Crypto Daybook Americas, Crypto Daybook Americas Your day-ahead search for March 17, 2025

By Omkar Godbole (All instances ET except indicated in any other case)

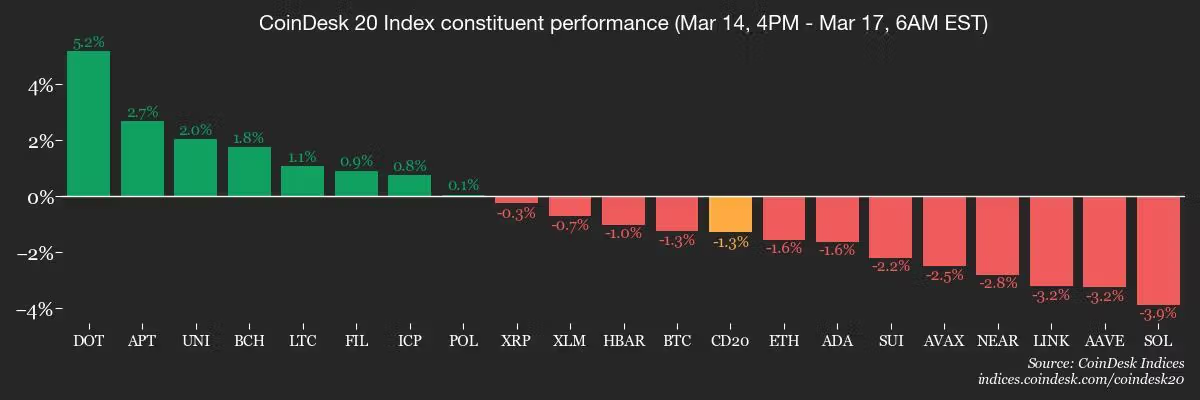

Bitcoin (BTC) has discovered some stability round its 200-day common at about $84,000 after dipping under $77,000 early final week. The broader market restoration was led by memecoins, layer-2 tokens and gaming tokens.

However, sustaining a sustained uptick may nonetheless be a problem, particularly since President Donald Trump’s administration seems to have a higher tolerance for market instability than many anticipated. Just two months in the past, when Trump took workplace, the crypto market was buzzing with optimism that any turbulence created by tariffs would result in immediate coverage assist from the White House.

That optimism appears to have been misplaced. Over the weekend, Treasury Secretary Scott Bessent stated corrections are wholesome and regular, a touch that the anticipated “Trump put” would possibly take longer to materialize than merchants hoped.

More importantly, on NBC News’ “Meet the Press” on Sunday, Bessent did not rule out the possibility of a recession. This starkly contrasts with authorities officers’ typical perspective of emphasizing “glass half full” perspective when the going will get powerful.

It may imply Trump is not able to again down from his tariff battle simply but, maintaining danger belongings feeling uneasy. If inventory costs proceed to fall, it is arduous to think about bitcoin staying resilient for lengthy, particularly given the shortage of uplifting narratives within the crypto market.

“It’s just a guess, but I doubt Trump will reverse course on tariffs and his drive to bring U.S. manufacturing back at these price levels,” Greg Magadini, director of derivatives at Amberdata, shared in an electronic mail. “I can’t picture a scenario where risk assets crash and crypto remains unaffected, or where the VIX increases and crypto’s implied volatility doesn’t follow suit.”

