Crypto Daybook Americas, Crypto Daybook Americas Your day-ahead seek for April 3, 2025

By James Van Straten (All situations ET besides indicated in some other case)

Liberation Day is accomplished, and markets lastly have readability on U.S. tariffs. Starting April 5, all U.S. shopping for and promoting companions will face a minimal of a ten% import tariff, with bigger, country-specific tariffs kicking in on April 9 for about 60 worldwide areas.

President Donald Trump launched the tariffs based totally on perceived commerce imbalances and non-tariff boundaries, saying the aim is to encourage reshoring of producing, generate revenue to help fund tax cuts and stage the participating in self-discipline for U.S. producers.

Among primarily essentially the most affected worldwide areas is China, which faces a model new 34% tariff on prime the current levy, bringing its full to 54%. Many completely different Asian economies have moreover been hit exhausting, whereas the European Union faces a 20% tariff.

There’s been rising curiosity in how the U.S. determined the tariff expenses, which the administration referred to as reciprocal. One individual on X claims to have cracked the formula: Take a country’s commerce deficit with the U.S. and divide it by that nation’s exports to the U.S.

For occasion, Vietnam exports $136.6 billion to the U.S. and imports merely $13.1 billion, resulting in a $123.5 billion commerce deficit. When you divide the deficit by exports, you get about 90%, which aligns with the implied reciprocal tariff charge the U.S. has utilized.

Global shares are under pressure, with the Nikkei 225 shedding 2.8% after dropping as quite a bit as 4.6% and the FTSE 100 shedding larger than 1%. Nasdaq futures are down over 3.5%. Vietnam led losses in Asia, falling 5.5% in its worst single-day drop for over 4 years.

The buck weakened too, with the yen rallying to 147 in opposition to the U.S. overseas cash and the pound to 1.31. The buck index (DXY) fell to 102.5. Bitcoin (BTC) stays company above $83,000, though nonetheless beneath its 200-day transferring frequent of $86,400 — a key stage it should reclaim.

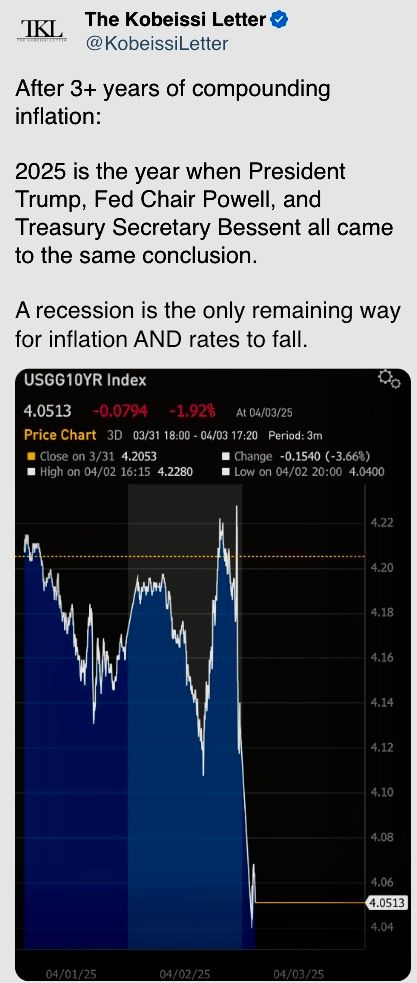

The all-important U.S. 10-year Treasury yield is hovering merely above 4%, the underside stage since October, which is seen as a optimistic for the administration with a view to get interest-rates down. Stay alert!

What to Watch

Crypto:

April 5: The purported birthday of Satoshi Nakamoto.

April 9, 10:00 a.m.: U.S. House Financial Services Committee hearing about how the U.S. securities authorized tips may probably be updated to be aware of digital property. Livestream link.

Macro

April 3, 8:30 a.m.: The U.S. Department of Labor releases unemployment insurance coverage protection data for the week ended March 29.

Initial Jobless Claims Est. 225K vs. Prev. 224K

April 3, 9:00 a.m.: S&P Global releases Brazil March shopping for managers’ index (PMI) data.

