Crypto Daybook Americas, Crypto Daybook Americas Your day-ahead seek for April 4, 2025

By Omkar Godbole (All situations ET besides indicated in some other case)

Major money reversed early options after Beijing stepped up trade tensions by saying retaliatory tariffs following President Donald Trump’s Wednesday decision to impose further levies on China and completely different nations.

Bitcoin dropped to $83,000 from $84,600, though the draw again appeared restricted, most probably on account of the market’s worst fears have lastly come true. Markets dislike uncertainty, and the anticipation of a looming menace normally creates further anxiousness and concern than the exact realization of that menace.

Since Trump took office on Jan. 20, markets have been wrestling with the specter of tariffs and a world commerce battle. That damped investor hazard urge for meals, inflicting the BTC worth to tumble from a report extreme over $109,000 to beneath $80,000 last month.

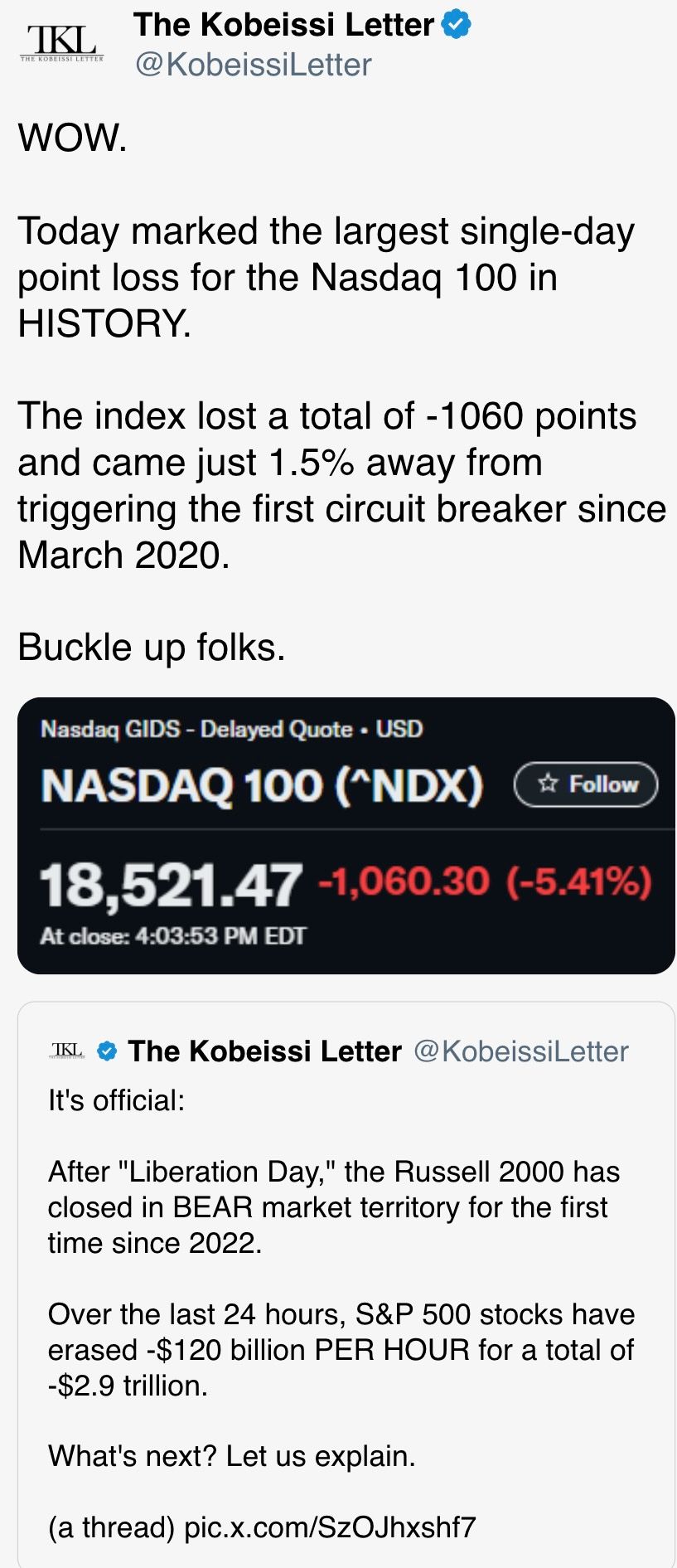

This week, Trump launched sweeping tariffs on 180 nations, with higher levies on China, the European Union and Southeast Asia. The environment friendly U.S. tariff payment is now above the extent of spherical 20% set by the 1930’s Smoot-Hawley Tariff Act.

