Policy, Newsletters, State of Crypto, News Seth Wilks and Raj Mukherjee, two IRS digital asset administrators, are leaving the company simply over a yr after becoming a member of it.

The IRS, alongside many different regulators, has been fairly energetic within the crypto world over current years. On Friday, two administrators left.

You’re studying State of Crypto, a CoinDesk publication trying on the intersection of cryptocurrency and authorities. Click here to enroll in future editions.

Deferred resignations

The narrative

Over 20,000 IRS staff accepted deferred resignation affords made by the Donald Trump administration, together with two administrators tasked with overseeing digital property rulemaking.

Why it issues

Raj Mukherjee and Seth Wilks went on paid administrative depart Saturday, although people accustomed to the scenario informed CoinDesk that their departures shouldn’t point out any change within the IRS’ strategy to crypto guidelines.

Breaking it down

Wilks, the IRS’ govt director of digital asset technique and improvement, and Mukherjee, the manager director of the digital property workplace, accepted deferred resignation affords and left the IRS on Friday, two people informed CoinDesk.

They joined thousands of other IRS employees who accepted the supply, which places them on paid administrative depart till September.

Both of CoinDesk’s sources stated Wilks and Mukherjee left forward of anticipated widespread layoffs on the IRS.

Stories you will have missed

- Inside Movement’s Token-Dump Scandal: Secret Contracts, Shadow Advisers and Hidden Middlemen: CoinDesk’s Sam Kessler revealed a blockbuster investigation into Movement Labs, its current agreements with a market maker and the way its present inner investigation into whether or not it was misled into signing an settlement which gave that market maker management over a major variety of its tokens got here to be.

- Fed Joins OCC, FDIC in Withdrawing Crypto Warnings for U.S. Banks: The Federal Reserve withdrew its crypto steering advising banks to get pre-approvals earlier than coming into crypto exercise (and different particulars).

- TRUMP Coin Jumps 70% on President’s Dinner Event for Top Token Holders: The 220 people who maintain essentially the most TRUMP tokens will be capable of attend a dinner with Donald Trump in May. The information sparked a surge within the token’s value.

- Trump’s Truth Social Mulls Launching Token for Subscriptions in Latest Crypto Push: Truth Social, the social media firm owned by Donald Trump’s Trump Media & Technology Group, stated in a shareholder letter that it was exploring launching a utility token.

- Bitcoin-Friendly Poilievre Loses Seat as Carney’s Liberals Win 2025 Election: Canada voted, and the Liberal Party is forming a minority authorities with Mark Carney staying on because the Prime Minister. Conservative Party chief Pierre Poilievre misplaced his seat.

- Unicoin CEO Rejects SEC’s Attempt to Settle Enforcement Probe: Unicoin rejected a settlement negotiation assembly with the U.S. Securities and Exchange Commission, CEO Alex Konanykhin informed shareholders in a letter.

- Senator and Ex-Bridgewater CEO McCormick Invests More in Bitcoin as Bill in Works: Pennsylvania Republican Dave McCormick, who gained his seat in final yr’s election and now sits on the Senate Banking Committee, disclosed investing as much as $450,000 in Bitwise’s Bitcoin exchange-traded fund (ETF).

- New SEC Chief Atkins Says Agency Doesn’t Have to Wait to Impose Crypto Policy: Paul Atkins, who was sworn in as SEC chair last week, stated the company was contemplating special-purpose dealer sellers and custody insurance policies on the newest crypto roundtable hosted by the company, and that it might not want to attend for brand spanking new legal guidelines to behave.

- FBI Says Americans Lost $9.3B to Crypto Scams in 2024: The FBI’s newest Internet Crime Complaint Center report stated Americans misplaced $9.3 billion to crypto crimes final yr, a 66% year-over-year rise. Total losses added up to $16.6 billion, and the general year-over-year enhance was 33%.

