Crypto Daybook Americas, Crypto Daybook Americas, News Your day-ahead search for May 1, 2025

By Francisco Rodrigues (All occasions ET until indicated in any other case)

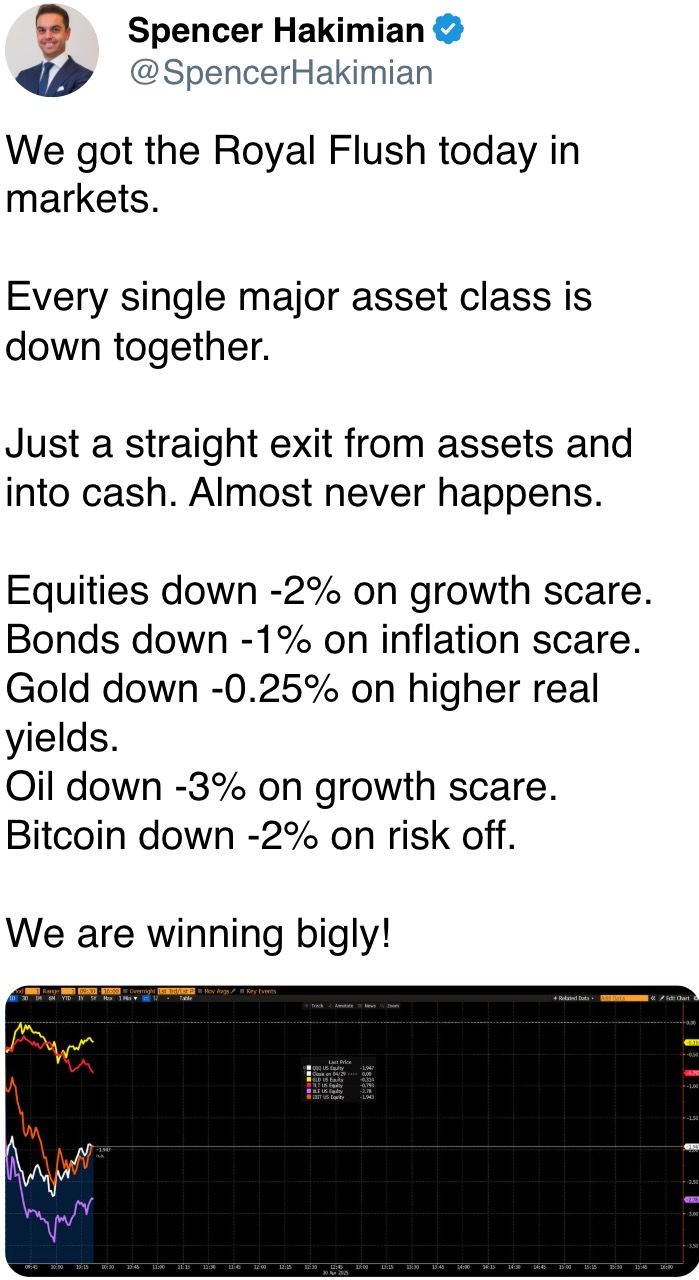

The affect of President Donald Trump’s reciprocal tariffs is beginning to be felt. The U.S. financial system contracted for the primary time in three years final quarter and inventory costs have seen their worst first 100-day efficiency of a presidential administration since 1974.

Results from buying and selling platform Robinhood additionally confirmed markets cooled within the first three months of the yr, even because it beat analyst forecasts for each income and earnings per share.

It wasn’t alone, main tech corporations together with Microsoft and Meta beat estimates and, crucially, Robinhood’s income from crypto doubled from the year-earlier quarter. That could foreshadow what to search for later immediately, when Block, Riot Platforms, Strategy and Reddit submit outcomes after the closing bell.

“The recent wave of weak macroeconomic data has pointed to both recessionary risks and rising inflation,” James Butterfill, the top of analysis at CoinShares, instructed CoinDesk. “Despite this, bitcoin has shown remarkable resilience, outperforming the Nasdaq by 11% since ‘Liberation Day’” on April 2.

Indeed, whereas first-quarter gross home product (GDP) fell 0.3% and main inventory indexes submit posted losses in final month, bitcoin (BTC) held robust. The largest cryptocurrency rose practically 15% towards the greenback in April as traders began utilizing it as a protected haven, together with gold and the Swiss franc.

