Crypto Daybook Americas, Crypto Daybook Americas, Breaking News Your day-ahead search for March 12, 2025

By James Van Straten (All occasions ET until indicated in any other case)

Macroeconomic elements proceed to drive bitcoin’s (BTC) short-term value volatility because it holds regular above $80,000, with a wave of serious information rising over the previous 24 hours.

Still, there is a risk-off feeling within the air because the divergence between bitcoin and the broader crypto market grows. Bitcoin dominance has surged to 62%, approaching a year-to-date excessive, whereas the ether-to-bitcoin (ETH-BTC) ratio has turned unfavourable on a four-year compound annual foundation, that means ETH is underperforming.

Meanwhile, Trump’s commerce wars persist as one other concern reining in optimism available in the market. That’s not simply with Canada, but in addition within the type of metallic tariffs, prompting retaliatory measures from the European Union.

One of probably the most intriguing developments comes from Canada, the place newly appointed Prime Minister Mark Carney has filed to promote U.S. greenback bonds. While the scale of the sale stays undisclosed, it is value noting the nation is the sixth-largest holder of U.S. Treasuries, possessing $379 billion as of the top of 2024. If the sale proceeds, it might put upward stress on yields, which is the other of what Trump needs.

The Treasury yield narrative is paramount as a result of roughly $9 trillion worth of U.S. debt is about to mature or require refinancing this 12 months alone. This is likely one of the key the explanation why the U.S. administration is raring to deliver down Treasury yields.

More instantly, market consideration is popping to as we speak’s Consumer Price Index (CPI) report, with risk-asset bulls hoping for a softer inflation print. The S&P 500 is hovering round correction territory, down almost 10%. If inflation is available in hotter than anticipated, threat belongings might face additional draw back. Stay Alert!

What to Watch

Crypto:

March 12: Hemi (HEMI), an L2 blockchain that operates on each Bitcoin and Ethereum, has its mainnet launch.

March 15: Athene Network (ATH) mainnet launch.

March 15: Reploy will shut its V1 RAI staking program to new customers because it transitions to a completely automated revenue-sharing protocol.

March 17: CME Group launches solana (SOL) futures.

March 18: Zano (ZANO) hard fork network upgrade which prompts “ETH Signature support for off-chain signing and asset operations.”

March 20: Pascal hard fork network upgrade goes dwell on the BNB Smart Chain (BSC) mainnet.

Macro

March 12, 8:00 a.m.: The Brazilian Institute of Geography and Statistics (IBGE) releases February client value inflation information.

Inflation Rate MoM Est. 1.3% vs. Prev. 0.16%

Inflation Rate YoY Est. 5% vs. Prev. 4.56%

March 12, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases February client value inflation information.

Core Inflation Rate MoM Est. 0.3% vs. Prev. 0.4%

Core Inflation Rate YoY Est. 3.2% vs. Prev. 3.3%

Inflation Rate MoM Est. 0.3% vs. Prev. 0.5%

Inflation Rate YoY Est. 2.9% vs. Prev. 3%

March 12, 9:45 a.m.: The Bank of Canada publicizes its interest-rate decision adopted by a press convention (livestream link) 45 minutes later.

Policy Interest Rate Est. 2.75% vs. Prev. 3%

March 12, 12:00 p.m.: Russia’s Federal State Statistics Service releases February client value inflation information.

Inflation Rate MoM Est. 0.8% vs. Prev. 1.2%

Inflation Rate YoY Est. 10.1% vs. Prev. 9.9%

March 13, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases February producer value inflation information.

Core PPI MoM Est. 0.3% vs. Prev. 0.3%

Core PPI YoY Est. 3.6% vs. Prev. 3.6%

PPI MoM Est. 0.3% vs. Prev. 0.4%

PPI YoY Est. 3.3% vs. Prev. 3.5%

Earnings (Estimates primarily based on FactSet information)

March 12 (TBC): TeraWulf (WULF), $-0.03

March 14: Bit Digital (BTBT), pre-market, $-0.05

March 24 (TBC): Galaxy Digital Holdings (TSE: GLXY), C$0.38

Token Events

Governance votes & calls

Uniswap DAO is discussing continuing treasury delegation to keep up governance stability and retain lively delegates, together with a renewed framework and construction expiration and allocation mechanisms.

March 13, 10 a.m.: Mantra to host a Community Connect call with its CEO and Co-Founder to debate varied main updates.

March 13, 10 a.m.: Mantle Network to carry a Surge Ask Me Anything (AMA) session.

