Crypto Daybook Americas, Crypto Daybook Americas, News Your day-ahead look for May 16, 2025

By Omkar Godbole (All times ET unless indicated otherwise)

The global crypto corporate-adoption narrative is thriving even as bitcoin and the wider crypto market take a bull breather, potentially establishing a base for a new high.

Méliuz, a publicly listed Brazilian fintech firm, announced Thursday the purchase of 274.52 BTC. It now holds 320.2 BTC worth over $33.3 million. On Wednesday, Bahrain-listed A1 Abraaj Restaurants Group disclosed an initial purchase of 5 BTC with plans to scale holdings significantly.

Eric Trump, the second-eldest son of President Donald Trump, captured the feeling on day 2 of CoinDesk’s Consensus Toronto event: “I’m traveling. I’m on a plane. Everybody in the world is trying to hoard bitcoin right now. Everybody. I hear it from sovereign wealth funds. I hear it from the wealthiest families. I hear from the biggest companies.”

While the global adoption race no doubt favors a continued bull market, some recent developments, such as the crumbling bipartisan support for the GENUIS Act aimed at creating a national regulatory framework for payment stablecoins and the Coinbase (COIN) data breach, are concerning.

“While many are cheering COIN’s entry into the S&P 500, it’s been quite the week otherwise,” Quinn Thompson, chief investment officer at Lekker Capital, said on X. “Obstructing the stablecoin bill to prolonging their regulatory capture at the industry’s expense, losing customer funds and jeopardizing personal data and now an SEC investigation. What amazing timing, too, that this was all announced after the S&P 500 inclusion pump that insiders sold into.”

On Thursday, Coinbase’s shares tanked 7% as the exchange confirmed an ongoing SEC investigation into potentially inflated user metrics from 2021.

