CoinDesk Indices, Solana, Crypto for Advisors, CoinDesk Indices, Newsletters, News Despite previous setbacks, Solana has emerged as a leading platform for retail activity, particularly in the fast-growing sectors of meme coins and NFTs.

In today’s Crypto for Advisors, Josh Olszewicz from Canary Capital provides a breakdown of Solana – where it came from, and what’s happening with the asset today.

Then, Alec Beckman from Psalion answers questions about Solana’s history and considerations for investors in Ask an Expert.

Solana’s Rise: Resilience, Regulation, and the Road to Adoption

Solana has emerged as a formidable player in the blockchain arena, showcasing remarkable resilience in the face of significant challenges. Despite setbacks such as the FTX collapse and network outages, Solana has rebounded impressively, with its native token, SOL, experiencing substantial growth since its lows in late 2022. The platform’s appeal lies in its high-speed, low-cost transactions, positioning it as a preferred choice for both developers and users. However, concerns about centralization persist, stemming from the network’s reliance on a limited number of validators and high hardware requirements. While Solana operates on a proof-of-stake consensus mechanism, offering scalability and staking yield, the legal classification of the SOL token remains a contentious issue in the United States, with the Securities and Exchange Commission yet to provide definitive guidance.

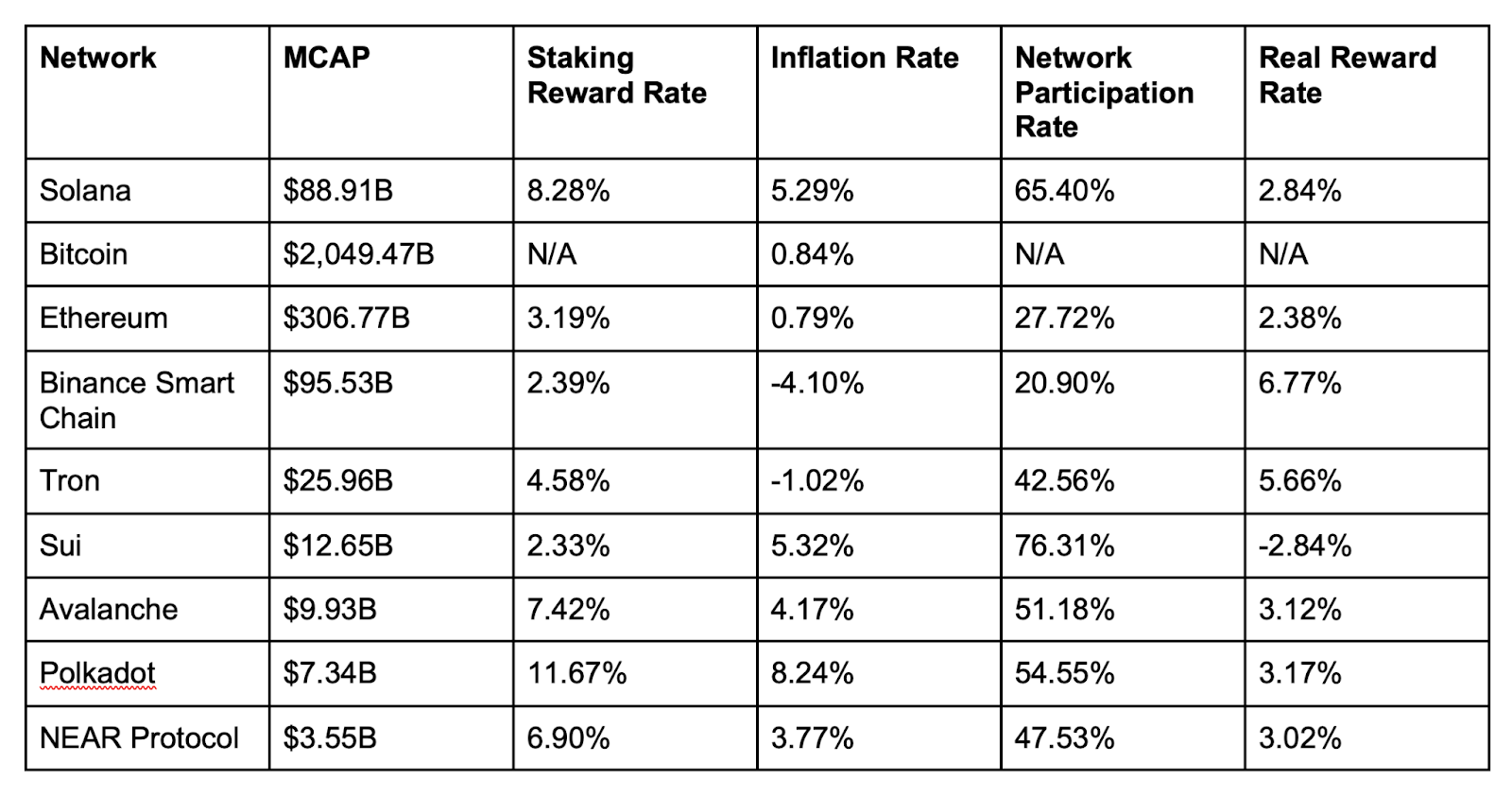

Amid the global disruption of the COVID-19 pandemic, Solana Labs launched the Solana blockchain and its native token, SOL, in March 2020. Backed by leading venture capital firms including a16z, Jump, Multicoin Capital and Polychain Labs, as well as the now-defunct Alameda Research, the platform quickly differentiated itself through high-speed, low-cost transactions, offering a compelling alternative to legacy Layer 1 protocols such as Ethereum (ETH), Binance Smart Chain (BNB) and Tron (TRX). Competing platforms, such as Avalanche (AVAX), Polkadot (DOT), and NEAR Protocol (NEAR), followed later that year, intensifying the race for smart contract dominance.