March 13, 11:30 a.m.: Jupiter to hold a Planetary Call.

Unlocks

March 12: Aptos (APT) to unlock 1.93% of circulating provide value $58.26 million.

March 14: Starknet (STRK) to unlock 2.33% of its circulating provide value $10.67 million.

March 15: Sei (SEI) to unlock 1.19% of its circulating provide value $10.35 million.

March 16: Arbitrum (ARB) to unlock 2.1% of its circulating provide value $31.53 million.

March 18: Fasttoken (FTN) to unlock 4.66% of its circulating provide value $79.60 million.

March 21: Immutable (IMX) to unlock 1.39% of circulating provide value $12.70 million.

Token Listings

March 31: Binance to delist USDT, FDUSD, TUSD, USDP, DAI, AEUR, UST, USTC, and PAXG.

Conferences

CoinDesk’s Consensus is going down in Toronto on May 14-16. Use code DAYBOOK and save 15% on passes.

Day 3 of three: AIBC Africa (Cape Town)

Day 2 of two: VanEck Southern California Blockchain Conference 2025 (Los Angeles)

March 13-14: Web3 Amsterdam ‘25

March 16, 6:00 p.m.: Solana AI Summit (San Jose, Calif.)

March 18-20: Digital Asset Summit 2025 (New York)

March 18-20: Fintech Americas Miami 2025

March 19-20: Next Block Expo (Warsaw)

March 24-26: Merge Buenos Aires

March 25-26: PAY360 2025 (London)

March 25-27: Mining Disrupt (Fort Lauderdale, Fla.)

March 26: Crypto Assets Conference (Frankfurt)

March 26: DC Blockchain Summit 2025 (Washington)

March 26-28: Real World Crypto Symposium 2025 (Sofia, Bulgaria)

March 27: Building Blocks (Tel Aviv)

March 27: Digital Euro Conference 2025 (Frankfurt)

March 27: WIKI Finance EXPO Hong Kong 2025

March 27-28: Money Motion 2025 (Zagreb, Croatia)

March 28: Solana APEX (Cape Town)

Token Talk

By Shaurya Malwa

The freshly issued BMT tokens of Bubblemaps, a crypto transparency and on-chain evaluation device, are down greater than 50% since going dwell on Tuesday.

Bubblemaps makes use of clustering to group pockets addresses into bubbles, revealing whale concentrations, insider management or suspicious patterns (e.g. a deployer with 76% of provide), serving to buyers assess dangers via visible possession maps.

BMT can be utilized to entry an “Intel Desk” for community-driven rip-off investigations and premium analytics options, and take part in governance.

People are slamming BMT for a nearly 90% supply concentration in a single pockets, a mintable contract risking inflation, an elitist airdrop excluding many, and unlocked liquidity elevating rug-pull fears, which is reasonably ironic for a transparency-focused venture.

Derivatives Positioning

Cumulative open curiosity in ETH commonplace and perpetual futures has risen to 9.75 million ETH, the best since Feb. 3. The depend has elevated from 8.4 million ETH 4 weeks in the past, which reveals merchants have been promoting into the falling market.

Open curiosity in BTC perp and commonplace futures stays gentle, with funding charges marginally optimistic. SOL, ADA, TRX and LINK nonetheless see unfavourable perpetual funding charges.

Deribit-listed BTC and ETH choices proceed to exhibit a bias for places out to May expiry, with significant constructive outlook for calls rising from the third quarter.

Overnight block flows featured promoting larger strike BTC and ETH calls and buy of short-tenor places.