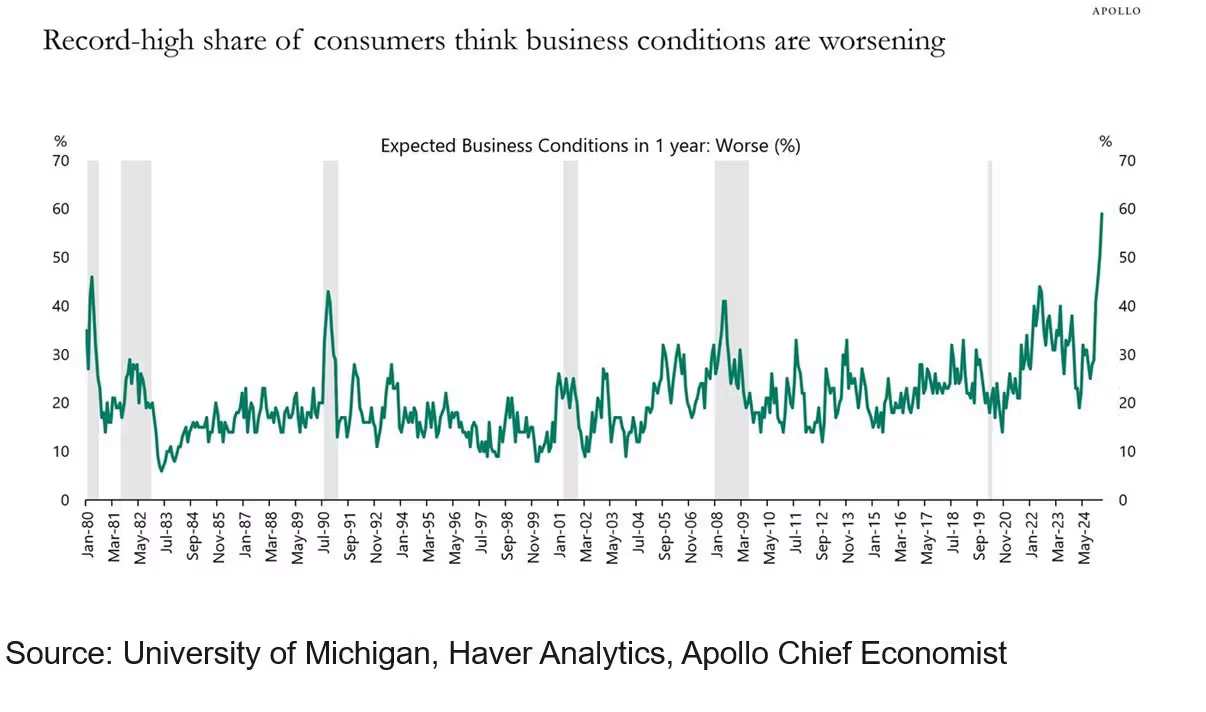

Plus, sentiment is deteriorating on Main Street, which may add to the current danger aversion in each the crypto and conventional markets. A chart shared on X by Otavio Costa, a macro strategist at Crescat’s Capital, highlights a file variety of U.S. customers anticipating circumstances to worsen over the subsequent yr (see Chart of the Day, under).

The give attention to macro means merchants will observe Wednesday’s Fed assembly for cues on the central financial institution’s readiness to deploy stimulus. The bar is low after Chairman Powell stated the financial institution is in a wait-and-watch mode to evaluate the impression of Trump’s insurance policies earlier than chopping charges.

In different information, Aave Labs’s Founder, Stani Kulechov, confirmed that the Aave decentralized autonomous group had reached a transparent consensus in opposition to introducing a brand new token for Horizon, an Aave initiative to combine real-world belongings into decentralized finance.

Trump is reportedly going to talk to Russian President Vladimir Putin about ending the Ukraine conflict. Digital asset prime dealer FalconX said it had accomplished the “first-ever” block commerce in CME’s SOL futures with StoneX as counterparty. Stay alert!

What to Watch

Crypto:

March 17: CME Group launches solana (SOL) futures.

March 17: Ethereum (ETH) testnet Hoodi goes live.

March 18: Zano (ZANO) hard fork network upgrade; this prompts “ETH Signature support for off-chain signing and asset operations.”

March 20: Pascal hard fork network upgrade goes stay on the BNB Smart Chain (BSC) mainnet.

March 21, 1:00 p.m.: The SEC’s Crypto Task Force hosts a roundtable, open to the public, that can give attention to the definition of a safety.

