Tech, Move, Ethereum, Finance, Market Manipulation, Binance, Feature Movement, backed by Trump’s World Liberty Financial, says it was duped into an settlement that specialists say incentivized worth manipulation.

A monetary deal was supposed to assist launch the MOVE crypto token.

Instead, it led to a token-dumping scandal, a Binance ban, and behind-the-scenes infighting.

Contracts obtained by CoinDesk assist clarify the place all of it went improper.

Movement, the blockchain mission behind the MOVE cryptocurrency, is investigating whether or not it was deceived into signing a monetary settlement that granted a single entity outsized management over the marketplace for its token, in response to inner paperwork reviewed by CoinDesk.

The settlement led to 66 million MOVE tokens being bought onto the market the day after the asset’s December 9 trade debut, triggering a steep worth drop and allegations of insider dealing inside a crypto mission endorsed by World Liberty Financial, the crypto enterprise backed by Donald Trump.

Cooper Scanlon, Movement Labs’ co-founder, advised staff in an April 21 Slack message that the corporate was analyzing how greater than 5% of MOVE tokens earmarked for Web3Port, a market maker, have been routed by way of a intermediary named Rentech — “an entity the foundation was led to believe was a subsidiary of Web3Port but apparently is not.” Rentech denies participating in any misrepresentation.

Movement’s contract with Rentech loaned a single counterparty round half of MOVE’s publicly held provide, in response to an inner Movement Foundation memo. This granted the entity an unusually giant diploma of management over the fledgling token, specialists advised CoinDesk.

More worryingly, in variations of the contracts obtained by CoinDesk, “there are incentives basically to manipulate the price to over $5 billion fully diluted value and then dump on retail for shared profit,” concluded Zaki Manian, a veteran crypto founder who reviewed the paperwork. “Even participating in a discussion where that’s on paper is insane.”

Market makers, employed to supply liquidity for brand new tokens, stabilize costs by shopping for and promoting on exchanges utilizing cash loaned to them by a token’s issuer. But the position can also be abused, giving insiders a method to quietly manipulate markets and offload giant token holdings with out drawing consideration.

A collection of contracts obtained by CoinDesk supply a uncommon look right into a murky nook of crypto, the place weak oversight and opaque authorized agreements can flip public initiatives into non-public windfalls.

While crypto market-making abuses are sometimes rumored about, the main points behind them nearly by no means floor to the general public.

The market-making contracts reviewed by CoinDesk present Rentech appeared in agreements on either side of a take care of the Movement Foundation — as soon as as an agent of the Movement Foundation and as soon as as a Web3Port subsidiary — a setup that would theoretically permit the intermediary to dictate phrases and revenue from its place within the center.

Movement’s take care of Rentech in the end enabled wallets tied to Web3Port — a Chinese monetary agency that claims to have labored with initiatives together with MyShell, GoPlus Security, and the Donald Trump-affiliated World Liberty Financial — to instantly liquidate $38 million in MOVE tokens the day after the token debuted on exchanges.

Binance, the crypto trade, later banned the market-making account for “misconduct,” and Movement introduced a token buyback plan.

Like inventory choices at startups, token allocations in crypto initiatives are sometimes topic to lock-up intervals meant to forestall insiders from promoting giant stakes throughout a mission’s early buying and selling.

The Binance ban created the impression — which Movement denied — that mission insiders might need entered into an improper settlement with Web3Port to promote tokens forward of schedule.

Pointing fingers

Movement, a brand new Layer 2 blockchain designed to scale Ethereum utilizing Facebook’s Move programming language, is among the most talked-about crypto initiatives of latest years.

Founded by 22-year-old Vanderbilt University dropouts Rushi Manche and Cooper Scanlon, the corporate raised $38 million from traders, nabbed a spot within the World Liberty Financial crypto portfolio, and has been the topic of intense social media consideration.

Reuters reported in January that Movement Labs was near wrapping a $100 million funding spherical that will have valued the corporate at $3 billion.

In interviews with greater than a dozen folks conversant in Movement’s inner operations, most of whom requested anonymity to keep away from reprisal, CoinDesk heard a spread of conflicting allegations over who architected the Rentech association, which business specialists known as extremely uncommon.