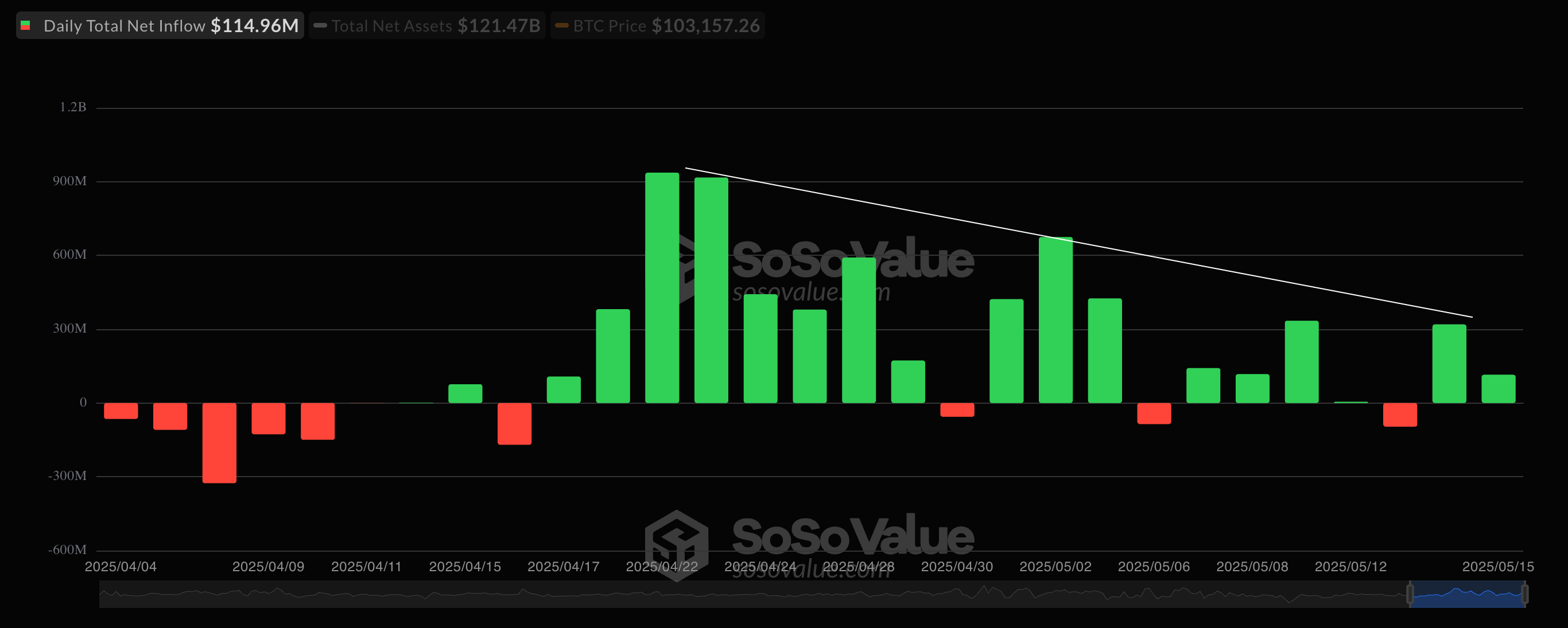

Add to the pot that inflows into U.S.-listed spot BTC exchange-traded funds (ETFs) have slowed (see Chart of the Day), alongside large sell orders at around $105,000. FTX creditors are set to receive over $5 billion in distributions starting May 30, as part of the second phase of the bankrupt exchange’s court-approved recovery plan.

All this indicates scope for price volatility in the short term. Stay alert!

What to Watch

- Crypto:

- May 16, 9:30 a.m.: Galaxy Digital Class A shares begin trading on the Nasdaq under the ticker symbol GLXY.

- May 19: CME Group is expected to launch its cash-settled XRP futures.

- May 19: Coinbase Global (COIN) will replace Discover Financial Services (DFS) in the S&P 500, effective before the opening of trading.

- May 22: Bitcoin Pizza Day.

- May 22: Top 220 TRUMP token holders will attend a gala dinner hosted by the U.S. president at the Trump National Golf Club in Washington.

- May 30: The second round of FTX repayments starts.

- Macro

- May 16, 10 a.m.: The University of Michigan releases (preliminary) May U.S. consumer sentiment data.

- Michigan Consumer Sentiment Est. 53 vs. Prev. 52.2

- May 20, 8:30 a.m.: Statistics Canada releases April consumer price inflation data.

- Core Inflation Rate MoM Prev. 0.1%

- Core Inflation Rate YoY Prev. 2.2%

- Inflation Rate MoM Prev. 0.3%

- Inflation Rate YoY Prev. 2.3%

- May 16, 10 a.m.: The University of Michigan releases (preliminary) May U.S. consumer sentiment data.

- Earnings (Estimates based on FactSet data)

- May 20: Canaan (CAN), pre-market

- May 28: NVIDIA (NVDA), post-market, $0.88

Token Events

- Governance votes & calls

- Uniswap DAO is voting on a proposal to fund the integration of Uniswap V4 on Ethereum in Oku and add Unichain on Oku in a bid to enhance Uniswap’s reach and liquidity migration to V4. Voting ends May 18.

- Arbitrum DAO is voting on launching “The Watchdog,” a 400,000-ARB bounty program to reward community sleuths for uncovering misuse of the hundreds of millions in grants, incentives and service budgets the DAO has deployed. Voting ends May 23.

- May 20, 12 p.m.: Lido to host its 28th Node Operator Community Call.

- May 21: Maple Finance teased an announcement on the future of asset management.

- May 21, 6 p.m.: Theta Network to host an Ask Me Anything session in a livestream

- May 22: Official Trump to announce its “next Era” at the day of the dinner for its largest holders.

- Unlocks

- May 16: Arbitrum (ARB) to unlock 1.95% of its circulating supply worth $38.1 million.

- May 17: Avalanche (AVAX) to unlock 0.4% of its circulating supply worth $39.44 million.

- May 18: Fasttoken (FTN) to unlock 4.66% of its circulating supply worth $87.8 million.

- May 19: Polyhedra Network (ZKJ) to unlock 5.3% of its circulating supply worth $31.24 million.

- May 19: Pyth Network (PYTH) to unlock 58.62% of its circulating supply worth $354.45 million.

- Token Launches

- May 16: Galxe (GAL), Litentry (LIT), Mines of Dalarnia (DAR), Orion Protocol (ORN), and PARSIQ (PRQ) to be delisted from Coinbase.

Conferences

CoinDesk’s Consensus is taking place in Toronto on May 14-16. Use code DAYBOOK and save 15% on passes.