DOJ’s mixers

Prosecutors and protection attorneys within the Department of Justice’s case towards the builders of Samourai Wallet filed a joint memo asking the federal decide overseeing the case to pause it for a few weeks whereas the DOJ considers a request from the protection to drop it totally.

An lawyer for Roman Storm, requested if the Tornado Cash developer’s crew had made an analogous request, declined to remark.

This similar week, a federal judge ruled that the U.S. Treasury Department can not sanction Tornado Cash once more, saying the Office of Foreign Asset Control did “not suggest they will not sanction Tornado Cash again, and they may seek to ‘reenact precisely the same [designation] in the future.'”

Last month, Leah Moushey, an lawyer with Miller & Chevalier, informed CoinDesk that the decide might resolve to reject OFAC’s argument that the case was moot due to earlier instances the place businesses tried to maintain the power to redesignate somebody after a courtroom case was resolved.

The decide certainly appeared to purchase into that view in his ruling.

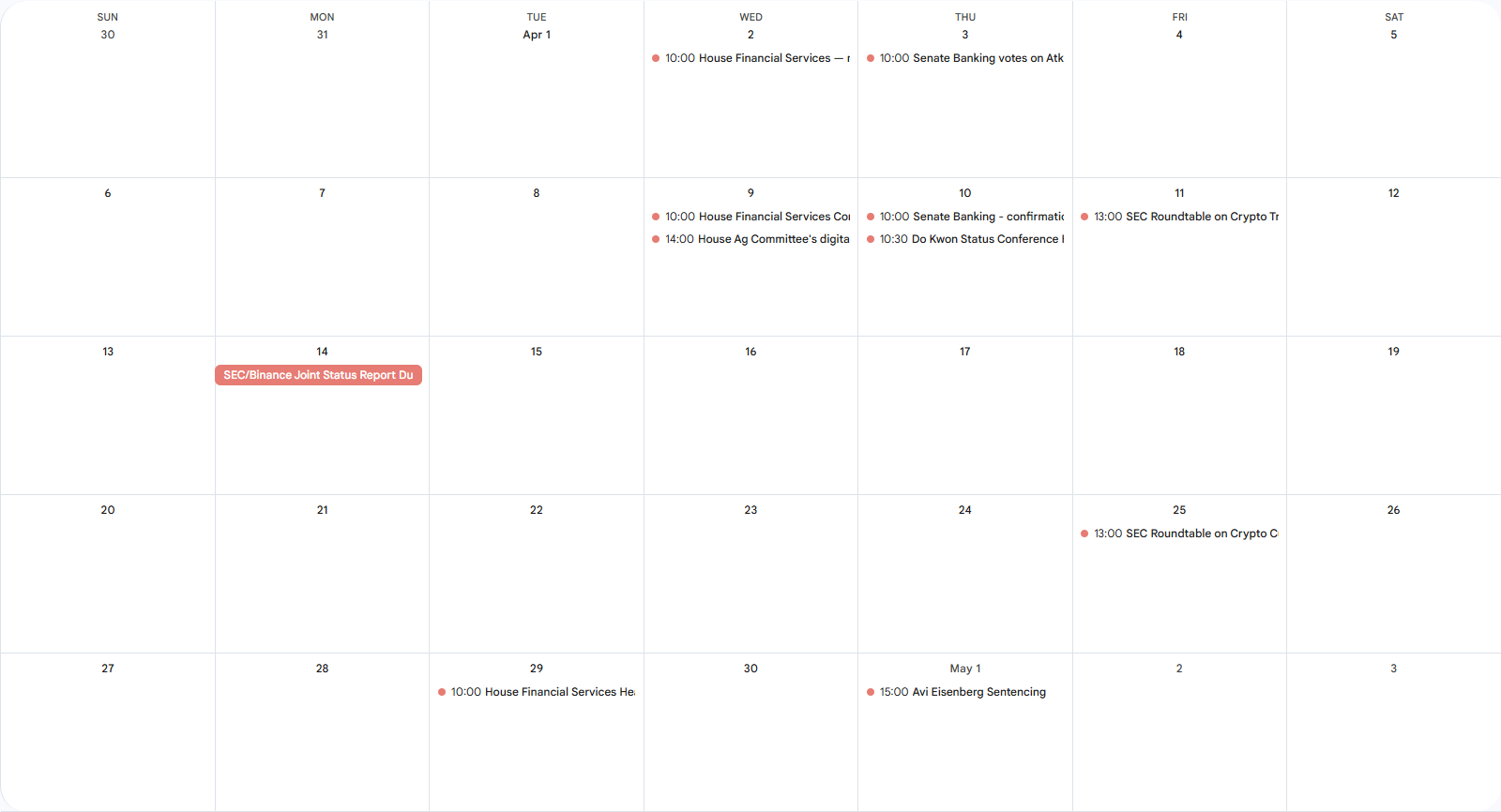

This week

Tuesday

- 14:00 UTC (10:00 a.m. ET) The House Financial Services Committee held a subcommittee listening to titled “Hearing Entitled: Regulatory Overreach: The Price Tag on American Prosperity.”

Thursday

- 19:00 UTC (3:00 p.m. ET) Avraham Eisenberg, who was arrested and tried for his $110 million exploit of Mango Markets, was sentenced to just over four years in prison after pleading responsible to possession of kid sexual abuse materials. During the sentencing listening to, the federal decide overseeing the case stated he was open to a retrial on the Mango Markets-related expenses.

Elsewhere:

- (The New York Times) The Times dug into Donald Trump’s entry and deepening connections into the crypto business.

- (The Washington Post) The Post revealed an inventory of the highest donors to Trump’s inauguration fund. Included on this record: Ripple Labs ($4.9 million donated), Robinhood Markets ($2 million), Fred Ehrsam, Circle, Coinbase, Crypto.com, Galaxy Digital, Ondo Finance, Kraken and Solana Labs ($1 million every). Several of those corporations have since filed to go public, seen the SEC drop lawsuits and investigations towards them or introduced partnerships with Trump-affiliated companies.

