guidelines.

The U.S. Securities and Exchange Commission is seeking to reset its relationship with the crypto trade, even earlier than a everlasting chair is confirmed by Congress. The newest effort was Friday’s roundtable, hosted on the SEC’s headquarters in Washington, D.C. and that includes a dozen attorneys representing completely different views and positions throughout the crypto trade.

You’re studying State of Crypto, a CoinDesk publication wanting on the intersection of cryptocurrency and authorities. Click here to enroll in future editions.

Ostrich farms and orange groves

The narrative

The SEC’s reset started when Acting Chair Mark Uyeda launched a crypto activity pressure and oversaw his company withdraw Staff Accounting Bulletin 121, drop plenty of ongoing lawsuits, pause just a few extra and publish a number of workers statements about how the company may take a look at memecoins and proof-of-work mining.

Why it issues

The SEC is arguably an important federal regulator in crypto in the meanwhile. While its sister company, the Commodity Futures Trading Commission, stands out as the regulator which may someday oversee crypto spot markets, proper now it is the SEC that almost all firms within the sector look to for steerage on what, precisely, it’s they’ll do.

Breaking it down

The roundtable was break up into two parts (three, in case you rely introductory remarks from the three commissioners): A roughly 90-minute moderated panel dialogue, led by former SEC Commissioner and Paredes Strategies founder Troy Paredes, and a 90-minute city corridor nonetheless moderated by Paredes however that includes questions from most people.

You can learn CoinDesk’s protection of the panel dialogue at this link.

Though the central query throughout the dialogue was — because it has been for years — when and the way precisely is a crypto or crypto transaction a safety, panelists touched on every thing from the function of crypto in boosting ransomware to how precisely firms ought to function.

Chris Brummer, the CEO of Bluprynt and professor at Georgetown Law, opened up the dialogue along with his evaluation of what the Howey Test really means: We’re mainly saying when you will have financial savings, there’s a difficulty of investor safety. The widespread enterprise prong that we’re all aware of is absolutely addressing a sort of offering drawback.”

“It really just goes to information asymmetries, and then the question of profits goes to investor psychology, greed and fear, the kinds of things that can distort decision-making,” he stated. “And basically, when you have all those factors together, you have a mandated disclosure [rule].”

The SEC’s method to this point has restricted plenty of crypto initiatives, Delphi Ventures General Counsel Sarah Brennan stated. While many crypto initiatives are supposed to have a broad preliminary distribution, “the specter of the applications of securities laws” means many initiatives act extra like they will go public than really embrace the crypto features of their initiatives.

“We see more and more the token is the product … there’s different ways that people are artificially supporting price and it’s generally been, I’d say, sort of toxic to the market,” she stated.

John Reed Stark, a former SEC lawyer, stated that the “economic reality of the transaction” is essential.

“However you want to look at it, the people buying crypto are not collectors,” he stated. “We all know that they’re investors, and the mission of the SEC is to protect investors.”

It stays to be seen how the SEC’s efforts will proceed, however the company is taking a extra energetic function in publicly partaking with these questions and the trade appears to be responding. The SEC auditorium was about three-quarters full at occasions, to say nothing of anybody who tuned into the livestream.

Stories you could have missed

As Congress Talks Up Its Earth-Shaking Crypto Bill, Regulators Are Already at Work: Federal businesses aren’t ready for Congress and even their everlasting heads to get busy with crypto policymaking, Jesse Hamilton famous on this prescient evaluation which got here forward of the SEC’s PoW mining assertion and OCC’s reputational threat replace.

Proof-of-Work Crypto Mining Doesn’t Trigger Securities Laws, SEC Says: Pooled and solo proof-of-work mining is exterior the SEC’s jurisdiction, the company stated in a workers assertion.

U.S. Bank Agency Cuts ‘Reputational Risk’ From Exams After Crypto Sector Cites Issues: The Office of the Comptroller of the Currency eliminated “reputational risk” from its supervision handbook, it informed nationwide banks on Thursday.

XRP Zooms 10% as Garlinghouse Says SEC Is Dropping Case Against Ripple: Ripple CEO Brad Garlinghouse stated the SEC agreed to drop its attraction of a July 2023 ruling that stated Ripple didn’t violate federal securities legal guidelines in promoting XRP to retail traders by making it accessible by means of exchanges, and that the case itself is near an finish.

