Crypto Daybook Americas, Crypto Daybook Americas Your day-ahead search for April 17, 2025

By Francisco Rodrigues (All occasions ET except indicated in any other case)

President Donald Trump’s “reciprocal tariffs” announcement earlier this month drove the economic trade policy uncertainty index to a document excessive and despatched buyers away from danger belongings, which embrace bitcoin (BTC) and different cryptocurrencies.

Federal Reserve Chairman Jerome Powell fanned the flames late Wednesday, saying the central financial institution sees unemployment rising with the financial system more likely to gradual and inflation more likely to go up as “some a part of these tariffs come to be paid by the general public.”

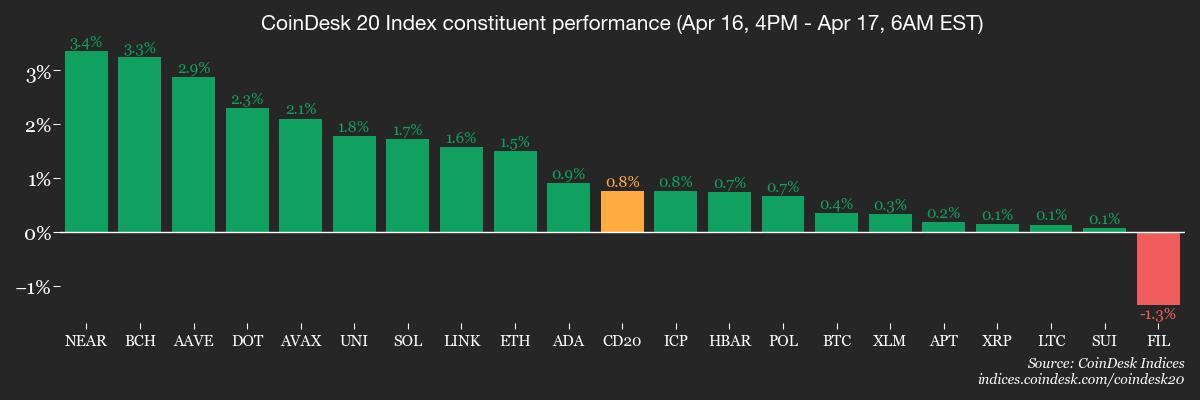

His feedback weighed additional on danger belongings, bringing the Nasdaq down 1.17% and the S&P 500 dropping 2.24% earlier than the closing bell. Still, bitcoin is up greater than 1% within the final 24 hours, whereas the CoinDesk 20 (CD20) index, which captures the broader market, added 1.8%, although crypto is seen more as gauge of risk than a secure haven.

To Michael Brown, an analyst at Pepperstone, demand for “assets which provide shelter from political incoherence and trade uncertainty” is more likely to continue to grow, The Telegraph reported.

While bitcoin has outperformed the inventory market — up 1% prior to now month in contrast with the Nasdaq’s close to 8% drop — institutional buyers are piling into gold, the battle-tested secure haven.

The treasured steel is up 11% over the past month and 27% this yr to round $3,340 a troy ounce. Bank of America’s Global Fund Manager Survey reveals that 49% of fund managers see “long gold” as Wall Street’s most crowded trade, with 42% of fund managers forecasting it to be the best-performing asset of the yr.

UBS analysts wrote in a observe that the “case for adding gold allocations has become more compelling than ever in this environment of escalating tariff uncertainty, weaker growth, higher inflation, geopolitical risks & diversification away from US assets & the US$,” Investopedia reported.

Gold fund flows have hit $80 billion thus far this yr, whereas SoSoValue data reveals spot bitcoin ETFs noticed $5.25 billion web inflows in January and web outflows because the uncertainty began. Month-to-date, over $900 million left these funds, after February and March noticed $3.56 billion and $767 billion of web outflows, respectively. Stay alert!

What to Watch

Crypto:

April 17: EigenLayer (EIGEN) prompts slashing on Ethereum mainnet, implementing penalties for operator misconduct.

April 18: Pepecoin (PEP), a layer-1, proof-of-work blockchain, undergoes its second halving, lowering block rewards to fifteen,625 PEP per block.

April 20, 11 p.m.: BNB Chain (BNB) — opBNB mainnet hardfork.

April 21: Coinbase Derivatives will list XRP futures pending approval by the U.S. Commodity Futures Trading Commission (CFTC).

April 25, 1:00 p.m.: U.S. Securities and Exchange Commission (SEC) Crypto Task Force Roundtable on “Key Considerations for Crypto Custody“.

Macro

April 17, 8:30 a.m.: U.S. Census Bureau releases March new residential development information.

Housing Starts Est. 1.42M vs. Prev. 1.501M

Housing Starts MoM Prev. 11.2%

April 17, 8:30 a.m.: The U.S. Department of Labor releases unemployment insurance coverage information for the week ended April 12.

Initial Jobless Claims Est. 225K vs. Prev. 223K

April 17, 7:30 p.m.: Japan’s Ministry of Internal Affairs & Communications releases March shopper value index (CPI) information.