Galen Law-Kun, the proprietor of Rentech, rejects the suggestion that the Foundation was deceived into signing a market-making settlement, asserting that the entity construction was crafted with full collaboration from the Movement Foundation’s basic counsel, YK Pek.

Pek disputes having any involvement in creating Rentech and was, a minimum of at first, deeply crucial of the deal internally, in response to a memo and different communications reviewed by CoinDesk.

In his message to staff, Scanlon, the co-founder of Movement Labs, states that Movement is “a victim in this situation.”

According to 4 sources conversant in the investigation who spoke to CoinDesk on situation of anonymity, Movement can be analyzing the involvement of its co-founder Rushi Manche, who initially forwarded a take care of Rentech to the Movement group and promoted it internally, and Sam Thapaliya, a casual advisor to Movement and enterprise accomplice to Law-Kun.

Web3Port didn’t reply to a number of requests for remark.

“Possibly the worst agreement I have ever seen”

Despite initially rejecting a dangerous market-making take care of Rentech, Movement in the end signed a revised settlement with comparable options, counting on assurances from a intermediary with none identifiable monitor report.

In the calmly regulated cryptocurrency business, initiatives sometimes break up their operations between a nonprofit basis and a for-profit growth agency. The developer — Movement Labs, on this case — builds the know-how, whereas the muse stewards the token and manages group assets.

The two entities are alleged to function independently: a construction designed to defend the token from securities laws. In Movement’s case, nonetheless, inner correspondence reviewed by CoinDesk means that Manche — an worker of the event agency, Movement Labs — additionally performed an energetic position within the non-profit Movement Foundation.

On March 28, Manche despatched a market-making contract to the Movement Foundation in a Telegram message — it wanted a signature.

