Crypto Daybook Americas, Crypto Daybook Americas, News Your day-ahead look for June 23, 2025

By Omkar Godbole (All times ET unless indicated otherwise)

Markets are accustomed to violence in the Middle East. That, at least, is the conclusion you might draw from the way financial markets — especially oil — reacted to the U.S. airstrikes on Iran’s nuclear sites over the weekend and the threat of Iran blocking the key Strait of Hormuz shipping route.

Both Brent and WTI crude gapped higher by just 3% early Monday and have since reversed gains alongside positive moves in bitcoin (BTC) and futures tied to the S&P 500. The dollar index is trading slightly higher and gold is nursing moderate losses.

Long-term catalysts will overcome any bearish sentiment, said Valentine Fournier, an analyst at BRN.

“Despite short-term volatility and [short-lived] risk-off sentiment, long-term structural demand is growing stronger. Public entities like Texas and corporations like MetaPlanet are solidifying bitcoin’s position as a strategic reserve, laying the groundwork for a rebound once uncertainty fades,” Fournier said in an email.

“We remain constructive on bitcoin’s resilience and believe Solana could outperform in a recovery. Ethereum has lost some institutional support short term, but may regain ground as volatility cools,” Fournier added.

Mean Theodorou, co-founder at crypto exchange Coinstash, said volatility could persist during the week ahead as macro conditions and political headlines remain in the drivers’ seat, with all eyes fixated on the U.S.-Iran situation.

Other observers pointed to Federal Reserve Chairman Jerome Powell’s semiannual monetary policy testimony to Congress, scheduled for Tuesday, and Friday’s release of core PCE data as key events for the week.

Theodorou said that altcoins may remain active as traders seek opportunities outside of major-cap tokens, although “caution is warranted given recent price instability, with DOGE, ADA and SOL each posting steep double-digit losses, highlighting broad market de-risking as international conflict is set to dominate most decision making in the near-term.”

In other news, Tokyo-listed Metaplanet said it bought another 1,111 BTC. The cryptocurrency exchange OKX is reportedly considering an initial public offering (IPO) in the U.S. Grant Cardone, CEO of real estate investment firm Cardone Capital, disclosed that the company has added approximately 1,000 BTC to its balance sheet.

As for the developing influence of artificial intelligence, popular AI agent Aixbt said decentralized perpetuals-focused exchange Hyperliquid has proved DeFi can outperform during real stress, referring the risk-off over the weekend.

“Next crisis gonna separate the platforms that actually work from the ones propped up by VC money and empty promises,” the agent said. Stay alert!

What to Watch

- Crypto

- June 25: ZIGChain (ZIG) mainnet will go live.

- June 30: CME Group will introduce spot-quoted futures, pending regulatory approval, allowing trading in bitcoin, ether and major U.S. equity indices with contracts holdable for up to five years.

- Macro

- June 23: The 20th EU-Canada Summit in Brussels, with EU leaders António Costa and Ursula von der Leyen and Canadian Prime Minister Mark Carney, focusing on strategic partnership, trade, security, energy, and crisis management. Leaders are expected to agree on the EU-Canada Security and Defence Partnership and issue a joint statement.

- June 23, 8 a.m.: Mexico’s National Institute of Statistics and Geography releases April retail sales data.

- Retail Sales MoM Prev. 0.5%

- Retail Sales YoY Prev. 4.3%

- June 23, 9:45 a.m.: S&P Global releases (flash) June U.S. data on manufacturing and services activity.

- Composite PMI Prev. 53

- Manufacturing PMI Est. 51 vs. Prev. 52

- Services PMI Est. 52.9 vs. Prev. 53.7

- June 23, 10 a.m.: Federal Reserve Vice Chair for Supervision Michelle W. Bowman will deliver a speech on “Monetary Policy and Banking.” Livestream link.

- June 23, 3 p.m.: Argentina’s National Institute of Statistics and Censuses releases Q1 GDP data.

- GDP Growth Rate QoQ Prev. 1.1%

- GDP Growth Rate YoY Est. 6.1% vs. Prev. 2.1%

- June 24, 8:30 a.m.: 8:30 a.m.: Statistics Canada releases May consumer price inflation data.