March 24 (earlier than market open): Bitcoin miner CleanSpark (CLSK) will join the S&P SmallCap 600 index.

March 24, 11:00 a.m.: Bugis network upgrade goes stay on Enjin Matrixchain mainnet.

March 25: The Mimir upgrade goes stay on Chromia (CHR) mainnet.

Macro

March 17, 8:30 a.m.: The U.S. Census Bureau releases February gross sales information.

Retail Sales MoM Est. 0.7% vs. Prev. -0.9%

Retail Sales YoY Prev. 4.2%

March 18, 8:30 a.m.: Statistics Canada releases February client value index (CPI) information.

Core Inflation Rate MoM Prev. 0.4%

Core Inflation Rate YoY Prev. 2.1%

Inflation Rate MoM Est. 0.6% vs. Prev. 0.1%

Inflation Rate YoY Est. 2.1% vs. Prev. 1.9%

March 18, 8:30 a.m.: The U.S. Census Bureau releases February residential building information.

Housing Starts Est. 1.375M vs. Prev. 1.366M

March 18, 11:00 p.m.: The Bank of Japan (BoJ) releases its Statement on Monetary Policy.

Interest Rate Decision Est. 0.5% vs. Prev. 0.5%

March 19, 6:00 a.m.: Eurostat releases (closing) February eurozone client value index (CPI) information.

Core Inflation Rate YoY Est. 2.6% vs. Prev. 2.7%

Inflation Rate MoM Est. 0.5% vs. Prev. -0.3%

Inflation Rate YoY Est. 2.4% vs. Prev. 2.5%

March 19, 2:00 p.m.: The Federal Reserve declares its rate of interest resolution. The FOMC press convention is livestreamed half-hour later.

Fed Funds Interest Rate Est. 4.5% vs. Prev. 4.5%

March 19, 5:30 p.m.: The Central Bank of Brazil declares its rate of interest resolution.

Selic Rate Est. 14.25% vs. Prev. 13.25%

Earnings (Estimates primarily based on TruthSet information)

March 27: KULR Technology Group (KULR), post-market

March 28: Galaxy Digital Holdings (GLXY), pre-market

Token Events

Governance votes & calls

Aave DAO is discussing the launch of Horizon, a licensed occasion of the Aave Protocol to permit establishments to “access permissionless stablecoin liquidity while meeting issuer requirements.”

Balancer DAO is discussing the deployment of Balancer V3 on OP Mainnet.

March 17, 10 a.m.: Jito to carry a Delegate’s Call to debate JIP-15, JIP-16, and its Tokenomics Report.

March 18, 6 a.m.: Toncoin (TON) to host an Ask Me Anything (AMA) session on its ecosystem growth.

March 18, 8 a.m.: Binanceto host an AMA session with Binance’s VP of Product Jeff Li and Binance Angel Victor Balaban.

Unlocks

March 18: Fasttoken (FTN) to unlock 4.66% of its circulating provide price $79.80 million.

March 18: Mantra (OM) to unlock 0.51% of its circulating provide price $34.1 million.

March 21: Immutable (IMX) to unlock 1.39% of circulating provide price $14.04 million.

March 23: Metars Genesis (MRS) to unlock 11.87% of its circulating provide price $96.8’0 million.

March 31: Optimism (OP) to unlock 1.93% of its circulating provide price $27.31 million.

Token Listings

March 18: Jupiter (JUP) to be listed on Arkham.

March 18: Paws (PAWS) to be listed on Bybit.

March 31: Binance to delist USDT, FDUSD, TUSD, USDP, DAI, AEUR, UST, USTC, and PAXG.

Conferences

CoinDesk’s Consensus is going down in Toronto on May 14-16. Use code DAYBOOK and save 15% on passes.

March 18-20: Digital Asset Summit 2025 (New York)

March 18-20: Fintech Americas Miami 2025

March 19-20: Next Block Expo (Warsaw)

March 24-26: Merge Buenos Aires

March 25-26: PAY360 2025 (London)

March 25-27: Mining Disrupt (Fort Lauderdale, Fla.)

