Crypto Daybook Americas, Crypto Daybook Americas, Top Stories Your day-ahead search for March 18, 2025

By Omkar Godbole (All occasions ET until indicated in any other case)

Bitcoin (BTC) traded round its 200-day common of $84,000 because the notorious Hyperliquid whale exited its multimillion greenback brief BTC place. Smaller cash like CAKE, TKX, OKB and ATOM contributed to market optimism with constructive performances.

The SUI token struggled to increase Monday’s 6% surge, which was spurred by asset managers’ ETF filings with the SEC, showcasing rising institutional curiosity within the wider crypto market.

While some analysts declared the end of the bitcoin bull run, casting doubt in regards to the sustainability of the latest bounce, knowledge indicated in any other case, pointing to exhaustion within the ETF-led promoting strain.

On Monday, U.S.-based spot bitcoin ETFs attracted $275 million in investor funds, constructing on Friday’s $41 million inflow. That’s the primary back-to-back inflows since Feb. 7, in keeping with knowledge tracked by Farside Investors.

“This data reinforces the narrative that ETF-driven selling pressure is exhausting,” stated Valentin Fournier, an analyst at BRN. “If this trend continues, we could see inflows gradually build momentum, further supporting bitcoin’s price.”

The Fed’s fee determination on Wednesday may introduce volatility into the crypto market with a dovish assertion presumably spurring elevated risk-taking.

“Post-FOMC, bitcoin is expected to trade within the range of $80,000 to $86,000 with 80% confidence, while ethereum is projected to fluctuate between $1,800 and $2,100 under the same confidence level,” in keeping with Ryan Lee, chief analyst at Bitget Research. “These ranges reflect potential movements tied to macroeconomic signals, investor sentiment, and broader financial conditions.”

In conventional markets, European shares edged larger earlier than a German parliamentary vote on historic debt reforms. Gold remained agency above $3,000 per ounce, with BlackRock calling the yellow steel a greater diversifier than Treasury notes within the ongoing macro atmosphere.

Meanwhile, futures tied to the Nasdaq, S&P 500 and Dow traded unchanged to detrimental amid reports that the Trump-Putin name relating to the Ukraine peace deal would happen between 13:00 and 15:00 GMT. Stay alert!

What to Watch

Crypto:

March 18: Zano (ZANO) hard fork network upgrade; this prompts “ETH Signature support for off-chain signing and asset operations.”

March 20: Pascal hard fork network upgrade goes reside on the BNB Smart Chain (BSC) mainnet.

March 21, 1:00 p.m.: The SEC’s Crypto Task Force hosts a roundtable, open to the public, that can deal with the definition of a safety.

March 24 (earlier than market open): Bitcoin miner CleanSpark (CLSK) will join the S&P SmallCap 600 index.

March 24, 11:00 a.m.: Bugis network upgrade goes reside on Enjin Matrixchain mainnet.

March 25: The Mimir upgrade goes reside on Chromia (CHR) mainnet.

Macro

March 18, 8:30 a.m.: Statistics Canada releases February client worth index (CPI) knowledge.

Core Inflation Rate MoM Prev. 0.4%

Core Inflation Rate YoY Prev. 2.1%

Inflation Rate MoM Est. 0.6% vs. Prev. 0.1%

Inflation Rate YoY Est. 2.1% vs. Prev. 1.9%

March 18, 8:30 a.m.: The U.S. Census Bureau releases February residential development knowledge.

Housing Starts Est. 1.38M vs. Prev. 1.366M

March 18, 11:00 p.m.: The Bank of Japan (BoJ) releases its financial coverage assertion.

Interest Rate Est. 0.5% vs. Prev. 0.5%

March 19, 6:00 a.m.: Eurostat releases (ultimate) February eurozone client worth index (CPI) knowledge.

Core Inflation Rate YoY Est. 2.6% vs. Prev. 2.7%

Inflation Rate MoM Est. 0.5% vs. Prev. -0.3%

Inflation Rate YoY Est. 2.4% vs. Prev. 2.5%

March 19, 2:00 p.m.: The Federal Reserve declares its rate of interest determination. The FOMC press convention is live-streamed half-hour later.

Fed Funds Interest Rate Est. 4.5% vs. Prev. 4.5%

March 19, 3:00 p.m.: Argentina’s National Institute of Statistics and Census releases GDP knowledge.