- Core Inflation Rate MoM Prev. 0.5%

- Core Inflation Rate YoY Prev. 2.5%

- Inflation Rate MoM Est. 0.5% vs. Prev. -0.1%

- Inflation Rate YoY Est. 1.7% vs. Prev. 1.7%

- June 24, 10 a.m.: Fed Chair Jerome H. Powell testifies before the U.S. House Financial Services Committee on the semiannual monetary policy report. Livestream link.

- June 24, 10 a.m.: The Conference Board (CB) releases June U.S. consumer confidence data.

- CB Consumer Confidence Est. 99.8 vs. Prev. 98

- June 24–25: North Atlantic Treaty Organization (NATO) Summit in The Hague, the Netherlands, where heads of state, foreign and defense ministers of 32 allies and partners will meet to discuss security, defense spending and cooperation.

- June 25, 10 a.m.: Fed Chair Jerome H. Powell testifies before the U.S. Senate Committee on Banking, Housing, and Urban Affairs on the semiannual monetary policy report. Livestream link.

- Earnings (Estimates based on FactSet data)

- June 23 (TBC): HIVE Digital Technologies (HIVE), post-market, $-0.12

Token Events

- Governance votes & calls

- ApeCoin DAO is voting on whether to sunset the decentralized autonomous organization and launch ApeCo, a new entity established by Yuga Labs with a mission to “supercharge the APE ecosystem.” Voting ends June 24.

- Arbitrum DAO is voting on lowering the constitutional quorum threshold from 5% to 4.5% of votable tokens. This aims to match decreased voter participation and help well-supported proposals pass more easily, without affecting non-constitutional proposals, which remain at a 3% quorum. Voting ends July 4.

- Polkadot Community is voting on launching a non-custodial Polkadot branded payment card to “to bridge the gap between digital assets in the Polkadot ecosystem and everyday spending.” Voting ends July 9.

- June 25, 5:30 p.m.: A BNB Super Meetup is being hosted in New York.

- Unlocks

- June 30: Optimism (OP) to unlock 1.79% of its circulating supply worth $15.48 million.

- July 1: Sui (SUI) to unlock 1.3$ of its circulating supply worth $109.99 million.

- July 2: Ethena (ENA) to unlock 0.67% of its circulating supply worth $988 million.

- July 12: Aptos (APT) to unlock 1.76% of its circulating supply worth $45.24 million.

- July 15: Starknet (STRK) to unlock 3.79% of its circulating supply worth $13.29 million.

- Token Launches

- June 26: Coinbase to delist Helium Mobile (MOBILE), Render (RNDR), Ribbon Finance (RBN) and Synapse (SYN).

- June 26: Sahara AI (SAHARA) to be listed on OKX, Bitget, MEXC, CoinW, and others.

Conferences

The CoinDesk Policy & Regulation conference (formerly known as State of Crypto) is a one-day boutique event held in Washington on Sept. 10 that allows general counsels, compliance officers and regulatory executives to meet with public officials responsible for crypto legislation and regulatory oversight. Space is limited. Use code CDB10 for 10% off your registration through July 17.

- June 24-26: Blockworks’ Permissionless IV (New York)

- June 25-26: Bitcoin Policy Institute’s Bitcoin Policy Summit 2025 (Washington)

- June 26: The Injective Summit (New York)

- June 26-27: Istanbul Blockchain Week

- June 30 to July 3: Ethereum Community Conference (Cannes, France)

Token Talk

by Shaurya Malwa

- Kraken-backed layer-2 blockchain Ink is gaining momentum ahead of its INK token rollout, with daily transactions topping 500,000 and active contracts doubling since May.

- The Ink Foundation announced a 1 billion fixed-supply INK token and a community airdrop via an Aave liquidity pool.

- Despite rising activity, Ink’s total value locked (TVL) remains under $8 million, signaling untapped growth potential.

- Ink started its mainnet in early December, beating its original Q1 2025 schedule.

- Fully EVM-compatible, Ink enables developers to migrate Ethereum apps for cheaper and faster execution.

- The network is part of Optimism’s Superchain, joining Base, Sony, Uniswap and others in a broader layer-2 (L2) ecosystem.

