Crypto Daybook Americas, Crypto Daybook Americas, Breaking News Your day-ahead search for March 11, 2025

By Omkar Godbole (All occasions ET except indicated in any other case)

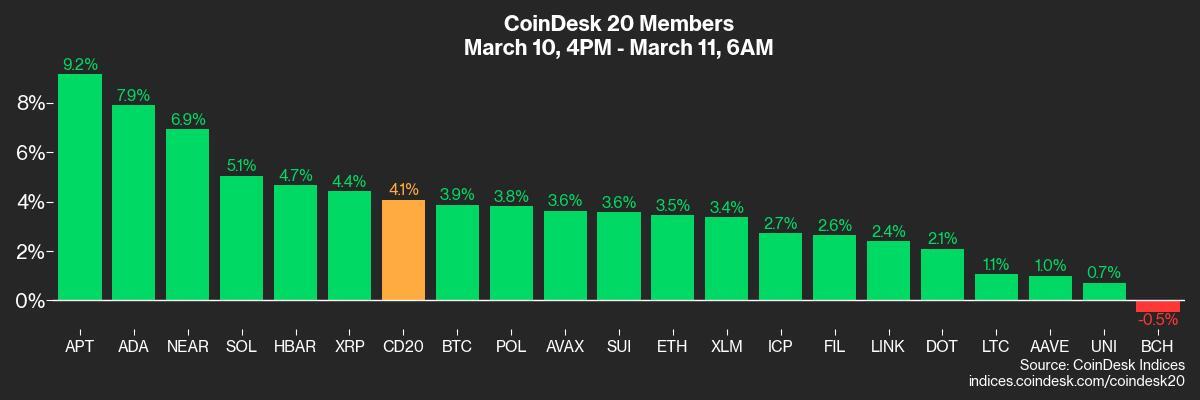

The crypto market is seeking to regain poise, with bitcoin bouncing above $81,000 forward of tomorrow’s U.S. inflation report. Broadly talking, the restoration from in a single day lows is led by layer-1 and layer-2 cash, with gaming tokens additionally rising.

The rebound comes amid indications of “peak fear” on Wall Street, a dynamic sometimes noticed at market bottoms.

Interestingly, the unfold between one- and six-month futures tied to the VIX, Wall Street’s so-called worry gauge, crossed above zero on Monday, signaling a uncommon constructive studying and reflecting expectations for higher volatility within the short-term than six months out. Volmex’s Bitcoin volatility index exhibits the same inversion, though that’s extra widespread within the crypto market.

“Is the worst behind us? It’s impossible to say,” famous Ilan Solot, senior world market strategist at Marex Solutions, in an e mail to CoinDesk. “However, the risk-reward for entering long positions in U.S. stocks is improving. The VIX index for volatility is now significantly inverted, meaning near-term contracts are priced higher than long-term ones. This is an important sign of stress, but it can also indicate extremes in sentiment.”

Meanwhile, bullish positioning within the yen seems stretched, suggesting the haven forex’s rally might quickly lose steam, doubtlessly offering aid to threat property within the course of.

The Truflation U.S. Inflation Index, which affords a every day, real-time measurement of inflation based mostly on information from over 30 sources and 13 million worth factors, has dropped to 1.35%, extending a decline from February’s excessive of over 2%. This pattern hints on the progress on inflation the Federal Reserve is in search of earlier than contemplating fee cuts.

On Wednesday, the Bureau of Labor Statistics is anticipated to indicate a month-over-month enhance of 0.3% for February. This can be a notable deceleration from January’s regarding 0.5%. A comfortable studying may validate merchants’ expectations for fast fee cuts beginning in June, presumably resulting in renewed risk-on sentiment. However, it’s vital to notice that Chairman Jerome Powell has indicated the Fed is ready for readability on President Trump’s insurance policies earlier than making its subsequent transfer, suggesting that comfortable CPI information alone won’t be sufficient.

On the opposite hand, a hotter-than-expected CPI print may derail restoration prospects, doubtlessly setting the stage for a deeper slide in bitcoin and the broader crypto market. Some analysts even predict bitcoin may drop to $74,000.

“A bearish pattern persists on the daily timeframes, indicating a strengthening sell-off after failing to hold above the 200-day moving average. The scenario of a pullback to the $70,000 to $74,000 range still looks most probable,” mentioned Alex Kuptsikevich, senior market analyst at FxPro, in an e mail to CoinDesk. Stay alert!

What to Watch

Crypto:

March 11, 9:00 a.m.: Horizen (ZEN) mainnet network upgrade to model ZEN 5.0.6 at block peak 1,730,680.

March 11, 10:00 a.m.: U.S. House Financial Services Committee hearing a couple of federal framework for stablecoins and a CBDC. Livestream link.