- Day 3 of 3: CoinDesk’s Consensus 2025 (Toronto)

- May 19-25: Dutch Blockchain Week (Amsterdam, Netherlands)

- May 20-22: Avalanche Summit London

- May 20-22: Seamless Middle East Fintech 2025 (Dubai)

- May 21-22: Crypto Expo Dubai

- May 21-22: Cryptoverse Conference (Warsaw, Poland)

- May 27-29: Bitcoin 2025 (Las Vegas)

- May 27-30: Web Summit Vancouver (Vancouver, British Columbia)

- May 29: Stablecon (New York)

- May 29-30: Litecoin Summit 2025 (Las Vegas)

- May 29-June 1: Balkans Crypto 2025 (Tirana, Albania)

Token Talk

By Shaurya Malwa

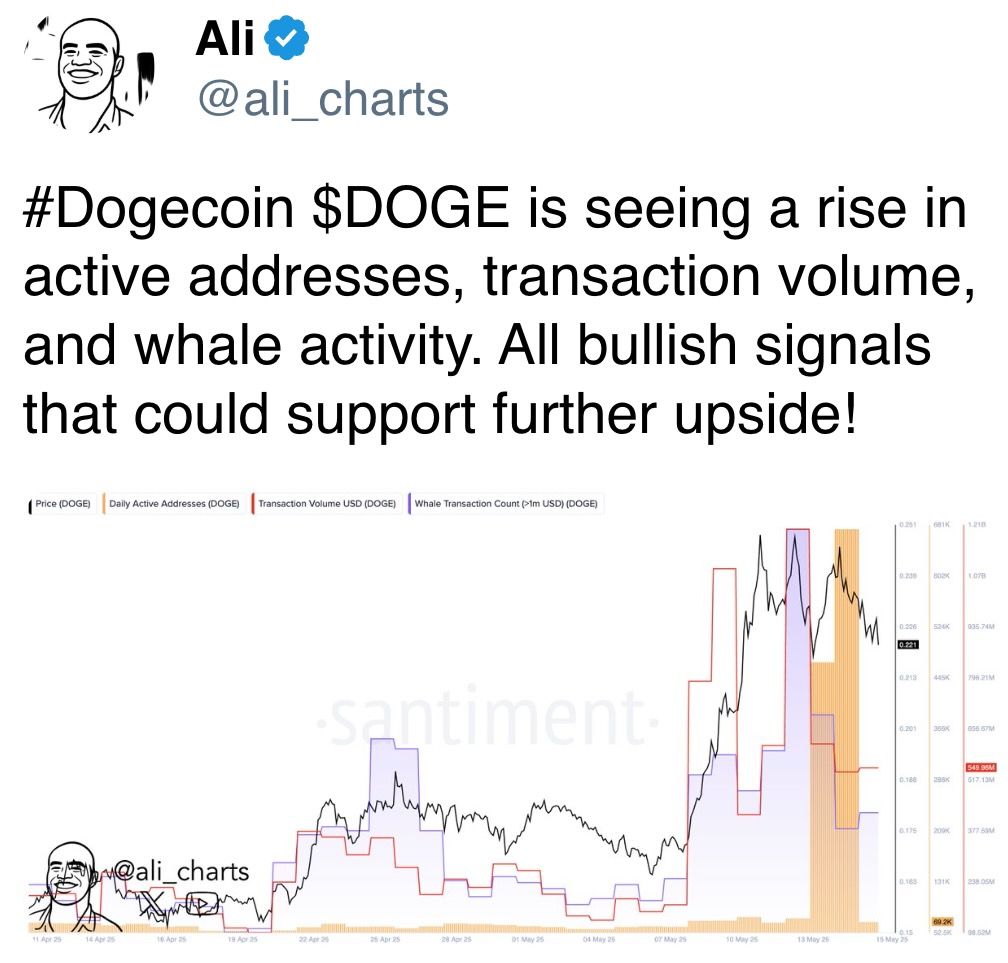

- Berachain’s native token, BERA, has dropped 9% in the past week despite a jump in the broader market, with majors like xrp (XRP) and ether (ETH) and memecoins dogecoin (DOGE), mog (MOG) and others adding more than 15%.

- At $3.55, the BERA price is now more than 80% below its peak of $14.83. The slide follows a substantial $2.7 billion token unlock on May 6, which introduced increased selling pressure into the market.

- The grim price action illustrates how hype and short-term incentives aren’t enough to buoy prices of even fundamentally strong and utility-focused projects in the current market environment.

- The total value locked in Berachain’s DeFi protocols has dropped from a peak of $3.5 billion to around $1.2 billion as of Friday. Before the token issuance, it had been one of the most viral and hyped blockchains in recent years.

- Meanwhile, inflows to Solana and Ethereum have increased, suggesting a potential shift in investor sentiment or a redistribution of assets within DeFi.

- Berachain’s stablecoin market capitalization has seen a significant reduction, with a 36% drop in just seven days to $250 million. This decline could influence liquidity among ecosystem applications.

- Berachain application revenue has hovered around $10,000 per day since late April, a stark drop from the above $100,000 level in January and February, DefiLlama data shows.

Derivatives Positioning

- Funding rates in perpetual futures tied to major coins remain below an annualized 10%. It shows positioning remains bullish, but not overcrowded.