Full Year GDP Growth (2024) Prev. -1.6%

GDP Growth Rate QoQ (This autumn) Prev. 3.9%

GDP Growth Rate YoY(This autumn) Est. 1.7% vs. Prev. -2.1%

March 19, 5:30 p.m.: The Central Bank of Brazil declares its rate of interest determination.

Selic Rate Est. 14.25% vs. Prev. 13.25%

Earnings (Estimates based mostly on RealitySet knowledge)

March 27: KULR Technology Group (KULR), post-market

March 28: Galaxy Digital Holdings (GLXY), pre-market

Token Events

Governance votes & calls

Arbitrum DAO is voting on registering the “Sky Custom Gateway contracts” within the “Router contracts” to allow customers to bridge USDS and sUSDS by way of the official Arbitrum Bridge UI.

Frax DAO is voting on introducing the WisdomTree Government Money Market Digital Fund (WTGXX) as an on-chain reserve for Frax USD.

March 18, 8 a.m.: Binance to host an AMA session with VP of Product Jeff Li and Binance Angel Victor Balaban.

March 18, 9 a.m.: NEAR Protocol to host a governance talk session.

March 21, 11:30 a.m.: Flare to host an X Spaces session on Flare 2.0.

Unlocks

March 21: Immutable (IMX) to unlock 1.39% of circulating provide price $13.96 million.

March 23: Metars Genesis (MRS) to unlock 11.87% of its circulating provide price $242.9 million.

March 31: Optimism (OP) to unlock 1.93% of its circulating provide price $27.47 million.

April 1: Sui (SUI) to unlock 2.03% of its circulating provide price $147.65 million.

April 3: Wormhole (W) to unlock 47.7% of its circulating provide price $121.48 million.

April 7: Kaspa (KAS) to unlock 0.59% of its circulating provide price $11.28 million.

Token Listings

March 18: Jupiter (JUP) to be listed on Arkham.

March 18: Paws (PAWS) to be listed on Bybit.

March 18: Slingshot (SLING) to be listed on KuCoin.

March 19: Hamster Kombat (HMSTR) and DuckChain (DUCK) to be listed on Kraken.

March 31: Binance to delist USDT, FDUSD, TUSD, USDP, DAI, AEUR, UST, USTC, and PAXG.

Conferences

CoinDesk’s Consensus is going down in Toronto on May 14-16. Use code DAYBOOK and save 15% on passes.

Day 1 of three: Digital Asset Summit 2025 (New York)

Day 1 of three: Fintech Americas Miami 2025

March 19-20: Next Block Expo (Warsaw)

March 24-26: Merge Buenos Aires

March 25-26: PAY360 2025 (London)

March 25-27: Mining Disrupt (Fort Lauderdale, Fla.)

March 26: Crypto Assets Conference (Frankfurt)

March 26: DC Blockchain Summit 2025 (Washington)

March 26-28: Real World Crypto Symposium 2025 (Sofia, Bulgaria)

March 27: Building Blocks (Tel Aviv)

March 27: Digital Euro Conference 2025 (Frankfurt)

March 27: WIKI Finance EXPO Hong Kong 2025

March 27-28: Money Motion 2025 (Zagreb, Croatia)

March 28: Solana APEX (Cape Town)

Token Talk

By Shaurya Malwa

Hackers attacked BNB Chain’s Four.meme launch platform, exploiting new meme tokens to empty liquidity by bypassing itemizing restrictions and creating unauthorized buying and selling pairs on PancakeSwap, siphoning off funds round 04:00 GMT.

The assault preempted Four.meme’s curated token launches, shopping for small token quantities pre-launch, including liquidity to PancakeSwap pairs, and rug-pulling them, focusing on widespread tokens like MubaraKing (87.90 BNB stolen) and others reminiscent of EDDY and Cocoro.

Four.meme suspended new token launches and promised compensation for affected customers, although no sensible contract vulnerability was discovered. Leaked early transactions enabled the hacker’s front-running, in keeping with analyst Chaofan Shou.

The assault exploited a flawed token operate permitting transfers through the bonding curve stage, a recurring circulate cell manipulation situation, probably affecting all Four.meme tokens regardless of just a few being hit resulting from their reputation.