March 11: The Bitcoin Policy Institute and Senator Cynthia Lummis co-host the invitation-only one-day “Bitcoin for America” occasion in Washington.

March 12: Hemi (HEMI), an L2 blockchain that operates on each Bitcoin and Ethereum, has its mainnet launch.

March 15: Athene Network (ATH) mainnet launch.

March 15: Reploy will shut its V1 RAI staking program to new customers because it transitions to a totally automated revenue-sharing protocol.

March 17.: CME Group launches solana (SOL) futures.

March 18: Zano (ZANO) hard fork network upgrade which prompts “ETH Signature support for off-chain signing and asset operations.”

March 20: Pascal hard fork network upgrade goes reside on the BNB Smart Chain (BSC) mainnet.

Macro

March 11, 8:00 a.m.: The Brazilian Institute of Geography and Statistics (IBGE) releases January industrial manufacturing information.

Industrial Production MoM Est. 0.4% vs. Prev. -0.3%

Industrial Production YoY Est. 2.2% vs. Prev. 1.6%

March 11, 10:00 a.m.: The U.S. Department of Labor releases January’s JOLTs report (job openings, hires, and separations).

Job Openings Est. 7.75M vs. Prev. 7.6M

Job Quits Prev. 3.197M

March 12, 4:45 a.m.: European Central Bank President Christine Lagarde gives a speech on the twenty fifth “ECB and Its Watchers” convention in Frankfurt.

March 12, 8:00 a.m.: The Brazilian Institute of Geography and Statistics (IBGE) launch February client worth inflation information.

Inflation Rate MoM Est. 1.3% vs. Prev. 0.16%

Inflation Rate YoY Est. 5% vs. Prev. 4.56%

March 12, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases February client worth inflation information.

Core Inflation Rate MoM Est. 0.3% vs. Prev. 0.4%

Core Inflation Rate YoY Est. 3.2% vs. Prev. 3.3%

Inflation Rate MoM Est. 0.3% vs. Prev. 0.5%

Inflation Rate YoY Est. 2.9% vs. Prev. 3%

March 12, 9:45 a.m.: The Bank of Canada broadcasts its interest rate decision adopted by a press convention (livestream link) 45 minutes later.

Policy Interest Rate Est. 2.75% vs. Prev. 3%

March 12, 12:00 p.m.: Russia’s Federal State Statistics Service launch February client worth inflation information.

Inflation Rate MoM Est. 0.8% vs. Prev. 1.2%

Inflation Rate YoY Est. 10.1% vs. Prev. 9.9%

Earnings (Estimates based mostly on FactSet information)

March 17 (TBC): Bit Digital (BTBT), $-0.05

March 18 (TBC): TeraWulf (WULF), $-0.04

March 24 (TBC): Galaxy Digital Holdings (TSE: GLXY), C$0.39

Token Events

Governance votes & calls

GMX DAO is voting on the decentralization and automation of the fee distribution process for the GMX ecosystem to make sure “real-time, trustless, and verifiable fee allocations.”

Frax DAO is discussing upgrading the protocol by renaming FXS to FRAX, making it the fuel token on Fraxtal, implementing the Frax North Star onerous fork, and introducing a tail emission plan with regularly lowering emissions and different enhancements.

Uniswap DAO is discussing continuing treasury delegation to take care of governance stability and retain lively delegates, together with a renewed framework and construction expiration and allocation mechanisms.

March 13, 10 a.m.: Mantra to host a Community Connect call with its CEO and Co-Founder to debate numerous main updates.

Unlocks

March 12: Aptos (APT) to unlock 1.93% of circulating provide price $63.33 million.

March 15: Sei (SEI) to unlock 1.19% of its circulating provide price $10.65 million.

March 16: Arbitrum (ARB) to unlock 2.1% of its circulating provide price $30.76 million.

March 18: Fasttoken (FTN) to unlock 4.66% of its circulating provide price $80 million.

March 21: Immutable (IMX) to unlock 1.39% of circulating provide price $12.29 million.

Token Listings

March 11: Bybit to delist Bancor (BNT), Paxos Gold (PAXG), and Threshold.

March 11: Cookie DAO (COOKIE) to be listed on Coinbase.

March 11: PancakeSwap is retiring its crypto choices product.

March 11: Mystery (MERY) was listed on the Crypto.com app.

March 31: Binance to delist USDT, FDUSD, TUSD, USDP, DAI, AEUR, UST, USTC, and PAXG.

Conferences

CoinDesk’s Consensus is happening in Toronto on May 14-16. Use code DAYBOOK and save 15% on passes.

Day 2 of two: MoneyLIVE Summit (London)

Day 2 of three: AIBC Africa (Cape Town)

Day 1 of two: VanEck Southern California Blockchain Conference 2025 (Los Angeles)

March 13-14: Web3 Amsterdam ‘25

March 16, 6:00 p.m.: Solana AI Summit (San Jose, Calif.)