Composite PMI Prev. 51.2

Services PMI Prev. 50.6

April 3, 9:30 a.m.: S&P Global releases Canada March shopping for managers’ index (PMI) data.

Composite PMI Prev. 46.8

Services PMI Prev. 46.6

April 3, 9:45 a.m.: S&P Global releases (Final) U.S. March shopping for managers’ index (PMI) data.

Composite PMI Est. 53.5 vs. Prev. 51.6

Services PMI Est. 54.3 vs. Prev. 51

April 3, 10:00 a.m.: Institute for Supply Management (ISM) releases U.S. March monetary train data.

Services PMI Est. 53 vs. Prev. 53.5

April 3, 10:00 a.m.: April 3, 10:00 a.m.: The U.S. Senate Banking Committee will meet in executive session to vote on the nominations of Paul Atkins as SEC chair and Jonathan Gould as comptroller of the overseas cash. Livestream link.

April 3, 12:30 p.m.: Fed Vice Chair Philip N. Jefferson will give a speech titled “U.S. Economic Outlook and Central Bank Communications.” Livestream link.

April 4, 8:30 a.m.: Statistics Canada releases March employment data.

Unemployment Rate Est. 6.7% vs. Prev. 6.6%

April 4, 8:30 a.m.: The U.S. Bureau of Labor Statistics releases March employment data.

Nonfarm Payrolls Est. 140K vs. Prev. 151K

Unemployment Rate Est. 4.1% vs. Prev. 4.1%

April 4, 11:25 a.m.: Fed Chair Jerome H. Powell will give a speech titled “Economic Outlook.”

April 5, 12:01 a.m.: The Trump administration’s 10% baseline tariff on imports from all worldwide areas takes influence.

April 9, 12:01 a.m.: The Trump administration’s bigger individualized tariffs on imports from prime U.S. commerce deficit worldwide areas take influence.

Earnings (Estimates based totally on FactSet data)

No earnings scheduled.

Token Events

Governance votes & calls

Yearn DAO is discussing a revised proposal to endorse and fund “Bearn,” a model new sub-DAO for developing DeFi merchandise along with a yield-backed stablecoin and a BGT liquid locker. The proposal seeks $200,000 for audit costs and $1 million in locked liquidity, offering 5% of BEARN tokens to the Yearn Treasury in return.

Lido DAO is discussing the re-endorsement of wstETH on Starknet as a result of the canonical bridge endpoint following a achieved migration from the legacy token.

April 3, 9 a.m.: SafePal, Wallet Connect and Trader to host a month-to-month group livestream discussing monthly updates for the duties.

April 3, 2 p.m.: Arbitrum to host an X Spaces session on real-world assets on Arbitrum.

April 3, 3 p.m.: Movement to host an X Spaces session on non-fungible tokens.

April 3, 12 p.m.: Seamless Protocol, Morpho Labs and Gauntlet to host an Ask Me Anything (AMA) session.

April 3, 12 p.m.: Wormhole to host an ecosystem call defending the latest updates and developments.

April 7, 9 a.m.: OriginTrail to host a “Shaping AI for Good” Zoom communicate.

April 7, 4 p.m.: Livepeer to host a monthly community call focused on governance, funding and the strategic route of its on-chain treasury.

Unlocks

April 3: Wormhole (W) to unlock 47.64% of its circulating present value $118.42 million.

April 5: Ethena (ENA) to unlock 3.25% of its circulating present value $55.30 million.

April 7: Kaspa (KAS) to unlock 0.59% of its circulating present value $9.73 million.

April 9: Movement (MOVE) to unlock 2.04% of its circulating present value $19.71 million.

April 12: Aptos (APT) to unlock 1.87% of its circulating present value $59.49 million.

Token Listings

April 3: Mantle (MNT), Vine Coin (VINE), CZ’s Dog (BROCCOLI), Moca Network (MOCA) and Nakamoto Games (NAKA) to be listed on DigiFinex.

