Finance, Curve Finance, Crv, DeFi, Yield, Governance, News A Curve DAO proposal seeks to introduce Yield Basis, a protocol with a $60 million stablecoin mint that offers direct rewards to veCRV token holders.

Curve Finance founder Michael Egorov unveiled a proposal on the Curve DAO governance forum that would give the decentralized exchange’s token holders a more direct way to earn income.

The protocol, called Yield Basis, aims to distribute sustainable returns to CRV holders who stake tokens to participate in governance votes, receiving veCRV tokens in exchange. The plan moves beyond the occasional airdrops that have defined the platform’s token economy to date.

Under the proposal, $60 million of Curve’s crvUSD stablecoin will be minted before Yield Basis starts up. Funds from selling the tokens will support three bitcoin-focused pools; WBTC, cbBTC and tBTC, each capped at $10 million.

Yield Basis will return between 35% and 65% of its value to veCRV holders, while reserving 25% of Yield Basis tokens for the Curve ecosystem. Voting on the proposal runs from Sept. 17 to Sept. 24.

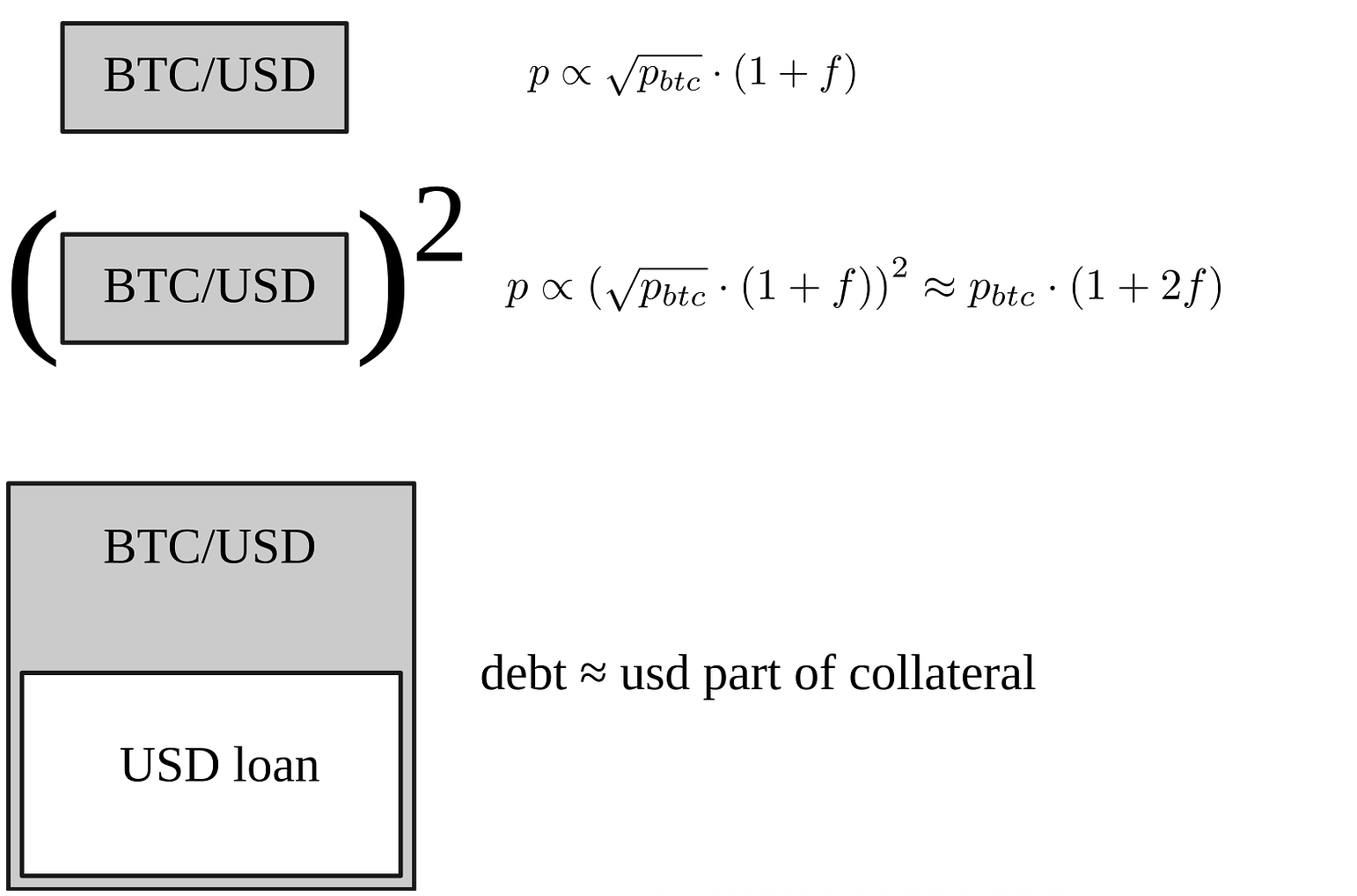

The protocol is designed to attract institutional and professional traders by offering transparent, sustainable bitcoin yields while avoiding the impermanent loss issues common in automated market makers.

Impermanent loss occurs when the value of assets locked in a liquidity pool changes compared with holding the assets directly, leaving liquidity providers with fewer gains (or greater losses) once they withdraw.

The new protocol comes against a backdrop of financial turbulence for Egorov himself. The Curve founder has suffered several high-profile liquidations in 2024 tied to leveraged CRV purchases.

In June, more than $140 million worth of CRV positions were liquidated after Egorov borrowed heavily against the token to support its price. That episode left Curve with $10 million in bad debt.

Most recently, in December, Egorov was liquidated for 918,830 CRV (about $882,000) after the token dropped 12% in a single day. He later said on X that the position was linked to funds from the uWu hack and represented repayment of a promise by uWu’s founder.

CRV rose around 1% in the past 24 hours.

CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data Read More