CoinDesk Indices, Crypto for Advisors, CoinDesk Indices, Financial Advisors, Institutional Investments, News Crypto has developed from a speculative wager to a strategic asset that now performs a reputable position in institutional portfolios. It’s not the Wild West anymore.

In immediately’s crypto for advisors, Dovile Silenskyte from WisdomTree talks concerning the development of crypto merchandise and the way they’ve developed right into a strategic funding allocation.

Then, Kim Klemballa from CoinDesk Indices solutions questions on digital asset benchmarks and traits in Ask an Expert.

You’re studying Crypto for Advisors, CoinDesk’s weekly e-newsletter that unpacks digital belongings for monetary advisors. Subscribe here to get it each Thursday.

The Evolution of Crypto Products — From Speculative Bets to Strategic Assets

Crypto is not the “Wild West” of investing. Once dismissed as mere speculative bets, digital belongings have matured into a reputable and more and more strategic part of institutional portfolios.

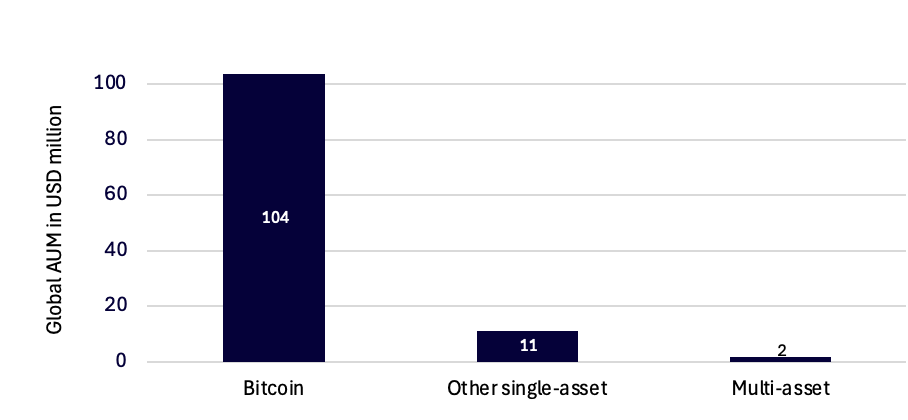

Figure 1: Global belongings underneath administration (AUM) in bodily crypto ETPs

Source: Bloomberg, WisdomTree. 01 April 2025. Historical efficiency just isn’t a sign of future efficiency and any funding might go down in worth.

As of the top of Q1 2025, world belongings underneath administration (AUM) in bodily bitcoin exchange-traded merchandise (ETPs) was greater than $100 billion. That determine indicators deep, sustained conviction from institutional buyers, which means that is not simply the realm of early adopters. Today, sovereign wealth funds, pension schemes and asset managers are allocating to crypto at scale.

After greater than 15 years of improvement, a number of boom-and-bust cycles and a world consumer base exceeding half a billion people, crypto has confirmed it’s no passing development. Bitcoin has emerged as a crypto macro asset — scarce, decentralized and more and more positioned as a core holding inside diversified multi-asset portfolios.

But right here’s the catch — crypto allocations are nonetheless under-diversified.

Despite rising adoption, most crypto portfolios stay narrowly concentrated in bitcoin. That is a legacy mindset and one that’s essentially flawed. Investors wouldn’t allocate their whole fairness publicity to Apple, nor depend on a single bond to signify mounted revenue. Yet that’s exactly what number of nonetheless deal with crypto.

Diversification is foundational in conventional finance. It spreads danger, enhances resilience and unlocks entry to broader alternative units. The similar precept holds in digital belongings.

The cryptocurrency universe has expanded far past bitcoin, evolving right into a dynamic ecosystem of distinct applied sciences, use circumstances and funding theses.

Smart contract platforms like Ethereum, Solana and Cardano are constructing decentralized infrastructure for all the pieces from decentralized finance (DeFi) to non-fungible tokens (NFTs), every with distinctive trade-offs in scalability, safety and community design. Meanwhile, Polkadot is advancing interoperability, enabling seamless communication throughout chains — a key constructing block for a multi-chain future.

Beyond these Layer 1 blockchains, we’re seeing speedy innovation in:

- Real-world asset (RWA) tokenization the place conventional finance meets blockchain rails

- DeFi protocols powering decentralized lending, buying and selling and liquidity options

- Web3 infrastructure, from decentralized id to storage, forming the spine of a extra open web

Each of those sectors carries its personal risk-return profile, adoption curve and regulatory trajectory. Treating them as interchangeable, or worse, ignoring them altogether, is much like lowering world fairness investing to a single tech inventory. It is not only outdated — it’s strategically inefficient.

Diversification in crypto just isn’t about avoiding danger, however slightly, capturing the complete spectrum of innovation. In a multi-chain, multi-thesis world, failing to diversify means leaving alternative on the desk.

The case for crypto indices

The actuality is that the majority buyers do not need the time, instruments or technical experience to maintain up with 24/7 crypto markets. Crypto indices provide a strong answer for these in search of broad, systematic publicity with out having to dive into tokenomics, validator uptime or community upgrades.

Just as fairness buyers depend on benchmarks such because the S&P 500 or MSCI indices, diversified crypto indices permit buyers to entry the market passively — with scale, construction and ease. No guesswork, no token-picking, no want for fixed rebalances. Just clear, rules-based publicity to the evolving crypto panorama.

– Dovile Silenskyte, Director of Digital Assets Research, WisdomTree

Ask an Expert

Q. Why is diversification essential in crypto?

A. Among over 20,000 listed cryptocurrencies, bitcoin now accounts for roughly 65% of total market capitalization. Diversification is essential for institutional buyers to handle volatility and seize broader alternatives. Indices may be an environment friendly approach of monitoring asset class efficiency, whereas merchandise like exchange-traded funds (ETFs) and individually managed accounts (SMAs) can present publicity to a number of cryptocurrencies directly, doubtlessly serving to to unfold danger.

Q. What traits are you seeing in digital belongings?

A. Institutional buyers are coming into the market, pushing digital belongings from a distinct segment funding right into a key asset class. EY-Parthenon and Coinbase carried out a survey of greater than 350 institutional buyers all over the world in January 2025. Of the buyers surveyed, 87% plan to extend general allocations to crypto in 2025, spanning quite a lot of choices comparable to exchange-traded merchandise (ETPs), investments in digital asset firms, stablecoins, futures and thematic mutual funds. Per the survey, 55% maintain spot crypto via ETPs, with 69% of those that plan to personal spot crypto planning to take action utilizing registered automobiles.

Q. Does a broad-based benchmark exist in crypto?

A. There are broad benchmarks in digital belongings. At CoinDesk Indices, we launched the CoinDesk 20 Index in January 2024, to seize the efficiency of high digital belongings and act as a gateway to measure, commerce and spend money on the ever-expanding crypto asset class. Designed with liquidity and diversification in thoughts, the CoinDesk 20 has generated an unprecedented $14.5 billion in whole buying and selling quantity and is offered in twenty funding automobiles globally. CoinDesk Indices additionally has the CoinDesk 80 Index, CoinDesk 100 Index (CoinDesk 20 + CoinDesk 80) and CoinDesk Memecoin Index, amongst others.

– Kim Klemballa, Head of Marketing, CoinDesk Indices

Keep Reading

- Why a Diversified Approach to Crypto Investing Makes Sense, an interview with Dovile Silenskyte.

- International grocery large SPAR begins accepting bitcoin payments in Switzerland.

- The new crypto-friendly U.S. SEC Chair, Paul S. Atkins, was sworn in Wednesday.

CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data Read More