March 18-20: Digital Asset Summit 2025 (New York)

March 18-20: Fintech Americas Miami 2025

March 19-20: Next Block Expo (Warsaw)

March 24-26: Merge Buenos Aires

March 25-26: PAY360 2025 (London)

March 25-27: Mining Disrupt (Fort Lauderdale, Fla.)

March 26: Crypto Assets Conference (Frankfurt)

March 26: DC Blockchain Summit 2025 (Washington)

March 26-28: Real World Crypto Symposium 2025 (Sofia, Bulgaria)

March 27: Building Blocks (Tel Aviv)

March 27: Digital Euro Conference 2025 (Frankfurt)

March 27: WIKI Finance EXPO Hong Kong 2025

March 27-28: Money Motion 2025 (Zagreb, Croatia)

March 28: Solana APEX (Cape Town)

Token Talk

By Shaurya Malwa

Grok Coin, a token impressed by, however not formally affiliated with, xAI’s Grok AI, was launched on Base utilizing buying and selling mechanisms from Bankr and Clanker.

The token’s AI-controlled pockets reportedly amassed over $200K in charges within the hours after going reside.

It was additional amplified by the official Base account on X, which posted, “icymi, @grok launched a token on Base,” and framing it as a futuristic step the place “AI is owning wallets, making markets, and generating revenue.” This appeared like an endorsement from Base’s management.

The submit prompted Base builders like Kawz, the founding father of Time.enjoyable, to precise frustration over the shortage of recognition for their very own tasks.

Calling the GrokCoin submit unfair and selective, Kawz famous they’d spent months constructing an app on Base and not using a single tweet from @base.

Derivatives Positioning

ETH CME futures foundation has dropped to an annualized 5%, the bottom since July.

BTC’s foundation has stabilized between 5% and 10% in a constructive signal for the market.

BTC choices present the same expectation sample to gold, whereas ETH and different cryptocurrencies are much like the expectation patterns of equities traders, information tracked by BloFin Academy present.

BTC and ETH threat reversals present bias for protecting places out to the May finish expiry.

The $100K strike name is now the most well-liked BTC possibility on Deribit, versus the $120K name a couple of weeks in the past.

Market Movements:

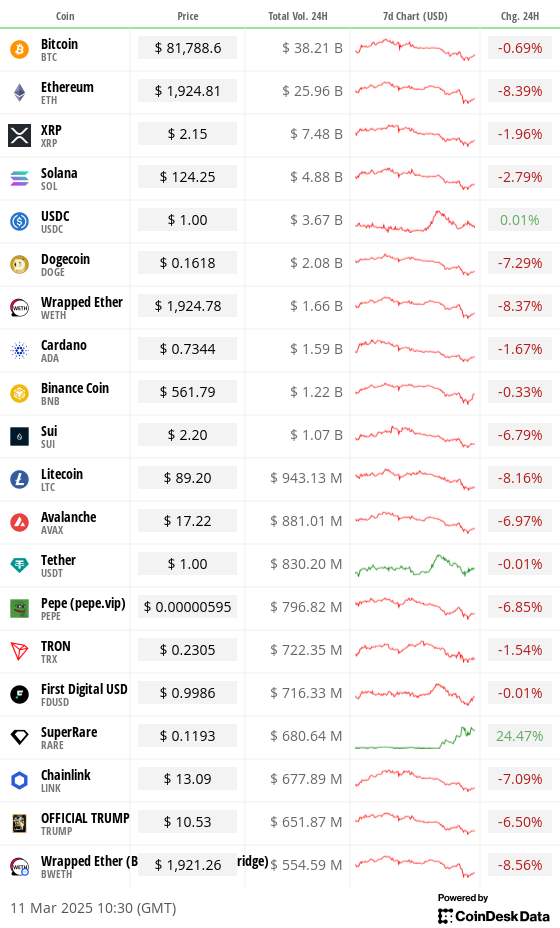

BTC is up 2.87% from 4 p.m. ET Monday at $81,425.03 (24hrs: -0.93%)

ETH is up 2.84% at $1,917.00 (24hrs: -8.65%)

CoinDesk 20 is up 3.05% at 2,531.70 (24hrs: -3.66%)