Core Inflation Rate YoY Est. 3.2% vs. Prev. 3%

Inflation Rate MoM Prev. -0.1%

Inflation Rate YoY Prev. 3.7%

Earnings (Estimates based mostly on FactSet information)

April 22: Tesla (TSLA), post-market

April 30: Robinhood Markets (HOOD), post-market

Token Events

Governance votes & calls

GMX DAO is discussing the institution of a GMX Reserve on Solana, which might contain bridging $500,000 in GMX to the Solana community and transfering the funds to the GMX-Solana Treasury.

Treasure DAO is discussing handing authority to the core contributor crew to wind down and shutter Treasure Chain infrastructure on ZKsync and handle the first MAGIC-ETH protocol-owned liquidity pool given the “crucial financial situation” of the protocol.

April 17, 11 a.m.: Starknet to host a governance call to debate the right way to enhance Cairo and the “overall dev experience.”

Unlocks

April 18: Official Trump (TRUMP) to unlock 20.25% of its circulating provide price $314.23 million.

April 18: Fasttoken (FTN) to unlock 4.65% of its circulating provide price $84.4 million.

April 18: Official Melania Meme (MELANIA) to unlock 6.73% of its circulating provide price $10.72 million.

April 18: UXLINK (UXLINK) to unlock 11.09% of its circulating provide price $16.52 million.

April 18: Immutable (IMX) to unlock 1.37% of its circulating provide price $10.03 million.

April 22: Metars Genesis (MRS) to unlock 11.87% of its circulating provide price $126.7 million.

Token Launches

April 17: VeThor (VTHO) to be listed on Bybit.

April 17: Babylon (BABY), AI Rig Complex (ARC), and Alchemist AI (ALCHI) to be listed on Kraken.

April 22: Hyperlane to airdrop its HYPER tokens.

Conferences:

CoinDesk’s Consensus is going down in Toronto on May 14-16. Use code DAYBOOK and save 15% on passes.

Day 3 of three: NexTech Week Tokyo

April 22-24: Money20/20 Asia (Bangkok)

April 23: Crypto Horizons 2025 (Dubai)

April 23-24: Blockchain Forum 2025 (Moscow)

April 24: Bitwise’s Investor Day for Bitcoin Standard Corporations (New York)

April 26: Crypto Vision Conference 2025 (Manilla)

April 26-27: Harvard Blockchain in Action Conference (Cambridge, Mass.)

April 27: N Crypto Conference 2025 (Kyiv)

April 27-30: Web Summit Rio 2025

April 28-29: Blockchain Disrupt 2025 (Dubai)

April 28-29: Staking Summit Dubai

April 29: El Salvador Digital Assets Summit 2025 (San Salvador, El Salvador)

April 29: IFGS 2025 (London)

Token Talk

By Shaurya Malwa

Raydium’s platform for introducing tokens, LaunchLab, went dwell late Wednesday.

It instantly competes with Pump.enjoyable, which just lately pivoted away from Raydium and began its personal trade, PumpSwap, prompting Raydium to introduce a perceived competing platform.

The Solana ecosystem noticed a surge in exercise with LaunchLab’s debut, creating over 1,750 tokens shortly after it began up. The value of Raydium’s RAY token rose as a lot as 10% within the hours afterwards.

LaunchLab’s dynamic joint curve system affords linear, exponential and logarithmic curves — three sorts of pricing mechanisms that affect how token values change based mostly on consumer buying and selling — a shift from the fixed-slope pricing fashions utilized in memecoin launch platforms.

Integration with main Solana buying and selling apps like Axiom, BullX and JupiterExchange enhances LaunchLab’s visibility, doubtlessly driving broader adoption throughout the ecosystem.

Derivatives Positioning

Open curiosity in bitcoin futures on the CME reached 138,235 BTC, the very best degree the month, as merchants re-enter the idea commerce. The annualized foundation on the CME has climbed to eight%.

With simply over per week remaining till the April choices expiry on Deribit, the $100,000 strike stays essentially the most dominant, holding over $315 million in notional open curiosity.

The futures perpetual funding fee turned detrimental once more on Wednesday throughout Fed Chair Powell’s speech. Throughout the week, funding charges have oscillated between optimistic and detrimental, highlighting continued short-term uncertainty round bitcoin’s course.

Market Movements:

BTC is unchanged from 4 p.m. ET Wednesday at $84,312 (24hrs: +0.4%)

ETH is up 1.26% at $1,593.44 (24hrs: +0.91%)

CoinDesk 20 is unchanged at 2,459.45 (24hrs: +1.36%)

Ether CESR Composite Staking Rate is down 1bp bps at 3%

BTC funding fee is at 0.012% (4.3866% annualized) on Binance

DXY is up 0.11% at 99.49

Gold is up 0.35% at $3,338.30/oz

Silver is down 1.49% at $32.44/oz

Nikkei 225 closed +1.35% at 34,377.60

Hang Seng closed +1.61% at 21,395.14

FTSE is down 0.82% at 8,207.47

Euro Stoxx 50 is down 0.56% at 4,938.69

DJIA closed on Wednesday -1.73% at 39,669.39

S&P 500 closed -2.24% at 5,275.70

Nasdaq closed -3.07% at 16,307.16

S&P/TSX Composite Index closed -0.16% at 24,106.80

S&P 40 Latin America closed +0.32% at 2,345.32

U.S. 10-year Treasury fee is up 3 bps at 4.31%

E-mini S&P 500 futures are up 0.9% at 5,353.25

E-mini Nasdaq-100 futures are up 1.02% at 18,573.25

E-mini Dow Jones Industrial Average Index futures are up 0.81% at 40,175.00

Bitcoin Stats:

BTC Dominance: 63.89 (-0.07%)

Ethereum to bitcoin ratio: 0.01889 (0.64%)

Hashrate (seven-day shifting common): 905 EH/s

Hashprice (spot): $43.9

Total Fees: 5.78 BTC / $482,907

CME Futures Open Interest: 138,235 BTC

BTC priced in gold: 25.4 oz

BTC vs gold market cap: 7.15%

Technical Analysis

Bitcoin has bounced cleanly off the golden pocket zone, with the 0.618 and 0.65 Fibonacci ranges at $74,995 and $73,213 holding as help.

This space marked the primary actual retracement from the $109,396 excessive and has proven sturdy purchaser curiosity.

The bounce additionally coincided with a breakout from the day by day downtrend that has been in place since February — a key shift in construction price noting.

BTC is now sitting just under the day by day 50 and 200 exponential shifting averages, which have begun to converge.

These ranges typically act as choice factors, and with the worth urgent proper up towards them, the subsequent transfer ought to supply clearer course. A clear break and maintain above would give bulls extra management, whereas a rejection may see costs head again towards the golden pocket.

The weekly 50 EMA — presently $78,071 — can also be in play and provides to the confluence just under. As lengthy as BTC holds above the damaged trendline and continues to defend this cluster of help, short-term momentum stays constructive.

Crypto Equities

Strategy (MSTR): closed on Wednesday at $311.66 (+0.3%), up 0.98% at $314.70 in pre-market

Coinbase Global (COIN): closed at $172.21 (-1.91%), up 0.87% at $173.70

Galaxy Digital Holdings (GLXY): closed at C$15.58 (+0.84%)

MARA Holdings (MARA): closed at $12.32 (-2.07%), up 0.81% at $12.42

Riot Platforms (RIOT): closed at $6.36 (-2.9%), up 0.31% at $6.38

Core Scientific (CORZ): closed at $6.59 (-3.8%), up 1.67% at $6.70

CleanSpark (CLSK): closed at $7.28 (+0.0%), up 0.27% at $7.30

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $11.91 (-0.58%)

Semler Scientific (SMLR): closed at $31 (-9.88%)

Exodus Movement (EXOD): closed at $37.19 (-2.16%), up 2.18% at $38

ETF Flows

Spot BTC ETFs:

Daily web circulation: -$171.1 million

Cumulative web flows: $35.36 billion

Total BTC holdings ~ 1.10 million

Spot ETH ETFs

Daily web circulation: -$12.1 million

Cumulative web flows: $2.26 billion

Total ETH holdings ~ 3.30 million

Source: Farside Investors

Overnight Flows

Chart of the Day

Yesterday, the SOL/ETH ratio surged to a document excessive, closing at 0.0833 and highlighting sol’s continued power relative to ether.

Ether’s weak spot additionally confirmed within the the ETH/BTC ratio, which slipped to 0.0187, its lowest degree since Jan. 6, 2020.

While You Were Sleeping

SOL Jumps 6%, Bitcoin Clings to $84K on Dampened Rate Cut Hopes (CoinDesk): Bitcoin will possible keep between $80,000 and $90,000 as merchants await readability on tariff talks and delayed Fed fee cuts, mentioned BTSE COO Jeff Mei.

Meloni, Europe’s Trump Whisperer, to Try Her Hand on Tariffs (The Wall Street Journal): Italy’s prime minister is predicted to press Trump right this moment on the EU’s “zero-for-zero” proposal, which might remove tariffs on industrial items if each side agree.

Nvidia Chief Jensen Huang Flies Into Beijing for Talks (Financial Times): The go to follows a U.S. choice requiring a license to export Nvidia’s H20 chip to China, prompting the corporate to warn of a $5.5 billion earnings hit.

China Stocks Face Risk of $800 Billion U.S. Outflows, Goldman Says (Bloomberg): In a full monetary decoupling, U.S. buyers may dump $800 billion of Chinese shares whereas Chinese buyers would possibly offload $370 billion of U.S. equities and $1.3 trillion in bonds.

Bitcoin, the Haven Crypto Bulls Hoped for, Is More a Barometer of Risk: Godbole (CoinDesk): Bitcoin, moderately than behaving as a digital gold, has solidified as a proxy for danger, validating FX market contributors who observe it as a gauge of speculative sentiment.

Quantum Computing Group Offers 1 BTC to Whoever Breaks Bitcoin’s Cryptographic Key (CoinDesk): A contest is providing one bitcoin to the primary individual or crew to interrupt elliptic curve cryptography (ECC) utilizing Shor’s algorithm on a quantum pc.

In the Ether

CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data Read More

CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data Read More