Solana operates on a proof-of-stake consensus mechanism, which allows users to secure the network and participate in governance by staking tokens. Unlike Bitcoin’s proof-of-work, proof-of-stake networks such as Solana rely on validators — entities entrusted with maintaining the ledger and processing transactions. Solana’s governance is partially influenced by stake-weighted voting, similar to a representative democracy, where the validators with the most staked assets wield the most influence.

Solana’s early momentum was fueled by endorsements from Sam Bankman-Fried and the now-defunct FTX exchange, which portrayed Solana as a faster and more scalable alternative to Ethereum. Bankman-Fried’s entities invested heavily in the ecosystem and built significant infrastructure around it. However, the collapse of FTX and Alameda Research in late 2022 revealed material centralization risks. Both firms held significant positions in SOL, and their bankruptcy triggered a sharp sell-off, raising questions about token distribution and ecosystem resilience.

In 2023, Solana faced further scrutiny when the SEC, under Chair Gary Gensler, identified SOL as a potential unregistered security in lawsuits against Binance and Coinbase. Robinhood subsequently delisted SOL, causing the asset to plummet to an extreme low, which was only surpassed by the FTX fallout. Nonetheless, SOL appreciated nearly 700% between October 2023 and March 2024, reflecting robust retail demand and increasing developer activity despite regulatory ambiguity.

The regulatory tide began to shift in late 2024. Robinhood relisted SOL in November, citing evolving policy guidance and customer interest. In early 2025, the SEC, under its newly appointed Chair Paul Atkins, dismissed its case against Coinbase and paused proceedings against Binance. While Solana’s classification remains unresolved, the industry anticipates a revised framework that could allow blockchain projects to be deemed “sufficiently decentralized,” thereby sidestepping securities law constraints. The recent approval of crypto-based ETFs further signals growing regulatory acceptance and may provide a pathway to broader institutional involvement.

Despite previous setbacks, Solana has emerged as a leading platform for retail activity, particularly in the fast-growing sectors of meme coins and NFTs. Phantom, a self-custody wallet built for Solana, reported 10 million monthly active users in 2024, more than 850 million transactions, and 24 million mobile app downloads. One notable catalyst was the January 2025 launch of the TRUMP coin, which coincided with SOL reaching an all-time high of nearly $300.