- (Politico) The Senate is more likely to vote on stablecoin laws earlier than the tip of May, Majority Leader John Thune stated at a Republican convention lunch.

- (The New York Times) The Times additionally revealed a deep dive into Tether and its personal deepening ties to Washington, D.C.

- (Reuters) North Korean staff arrange company entities within the U.S. to focus on crypto companies.

- (The New York Times) This is a really bonkers story of some people who stole some crypto. Just learn it.

- (Politico) This is an enchanting learn by Politico’s Victoria Guida about Canadian Prime Minister Mark Carney’s expertise and views.

- (404 Media) Researchers claiming to be a part of the University of Zurich arrange a “large-scale experiment in which they secretly deployed AI-powered bots into a popular debate subreddit” to see whether or not AI would change folks’s minds. These bots used faux backstories and revamped 1,700 feedback. Reddit stated it was issuing “formal legal demands” to the researchers in response.

- (The New York Times) Roger Ver, i.e. “Bitcoin Jesus,” employed Roger Stone to try to foyer for authorized modifications which may assist Ver, who’s accused of tax expenses.

- (Semafor) Various outstanding enterprise capitalists and tech executives, together with crypto firm executives, have personal group chats that Semafor experiences present a rising political divide.

- (Wired) Spain and Portugal suffered an enormous blackout earlier this week. Wired dug into a number of the technical points at play.

If you’ve acquired ideas or questions on what I ought to focus on subsequent week or every other suggestions you’d wish to share, be at liberty to e mail me at nik@coindesk.com or discover me on Bluesky @nikhileshde.bsky.social.

You may also be part of the group dialog on Telegram.

See ya’ll subsequent week!

CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data Read More