Digital Chamber Gets New Chief as Crypto Lobbyists Embrace Friendlier Washington: Digital Chamber founder and CEO Perianne Boring is stepping down subsequent month and changing into the chair of its board. The foyer group’s president, Cody Carbone, will take over as CEO.

Crypto Exchange Bithumb Raided by South Korean Prosecutors Over Embezzlement Allegations: Report: South Korean prosecutors have launched an investigation into crypto alternate Bithumb, wanting into embezzlement allegations.

Inside Pump.fun’s Plan to Dominate Solana DeFi Trading: Pump.enjoyable is launching a token swap service in an effort to get a slice of the charges generated by automated market makers on Solana.

Gotbit Founder Aleksei Andriunin Pleads Guilty to Wire Fraud, Market Manipulation: Aleksei Andriunin, the Russian nationwide who informed CoinDesk in 2019 that he ran a wash buying and selling service to make cryptocurrencies seem to have a higher liquidity and market capitalization than they really do, pleaded responsible to market manipulation and wire fraud prices in a plea deal.

Nasdaq Shift to Round-The-Clock Stock Trading Partly Due to Crypto, Says Exchange Executive: Nasdaq and the New York Stock Exchange are each working towards round the clock buying and selling a minimum of partially attributable to crypto buying and selling already being round the clock, Nasdaq’s head of U.S. Equities and Exchange-traded Products Giang Bui stated.

SEC Chair Nominee Paul Atkins to Face Senate Panel Next Week: SEC Chair nominee Paul Atkins and Comptroller nominee Jonathan Gould will face the Senate Banking Committee for his or her affirmation listening to subsequent week.

U.S. Government Removes Tornado Cash Sanctions: Just a few months after the Fifth Circuit Court of Appeals dominated that the Treasury Department’s Office of Foreign Asset Control could not sanction good contracts, OFAC eliminated its sanctions in opposition to crypto mixer Tornado Cash.