April 3: Binance to guidelines Gunz (GUN).

April 4: Pintu (PTU), Spartan Protocol (SPARTA), Derby Stars (DSRUN), Veloce (VEXT), BOB, and Kryptonite (SEILOR) to be deslisted from Bybit.

Conferences

CoinDesk’s Consensus goes down in Toronto on May 14-16. Use code DAYBOOK and save 15% on passes.

Day 2 of two: Southeast Asia Blockchain Week 2025 Main Conference (Bangkok)

Day 2 of 4: ETH Bucharest Conference & Hackathon (Romania)

Day 1 of 4: BitBlockBoom (Dallas)

April 6-9: Hong Kong Web3 Festival

April 8-10: Paris Blockchain Week

April 10: Bitcoin Educators Unconference (Nashville)

April 15-16: BUIDL Asia 2025 (Seoul)

April 22-24: Money20/20 Asia (Bangkok)

April 23: Crypto Horizons 2025 (Dubai)

April 23-24: Blockchain Forum 2025 (Moscow)

April 24: Bitwise’s Investor Day for Bitcoin Standard Corporations (New York)

Token Talk

By Shaurya Malwa

Treasure DAO, a decentralized video-game ecosystem, is restructuring to extend its financial runway to February 2026, with chief contributor John Patten resuming a administration place and proposing a plan to streamline operations, scale back costs, and focus on 4 key merchandise: market, Bridgeworld, Smolworld and AI agent.

As part of cost-cutting measures, 15 contributors have left or been laid off, Patten acknowledged in a video posted on X, and recreation publishing assist and the treasure chain will possible be terminated.

He further proposed withdrawing $785,000 from Flowdesk to increase the DAO’s treasury, which presently holds $2.4 million and 22.3 million MAGIC tokens valued at $2.3 million.

Patten warned that with the current burn charge of $8.3 million yearly and a doable decline in MAGIC’s price, the DAO might develop to be unsustainable between December 2025 and February 2026 with out these modifications.

Derivatives Positioning

BTC, ETH basis on the CME and offshore exchanges is holding at spherical an annualized 5% after the in a single day sell-off.

XRP, BNB and SOL are seeing detrimental funding expenses in a sign of renewed bias for bearish, fast bets, in line with data provide Velo.

XRM, BTC and OM stand out with optimistic cumulative amount deltas hinting at web searching for before now 24 hours.

The bearish mood in Deribit’s BTC and ETH decisions now extends out to the tip of June versus May sooner than the U.S. tariff announcement.

Market Movements

BTC is down 2.17% from 4 p.m. ET Wednesday at $83,799.17 (24hrs: -1.62%)

ETH is down 1.93% at $1,844.66 (24hrs: -3.15%)

CoinDesk 20 is down 0.56% at 2,559.88 (24hrs: -0.07%)

Ether CESR Composite Staking Rate is down 8 bps at 3.02%

BTC funding charge is at 0.0047% (5.0983% annualized) on Binance

DXY is down 1.66% at 102.09

Gold is up 0.32% at $3,149.9/oz

Silver is down 4.14% at $33.07/oz

Nikkei 225 closed -2.77% at 34,735.93

Hang Seng closed -1.52% at 22,849.81

FTSE is down 1.33% at 8,494.33

Euro Stoxx 50 is down 2.13% at 5,191.06

DJIA closed on Wednesday +0.56% at 42,225.32

S&P 500 closed +0.67% at 5670.97

Nasdaq closed +0.87% at 17,601.05

S&P/TSX Composite Index closed +1.09% at 25,307.20

S&P 40 Latin America closed +0.3% at 2,448.23

U.S. 10-year Treasury charge is down 7 bps at 4.05%

E-mini S&P 500 futures are down 3.05% at 5,538.00

E-mini Nasdaq-100 futures are down 3.3% at 19,105.25

E-mini Dow Jones Industrial Average Index futures are down 2.53% at 41,416.00

Bitcoin Stats:

BTC Dominance: 62.86 (0.13%)

Ethereum to bitcoin ratio: 0.02176 (0.05%)

Hashrate (seven-day transferring frequent): 835 EH/s

Hashprice (spot): $47.31

Total Fees: 4.43 BTC / $377,634

CME Futures Open Interest: 138,385 BTC

BTC priced in gold: 26.5 oz

BTC vs gold market cap: 7.53%

Technical Analysis

Solana’s SOL token dropped beneath $125, which acted as demand zone quite a lot of situations ultimate yr.