March 26: Crypto Assets Conference (Frankfurt)

March 26: DC Blockchain Summit 2025 (Washington)

March 26-28: Real World Crypto Symposium 2025 (Sofia, Bulgaria)

March 27: Building Blocks (Tel Aviv)

March 27: Digital Euro Conference 2025 (Frankfurt)

March 27: WIKI Finance EXPO Hong Kong 2025

March 27-28: Money Motion 2025 (Zagreb, Croatia)

March 28: Solana APEX (Cape Town)

Token Talk

By Shaurya Malwa

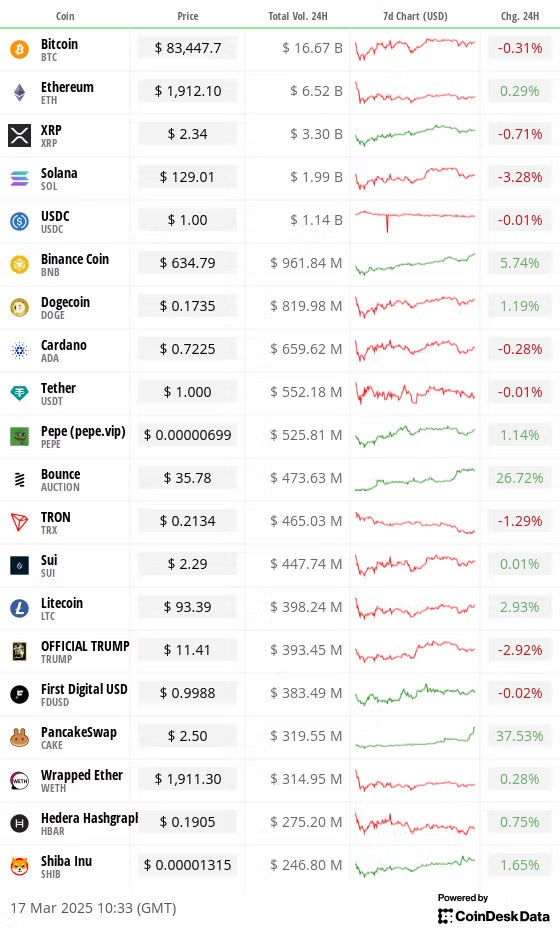

BNB Chain buying and selling volumes flipped these of Ethereum and Solana over weekend.

Decentralized exchanges (DEX) constructed on BNB Chain racked up over $1.7 billion in buying and selling quantity in every of the previous three days as newer memecoins created buying and selling alternatives for merchants.

The PancakeSwap DEX processed over $1.2 billion of quantity up to now 24 hours, serving to to spice up CAKE token costs by 30%.

The Mubarak (MUBARAK) memecoin emerged because the token gaining probably the most consideration on X, gaining listings on platforms like Binance Alpha and exchanges similar to Bitget on Monday.

It was launched by the BNB Chain-based Four Meme launchpad on March 13, with an preliminary market cap as little as $6,000. That soared previous $100 million on Sunday. The coin has no inherent utility past its meme-driven enchantment, typical of many tokens on this class, relying as an alternative on neighborhood engagement and speculative buying and selling.

Data from DEXTools reveals brisk token issuance exercise on BNB Chain as of European morning hours Monday, though most new launches fail to interrupt a $10,000 market capitalization or fall to zero as their creators pull liquidity from buying and selling swimming pools.

Meanwhile, BNB Chain’s BNB has gained 5% up to now 24 hours amid the renewed demand, beating a broader market fall.