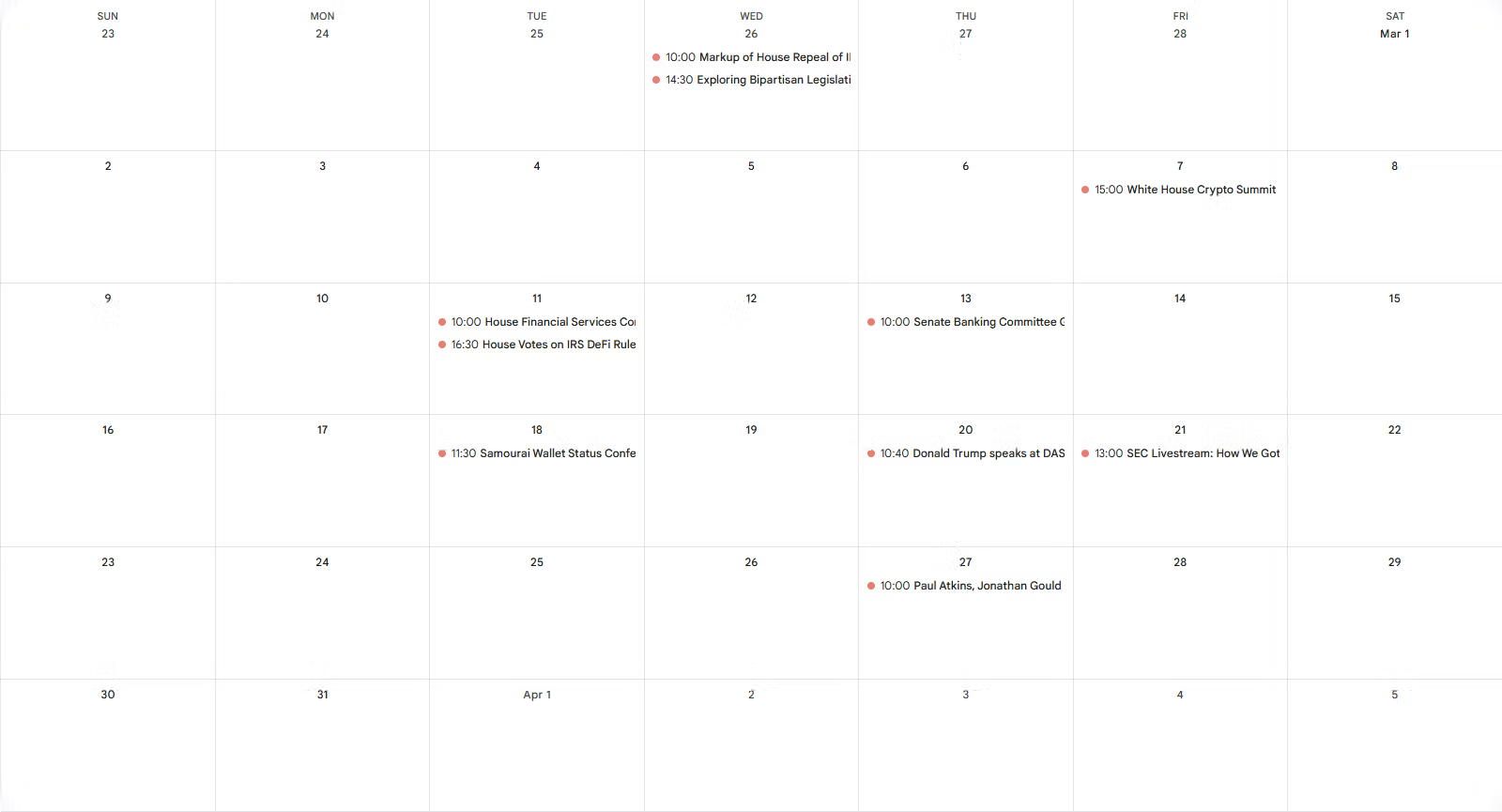

This week

Tuesday

15:30 UTC (11:30 a.m. ET) The federal choose overseeing the U.S. Department of Justice’s case in opposition to Samourai Wallet’s founders held a standing convention listening to within the case. Per my colleague Cheyenne Ligon, who attended, the 7-minute lengthy listening to addressed just a few procedural issues however didn’t delve into the substance of the case.

Thursday

14:40 UTC (10:40 a.m. ET) U.S. President Donald Trump spoke to the audience at the Digital Asset Summit through a short, pre-taped video largely reiterating feedback he beforehand made on the White House crypto summit on March 7.

Friday

17:00 UTC (1:00 p.m. ET) The U.S. Securities and Exchange Commission held a roundtable occasion with authorized consultants from the crypto trade and SEC workers.

Elsewhere:

(Reuters) Another pressure of hen flu — this time H7N9 — has hit the U.S. for the primary time since 2017. This is on prime of the continuing H5N1 epidemic.

(CNN) Amtrak CEO Stephen Gardner stated he can be stepping down from main the quasi-public transit firm on the White House’s route.

(Bloomberg) Coinbase is in superior talks to accumulate derivatives platform Deribit, Bloomberg reported, following CoinDesk’s reporting last month that the alternate was within the agency.

(Wired) A former Meta worker wrote a tell-all ebook about her experiences on the firm and Meta goes all out to restrict its distribution. Careless People has since risen to develop into a best-seller on Amazon.

(Bloomberg) Bloomberg profiled New York Democrat Kirsten Gillibrand’s function in pushing for crypto laws within the Senate.

(Politico) The Trump administration’s plans for USAID embrace reforming it and “leverag[ing] blockchain technology to secure transactions,” although this doc Politico obtained doesn’t embrace much more element. “All distributions would also be secured and traced via blockchain technology to radically increase security, transparency and traceability,” the document says. If you are one of many people pushing for blockchain integration with the U.S. authorities, let’s chat.

(The Guardian) The Trump administration renditioned greater than 200 men of Venezuelan origin to an El Salvadorian jail, potentially in violation of a court order and with out holding any hearings or trials. While the administration stated in public statements that every one 238 males had ties to the Tren de Aragua gang which in flip was taking route from Venezuela’s authorities, officers stated in court docket paperwork that lots of the individuals flown to El Salvador did not have criminal records. Family members of many of those people say they weren’t criminals and didn’t have gang ties. Some of the people reportedly signed deportation papers and expected to be flown back to Venezuela. U.S. intelligence businesses seemingly additionally discovered that TdA was not tied to the Venezuelan authorities, the Times reported.

If you’ve received ideas or questions on what I ought to focus on subsequent week or another suggestions you’d wish to share, be happy to e-mail me at nik@coindesk.com or discover me on Bluesky @nikhileshde.bsky.social.

You may be a part of the group dialog on Telegram.

See ya’ll subsequent week!

CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data Read More