- ETH, UNI, HYPE, BNB, XRM and AAVE have all seen an increase in open interest in perpetual futures in the past 24 hours.

- In options market, front-end skews have flipped bearish for BTC and ETH. Major flows featured buying BTC puts financed by selling calls, according to OTC desk Paradigm.

Market Movements

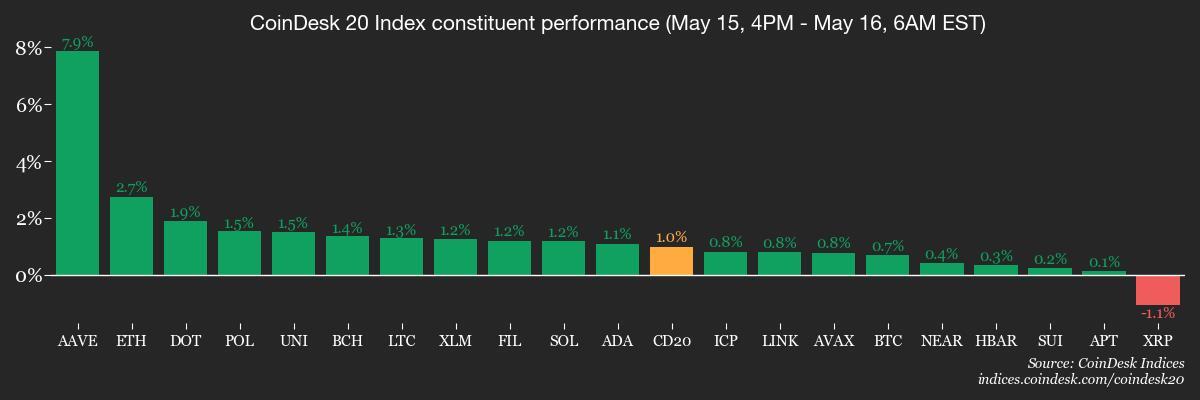

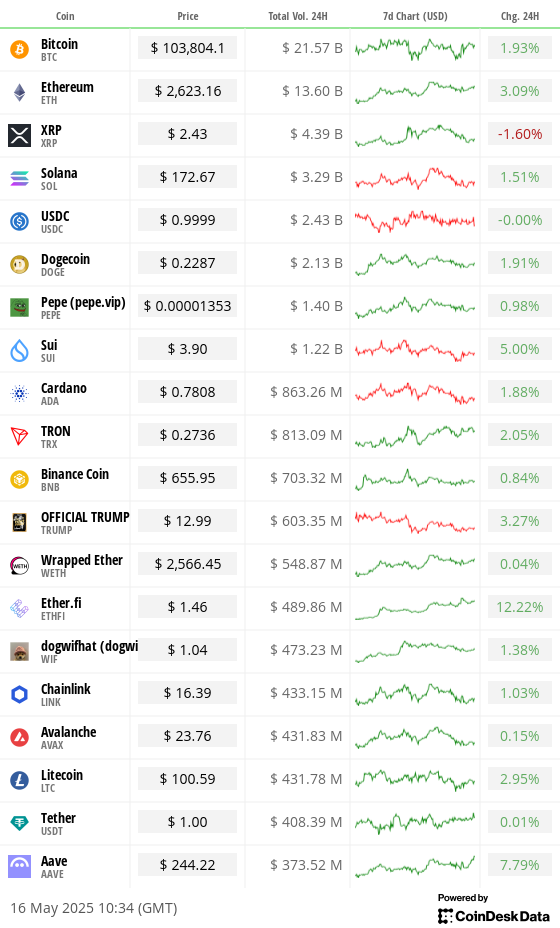

- BTC is up 0.28% from 4 p.m. ET Thursday at $103,688.48 (24hrs: +1.82%)

- ETH is up 2.62% at $2,610.41 (24hrs: +3.06%)

- CoinDesk 20 is up 0.92% at 3,241.45 (24hrs: +1.44%)