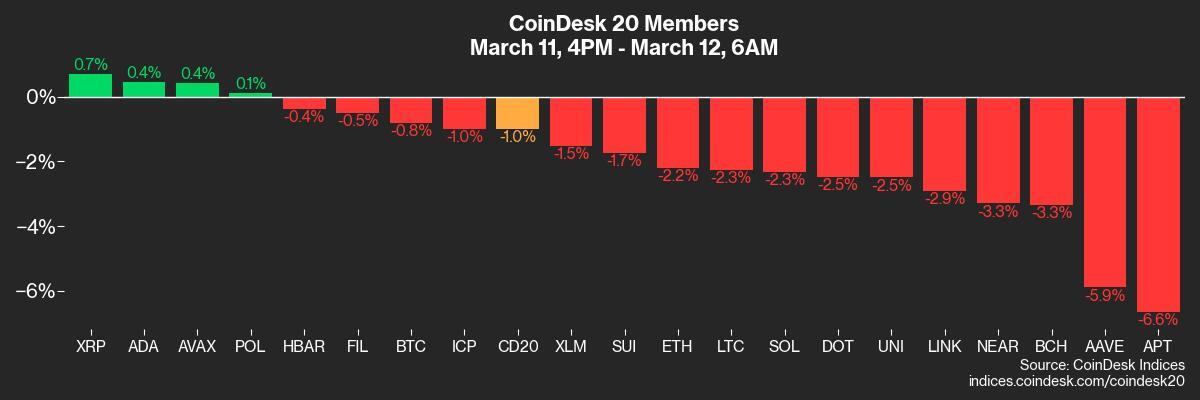

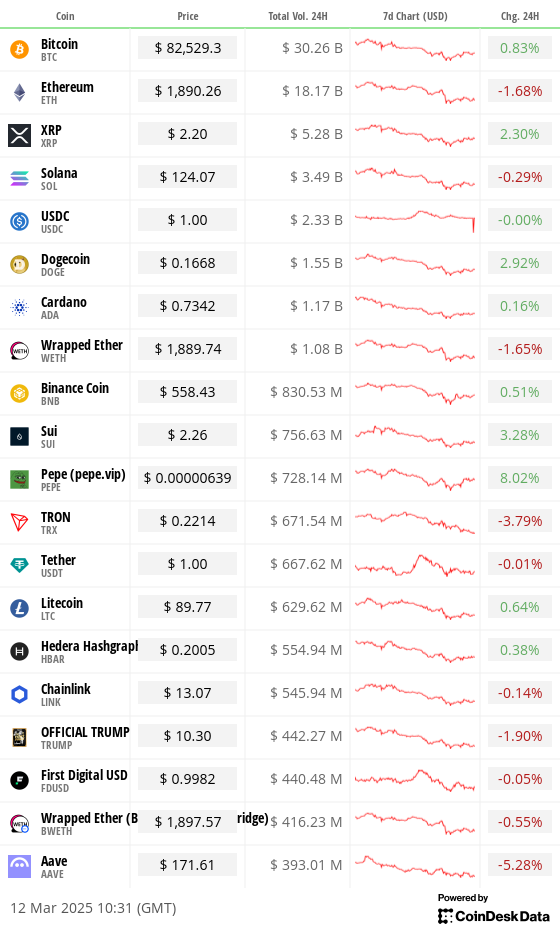

Market Movements:

BTC is down 0.55% from 4 p.m. ET Tuesday at $82,577.14 (24hrs: +0.87%)

ETH is down 2.6% at $1,892.41 (24hrs: -1.58%)

CoinDesk 20 is down 1% at 2,556.70 (24hrs: +0.52%)

Ether CESR Composite Staking Rate is up 32 bps at 3.43%

BTC funding price is at 0.007% (2.54% annualized) on Binance

DXY is down 0.31% at 103.52

Gold is unchanged at $2,914.29/oz

Silver is up 0.69% at $33.01/oz

Nikkei 225 closed unchanged at 36,819.09

Hang Seng closed -0.76 at 23,600.31

FTSE is up 0.43% at 8,532.17

Euro Stoxx 50 is up 1.19% at 5,373.08

DJIA closed on Tuesday -1.14% at 41,433.48

S&P 500 closed -0.76% at 5,572.07

Nasdaq closed -0.18% at 17,436.10

S&P/TSX Composite Index closed -0.54% at 24,248.20

S&P 40 Latin America closed +0.44% at 2,307.52

U.S. 10-year Treasury price is unchanged at 4.28%

E-mini S&P 500 futures are up 0.54% at 5,607.25

E-mini Nasdaq-100 futures are up 0.67% at 19,529.25

E-mini Dow Jones Industrial Average Index futures are up 0.37% at 41,627.00

Bitcoin Stats:

BTC Dominance: 62.13 (-0.16%)

Ethereum to bitcoin ratio: 0.02290 (-0.06%)

Hashrate (seven-day transferring common): 815 EH/s

Hashprice (spot): $46.1

Total Fees: 6.03 BTC / $490,764

CME Futures Open Interest: 142,725 BTC

BTC priced in gold: 28.3 oz

BTC vs gold market cap: 8.04%

Technical Analysis

The greenback index, which represents the buck’s alternate price in opposition to a basket of fiat currencies, has dropped beneath the 61.8% Fibonacci retracement help of the late September to January rally.

The breakdown means a possible tender U.S. CPI launch might simply ship the index sliding to 102.31, the 78.6% retracement help.

A deeper slide within the greenback might bode nicely for threat belongings, together with BTC.