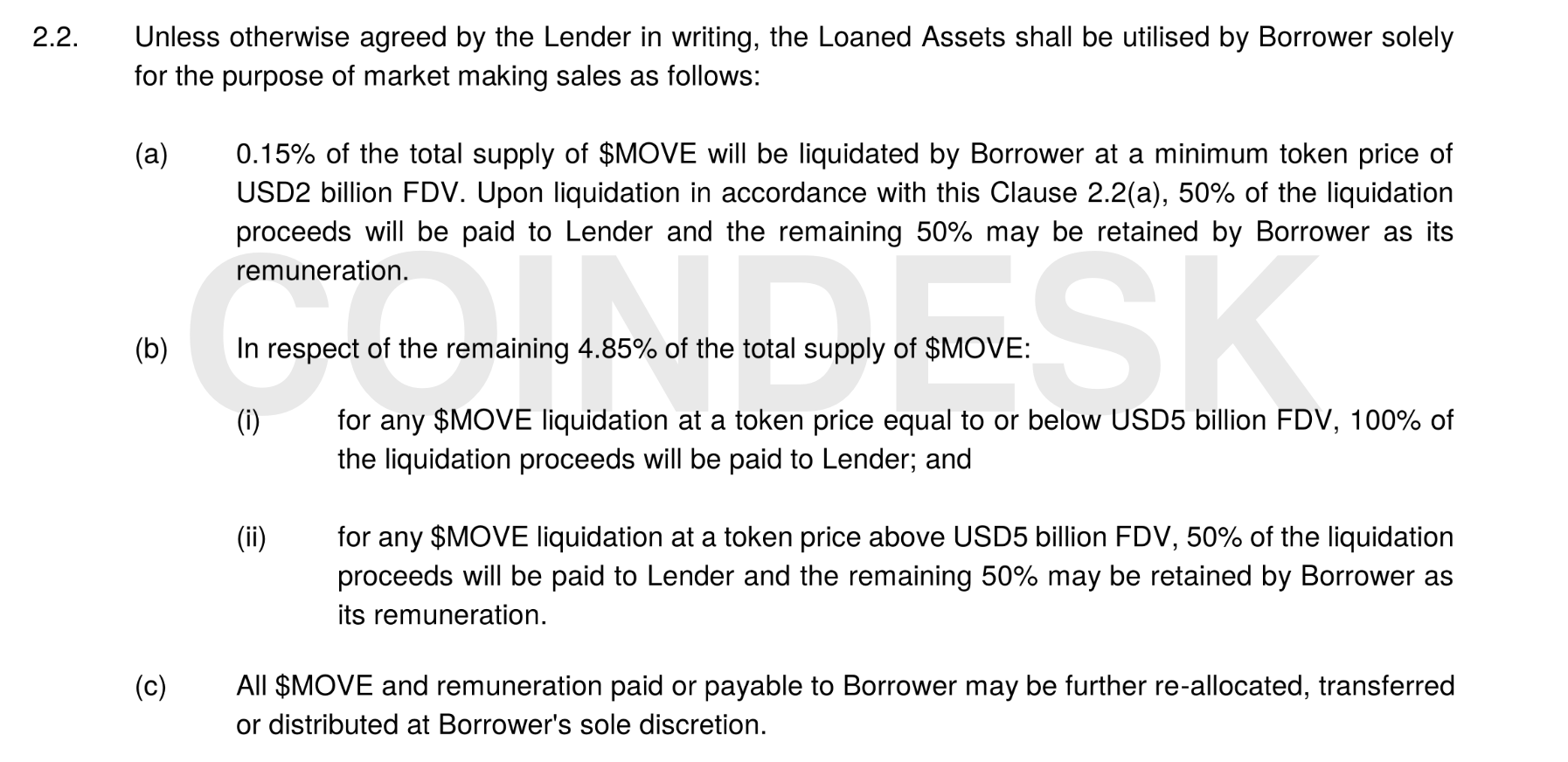

The draft settlement proposed loaning a large 5% allocation of MOVE tokens to Rentech, an organization with zero digital footprint.

Pek, the muse’s lawyer, flagged the doc in an electronic mail as “[p]ossibly the worst agreement” he had ever seen. In a separate memo reviewed by CoinDesk, he warned that it could hand management of MOVE’s market to a single unknown entity. Marc Piano, director of the muse’s British Virgin Islands entity, additionally refused to signal.