Ether CESR Composite Staking Rate is up 10 bps at 3.11%

BTC funding fee is at 0.0001% (0.1% annualized) on Binance

DXY is down 0.38% at 103.44

Gold is up 0.66% at $2,911.70/oz

Silver is up 1.12% at $32.49/oz

Nikkei 225 closed -0.64% at 36,793.11

Hang Seng closed unchanged at 23,782.14

FTSE is down 0.25% at 8,578.37

Euro Stoxx 50 is up 0.48% at 5,413.02

DJIA closed on Monday -2.08% at 41,911.71

S&P 500 closed -2.7% at 5,614.56

Nasdaq closed -4% at 17,468.32

S&P/TSX Composite Index closed -1.53% at 24,380.71

S&P 40 Latin America closed -2.73% at 2,297.38

U.S. 10-year Treasury fee is down 4 bps at 4.21%

E-mini S&P 500 futures are down 0.28% at 5636.50

E-mini Nasdaq-100 futures are down 0.41% at 19533.25

E-mini Dow Jones Industrial Average Index futures are down 0.21% at 42,036.00

Bitcoin Stats:

BTC Dominance: 61.95 (-0.24%)

Ethereum to bitcoin ratio: 0.02354 (-0.80%)

Hashrate (seven-day shifting common): 814 EH/s

Hashprice (spot): $45.2

Total Fees: 5.3 BTC / $429,994

CME Futures Open Interest: 141,395 BTC

BTC priced in gold: 28.2 oz

BTC vs gold market cap: 8.01%

Technical Analysis

Bitcoin’s RSI has carved out the next low, hinting at a bullish divergence, or constructive shift in momentum.

Traders who depend on charts might really feel tempted to check out longs as costs are near the important thing assist of the March 2024 excessive of $73,757, providing a horny risk-reward.

That, in flip, would possibly see the restoration collect tempo.

Crypto Equities

Strategy (MSTR): closed on Monday at $239.27 (-16.68%), up 4.57% at $250.20 in pre-market

Coinbase Global (COIN): closed at $179.23 (-17.58%), up 4.09% at $186.55

Galaxy Digital Holdings (GLXY): closed at C$17.46 (-7.32%)

MARA Holdings (MARA): closed at $13.41 (-16.29%), up 1.34% at $13.59

Riot Platforms (RIOT): closed at $7.56 (-9.68%), up 2.51% at $7.75

Core Scientific (CORZ): closed at $8.01 (+2.96%), up 3.62% at $8.30

CleanSpark (CLSK): closed at $7.98 (-9.63%), up 1.5% at $8.10

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $14.48 (-11.27%), up 3.04% at $14.92

Semler Scientific (SMLR): closed at $32.74 (-11.97%), unchanged in pre-market

Exodus Movement (EXOD): closed at $24.60 (-16.33%), down 5.65% at $23.21

ETF Flows

Spot BTC ETFs:

Daily web move: -$278.4 million

Cumulative web flows: $35.93 billion

Total BTC holdings ~ 1,122 million.

Spot ETH ETFs

Daily web move: -$34 million

Cumulative web flows: $2.69 billion

Total ETH holdings ~ 3.579 million.

Source: Farside Investors

Overnight Flows

Chart of the Day

The chart exhibits the unfold between yields on the 10-year U.S. and Japanese authorities bonds.

The hole has narrowed sharply, diving under a five-year-long uptrend line.

The narrowing of the yield unfold favors power within the yen, seen as an anti-risk, haven forex.

While You Were Sleeping

Global Markets Steady After Slowdown Fears Hit Wall Street (Financial Times): Stocks steadied globally as traders reassessed recession considerations following sharp Wall Street losses, whereas European protection and infrastructure shares continued to achieve on expectations of elevated authorities spending.

Bitcoin and Nasdaq Could Stabilize as Bull Positioning in Yen Appears Stretched (CoinDesk): Overstretched bullish bets on the yen may set off a reversal, providing aid to threat property, although the forex’s broader uptrend stays supported by a narrowing U.S.-Japan bond yield hole.

Latest Draft of U.S. Stablecoin Bill Aims to Split Power Between State and Federal Authorities (CoinDesk): States can oversee stablecoin issuers with a market cap below $10 billion, whereas bigger issuers might stay below state supervision in the event that they meet sure standards.

Dormant Ether Whale Moves $13M in ETH to Kraken (CoinDesk): A pockets that has held ether for the reason that cryptocurrency’s inception moved 7,000 ETH to Kraken after 5 months of inactivity as the value hit its lowest stage since October 2023.

Citi Downgrades U.S. Stocks, Raises China as America First Fades (Bloomberg): Citigroup downgraded U.S. equities to impartial, citing expectations for “more negative US data prints,” whereas upgrading China to obese attributable to enticing valuations and authorities assist for the tech sector.

Ukraine Hits Moscow With Largest Drone Attack Hours Before Talks (The Wall Street Journal): Ahead of a high-level U.S.-Ukraine assembly in Saudi Arabia, Kyiv carried out its largest drone strike on the Russian capital, escalating tensions as discussions on potential peace efforts loom.

In the Ether

CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data Read More

CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data Read More