Derivatives Positioning

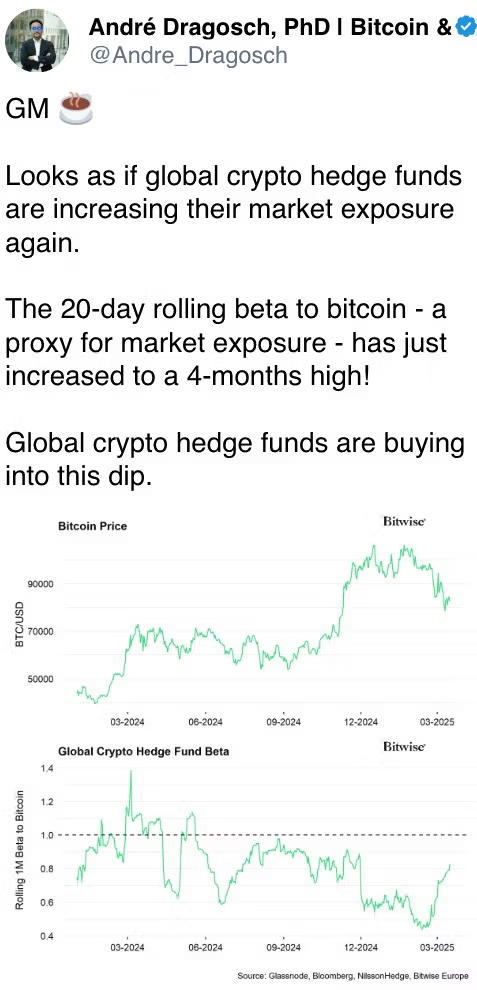

The barely constructive BTC and ETH perpetual funding charges sign warning and forged doubt on the worth restoration. Several altcoins like XRP, ADA, SOL, DOGE, LINK and TRX are seeing detrimental charges, indicating a bias for shorts.

BTC, ETH CME futures foundation stays low close to 5%.

Short and near-dated BTC and ETH places proceed to be pricier than calls.

Top block flows in BTC choices on Deribit featured OTM name promoting and put shopping for.

Market Movements:

BTC is down 0.9% from 4 p.m. ET Friday at $83,468.34 (24hrs: -0.23%)