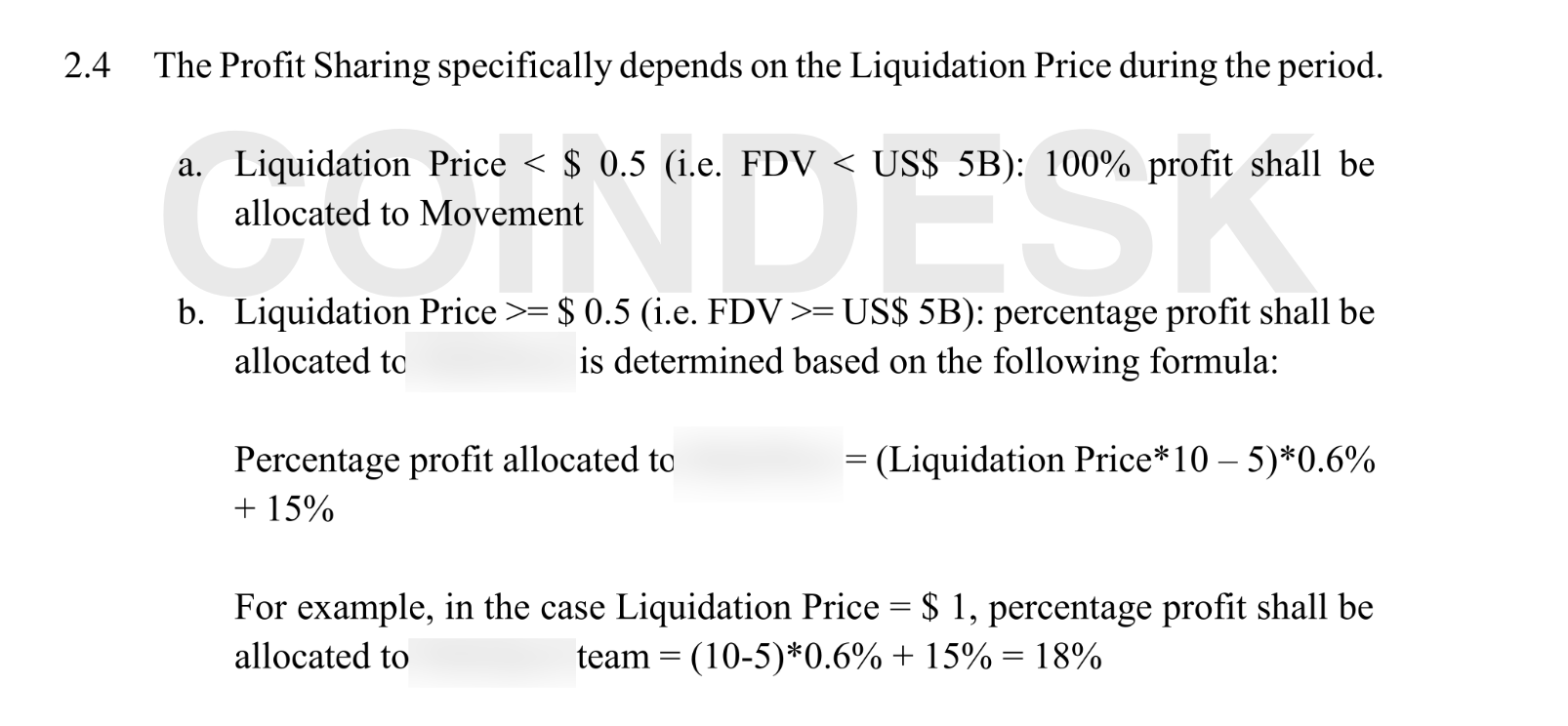

Among the contract’s extra uncommon provisions was a clause permitting Rentech to liquidate its MOVE tokens if the cryptocurrency’s totally diluted worth exceeded $5 billion — a benchmark that, if reached, would have allowed Rentech to separate earnings 50-50 with the muse.

According to Manian, this created a perverse incentive for the market maker to artificially enhance the value of MOVE in order that it may promote its huge provide of tokens for a revenue.

Movement Foundation declined to signal the deal, however they continued discussions with Rentech.

According to a few folks conversant in the discussions and authorized paperwork reviewed by CoinDesk, Rentech finally advised Movement Foundation it was working as a subsidiary of Web3Port, the Chinese market-making agency. According to those sources, Rentech additionally supplied to entrance $60 million of its personal collateral, a element that helped sweeten the association for the muse.

On December 8, the Movement Foundation agreed to a modified model of the market-making contract that eliminated a number of the provisions most troubling to the muse. Among the modifications: the brand new deal eradicated a clause that will have allowed Web3Port to sue Movement Foundation for damages if the MOVE token didn’t record on a selected crypto trade.

The revised settlement, which was primarily crafted by Pek, who initially pushed again, nonetheless contained lots of the similar options as the unique: It nonetheless allowed Web3Port to borrow 5% of MOVE’s provide and promote tokens for a revenue, albeit below a distinct disbursement construction.

The new contract listed Web3Port because the borrower, and a director of Rentech signed on its behalf.

DNS data present that the area title hooked up to the Rentech director’s electronic mail deal with, web3portrentech.io, was registered on the identical day the contract was signed.

A pre-existing settlement

According to a few folks near the scenario, Movement Foundation officers didn’t notice that Web3Port had already entered into an agreement with “Movement” weeks earlier than the December 8 deal was signed.

A contract dated November 25 and obtained by CoinDesk reveals that Web3Port had signed a deal, apparently with Movement, that carefully resembled the unique proposal Movement Foundation had rejected. In this deal, Rentech was listed as a consultant of Movement.

The deal was structured equally to the Nov. 27 contract, explicitly permitting the market maker to liquidate tokens if MOVE’s worth hit sure targets — a key provision from the older settlement that stood out to specialists like Manian.

“Shadow co-founder”

Sources near Movement have introduced a number of theories round who in the end architected the connection with Rentech, which led to December’s token-dumping incident and a wave of unfavourable press consideration for Movement.

The settlement was initially circulated internally by Manche, who was briefly positioned on administrative depart final week, as Blockworks first reported.

