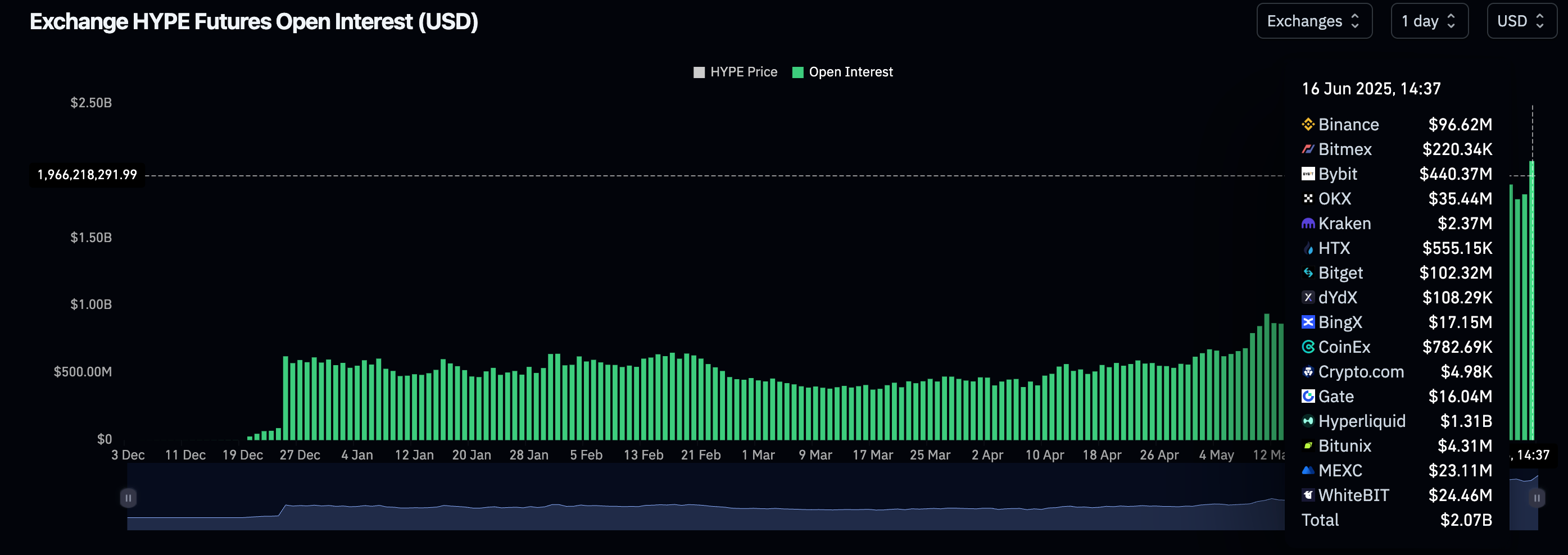

Markets, hype, Markets, DOGE, XRP, market analysis, News The dollar value of HYPE futures open interest is $2.06 billion, still lower than XRP futures.

HYPE, the token of leading decentralized perpetual exchange Hyperliquid, is now the fifth-largest digital asset by futures open interest.

At the time of writing, the dollar value of the number of active or open bets in HYPE futures (perpetual and standard) traded worldwide was $2.06 billion, according to data source Coinglass.

That placed HYPE ahead of dogecoin DOGE as futures tied to the meme token had an open interest of $1.83 billion. The payments-focused XRP cryptocurrency held ahead of HYPE with bitcoin BTC, ether ETH and solana’s SOL SOL leading the pack.

HYPE’s futures market leadership over DOGE and many other cryptocurrencies with bigger market values likely represents the growing popularity of purpose-built blockchain products.

Hyperliquid is a decentralized exchange that focuses squarely on providing an on-chain perpetual futures market and is built on its own Layer 1 blockchain. Last week, Hyperliquid accounted for 60% of the total onchain perpetuals trading volume of $94.3 billion, according to data source @uwusanauwu’s Dune-based tracker.

The HYPE token is used for economic incentives, fee payments and decentralized governance, allowing holders to participate in the decision-making process. The protocol utilizes 97% of the trading fees collected from users to buy back HYPE, thereby constantly adding bullish pressure to the market.

“92.78% of protocol (HyperCore) revenue goes to buying back HYPE on the open market — over $1B annually in buybacks,” Hyperliquid Hub said on X. “Major firms and funds are actively adding HYPE to their portfolios and top-tier market makers from traditional finance are trading on HyperCore’s CLOBs, creating the deepest liquidity in crypto.”

HYPE has chalked out over a four-gold rally to a record price of $44 in three months. The rally happened alongside a booming open interest and positive annualized funding rates, which surged to over 100% at one point, signaling strong demand for bullish leveraged bets.

CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data Read More