The breakdown of the essential factor assist indicators continuation of the downtrend, with the next assist at $100 adopted by $78, the January 2024 low.

Crypto Equities

Strategy (MSTR): closed on Wednesday at $312.54 (+2.13%), down 4.69% at $297.89 in pre-market

Coinbase Global (COIN): closed at $182.95 (+4.83%), down 5.49% at $172.90

Galaxy Digital Holdings (GLXY): closed at C$17.10 (+4.72%)

MARA Holdings (MARA): closed at $12.42 (+4.9%), down 6.28% at $11.64

Riot Platforms (RIOT): closed at $8.02 (+6.37%), down 5.61% at $7.57

Core Scientific (CORZ): closed at $8.42 (+5.25%), down 6.18% at $7.90

CleanSpark (CLSK): closed at $8.02 (+6.08%), down 7.11% at $7.45

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $14.24 (+4.17%)

Semler Scientific (SMLR): closed at $37.03 (+1.4%)

Exodus Movement (EXOD): closed at $47.33 (+3.73%), down 0.72% at $46.99

ETF Flows

Spot BTC ETFs:

Daily web stream: $218.1 million

Cumulative web flows: $36.33 billion

Total BTC holdings ~ 1.12 million.

Spot ETH ETFs

Daily web stream: -$51.3 million

Cumulative web flows: $2.38 billion

Total ETH holdings ~ 3.42 million.

Source: Farside Investors

Overnight Flows

Chart of the Day

Traders on decentralized prediction platform Polymarket now see an above-50% likelihood of the U.S. financial system slipping proper right into a recession this yr.

The outlook may weigh on harmful property throughout the short-term.

While You Were Sleeping

U.S. Recession Odds Surge in Prediction Markets on Tariff Shock. What Next for BTC? (CoinDesk): Recession odds on Kalshi and Polymarket jumped above 50% after the tariff announcement, sending U.S. stock futures and bitcoin lower on commerce battle fears.

Bitcoin Nears Death Cross, Yuan Tumbles With Asian Markets After Trump Tariffs Put Focus on China’s Response (CoinDesk): Asian equities and U.S. stock futures declined, whereas bitcoin approached a bearish technical pattern amid escalating commerce tensions.

XRP in Focus as RLUSD Sees $100M Minted on Ripple Payments Boost (CoinDesk): Ripple’s RLUSD stablecoin seen elevated issuance this week following its addition to the company’s funds platform.

Trump’s ‘Reciprocal’ Tariff Formula Is All About Trade Deficits (Bloomberg): The White House acknowledged the individualized reciprocal tariffs had been set by halving each nation’s 2024 commerce surplus with the U.S. as a share of its exports.

EU’s Von Der Leyen Vows Response to Trump’s 20% Tariffs (The Wall Street Journal): Von Der Leyen acknowledged the bloc is finalizing a response to metallic tariffs and warned further retaliatory measures had been throughout the works if talks with the U.S. fail.

‘Absolutely Nothing Good’ Coming out of Trump’s Tariff Announcement: Analysts React to Latest U.S. Levies (CNBC): Analysts warned Trump’s sweeping tariffs might spark stagflation, damage worldwide progress and drive the U.S. into recession, with some noting the measures rival Thirties-era commerce boundaries.

China Urges U.S. to Immediately Lift Tariffs, Vows Retaliation (Reuters): China’s Commerce Ministry acknowledged the U.S. tariffs ignore earlier multilateral commerce agreements and overlook how quite a bit Washington has historically gained from worldwide commerce.

In the Ether

CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data Read More

CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data Read More