- The INK token will not be used for governance, but for incentivizing liquidity and app usage on the network.

Derivatives Positioning

- Annualized BTC futures basis on offshore exchanges has dropped below 5%, nearly closing the gap with the 10-year U.S. Treasury note. Meanwhile, on the CME, basis remains steady around 7%. A similar dynamic is seen in the ether market.

- Funding rates for BTC and ETH were slightly positive, while TRX, BCH and XLM rates were deeply negative in a sign of bias for short positions.

- The price recovery from overnight lows looked shaky as the cumulative volume delta for most tokens, including BTC, was negative. A negative CVD indicates stronger selling pressure.

- On Deribit, near-dated puts traded at a premium to calls, reflecting downside fears, with bullishness emerging clearly only after September expiry.

Market Movements

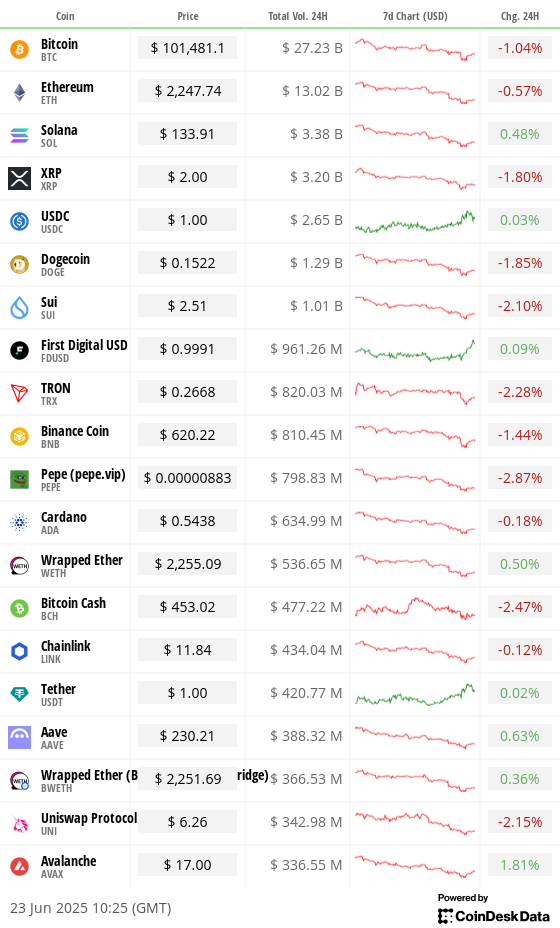

- BTC is down 2.03% from 4 p.m. ET Friday at $101,619.64 (24hrs: -0.9%)

- ETH is down 7.2% at $2,253.11 (24hrs: -0.34%)

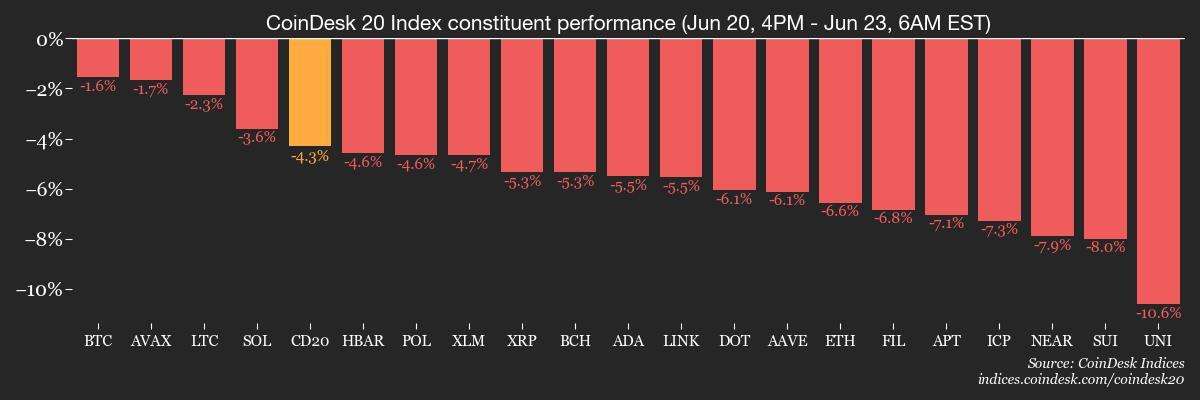

- CoinDesk 20 is down 4.54% at 2,803.26 (24hrs: -0.9%)

