CoinDesk Indices, DeFi, Portfolio administration, Institutional Investment, Crypto Long & Short, CoinDesk Indices, Opinion, Opinion Now that returns that merely mirror the broader crypto market are simply attainable, traders are searching for extra methods to doubtlessly exceed the market, says Lionsoul Global’s Gregory Mall.

Mainstream conversations round digital property largely give attention to the dramatic worth efficiency of bitcoin and ether. For years, retail and institutional traders have focused beta publicity, or returns that mirror the broader crypto market. However, the introduction of merchandise like bitcoin exchange-traded funds (ETFs) and exchange-traded products (ETPs) have made reaching beta extra accessible, with these merchandise drawing over $100 billion in institutional capital.

But because the asset class matures, the dialog is shifting. More establishments are actually pursuing alpha, or returns that exceed the market, by actively managed methods.

The position of uncorrelated returns in diversification

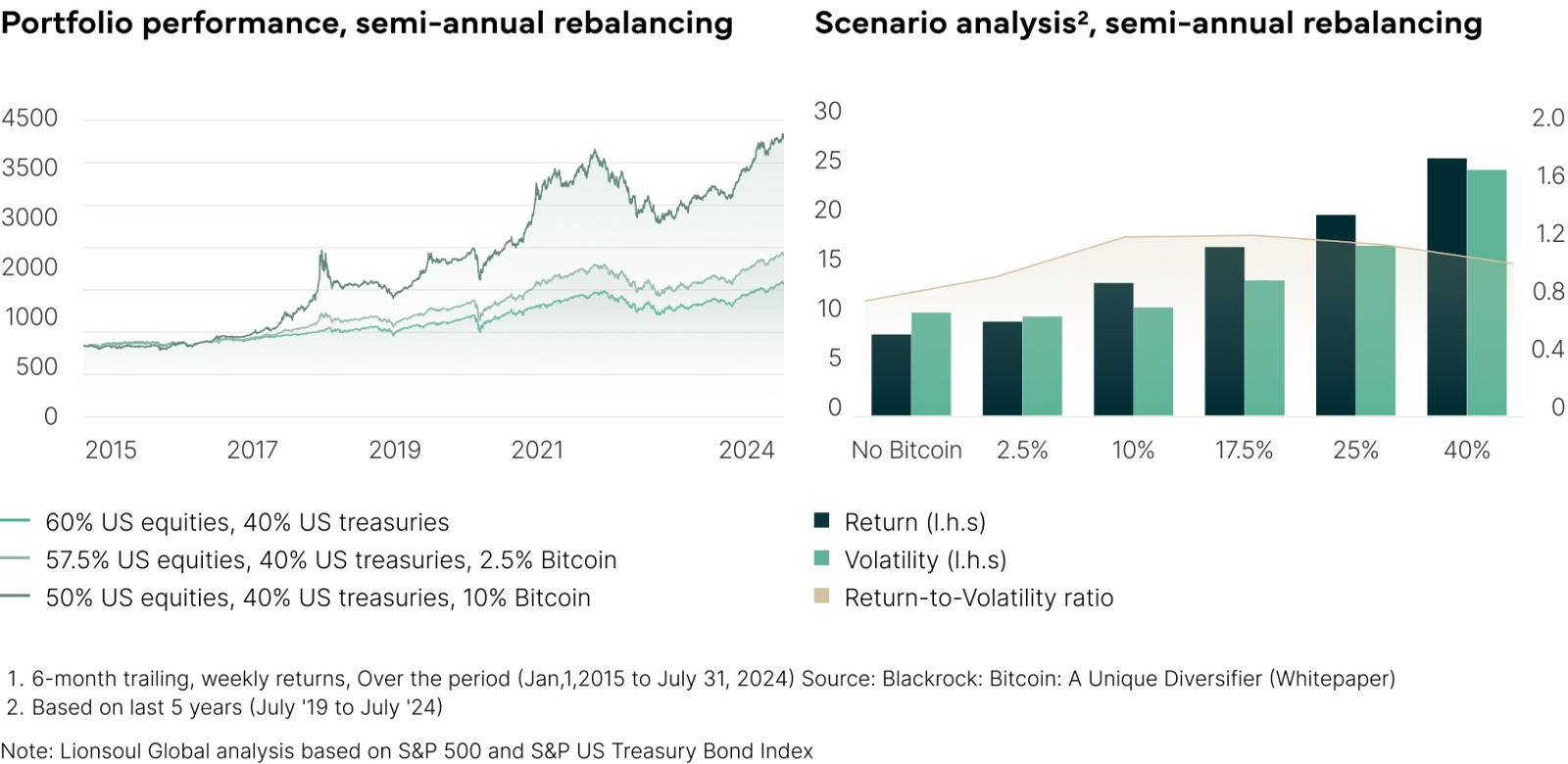

Low correlation to conventional property enhances the position of digital property in diversified portfolios. Since 2015, bitcoin’s day by day correlation to the Russell 1000 Index has been simply 0.231, that means that bitcoin’s day by day returns transfer solely weakly in the identical path because the Russell 1000 Index, with gold and rising markets remaining similarly low. A modest 5% allocation to bitcoin in a 60/40 portfolio, a portfolio containing 60% equities and 40% fastened revenue, has been proven to spice up the Sharpe ratio (the measure of risk-adjusted return on a portfolio) from 1.03 to 1.43. Even inside crypto itself, varying correlations permit for intra-asset diversification. This makes digital property a robust device for risk-adjusted return enhancement [see exhibit 1].

Digital property enter the lively period

Just as hedge funds and personal fairness redefined conventional markets, digital property are actually evolving past index-style investing. In conventional finance, lively administration represents over 60% of global assets. With informational asymmetries, fragmented infrastructure and inconsistent pricing, digital property current a compelling panorama for alpha generation.

This transition mirrors the early phases of the options business, when hedge funds and personal fairness capitalized on inefficiencies lengthy earlier than these methods have been adopted by the mainstream.