Crypto Equities

Strategy (MSTR): closed on Tuesday at $260.59 (+8.91%), down 0.58% at $259.09 in pre-market

Coinbase Global (COIN): closed at $191.69 (+6.95%), unchanged in pre-market

Galaxy Digital Holdings (GLXY): closed at C$17.27 (-1.09%)

MARA Holdings (MARA): closed at $13.32 (-0.67%), down 0.68% at $13.23

Riot Platforms (RIOT): closed at $7.72 (+2.12%), down 0.26% at $7.70

Core Scientific (CORZ): closed at $8.63 (+7.74%), down 0.46% at $8.59

CleanSpark (CLSK): closed at $8.26 (+3.51%), down 0.73% at $8.20

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $15.08 (+4.14%)

Semler Scientific (SMLR): closed at $32.80 (+0.18%)

Exodus Movement (EXOD): closed at $24.50 (-0.41%), up 0.94% at $24.73

ETF Flows

Spot BTC ETFs:

Daily internet move: -$371 million

Cumulative internet flows: $35.47 billion

Total BTC holdings ~ 1,121 million.

Spot ETH ETFs

Daily internet move: -$21.6 million

Cumulative internet flows: $2.66 billion

Total ETH holdings ~ 3.571 million.

Source: Farside Investors

Overnight Flows

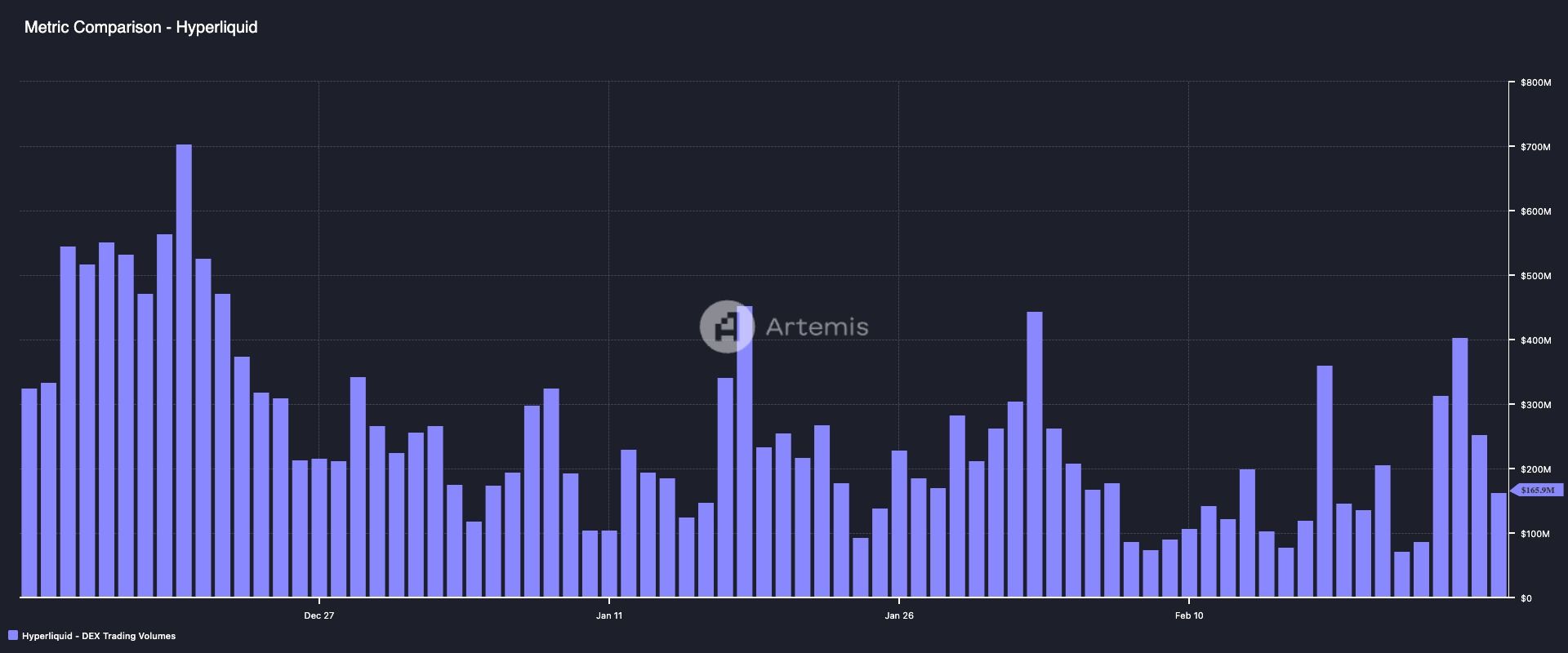

Chart of the Day

The chart reveals day by day buying and selling quantity on Hyperliquid, the main perpetual-focused decentralized alternate.