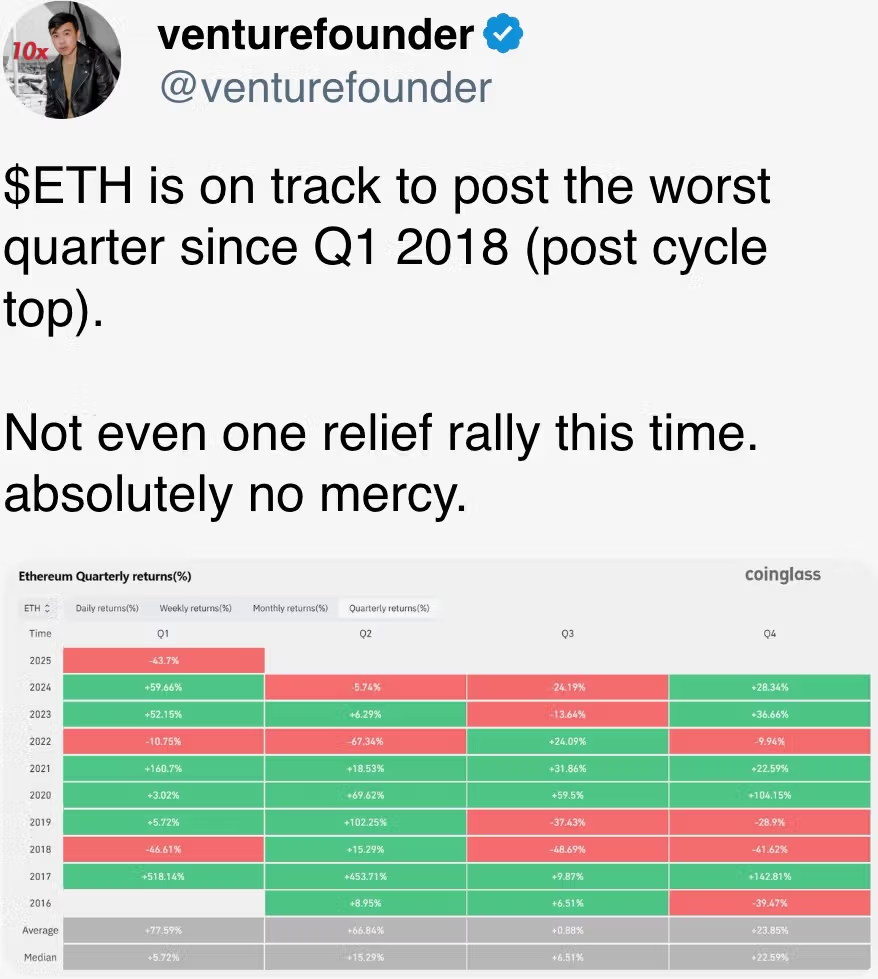

ETH is down 0.67% at $1,910.26 (24hrs: +0.18%)

CoinDesk 20 is down 0.76% at 2,625.62 (24hrs: -0.33%)

Ether CESR Composite Staking Rate is up 3 bps at 2.96%

BTC funding charge is at 0.0075% (8.2% annualized) on Binance

DXY is down 0.14% at 103.57

Gold is unchanged at $2,996.63/oz

Silver is up 0.18% at $33.84/oz

Nikkei 225 closed +0.93% at 37,396.52

Hang Seng closed +0.77% at 24,145.57

FTSE is up 0.21% at 8,650.39

Euro Stoxx 50 is up 0.22% at 5,415.98

DJIA closed on Friday +1.65% at 41,488.19

S&P 500 closed +2.13% at 5,638.94

Nasdaq closed +2.61% at 17,754.09

S&P/TSX Composite Index closed +1.45% at 24,553.40

S&P 40 Latin America closed +3.83% at 2,432.92

U.S. 10-year Treasury charge is down 3 bps at 4.29%

E-mini S&P 500 futures are down 0.35% at 5,672.50

E-mini Nasdaq-100 futures are down 0.31% at 19,858.50

E-mini Dow Jones Industrial Average Index futures are down 0.39% at 41,685.00

Bitcoin Stats:

BTC Dominance: 61.60 (-0.25%)

Ethereum to bitcoin ratio: 0.02289 (0.18%)

