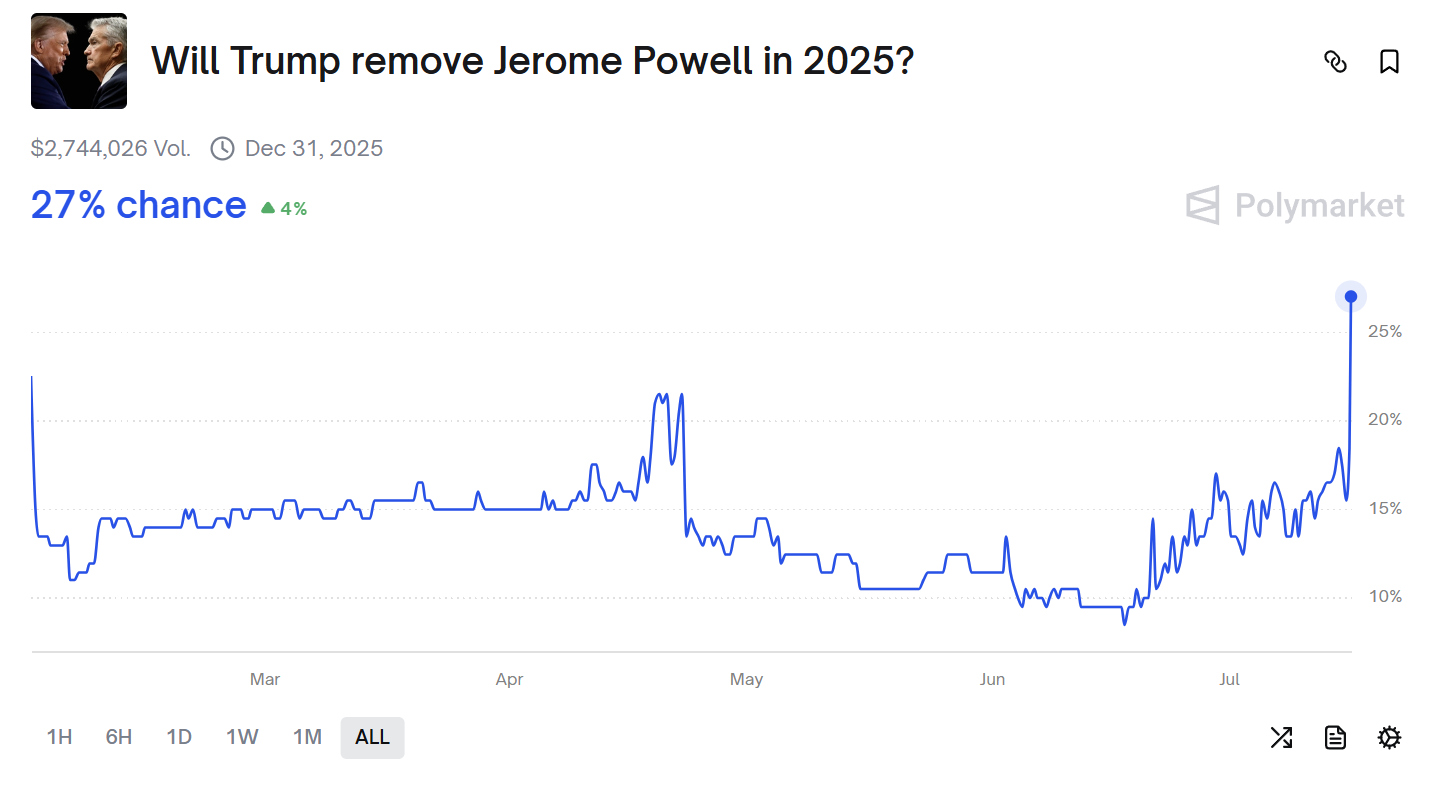

Policy, Jerome Powell, Donald Trump, Federal Reserve, Polymarket, News Significant legal challenges would arise from an attempt to remove Fed chair Jerome Powell, but Polymarket bettors are warming to the idea – even if it’s still a longshot.

A Florida Congresswoman’s post on X has moved the market for bettors looking to speculate on the firing of Federal Reserve chair Jerome Powell.

Anna Paulina Luna (R- Florida) claimed on the social media site that Powell’s firing was ‘imminent’, but provided no further details, moving the ‘yes’ side of a related contract on Polymarket by 4% up to 27%.

Luna does not serve on the House Financial Services Committee, which oversees the Federal Reserve.

The Florida 13th district representative serves on the House Oversight and Accountability Committee and Natural Resources Committee, and is a member of the House Freedom Caucus and Congressional Second Amendment Caucus.

President Trump has long wished to remove Jerome Powell, dating back to his first administration, but there would be significant legal challenges to removing him.

In 2019, the Brookings Institution prepared an analysis highlighting the 1935 Supreme Court case Humphreys’ Executor v. United States, which blocked President Franklin Roosevelt from removing an FTC commissioner, as a key precedent supporting the Federal Reserve Act’s “for cause” removal protections.

The law, as it stands, only permits the removal of Fed governors only for inefficiency, neglect of duty, or malfeasance in office, not policy disagreements.

And perhaps that has resonated with Polymarket bettors. In the hours since Rep. Luna’s post on X, the odds on the ‘Yes’ side have come back down to 25%.

Bitcoin traders dismissed the possibility entirely of Powell’s removal, with BTC staying flat.

CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data Read More