This so-called tariffagedon second marks the highest of lingering uncertainty and should very nicely be liberating for markets, primarily on account of bond yields have dropped all through the superior world throughout the aftermath, pricing in disinflation. That’s reverse to the favored narrative that tariffs would lead to stagflation — extreme inflation plus low growth — forcing the Fed to take care of charges of curiosity elevated.

The yield on the benchmark U.S. 10-year bond yield has dropped beneath 4% for the first time since October and yields have fallen sharply throughout the U.Ok., Germany and Japan. Plus, oil has declined sharply this week on prospects of higher present from OPEC worldwide places.

All this bodes properly for Fed payment scale back bets and hazard belongings, along with cryptocurrencies. The related is likely to be acknowledged for Friday’s March jobs report, which, if it beats estimates, will probably be seen as backward-looking, failing to account for this week’s Trump tariffs, whereas a weak print will solely add to Fed payment cuts.

With the important thing macro uncertainty behind us, the crypto market would possibly return to specializing in optimistic developments, equal to USDC issuer Circle’s IPO filing and technological developments.

On Thursday, Coinbase Derivatives submitted documentation to the CFTC to self-certify futures for XRP. In addition, Ethereum builders chose May 7 as a result of the date for the Pectra enhance to go keep on the mainnet.

Elsewhere, the SEC acknowledged Fidelity’s submitting for a spot exchange-traded fund tied to SOL, which takes it nearer to approval. Rather lots is occurring all through the commerce, so maintain alert!

What to Watch

Crypto:

April 5: The purported birthday of Satoshi Nakamoto.

April 7, 7:30 p.m.: Syscoin (SYS) prompts the Nexus upgrade on its mainnet at block 2,010,345.

April 9, 10:00 a.m.: U.S. House Financial Services Committee hearing about how U.S. securities authorized pointers could very nicely be updated to take note of digital belongings. Livestream link.

April 17: EigenLayer (EIGEN) prompts slashing on Ethereum mainnet, implementing penalties for operator misconduct.

April 21: Coinbase Derivatives will list XRP futures pending approval by the U.S. Commodity Futures Trading Commission (CFTC).

Macro

April 4, 8:30 a.m.: The U.S. Bureau of Labor Statistics releases March employment data.

Nonfarm Payrolls Est. 135K vs. Prev. 151K

Unemployment Rate Est. 4.1% vs. Prev. 4.1%

April 4, 8:30 a.m.: Statistics Canada releases March employment data.

Unemployment Rate Est. 6.7% vs. Prev. 6.6%

April 4, 11:25 a.m.: Fed Chair Jerome H. Powell will give a speech titled “Economic Outlook.” Livestream hyperlink.

April 5, 12:01 a.m.: The Trump administration’s 10% baseline tariff on imports from all worldwide places takes impression.

April 9, 12:01 a.m.: The Trump administration’s higher individualized tariffs on imports from prime U.S. trade-deficit worldwide places take impression.

April 14: Salvadoran President Nayib Bukele might be a part of President Donald Trump on the White House for an official working visit.

Earnings (Estimates based totally on FactSet data)

No earnings scheduled.

Token Events

Governance votes & calls

Sky DAO is voting on an executive proposal that options initializing ALLOCATOR-BLOOM-A, updating the Smart Burn Engine’s hop parameter, approving the Spark Tokenization Grand Prix DAO choice and executing a Spark Proxy Spell to develop SparkLend’s liquidity operations. Voting ends May 3.

AaveDAO is discussing an enhance to GHO Savings to introduce a technical design change to sGHO, a yield-bearing mannequin of GHO designed for multichain integration. It moreover introduces the Aave Savings Rate (ASR) that may resolve sGHO’s yield.

April 4, 9 a.m.: Core DAO to host an Ask Me Anything (AMA) session.

April 4, 2 p.m.: Sei’s evaluation initiative to hold a livestream on real-world asset tokenization.

April 7, 9 a.m.: OriginTrail to host a “Shaping AI for Good” Zoom converse.