- Ether CESR Composite Staking Rate is down 7 bps at 3.03%

- BTC funding rate is at 0.0066% (7.2544% annualized) on Binance

- DXY is down 0.12% at 100.76

- Gold is down 0.47% at $3,209.33/oz

- Silver is down 0.66% at $32.30/oz

- Nikkei 225 closed unchanged at 37,753.72

- Hang Seng closed -0.46% at 23,345.05

- FTSE is up 0.61% at 8,686.08

- Euro Stoxx 50 is up 0.57% at 5,443.14

- DJIA closed on Thursday +0.65% at 42,322.75

- S&P 500 closed +0.41% at 5,916.93

- Nasdaq closed -0.18% at 19,112.32

- S&P/TSX Composite Index closed +0.8% at 25,897.48

- S&P 40 Latin America closed -0.53% at 2,631.31

- U.S. 10-year Treasury rate is down 3 bps at 4.405%

- E-mini S&P 500 futures are up 0.21% at 5,946.00

- E-mini Nasdaq-100 futures are up 0.22% at 21,446.50

- E-mini Dow Jones Industrial Average Index futures are up 0.32% at 42,519.00

Bitcoin Stats

- BTC Dominance: 62.89 (-0.65%)

- Ethereum to bitcoin ratio: 0.02528 (2.93%)

- Hashrate (seven-day moving average): 848 EH/s

- Hashprice (spot): $55.41

- Total Fees: 5.42 BTC / $562,026.90

- CME Futures Open Interest: 149,515 BTC

- BTC priced in gold: 32.2 oz

- BTC vs gold market cap: 9.12%

Technical Analysis

- The chart shows the ratio between solana and ether’s dollar-denominated prices (SOL/ETH) has dropped to a trendline characterizing the uptrend from September 2023 lows.

- A break below the line, if confirmed, would signal a prolonged switch to ether outperformance relative to SOL.

Crypto Equities

- Strategy (MSTR): closed on Thursday at $397.03 (-4.73%), up 1.28% at $402.10 in pre-market

- Coinbase Global (COIN): closed at $244.44 (-7.2%), up 1.44% at $247.95

- Galaxy Digital Holdings (GLXY): closed at $30.57 (-4.35%)

- MARA Holdings (MARA): closed at $15.68 (-1.2%), up 1.15% at $15.86

- Riot Platforms (RIOT): closed at $8.7 (-2.36%), up 1.26% at $8.81

- Core Scientific (CORZ): closed at $10.51 (+1.84%), up 1.81% at $10.70

- CleanSpark (CLSK): closed at $9.36 (-2.6%), up 1.28% at $9.48

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $16.57 (-2.24%), up 2.11% at $16.92

- Semler Scientific (SMLR): closed at $31.79 (-2.3%), up 1.67% at $32.32

- Exodus Movement (EXOD): closed at $35.76 (+2.52%), up 2.07% at $36.50

ETF Flows

Spot BTC ETFs:

- Daily net flow: $114.9 million

- Cumulative net flows: $41.49 billion

- Total BTC holdings ~ 1.17 million

Spot ETH ETFs

- Daily net flow: -$39.8 million

- Cumulative net flows: $2.50 billion

- Total ETH holdings ~ 3.46 million

Source: Farside Investors

Overnight Flows

Chart of the Day

- The chart shows net inflows into the U.S.-listed spot bitcoin ETFs have slowed.

- The drop has probably played a role in keeping the BTC price range bound.

While You Were Sleeping

- Gold Set for Worst Week in Six Months as Trade Calm Dents Appeal (Reuters): Gold faced pressure from easing U.S.-China tensions, though the price dips are attracting buyers amid lingering uncertainty over global growth and inflation.

- Japan’s Economy Shrinks for First Time in a Year (Wall Street Journal): Japan’s GDP shrank 0.2% in the first quarter, worse than the expected 0.1% drop, raising recession fears as concerns mount that U.S. tariffs could curb exports and hinder investment.

- XRP Slides 4% as Bitcoin Traders Cautious of $105K Price Resistance (CoinDesk): XRP led declines among the biggest cryptocurrencies and, after a week of steady trading, bitcoin appears to be signaling a correction amid equity weakness and gold profit-taking, according to FxPro’s Alex Kuptsikevich.

- Bitcoin Bulls Face $120M Challenge in Extending ‘Stair-Step’ Uptrend (CoinDesk): Bitcoin’s climb from $75,000 to $104,000 has slowed near heavy sell walls, though analysts expect bullish momentum to eventually absorb the resistance and push prices higher.

- FTX to Pay Over $5B to Creditors as Bankrupt Estate Gears Up for Distribution (CoinDesk): Disbursements beginning May 30 will return between 54% and 120% of claims based on November 2022 valuations, with BitGo and Kraken handling transfers in one to three business days.

- Qatari Cybertrucks, Elite Camels and Trillion-Dollar Vows: Why Gulf Countries Are Going All Out for Trump’s Visit (CNBC): The Gulf’s record investment pledges were less about competing with one another and more about strengthening U.S. ties and securing advanced technologies, said economist Ahmed Rashad.

In the Ether

CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data Read More

CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data Read More