To Butterfill, threat belongings are actually seemingly benefiting from expectations of an earlier-than-expected interest-rate reduce.

“Equities and bitcoin seem to have recoupled, each rebounding immediately on renewed hopes of an imminent interest-rate reduce,” he said. “A disappointing payroll determine on Friday — which we see as probably — may very well be the ultimate nail within the coffin for Powell, paving the way in which for extra dovish coverage from the Fed.”

Yet within the cryptocurrency house, there’s extra to keep watch over. Ethereum’s long-awaited Pectra improve, which incorporates enhancements to make the community extra user-friendly and environment friendly, goes live on mainnet on May 7.

The improve is important for Ethereum, which has been dropping floor to extra environment friendly blockchains together with Solana, Base and BNB chain. DeFiLlama data reveals whole worth locked (TVL) on Ethereum’s good contracts grew simply 4% in April, in contrast with 21% on Solana, and 9.9% on BNB Chain. Base noticed a minor contraction.

In the previous yr, Artemis data reveals Ethereum internet outflows totaled $3.3 billion, whereas Base and Solana noticed $3.3 billion and $3.2 billion in internet inflows, respectively. Still, Ethereum recorded $880 million in internet inflows in April, suggesting the development is reversing forward of Pectra’s activation.

The development has, nonetheless, taken its toll. The ETH/BTC ratio has dropped to little over 0.19, the bottom stage in 5 years. Stay alert!

What to Watch

- Crypto:

- May 1: Coinbase Asset Management will introduce the Coinbase Bitcoin Yield Fund (CBYF), which is geared toward non-U.S. traders.

- May 1: Hippo Protocol starts up its personal layer-1 blockchain mainnet constructed on Cosmos SDK and completes a migration from Ethereum’s ERC-20 HPO token to its native HP token, enabling staking and governance.

- May 1, 9 a.m.: Constellation Network (DAG) activates the Tessellation v3 improve on its mainnet, introducing delegated staking, node collateral, token locking and new transaction sorts to boost community safety, scalability and performance.

- May 1, 11 a.m.: THORChain activates its v3.5 mainnet improve, including the TCY token to transform $200 million in debt into fairness. TCY holders earn 10% of community income, whereas native RUNE stays the protocol’s safety and governance token. TCY prompts May 5.

- May 5, 3 a.m.: IOTA’s Rebased network upgrade begins. Rebased strikes IOTA to a brand new community, boosting capability to as many as 50,000 transactions per second, providing staking rewards of 10%-15% a yr and including help for MoveVM good contracts.

- May 5, 11 a.m.: The Crescendo network upgrade goes stay on the Kaspa (KAS) mainnet. This improve boosts the community’s efficiency by growing the block manufacturing charge to 10 blocks per second from 1 block per second.

- May 7, 6:05 a.m.: The Pectra hard fork network upgrade will get activated on the Ethereum (ETH) mainnet at epoch 364032. Pectra combines two main parts: the Prague execution layer onerous fork and the Electra consensus layer improve.

- Macro

- May 1, 8:30 a.m.: The U.S. Department of Labor releases unemployment insurance coverage information for the week ended April 26.

- Initial Jobless Claims Est. 224K vs. Prev. 222K

- May 1, 9:30 a.m.: S&P Global releases Canada April buying managers’ index (PMI) information.

- Manufacturing PMI Prev. 46.3

- May 1, 9:45 a.m.: S&P Global releases (Final) U.S. April buying managers’ index (PMI) information.

- Manufacturing PMI Est. 50.7 vs. Prev. 50.2

- May 1, 10:00 a.m.: Institute for Supply Management (ISM) releases U.S. April financial exercise information.

- Manufacturing PMI Est. 48 vs. Prev. 49

- May 2, 8:30 a.m.: The U.S. Bureau of Labor Statistics releases April employment information.

- Nonfarm Payrolls Est. 130K vs. Prev. 228K

- Unemployment Rate Est. 4.2% vs. Prev. 4.2%

- May 2, 9:00 a.m.: S&P Global releases Brazil April buying managers’ index (PMI) information.

- Manufacturing PMI Prev. 51.8

- May 2, 11:00 a.m.: S&P Global releases Mexico April buying managers’ index (PMI) information.

- Manufacturing PMI Prev. 46.5

- May 1, 8:30 a.m.: The U.S. Department of Labor releases unemployment insurance coverage information for the week ended April 26.