“Throughout the market maker selection process, the MVMT Labs team trusted various advisors and members on the foundation team to provide input and help properly structure those deals,” Manche advised CoinDesk. “Apparently, at least one member of the Foundation team represented interests on both sides of the market maker deal, which we are now in the process of investigating.”

Among these near Movement, scrutiny over the deal has additionally spurred questions on whether or not Sam Thapaliya — the founding father of crypto protocol Zebec and an advisor to Manche and Scanlon — might have performed a behind-the-scenes position.

Thapaliya was CC’d alongside Rentech and Manche in an electronic mail from Web3Port to “Movement Team” and different communications relating to the market-making association reviewed by CoinDesk.

“My understanding is that Sam is a close advisor to Rushi and perhaps sort of a shadow third co-founder,” mentioned one worker. “Rushi kept the relationship pretty hidden; we often just heard his name.”

“A lot of times we’d decide on something, and at the last minute there would be this change,” mentioned one other. “In those cases, we knew it was probably coming from Sam.”

Thapaliya was current at Movement’s San Francisco workplace on the day that the MOVE token launched to the general public, in response to three individuals who have been current.

Telegram screenshots reviewed by CoinDesk additionally present that Scanlon commissioned Thapaliya to assist curate MOVE’s airdrop whitelist — the fastidiously managed record of pockets addresses eligible to obtain tokens in Movement’s (long-delayed) group token giveaway.

The association bolstered a notion amongst some Movement staff that Thapaliya’s affect throughout the firm was extra in depth than acknowledged.

Thapaliya, in response to a press release he shared with CoinDesk, met Manche and Scanlon whereas they have been faculty college students and has served as an outdoor advisor to Movement over time. Thapaliya advised CoinDesk he has “no equity in Movement Labs,” “no token from Movement Foundation” and “no decision-making power” inside both group.

Who is Rentech?

Rentech, the entity on the middle of the token dispute, was created by Galen Law-Kun, Thapaliya’s enterprise accomplice. Law-Kun advised CoinDesk he established Rentech as a subsidiary of Autonomy, his Singapore-based monetary providers agency, to attach crypto initiatives with household workplaces in Asia.

In a press release to CoinDesk, Law-Kun mentioned YK Pek “helped set up and was general counsel of Autonomy SG, which is the parent or affiliate company of Rentech.” He additionally claimed that Pek, regardless of pushing again in opposition to the preliminary Rentech deal internally, “advised to set up the Rentech structure for the launch” and “advised on the first version of the contract, which is almost identical to the contract he later drafted and approved for the foundation.”

CoinDesk’s investigation has not uncovered any proof confirming that Pek arrange Rentech or authored the primary model of the contract whereas appearing on behalf of Autonomy.

“I am not and have never been Galen or any of his entities’ general counsel,” said Pek. “A corporate administration firm that I co-founded, and which provides corporate secretarial services to over 150 entities in the Web3 space has provided corporate secretarial services to two of his companies, both of which filed ‘no assets’ as part of their annual renewals in 2025. Neither of these companies are Rentech.”

Pek states that he as soon as spent “two hours” reviewing an advisory settlement that Law-Kun had with a mission in 2024. Additionally, “[h]e reached out to me regarding the FTX filing deadline,” and in August, “he forwarded me an NDA Docusign which I cast my eye over without charging him.”

“I have no idea why Galen would claim I am his general counsel and I am frankly confused and disturbed by that claim,” Pek continued. “He was represented in electronic mail correspondence with my company providers accomplice by his private lawyer from one ‘Hillington Group’.”

According to Pek, “[b]oth the general counsels of Movement Foundation (myself) and Movement Labs were introduced to GS Legal as counsel for Rentech by Rushi Manche.”

In Law-Kun’s telling, Pek was “introduced to 10 projects as my Autonomy lawyer” and “never hesitated to say otherwise or correct the statement.” According to Law-Kun, “The GS introduction was just done as a formality requested by Movement.”

In his Slack message to staff, Scanlon mentioned Movement had retained Groom Lake, an outdoor auditing agency, to “conduct the third-party review into recent market maker abnormalities.”

“Movement is a victim in this situation,” he wrote.

CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data Read More