Derivatives Positioning

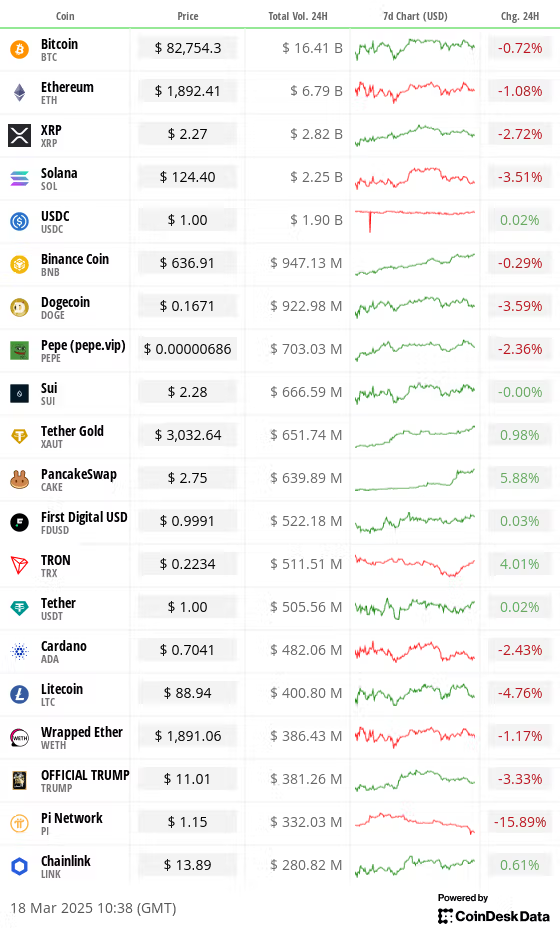

Open curiosity in ETH, LTC, XRP and SOL perpetual futures elevated previously 24 hours alongside a flat-to-negative cumulative quantity delta (CVD), indicating web promoting out there.

SOL, ADA and DOGE have additionally seen detrimental funding charges.

Both open curiosity and foundation in BTC and ETH CME futures stay depressed at latest lows, suggesting a insecurity amongst establishments to deploy capital.

Deribit’s BTC and ETH choices proceed to showcase put skews for expiries out to finish of April.

Market Movements:

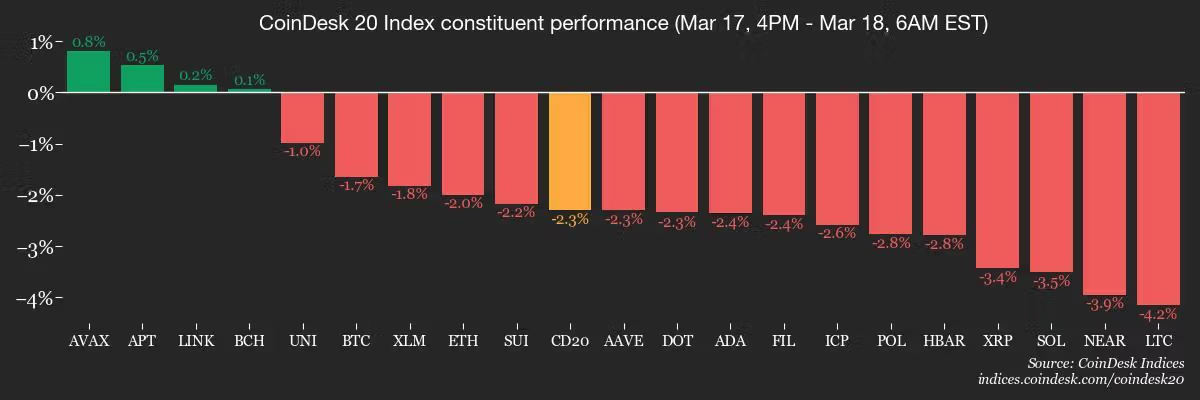

BTC is down 1.62% from 4 p.m. ET Monday at $82,676.40 (24hrs: -0.81%)

ETH is down 2.29% at $1,892.55 (24hrs: -1.1%)

CoinDesk 20 is down 2.25% at 2,582.56 (24hrs: -1.46%)