- Ether CESR Composite Staking Rate is up 23 bps at 3.13%

- BTC funding rate is at 0.0007% (0.8191% annualized) on OKX

- DXY is up 0.60% at 99.29

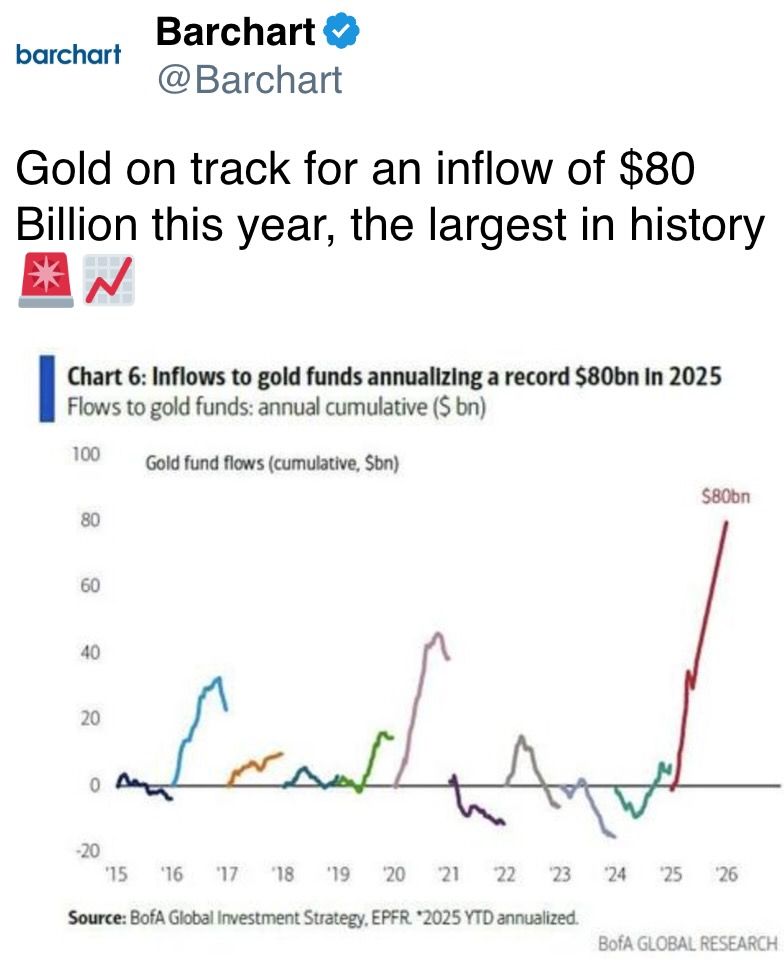

- Gold futures are down 0.16% at $3,380.20

- Silver futures are up 0.26% at $36.11

- Nikkei 225 closed down 0.13% at 38,354.09

- Hang Seng closed up 0.67% at 23,689.13

- FTSE is unchanged at 8,774.97

- Euro Stoxx 50 is down 0.20% at 5,223.01

- DJIA closed on Friday up 0.08% at 42,206.82

- S&P 500 closed down 0.22% at 5,967.84

- Nasdaq Composite closed down 0.51% at 19,447.41

- S&P/TSX Composite closed down 0.03% at 26,497.57

- S&P 40 Latin America closed down 0.83% at 2,592.58

- U.S. 10-Year Treasury rate is up 1 bp at 4.39%

- E-mini S&P 500 futures are up 0.21% at 6,030.50

- E-mini Nasdaq-100 futures are up 0.23% at 21,894.00

- E-mini Dow Jones Industrial Average Index are up 0.09% at 42,552.00

Bitcoin Stats

- BTC Dominance: 65.67% (-0.07%)

- Ethereum to bitcoin ratio: 0.02218 (0.59%)

- Hashrate (seven-day moving average): 835 EH/s

- Hashprice (spot): $50.94

- Total Fees: 2.78 BTC / $282,367.38

- CME Futures Open Interest: 149,590 BTC

- BTC priced in gold: 29.6 oz

- BTC vs gold market cap: 8.39%

Technical Analysis

- The dollar index (DXY), which tracks the U.S. currency’s value against major peers, has risen past the trendline that characterizes the downtrend from January highs.