- Earnings (Estimates primarily based on FactSet information)

Token Events

- Governance votes & calls

- Compound DAO is voting on moving 35,200 COMP (~$1.5 m) into a multisig safe to check promoting lined calls on COMP for USDC, lend that USDC in Compound for additional yield, then use the returns to purchase again COMP and repeat, concentrating on roughly 15 % annual achieve. Voting ends May 2.

- May 1, 1 p.m.: Wormhole to host an ecosystem call.

- May 2, 3 a.m.: Ontology to host a weekly group update on X spaces.

- May 5, 4 p.m.: Livepeer (LPT) to host a Treasury Talk session on Discord.

- Unlocks

- May 1: Sui (SUI) to unlock 2.28% of its circulating provide value $261.2 million.

- May 1: ZetaChain (ZETA) to unlock 5.67% of its circulating provide value $12.31 million.

- May 2: Ethena (ENA) to unlock 0.73% of its circulating provide value $13.39 million.

- May 7: Kaspa (KAS) to unlock 0.56% of its circulating provide value $13.96 million.

- May 9: Movement (MOVA) to unlock 2.04% of its circulating provide value $12.61 million.

- Token Launches

- May 2: Binance to delist Alpaca Finance (ALPACA), PlayDapp (PDA), Viberate (VIB), and Wing Finance (WING).

- May 5: Sonic (S) to be listed on Kraken.

Conferences

CoinDesk’s Consensus is going down in Toronto on May 14-16. Use code DAYBOOK and save 15% on passes.

- Day 2 of two: TOKEN2049 (Dubai)

- May 6-7: Financial Times Digital Assets Summit (London)

- May 11-17: Canada Crypto Week (Toronto)

- May 12-13: Dubai FinTech Summit

- May 12-13: Filecoin (FIL) Developer Summit (Toronto)

- May 12-13: Latest in DeFi Research (TLDR) Conference (New York)

- May 12-14: ACI’s 9th Annual Legal, Regulatory, and Compliance Forum on Fintech & Emerging Payment Systems (New York)

- May 13: Blockchain Futurist Conference (Toronto)

- May 13: ETHWomen (Toronto)

- May 14-16: CoinDesk’s Consensus 2025 (Toronto)

Token Talk

By Shaurya Malwa

- Over 3.7 million tokens — or 53% — listed on GeckoTerminal since 2021 have failed, which means they’re now not actively traded, per a CoinGecko report on Wednesday.

- The yr alone, 1.8 million have collapsed.

- That’s practically half of all lifeless tokens up to now 5 years, pushed by market turbulence post-Trump inauguration.

- The explosion in token creation, from 428,000 in 2021 to just about 7 million by 2025, is especially as a result of instruments like Pump.enjoyable that allow speedy memecoin launches.

- Most failures occurred in 2024 and 2025, as memecoin saturation and speculative hype led to short-lived, low-effort crypto initiatives flooding the market.

Derivatives Positioning

- Open curiosity throughout centralized exchanges has continued its regular climb, reaching $125 billion throughout all belongings in a transparent sign of rising speculative exercise and market engagement.

- On Binance, the BTC-USDT perpetual order guide heatmap reveals the following important provide zone is at $96.2K, with ask orders totaling 321 BTC. Additionally, liquidation heatmaps present clusters round $96K, suggesting a possible magnet for worth motion, with liquidation pockets of $58M, $42.7M and $56.1M.

- Notably, the biggest liquidation cluster sits on the $93K help, the place $76.3M in liquidations are stacked making it a key stage to look at for draw back volatility.

- Among belongings with over $100 million in open curiosity, the biggest week-on-week will increase had been seen in Virtuals Protocol, MemeFi, Curve, Fartcoin, and Hyperliquid.

- On the funding charge entrance, MemeFi, Virtuals Protocol and Alchemist AI posted the sharpest will increase, signaling elevated lengthy positioning and potential overheating in sentiment.