Ether CESR Composite Staking Rate is unchanged at 2.96%

BTC funding fee is at 0.0036% (3.89% annualized) on Binance

DXY is unchanged at 103.28

Gold is up 0.76% at $3,020.72/oz

Silver is up 0.82% at $34.07/oz

Nikkei 225 closed +1.2% at 37,845.42

Hang Seng closed +2.46% at 24,740.57

FTSE is up 0.44% at 8,715.59

Euro Stoxx 50 is up 0.85% at 5,491.99

DJIA closed on Monday +0.85% at 41,841.63

S&P 500 closed +0.64% at 5,675.12

Nasdaq closed +0.31% at 17,808.66

S&P/TSX Composite Index closed +0.94% at 24,785.11

S&P 40 Latin America closed +1.76% at 2,475.69

U.S. 10-year Treasury fee is down 1 bp at 4.31%

E-mini S&P 500 futures are down 0.29% at 5,715.75

E-mini Nasdaq-100 futures are down 0.38% at 19,963.00

E-mini Dow Jones Industrial Average Index futures are down 0.27% at 42,112.00

Bitcoin Stats:

BTC Dominance: 61.66 (-0.03%)

Ethereum to bitcoin ratio: 0.02285 (-0.31%)

Hashrate (seven-day shifting common): 805 EH/s

Hashprice (spot): $47.08

Total Fees: 4.68 BTC / $386,699

CME Futures Open Interest: 151,030 BTC

BTC priced in gold: 27 oz

BTC vs gold market cap: 7.68%

Technical Analysis

The greenback index’s (DXY) decline continues with the important thing 61.8% Fibonacci retracement help breached in a constructive signal for threat property.

The breakthrough has uncovered the following help at 102.32, representing the 78.6% Fibonacci stage.

Crypto Equities

Strategy (MSTR): closed on Monday at $294.27 (-1.08%), down 1.54% at $289.75 in pre-market

Coinbase Global (COIN): closed at $188.96 (+3.19%), down 1.55% at $186.21

Galaxy Digital Holdings (GLXY): closed at C$17.35 (-3.5%)

MARA Holdings (MARA): closed at $12.97 (-1.59%), down 1.39% at $12.79

Riot Platforms (RIOT): closed at $7.76 (-0.77%), down 1.16% at $7.67

Core Scientific (CORZ): closed at $8.76 (-0.57%), down 0.8% at $8.69

CleanSpark (CLSK): closed at $8.12 (+1.88%), down 1.23% at $8.02

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $15.37 (+0.46%)

Semler Scientific (SMLR): closed at $36.03 (+4.89%), up 2.19% at $36.82

Exodus Movement (EXOD): closed at $32.35 (+15.33%), unchanged in pre-market

ETF Flows

Spot BTC ETFs:

Daily web circulate: $274.6 million

Cumulative web flows: $35.67 billion

Total BTC holdings ~ 1,120 million.

Spot ETH ETFs

Daily web circulate: -$7.3 million

Cumulative web flows: $2.53 billion

Total ETH holdings ~ 3.509 million.

