Markets, Bitcoin, Gold, S&P, Nasdaq Initially BTC decoupled from shares, however the optimistic correlation has strengthened in the course of the latest downturn.

Pro-crypto Donald Trump gained the U.S. presidential election over 4 months in the past, and since then, the interval has been characterised by monetary market turbulence and world uncertainties surrounding tariffs, geopolitical tensions, and ongoing conflicts within the Middle East and between Ukraine and Russia.

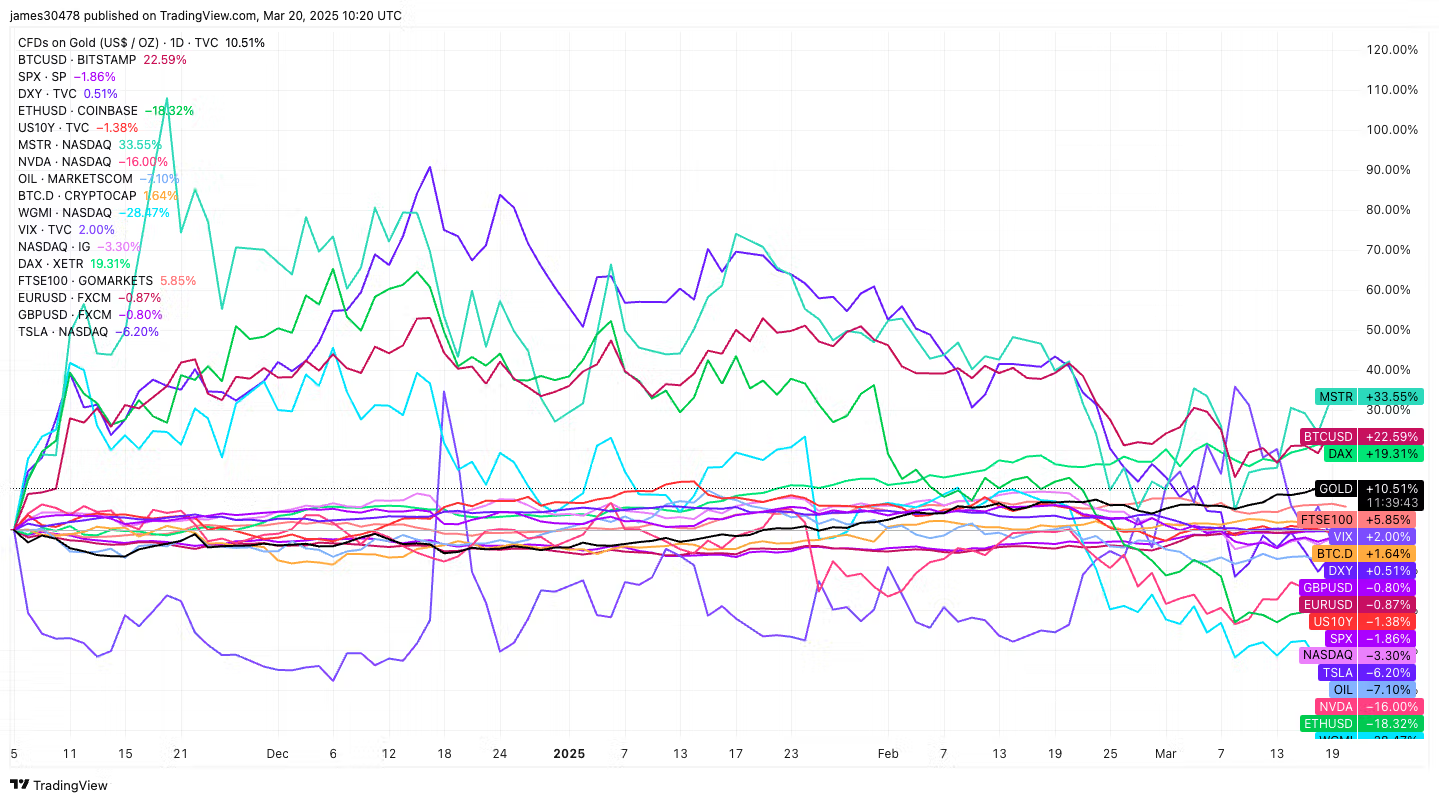

Bitcoin (BTC) has surged over 23% for the reason that Nov. 5 election, reaching an all-time excessive of over $109K on the finish of January. Despite a subsequent 30% decline from its peak, it stays one of many best-performing property. Strategy (MSTR), usually thought of a bitcoin proxy, has gained 34%, recovering nicely beneath the Trump administration regardless of beforehand dropping round 60% from its November highs.

Ethereum’s ether token (ETH) has fallen by as a lot as 18%, alongside disappointing motion within the broader crypto market. The Valkyrie Bitcoin Mining ETF has additionally struggled, dropping nearly 30%. Meanwhile, buyers have rotated cash into BTC, pushing its dominance charge larger by 2% to over 61.

European equities have carried out nicely, outshining their U.S. counterparts. The German DAX index is up 20%, and the UK’s FTSE 100 has gained 6%, alongside weaker performances within the U.S. inventory market, the place the Nasdaq and S&P 500 are each down roughly 2%. A recent report from Bank of America highlights a document drop in U.S. inventory allocations. Gold, benefiting from uncertainty, has continued to set new all-time highs, surpassing $3,030—an 11% enhance.

The U.S. Dollar Index (DXY), which measures the greenback’s power towards a basket of main currencies, stays flat. However, beneath Trump, the dollar has weakened considerably, offering some reduction to threat property and main currencies such because the Euro and the Great British Pound.

Meanwhile, the U.S. 10-year Treasury yield has barely declined to 4.2%, a key metric the administration is intently monitoring. Oil costs have plummeted by round 7% because the U.S. maintains its stance on power dominance to cut back power prices.

Notably, a few of the so-called “Magnificent 7” shares have struggled, with NVIDIA (NVDA) down 16% and Tesla (TSLA) declining 6%.

Detox underway?

Recent losses on Wall Street and within the crypto market have ignited hopes for the “Trump put,” or potential coverage help. However, the administration appears willing to endure short-term ache for long-term advantages, believing that this strategy will cleanse the markets of the fiscal spending excesses of the Biden period.

This reset is predicted to be characterised decrease inflation, improved power safety, and a lower 10-year Treasury yield.

“Scott Bessent’s talk of a “detox period” suggests a controlled downturn might be ahead. If that’s the case, Trump’s playbook seems clear: blame the recession on Biden, use tariffs and crypto narratives to manage costs, and push for lower interest rates to fuel tech and AI growth. Short-term pain, long-term gain—that’s the strategy,” Gracy Chen, CEO of Bitget, mentioned in an electronic mail to CoinDesk this week.

“Regardless, I don’t see BTC falling below 70k, possibly 73-78k which is a solid time to enter for any buyers on the fence. In the next 1-2 years, BTC at 200k isn’t as far-fetched as most would think,” Chen added.

CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data Read More

CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data Read More