Market Movements:

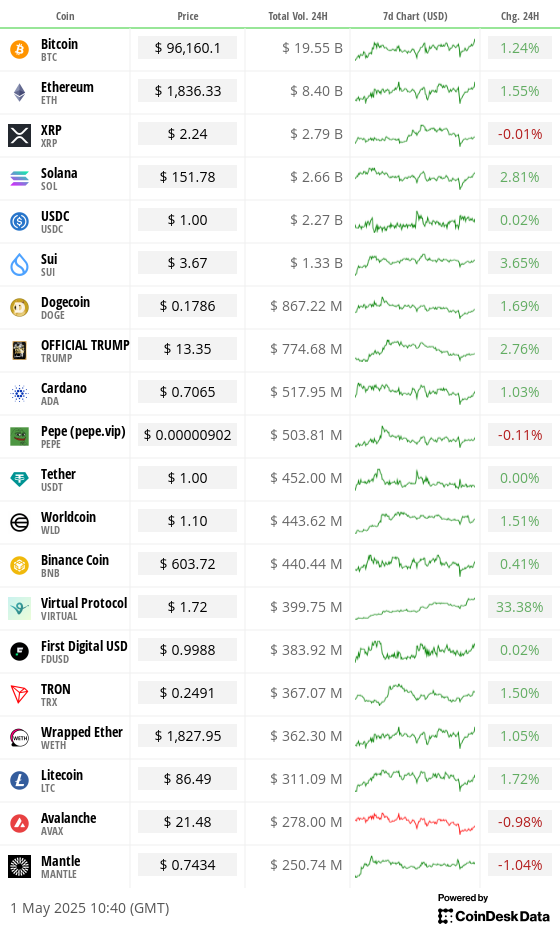

- BTC is up 1.76% from 4 p.m. ET Wednesday at $96,305.26 (24hrs: +1.49%)

- ETH is up 2.37% at $1,838.40 (24hrs: +2.03%)

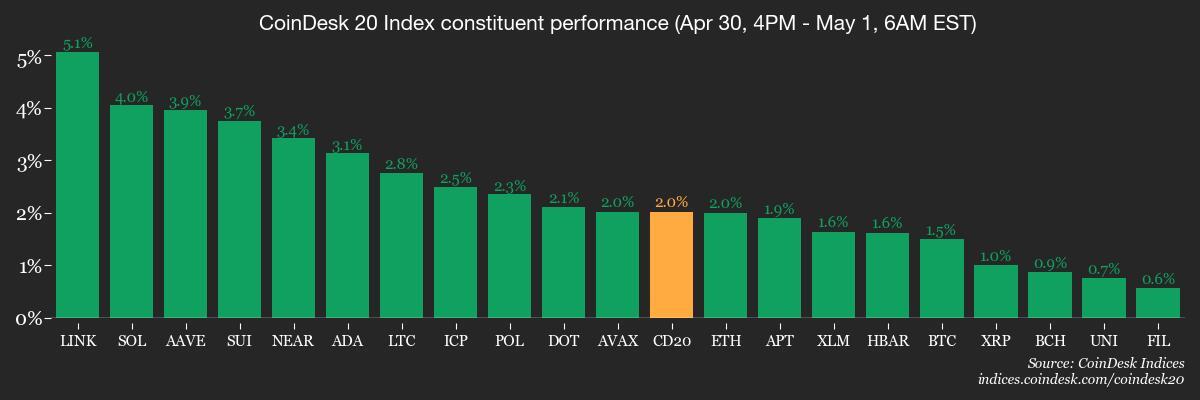

- CoinDesk 20 is up 1.64% at 2,787.00 (24hrs: +1.22%)