Market inefficiencies

Crypto markets stay unstable and structurally inefficient. Though bitcoin’s annualized volatility fell below 40% in 2024, it stays greater than twice that of the S&P 500. Pricing inconsistencies throughout exchanges, regulatory fragmentation and the dominance of retail conduct create important alternatives for lively managers.

These inefficiencies — mixed with restricted competitors in institutional-grade alpha methods — current a compelling case for specialised funding approaches.

- Arbitrage methods: Utilization of buying and selling methods similar to money and carry, which captures spreads between spot and futures costs, or foundation buying and selling, which includes getting into lengthy positions in discounted property and shorts in premium ones, permits alpha technology by using market inefficiencies throughout the digital property market.

- Market making methods: Market makers earn returns by putting bid/ask quotes to seize unfold. Success depends on managing dangers like stock publicity and slippage, particularly in fragmented or unstable markets.

- Yield farming: Yield farming faucets into Layer 2 scaling options, decentralized finance (DeFi) platforms and cross-chain bridges. Investors can earn yields by lending protocols or by offering liquidity on decentralized exchanges (DEXs), typically incomes each buying and selling charges and token incentives.

- Volatility arbitrage technique: This technique targets the hole between implied and realized volatility in crypto choices markets, providing market-neutral alpha by superior forecasting and threat administration.

High upside and an increasing universe

Meanwhile, new alternatives proceed to emerge. Tokenized real-world property (RWAs) are projected to exceed $10.9 trillion by 2030, whereas DeFi protocols, which have amassed 17,000 unique tokens and business models whereas accumulating $108 billion+ in property, are anticipated to surpass $500 billion in worth by 2027. All of this factors in direction of an ever increasing, ever creating digital asset ecosystem that’s superb for traders to make the most of as a respectable alpha producing medium.

Bitcoin’s worth has surged over time, whereas its long-term realized volatility has steadily declined, signaling a maturing market.

CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data Read More