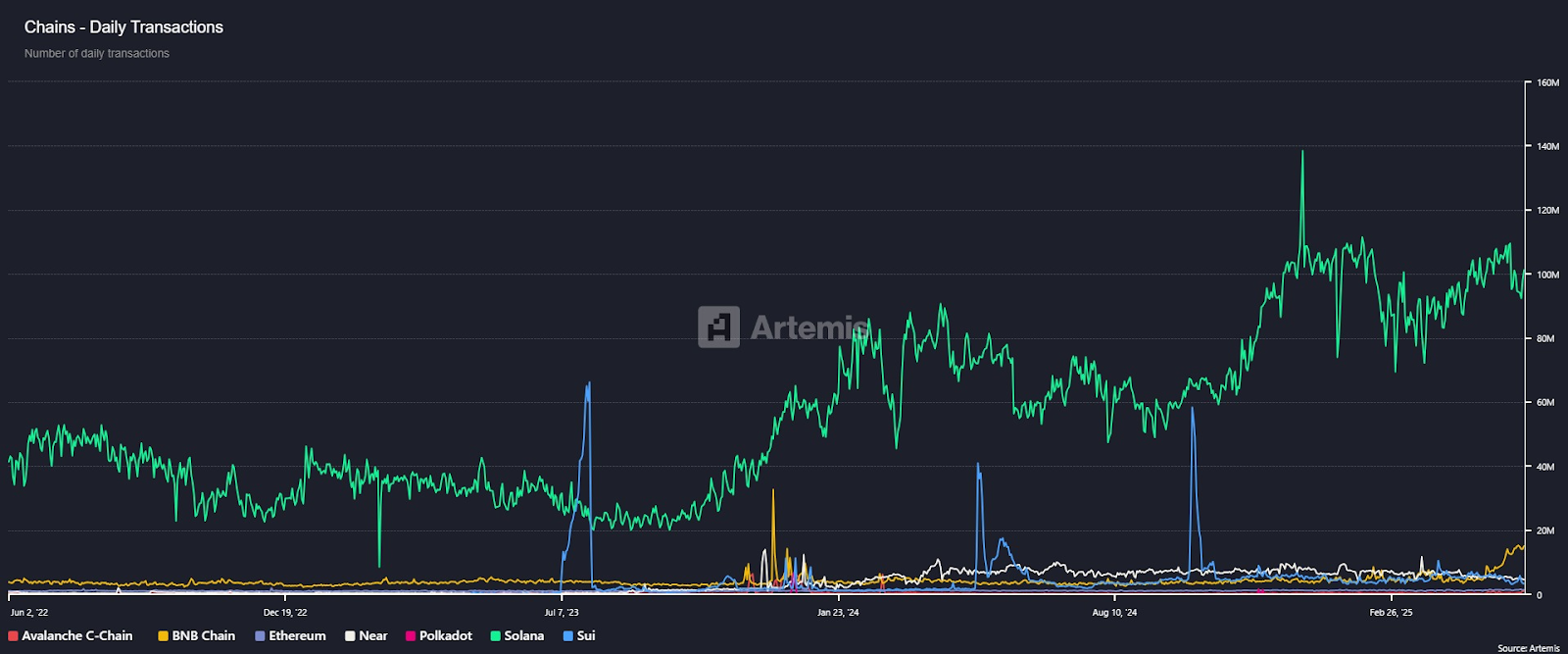

Daily Transactions

Source: Bloomberg Terminal

Although network reliability concerns persist, with seven temporary blockchain outages since 2020, Solana consistently ranks among the top blockchains in terms of daily active users, transaction volume, decentralized exchange activity and fee generation. However, in decentralized finance and real-world asset applications, Ethereum remains dominant, with Solana still trailing in key metrics, including total value locked and circulating stablecoins.

Comparison Table

Source: https://www.stakingrewards.com/

From an investment perspective, SOL has historically traded as a high-beta asset relative to bitcoin, resembling the behaviour of equities such as Strategy. Since late 2024, some firms have begun replicating the Strategy playbook, raising capital to acquire SOL for their balance sheets. While this may increase short-term demand, long-term efficacy will depend on sustained network adoption, regulatory clarity and institutional trust.

– Josh Olszewicz, portfolio manager, Canary Capital

Ask an Expert

Q. Why are investors interested in Solana?

Solana stands out for its high speed, low fees, and growing ecosystem:

- Performance – Solana can handle up to 65,000 transactions per second with finality in seconds, making it ideal for real-time applications such as trading, gaming, and payments.

- Cost Efficiency – Fees are consistently under a cent, making it appealing for retail-driven use cases.

- Ecosystem Growth – Platforms like Jupiter (DeFi) and Helium Mobile (telecom) are expanding real-world use.

- Big-Name Backing – Partnerships with Visa and Shopify have reinforced Solana’s position as a serious layer-1 contender.

With a loyal community and strong momentum, Solana has emerged as a high-beta play on blockchain usability and scalability.

Q. What should investors watch when evaluating Solana?

Investors should keep an eye on both technical and ecosystem fundamentals:

- Network Stability – Following a history of outages, Solana is introducing Firedancer, a new validator client designed to enhance reliability and throughput.

- On-Chain Metrics – Daily active users exceed 1 million. DeFi TVL has recently surpassed $4 billion, driven by strong NFT volumes and app usage.

- Tokenomics – SOL has a declining inflation schedule and high staking participation (~70% of supply is staked).

- Regulatory Momentum – ETF applications from VanEck and 21Shares are pending, and any U.S. approval would be a significant milestone and create institutional inflows to Solana.

Tracking development activity, usage, and upgrades is key to understanding Solana’s staying power.

Q. What are the biggest risks of investing in Solana?

Solana carries high upside potential, but also meaningful risks:

- Past Instability – The network faced multiple outages between 2021 and 2023, which hurt investor confidence. Stability has improved, but remains under scrutiny.

- Regulatory Pressure – SOL was mentioned in SEC lawsuits against Coinbase and Binance in 2023 as a possible unregistered security.

- Centralization Concerns – A significant portion of tokens went to insiders, and the validator set is significantly less decentralized than Ethereum’s.

- Market Volatility – Solana is closely tied to speculative trends, such as memecoins and NFT booms, leading to sharp price fluctuations.

- Institutional Builds – A significant increase in institutional building is occurring on the Ethereum blockchain.

For all its innovation, SOL has risks driven by both fundamentals and narrative momentum.

– Alec Beckman, vice president of Growth, Psalion

Keep Reading

- Stifel Financial Corp. greenlights advisors to invest in bitcoin for clients..

- The U.S. SEC Commissioner Peirce confirmed that banks can include crypto services.

- Discover how nearly 100 crypto exchanges rank on the industry’s most trusted risk assessment covering security, regulatory compliance and market quality: CoinDesk’s Latest Exchange Benchmark Rankings.

CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data Read More