- Ether CESR Composite Staking Rate is down 29 bps at 2.67%

- BTC funding charge is at 0.0078% (1.0416% annualized) on Binance

- DXY is up 0.31% at 99.81

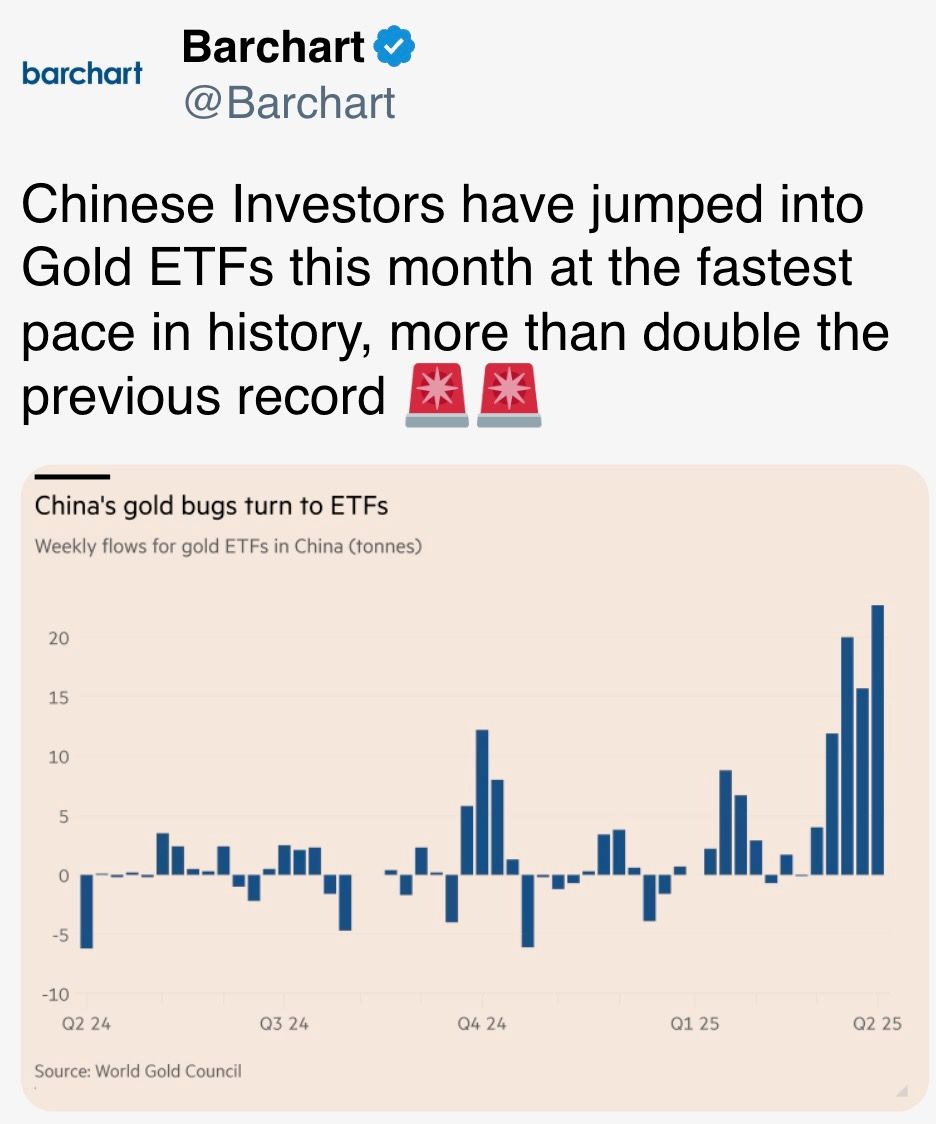

- Gold is down 2.01% at $3,221.46/oz

- Silver is down 1.32% at $32.14/oz

- Nikkei 225 closed +1.13% at 36,452.30

- Hang Seng closed +0.51% at 22,119.41

- FTSE is unchanged at 8,494.81

- Euro Stoxx 50 closed unchanged at 5,160.22

- DJIA closed on Wednesday +0.35% at 40,669.36

- S&P 500 closed +0.15% at 5,569.06

- Nasdaq closed unchanged at 17,446.34

- S&P/TSX Composite Index closed -0.13% at 24,841.68

- S&P 40 Latin America closed -0.73% at 2,529.66

- U.S. 10-year Treasury charge is up 4 bps at 4.17%

- E-mini S&P 500 futures are down 1.23% at 5,655.75

- E-mini Nasdaq-100 futures are up 1.73% at 20,002.75

- E-mini Dow Jones Industrial Average Index futures are up 0.83% at 41,109.00

Bitcoin Stats

- BTC Dominance: 64.57 (0.10%)

- Ethereum to bitcoin ratio: 0.01914 (0.47%)

- Hashrate (seven-day transferring common): 850 EH/s

- Hashprice (spot): $49.24

- Total Fees: 6.59 BTC / $630,313.73

- CME Futures Open Interest: 133,905 BTC

- BTC priced in gold: 29.6 oz

- BTC vs gold market cap: 8.40%

Technical Analysis

- After final week’s explosive rally, bitcoin is consolidating in a low-timeframe vary between $93,000 and $95,600.

- While yesterday’s U.S. GDP launch briefly triggered draw back stress, the worth shortly recovered, and BTC is holding above the yearly open, signaling underlying power.

- On the longer timeframe, bitcoin stays inside a provide zone, but with a current hourly candle closing decisively above native resistance, there is a suggestion of a possible continuation of the upward grind.

- If momentum persists, the following key space of curiosity lies between $96,000 and $98,000.