Source: Farside Investors

Overnight Flows

Chart of the Day

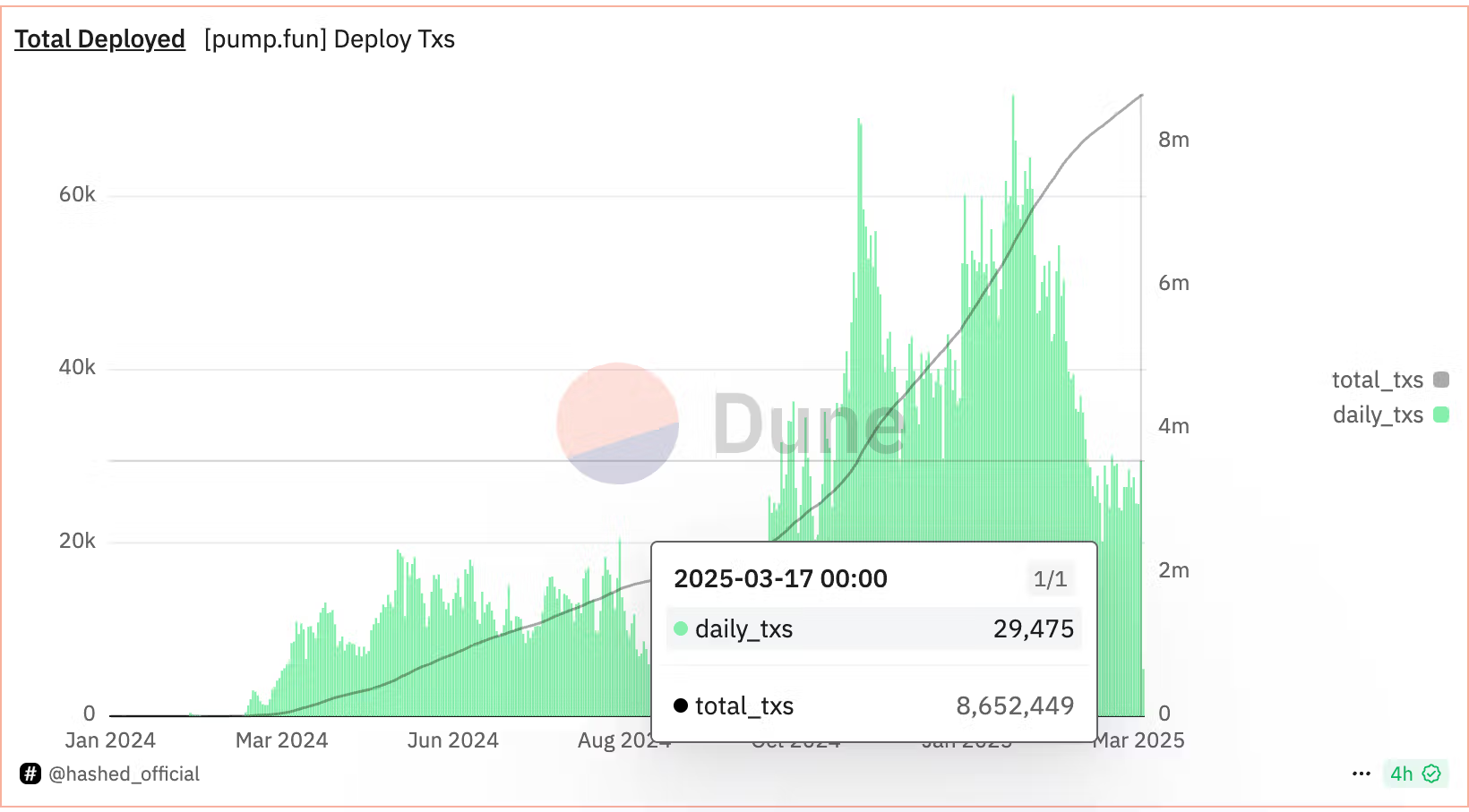

Pump.enjoyable is a Solana-based market broadly used to create and distribute tokens, primarily memecoins.

Daily token deployment exercise cooled to 29,475 transactions on Monday, down from 71,738 on Jan. 23.

Its an indication that the broader market slide has cooled speculative actions.

While You Were Sleeping

Bitcoin’s Bull Market Cycle Is Over, CryptoQuant’s Ki Young Ju Says (CoinDesk): Ki Young Ju forecasts 6-12 months of bearish or sideways worth motion resulting from declining market liquidity in a report suggesting BTC may drop to $63,000.

Metaplanet Continues Bond Issuance for Bitcoin Buys (CoinDesk): The Japanese agency issued 2 billion yen ($13.4 million) in zero-interest bonds utilizing a number of the proceeds to purchase 150 BTC for $12.5 million.

Bitcoin Storm Could Be Brewing, Crypto OnChain Options Platform Derive Says (CoinDesk): Derive warned that market calm could also be short-lived, citing uncertainty over Ukraine’s ceasefire and potential regulatory shifts beneath the Trump administration as triggers for volatility.

German Bonds Fall Ahead of Historic Vote on Fiscal Bazooka (Bloomberg): German bond yields rose forward of Tuesday’s parliamentary vote on a significant spending package deal amid considerations over rising debt issuance and inflation dangers.

Trump Team Explored Simplified Plan for Reciprocal Tariffs (The Wall Street Journal): Trump officers debated a simplified three-tier system for reciprocal tariffs earlier than choosing an individualized strategy, with the ultimate plan anticipated by April 2 alongside new industry-specific duties.

Europe’s defense spending spree risks debt crisis, warns Dutch politician (Financial Times): Pieter Omtzigt warned that the EU’s 800 billion euro ($875 billion) protection plan may result in unsustainable debt and probably set off one other eurozone sovereign-debt disaster.

In the Ether

CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data Read More

CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data Read More