Despite the market swoon, volumes have held remarkably regular, contrasting the sharp slowdown on different avenues like Solana’s Raydium.

While You Were Sleeping

EU Retaliates After Donald Trump’s Steel and Aluminum Tariffs Take Effect (Financial Times): The European Commission’s preliminary retaliatory tariffs on whiskey, denims and bikes take impact April 1 with further levies on industrial and agricultural exports anticipated by mid-April.

Bitcoin CME Futures Spread Slides to $490, Undoing the ‘Trump Bump’ in BTC (CoinDesk): Traders are scaling again expectations that Trump’s presidency will enhance crypto.

BOJ Unfazed by Rising Bond Yields, Signals Resolve to Keep Hiking Rates (Reuters): The governor of the Bank of Japan indicated no plans to intervene as markets count on additional price hikes, pushed by wage development and better costs.

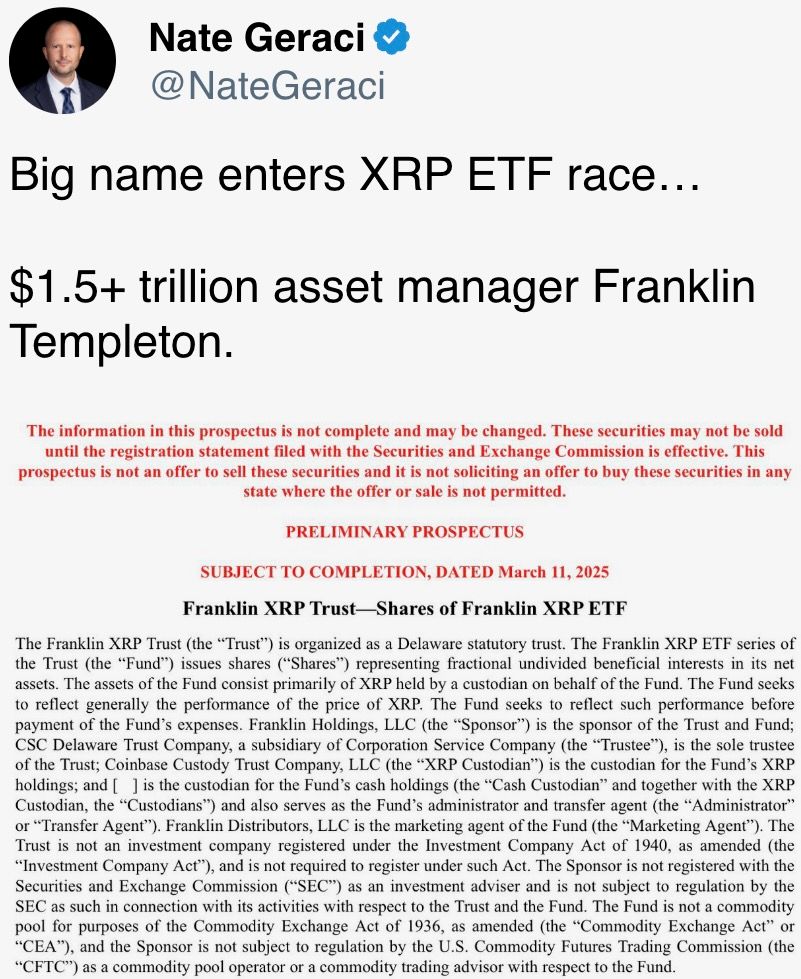

Franklin Templeton Joins XRP ETF Rush, Files Preliminary Application With SEC (CoinDesk): The American asset administration large filed a registration assertion Tuesday for a spot XRP ETF that may commerce on the Cboe BZX Exchange.

Metaplanet Increases Bitcoin Holdings With $13.5M Purchase and Bond Issuance (CoinDesk): The Japanese firm purchased 162 BTC and issued 2 billion yen in zero-interest bonds to broaden its bitcoin reserves.

Japanese Tech Giants Sony and LINE Join Forces in Blockchain Deal (CoinDesk): Sony’s blockchain division is partnering with the Japanese social media large to deliver 4 mini-apps to the Soneium blockchain. The goal is to facilitate options like in-game rewards and purchases.

In the Ether

CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data Read More

CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data Read More