Markets, Ether, Liquidations, CoinGlass, AI Market Insights, News ETH declined the most among the CoinDesk 20 Index, falling twice as far as bitcoin.

Friday brought carnage onto crypto markets as U.S.-China trade tensions ratcheted up with Trump threatening a massive increase in tariffs against Chinese goods.

Worst-hit among the crypto benchmark CoinDesk 20 Index constituents was Ethereum’s native token ether (ETH), nosediving 7% from Friday’s session high and hitting its weakest price since late September below $4,100. Its decline far outpaced bitcoin’s (BTC) 3.5% drop below $118,000 and the index’s 5% plunge.

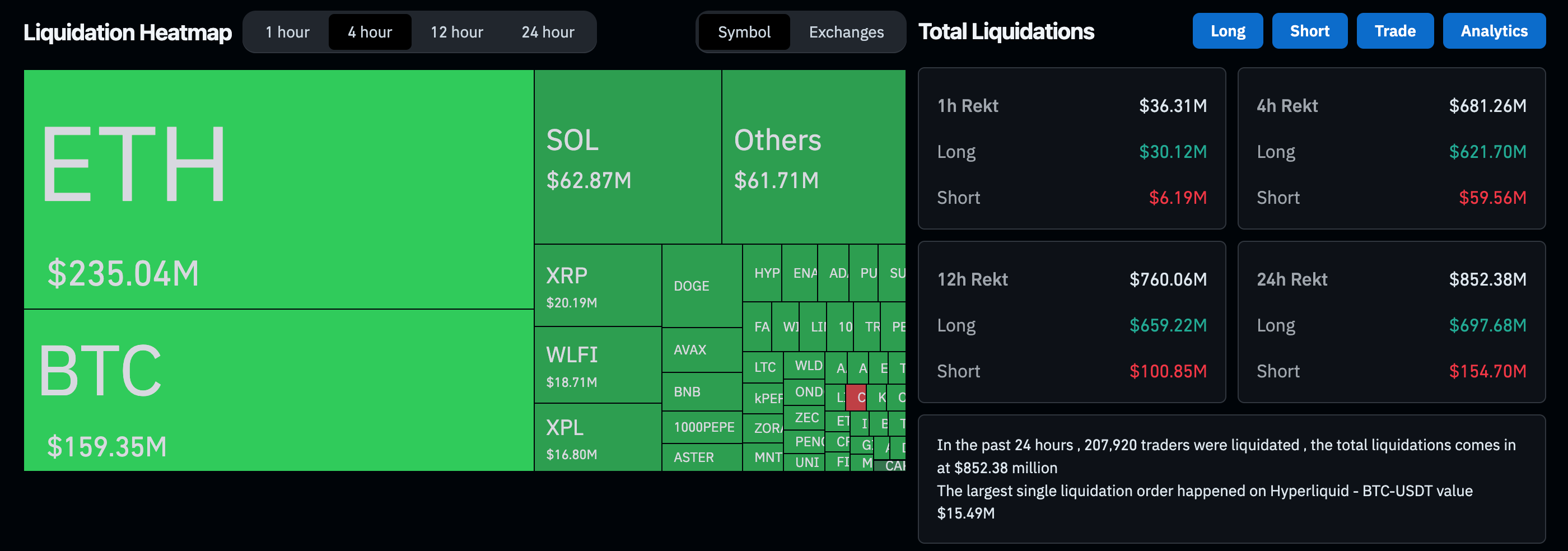

The broad-market downturn spurred a liquidation cascade across crypto derivatives markets, wiping out over $600 million of leveraged trading positions among all assets, CoinGlass data shows.

ETH also led in liquidations with over $235 million long positions wiped out through the session. Longs are leveraged bets seeking to profit from the asset’s price rise.

Technical breakdown

Behind the liquidation cascade was ETH’s breakdown of critical support levels, CoinDesk Research’s technical analysis model suggested.

• Selling pressure materialized at around 14:00 UTC with a volume of 372,211 units, almost double than the 24-hour average of 190,747 units.

• Volume-based resistance confirmed around $4,287.

• Primary resistance identified at $4,141 during failed recovery attempt.

• Potential support forming just below $4,100 where buyers emerged.

CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data Read More