Crypto Equities

- Strategy (MSTR): closed on Wednesday at $380.11 (-0.35%), up 3.1% at $391.85 in pre-market

- Coinbase Global (COIN): closed at $202.89 (-1.57%), up 2.89% at $208.75

- Galaxy Digital Holdings (GLXY): closed at $21.92 (+3.94%)

- MARA Holdings (MARA): closed at $13.37 (-5.98%), up 3.52% at $13.87

- Riot Platforms (RIOT): closed at $7.24 (-2.43%), up 3.87% at $7.52

- Core Scientific (CORZ): closed at $8.10 (-2.29%), up 5.80% at $8.57

- CleanSpark (CLSK): closed at $8.17 (-3.2%), up 4.90% at $8.57

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $13.68 (-3.59%)

- Semler Scientific (SMLR): closed at $32.33 (-4.83%), up 3.93% at $33.60

- Exodus Movement (EXOD): closed at $39.04 (-4.71%), up 1.82% at $39.75

ETF Flows

Spot BTC ETFs:

- Daily internet stream: -$56.3 million

- Cumulative internet flows: $39.11 billion

- Total BTC holdings ~ 1.15 million

Spot ETH ETFs

- Daily internet stream: -$2.3 million

- Cumulative internet flows: $2.50 billion

- Total ETH holdings ~ 3.45 million

Source: Farside Investors

Overnight Flows

Chart of the Day

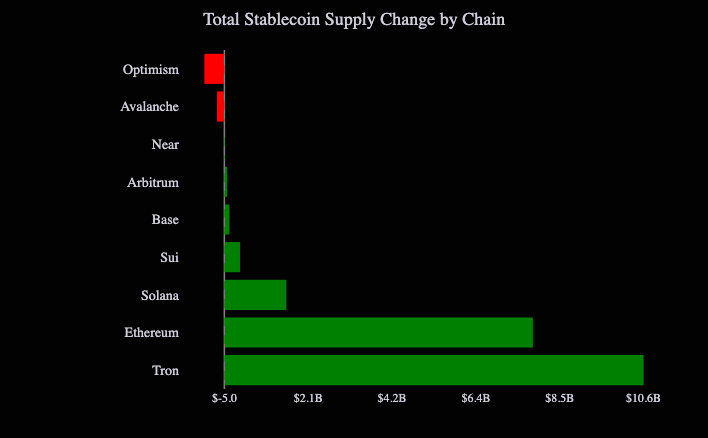

- Over the previous 12 months, the provision of stablecoins has been rapidly increasing on Tron and Ethereum, information from The Tie present.

- Optimism and Avalanche, each Ethereum layer-2 networks, have seen a decline in favor of these layer 1s.

While You Were Sleeping

- Sam Altman’s World Crypto Project Launches in U.S. With Eye-Scanning Orbs in 6 Cities (CoinDesk): World plans to deploy 7,500 eye-scanning units throughout the U.S. this yr, and individuals who use them to confirm their id will obtain the challenge’s WLD token.

- U.S. and Ukraine Sign Landmark Minerals Deal After Months of Fraught Negotiations (CNBC): In return for favored entry to Ukraine’s pure assets, Washington pledged reconstruction help, with Treasury Secretary Bessent calling the deal a sign of U.S. dedication to Ukrainian sovereignty and peace.

- Bank of Japan Slashes Growth Forecast as Trade War Hits (The Wall Street Journal): Japan’s central financial institution held charges at 0.5% and reduce its progress outlook to 0.5% for fiscal 2025 and 0.7% for fiscal 2026.

- Gold Shows Signs of Consolidation as Investment Eases, but Trump Looms (Reuters): Gold costs have dipped from document highs regardless of surging funding, as central-bank shopping for and traders grew hopeful Trump could ease world commerce tensions.

- How India and Pakistan’s Military, Nuclear Arsenals Stack Up (Bloomberg): After final week’s lethal Kashmir assault, India’s prime minister faces stress to reply, and whereas analysts see full-scale warfare as unlikely, restricted army battle stays a risk.

- Mesh Adds Apple Pay to Let Shoppers Spend Crypto, Settle in Stablecoins (CoinDesk): The characteristic goals to shut the so-called last-mile hole that has stalled mass crypto adoption in funds, co-founder and CEO Bam Azizi mentioned.

In the Ether

CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data Read More

CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data Read More