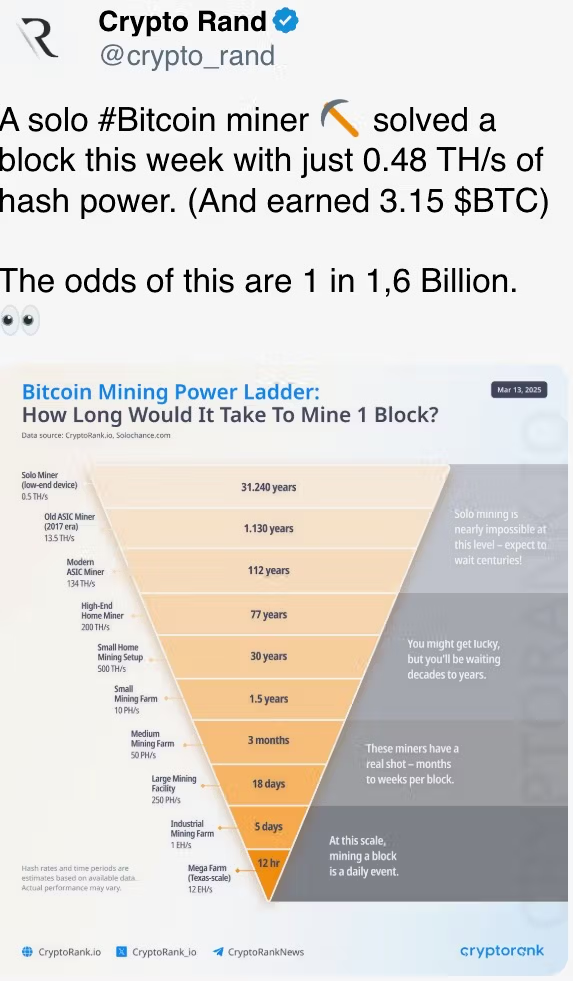

Hashrate (seven-day shifting common): 815 EH/s

Hashprice (spot): $47.38

Total Fees: 5.22 BTC / $436,428

CME Futures Open Interest: 149,470 BTC

BTC priced in gold: 27.6 oz

BTC vs gold market cap: 7.84%

Technical Analysis

The bitcoin-gold ratio has collapsed to ranges final seen in early November. The slide has penetrated the ratio’s March 2024 excessive, flipping it right into a resistance degree.

The 50-day SMA has peaked and can also be trending south, seeking to transfer under the 200-day SMA in a so-called loss of life cross. That would sign a chronic gold outperformance relative to bitcoin.

Crypto Equities

Strategy (MSTR): closed on Friday at $297.49 (+13%), down 1.91% at $291.80 in pre-market

Coinbase Global (COIN): closed at $183.12 (+3.17%), down 0.63% at $181.97

Galaxy Digital Holdings (GLXY): closed at C$17.98 (+8.18%)

MARA Holdings (MARA): closed at $13.18 (+8.39%), down 0.68% at $13.09

Riot Platforms (RIOT): closed at $7.82 (+6.98%), down 0.77% at $7.76

Core Scientific (CORZ): closed at $8.81 (+1.73%), down 1.14% at $8.71

CleanSpark (CLSK): closed at $7.97 (+3.64%), down 1.25% at $7.87

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $15.30 (+5.01%)

Semler Scientific (SMLR): closed at $34.35 (+5.3%), down 0.79% at $34.08

Exodus Movement (EXOD): closed at $28.05 (+7.55%), down 7.27% at $26.01

ETF Flows

Spot BTC ETFs:

Daily internet move: -$59.2 million

Cumulative internet flows: $35.29 billion

Total BTC holdings ~ 1,118 million.

Spot ETH ETFs

Daily internet move: -$46.9 million

Cumulative internet flows: $2.53 billion

Total ETH holdings ~ 3.521 million.

Source: Farside Investors

Overnight Flows

Chart of the Day

The share of U.S. customers anticipating enterprise circumstances to worsen within the months forward has hit a file excessive.

The improvement factors to a tricky time for danger and growth-sensitive belongings.

While You Were Sleeping

Bank of Korea Declines Bitcoin for Foreign Exchange Reserves Amid Volatility Concerns (Business Korea): The central financial institution stated bitcoin is unsuitable as a reserve asset because of its value swings, restricted liquidity, lack of convertibility and failure to satisfy investment-grade credit score standards.

OKX Suspends DEX Aggregator as It ‘Works Diligently’ to Upgrade Security (CoinDesk): The agency paused its decentralized alternate aggregator to implement tagging and safety upgrades amid EU scrutiny over potential misuse, which it denies.

Trump Says He Will Talk to Putin on Tuesday to Discuss Ukraine (The New York Times): Trump stated he’ll talk about land and energy crops within the March 18 name. He sees “a very good chance” of a 30-day Russia-Ukraine ceasefire .

Trade War With Europe Puts $9.5 Trillion at Risk, U.S. Firms Say (The Wall Street Journal): The American Chamber of Commerce stated a commerce conflict may harm transatlantic investments and result in EU retaliation in opposition to U.S. service exports.

Kraken to Offer Superfast Trading With Planned Launch of Colocation Service (CoinDesk): Kraken stated the service will probably be “accessible to all partners and clients, not just institutions.” Traders in London can count on sub-millisecond latency.

UBS Boosts Gold Target to $3,200 as Trade Risks Stay Elevated (Bloomberg): The agency’s analysts raised their one-year gold forecast, citing worldwide commerce tensions and rising U.S. recession dangers as key drivers of investor demand.

In the Ether

CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data Read More