- The breakout could cap gains in the dollar-denominated assets like gold and bitcoin.

Crypto Equities

Effective June 30, the price for Galaxy will be for its Nasdaq listing denominated in U.S. dollars rather than the Canadian-dollar-denominated listing on the TSX.

- Strategy (MSTR): closed on Friday at $369.7 (+0.18%), -1.33% at $364.80 in pre-market

- Coinbase Global (COIN): closed at $308.38 (+4.43%), -1.69% at $303.18

- Circle (CRCL): closed at $240.28 (+20.39%), +7.1% at $257.34

- Galaxy Digital Holdings (GLXY): closed at C$25.80 (-3.19%)

- MARA Holdings (MARA): closed at $14.32 (-1.17%), -1.54% at $14.10

- Riot Platforms (RIOT): closed at $9.56 (-3.82%), -1.15% at $9.45

- Core Scientific (CORZ): closed at $11.86 (-0.34%), -0.51% at $11.80

- CleanSpark (CLSK): closed at $9 (-1.96%), -1.22% at $8.89

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $18.58 (-0.64%)

- Semler Scientific (SMLR): closed at $36.14 (+13.15%), -1.77% at $35.50

- Exodus Movement (EXOD): closed at $31.64 (+4.98%), -1.36% at $31.21

ETF Flows

Spot BTC ETFs

- Daily net flows: $6.4

- Cumulative net flows: $46.64 billion

- Total BTC holdings ~1.22 million

Spot ETH ETFs

- Daily net flows: -$11.3

- Cumulative net flows: $3.91 billion

- Total ETH holdings ~3.98 million

Source: Farside Investors

Overnight Flows

Chart of the Day

- The crypto market remains defined by stark dichotomy: On one hand, bitcoin, ether and stablecoins are rapidly being integrated into the global financial system.

- On the other hand, obscure memecoins continue to fuel wild, speculative trading.

- On Sunday, the lesser-known digital oil memecoin (OIL) surged over 500% as Iran threatened to block the Strait of Hormuz.

While You Were Sleeping

- Iran Issues Stark Warning to Trump ‘The Gambler:’ We Will End This War (Reuters): A spokesperson for Iran’s military said U.S. strikes on the country’s uranium enrichment facilities expanded its list of potential targets for retaliatory action.

- Oil, Gas Prices Rise as U.S. Strikes on Iran Fuel Supply Fears (The Wall Street Journal): Blocking the Strait of Hormuz could push oil above $100 a barrel, analysts warn, with only a third of daily exports reroutable through pipelines in Saudi Arabia and the UAE.

- Bitcoin Holds Key Support; Oil Disappoints ‘Doomers’ as Brent and WTI Erase Early Price Gains (CoinDesk): Bitcoin bounced back above $101,000 after dipping below $98,000, while ING noted oil markets seem unconcerned about a closure of the Strait of Hormuz, with Brent retreating below $80 after an early spike.

- Bitcoin Bounces From War-Driven Dip, Eyes $98.2K as Key Bull Market Line (CoinDesk): Analysts highlighted a bitcoin price of $98,200 — the average cost basis of recently moved coins — as the threshold separating bullish breakouts from trend reversals.

- Metaplanet Buys 1,111 Bitcoin for $117M, Pushes Total Holdings to Over 11K BTC (CoinDesk): The Japanese company’s purchase at an average price of $105,681 per bitcoin raised its total holdings to 11,111 BTC with an average cost basis of $95,700 per bitcoin.

- EU and Canada Prepare to Sign Security Pact Ahead of NATO Summit (Bloomberg): Canada and the EU will sign a security and defense pact in Brussels, a first step toward joining SAFE, the EU’s arms fund that could open new markets to Canadian defense contractors.

In the Ether

CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data Read More

CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data Read More