April 7, 4 p.m.: Livepeer to host a monthly community call focused on governance, funding, and the strategic course of its on-chain treasury.

Unlocks

April 5: Ethena (ENA) to unlock 3.25% of its circulating present worth $54.22 million.

April 7: Kaspa (KAS) to unlock 0.59% of its circulating present worth $10.17 million.

April 9: Movement (MOVE) to unlock 2.04% of its circulating present worth $19.17 million.

April 12: Aptos (APT) to unlock 1.87% of its circulating present worth $57 million.

April 12: Axie Infinity (AXS) to unlock 5.68% of its circulating present worth $24.91 million.

Token Listings

April 4: Pintu (PTU), Spartan Protocol (SPARTA), Derby Stars (DSRUN), Veloce (VEXT), BOB and KryptoniteSEILOR) to be deslisted from Bybit.

April 9: IOST airdrop claims portal for a roughly 1.7 billion IOST token airdrop to open.

April 22: Hyperlane to airdrop its HYPER tokens.

Conferences

CoinDesk’s Consensus is occurring in Toronto on May 14-16. Use code DAYBOOK and save 15% on passes.

Day 3 of 4: ETH Bucharest Conference & Hackathon (Romania)

Day 2 of 4: BitBlockBoom (Dallas)

April 6-9: Hong Kong Web3 Festival

April 8-10: Paris Blockchain Week

April 10: Bitcoin Educators Unconference (Nashville)

April 15-16: BUIDL Asia 2025 (Seoul)

April 22-24: Money20/20 Asia (Bangkok)

April 23: Crypto Horizons 2025 (Dubai)

April 23-24: Blockchain Forum 2025 (Moscow)

April 24: Bitwise’s Investor Day for Bitcoin Standard Corporations (New York)

Token Talk

By Shaurya Malwa

Infected, a crypto recreation, strikes to Solana from Base group after saying the latter couldn’t cope with its launch.

Infected claimed it confronted technical factors by means of the start-up and Base was unable to cope with extreme transaction volumes, leading to gas worth spikes and a poor individual experience.

It reported {{that a}} gas spike triggered transaction failures by means of the essential first half-hour of the game’s debut, disrupting momentum.

Although front-end factors have been suspected initially, the workers concluded that Base’s scalability limitations have been the idea set off, a difficulty they’re saying persists all through Ethereum-based chains.

Jesse Pollak, the creator of Base, rejected the claims, asserting that Base operated simply and did not crash. He emphasised that Base, with a $3.05 billion complete value locked and 1.2 million energetic addresses, had equipped help to resolve front-end factors, suggesting the difficulty was not inherent to the chain.

Base developer ‘Saedeh’ known as out Infected’s inexperience, pointing to its introduction of quite a few tokens and exaggerated market cap claims as missteps.

Derivatives Positioning

BTC, ETH locations are shopping for and promoting at a premium relative to calls out to June expiry, representing near-term draw again points.

The optimistic vendor gamma on the $83K and $84K strikes means these market contributors would possibly commerce in opposition to the market to hedge their books, doubtlessly arresting worth volatility.

Perpetual funding expenses for a lot of primary tokens, excluding XRP and AVAX, keep marginally optimistic, implying cautiously bullish sentiment.

Market Movements

BTC is up 1.25% from 4 p.m. ET Thursday at $83,032.61 (24hrs: -0.28%)

ETH is up 0.61% at $1,795.41 (24hrs: +0.15%)

CoinDesk 20 is up 1.54% at 2,479.75 (24hrs: +0.62%)

Ether CESR Composite Staking Rate is up 6 bps at 3.08%

BTC funding payment is at 0.0023% (2.4988% annualized) on Binance

DXY is up 0.47% at 102.56

Gold is up 0.48% at $3,111.90/oz

Silver is down 1.38% at $31.40/oz

Nikkei 225 closed -2.75% at 33,780.58

Hang Seng closed -1.52% at 22,849.81

FTSE is down 3.4% at 8,186.43

Euro Stoxx 50 is down 4.26% at 4,895.26

DJIA closed on Thursday -3.98% at 40,545.93

S&P 500 closed -4.84% at 5,396.52

Nasdaq closed -5.97% at 16,550.61

S&P/TSX Composite Index closed -3.84% at 24,335.8

S&P 40 Latin America closed +0.21% at 2,453.38

U.S. 10-year Treasury payment is down 13 bps at 3.9%

E-mini S&P 500 futures are down 2.17% at 5,315.00

E-mini Nasdaq-100 futures are down 2.34%% at 18,238.75

E-mini Dow Jones Industrial Average Index futures are down 2.26% at 39,854

Bitcoin Stats:

BTC Dominance: 63 (0.31%)

Ethereum to bitcoin ratio: 0.02162 (-1.05%)

Hashrate (seven-day shifting widespread): 839 EH/s

Hashprice (spot): $46.31

Total Fees: 5.78 BTC / $478,070

CME Futures Open Interest: 135,025 BTC

BTC priced in gold: 27.1 oz

BTC vs gold market cap: 7.69%

Technical Analysis

The ratio between the dollar prices of bitcoin and gold is looking for to growth lower.

Gold, nonetheless, would possibly even see a “sell the fact” pullback throughout the wake of Wednesday’s Trump tariffs, doubtlessly leading to a breakout throughout the BTC-gold ratio.

Such a switch could very nicely be taken a sign of a renewed bull run in BTC, as a result of the cryptocurrency tends to rally after gold.

Crypto Equities

Strategy (MSTR): closed on Thursday at $282.28 (-9.68%), down 1.11% at $279.14 in pre-market

Coinbase Global (COIN): closed at $170.76 (-6.66%), down 3.29% at $165.14

Galaxy Digital Holdings (GLXY): closed at C$15.08 (-11.81%)

MARA Holdings (MARA): closed at $11.23 (-9.58%), down 3.29% at $10.86

Riot Platforms (RIOT): closed at $7.30 (-8.98%), down 3.15% at $7.07

Core Scientific (CORZ): closed at $7.15 (-15.08%), down 1.96% at $7.01

ClearSpark (CLSK): closed at $7.41 (-7.61%), down 3.51% at $7.15

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $12.75 (-10.46%), down 0.16% at $12.73

Semler Scientific (SMLR): closed at $34.06 (-8.02%), down 6.05% at $32

Exodus Movement (EXOD): closed at $42.63 (-9.93%), down 0.09% at $42.59

ETF Flows

Spot BTC ETFs:

Daily web flow into: -$99.8 million

Cumulative web flows: $36.23 billion

Total BTC holdings ~ 1.11 million.

Spot ETH ETFs

Daily web flow into: -$3.6 million

Cumulative web flows: $2.37 billion

Total ETH holdings ~ 3.39 million.

Source: Farside Investors

Overnight Flows

Chart of the Day

The world search curiosity for the time interval “tariffs” reached a peak value of 100 on Thursday, indicating heightened curiosity and concern about commerce taxes among the many many widespread public over the earlier 90 days.

Peak curiosity among the many many widespread populace usually marks the highest of a growth, which implies markets would possibly shortly be wanting earlier tariffs.

While You Were Sleeping

Bitcoin Falls Back to $83K as China Announces 34% Tariffs on All U.S. Goods (CoinDesk): China launched retaliatory tariffs on all gadgets from the U.S.

March Jobs Report a ‘Heads I Win, Tails You Lose’ Moment for Bitcoin Bulls (CoinDesk): Bitcoin’s worth stability above March lows suggests vendor fatigue, with implied volatility indicating a attainable 3.4% worth swing throughout the subsequent 24 hours.

South Korea’s President Yoon Ousted as Court Upholds Impeachment (Reuters): The Constitutional Court acknowledged Yoon overstepped his powers by declaring martial laws. An election ought to be held inside 60 days, with Prime Minister Han Duck-soo serving as interim president.

Inflation Fears Add to Pressure on Federal Reserve (Financial Times): Markets now see short-term U.S. inflation rising at its quickest tempo since 2022.

Solana’s SOL Could See Nearly 6% Price Swing as Whales Dump Coins Before U.S. Jobs Data (CoinDesk): Volmex’s one-day implied volatility index signifies SOL would possibly even see a 6% worth swing as big consumers offload holdings ahead of the U.S. non-farm payroll report.

China’s Response to New U.S. Tariffs Will Likely Focus More on Stimulus, Building Trade Ties (CNBC): China is liable to reply by boosting stimulus, deepening Asian and African commerce ties, and sustaining the yuan strong to shift inflationary stress onto the U.S., analysts acknowledged.

In the Ether

CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data Read More

CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data Read More