Markets, Robinhood, Trading Platforms, Markets The decline in retail buying and selling might need affected different exchanges together with Coinbase.

Robinhood’s (HOOD) crypto buying and selling volumes took a steep hit in February, tumbling 29% from the earlier month in a retail-trader-led decline that may carry a message for different platforms together with Coinbase (COIN).

The month-over-month drop to $14.4 billion outpaced declines in equities and choices buying and selling, which every fell 1%. Even so, the determine was greater than double the year-earlier stage, the corporate mentioned in a press release.

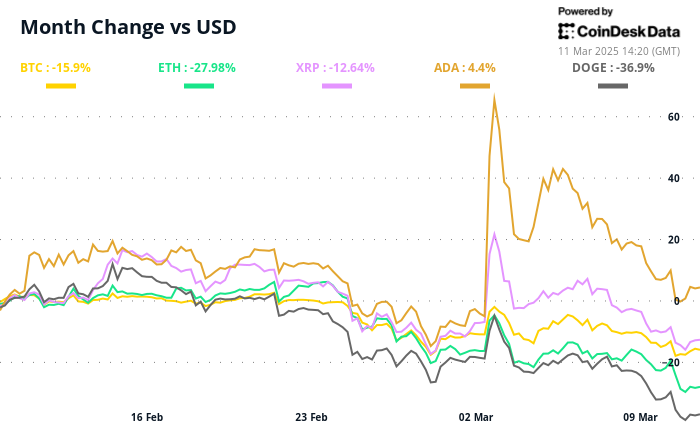

The determine reveals how buying and selling dropped off because the cryptocurrency market slid. Bitcoin (BTC) misplaced about 15% of its worth final month and the broader CoinDesk 20 Index (CD20) fell by round 23%. Across centralized cryptocurrency exchanges, spot buying and selling dropped 19% to $2.3 trillion in February in contrast with January, CoinDesk data reveals.

Memecoin exercise additionally eased, with main token launchpad Pump.enjoyable seeing every day token launches plunge to 24,000 from 62,000, in accordance with 10x Research.

The slowdown in cryptocurrency buying and selling volumes suggests decrease retail curiosity within the house and will have implications for different exchanges together with Coinbase (COIN), which caters to an analogous viewers.

Shares of Robinhood, a retail-focused buying and selling platform that additionally provides equities, have dropped 4% this 12 months. Coinbase, in distinction, has fallen 15%, in keeping with the broader crypto market retreat.

Coinbase has, nevertheless, been increasing its institutional companies and blockchain infrastructure enterprise, which may assist offset among the influence from weaker retail buying and selling. The firm not too long ago announced the introduction of 24/7 bitcoin and ether futures buying and selling.

CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data Read More