Crypto Daybook Americas, Crypto Daybook Americas Your day-ahead search for March 20, 2025

By Omkar Godbole (All instances ET until indicated in any other case)

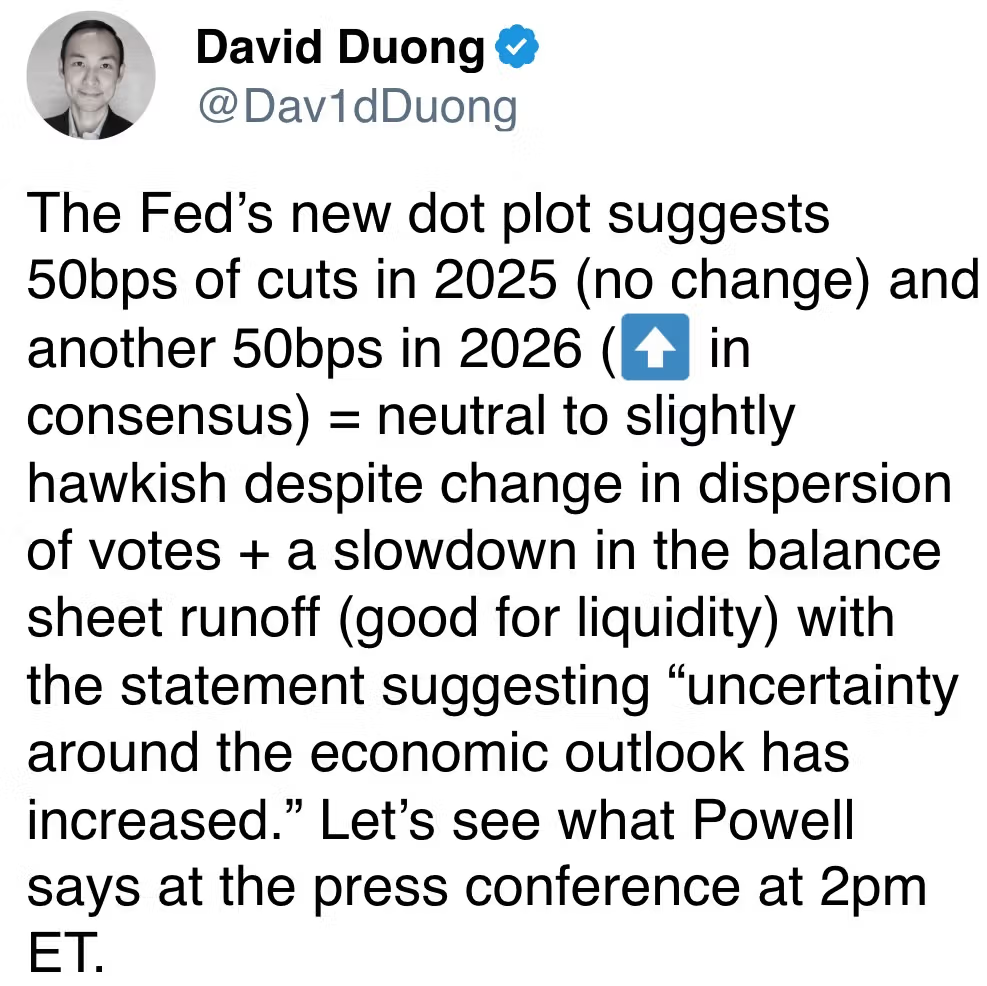

Bitcoin (BTC), ether (ETH) and the broader crypto market are dealing with renewed stress, reversing a few of good points made after Federal Reserve Chairman Jerome Powell downplayed issues about tariff-driven inflation .

President Donald Trump is reportedly scheduled to speak at Blockworks’ Digital Asset Summit in New York later, with merchants eager to listen to how the administration plans to amass BTC in a budget-neutral method. Don’t get too excited, the chance of such an announcement stays low.

Trump is extra prone to reiterate his aspiration to make America the “crypto capital of the world,” and even this may increasingly overwhelm markets.

On a extra optimistic observe, renewed curiosity in U.S.-listed spot ETFs helps market power. On Wednesday, bitcoin ETFs skilled a complete web influx of $11.8 million, a fourth consecutive day of optimistic flows, according to Farside Investors. In distinction, ether spot ETFs recorded a web outflow of $11.7 million, extending a streak of withdrawals to 11 straight days.

“Several catalysts continue to support a bullish outlook,” Blockhead Research Network stated. “The U.S. government exploring budget-neutral ways to accumulate bitcoin could be a game-changing factor for this cycle. Additionally, solana futures being added to the CME is a major bullish indicator for altcoins, potentially increasing institutional exposure to SOL.”

Speaking of on-chain flows, knowledge from IntoTheBlock reveals that whales now maintain some 62,000 extra BTC than they did initially of the month, indicating a resurgence in accumulation following practically a 12 months of declining balances. XRP whales have additionally been shopping for over the previous two months.

For its half, the SUI token has remained resilient, seeking to construct on its Wednesday good points within the wake of Canary Capital Group, an institutional crypto buying and selling and administration agency, filing for a Sui exchange-traded fund (ETF) with the SEC.

In wider market information, a site declare web page for Hyperlane, an open interoperability framework, surfaced, sparking speculation of a possible token airdrop on social media.

Traditional markets provided blended cues, with dollar-yen gazing a loss of life cross sample, teasing a serious surge forward within the Japanese forex, which is seen as an anti-risk holding. Meanwhile, copper neared a file excessive in a optimistic signal for dangerous belongings. Stay alert!

What to Watch

Crypto:

March 20, 9:30 a.m.: Bitnomial to debut what it claims are the first-ever CFTC-regulated XRP futures within the U.S.

March 20, 9:30 a.m.: Volatility Shares is introducing two Solana (SOL) futures ETFs: Volatility Shares Solana ETF (SOLZ) and Volatility Shares 2X Solana ETF (SOLT).

March 20, 10:40 a.m.: President Trump is predicted to address Blockworks’ Digital Asset Summit in New York in a recording.

March 21, 1:00 p.m.: The SEC’s Crypto Task Force hosts a roundtable, open to the public, that may deal with the definition of a safety.

March 24 (earlier than market open): Bitcoin miner CleanSpark (CLSK) will join the S&P SmallCap 600 index.

March 24, 11:00 a.m.: Bugis network upgrade goes dwell on Enjin Matrixchain mainnet.

March 25: The Mimir upgrade goes dwell on Chromia (CHR) mainnet.

March 26, 3:37 a.m.: Ethereum’s Hoodi testnet will activate the Pascal hard fork network upgrade at epoch 2048.

Macro

March 20, 8:00 a.m.: The Bank of England publicizes its interest rate decision.

Bank Rate Est. 4.5% vs. Prev. 4.5%

March 20, 8:30 a.m.: The U.S. Department of Labor releases employment knowledge for the week ended March 15.

Initial Jobless Claims Est. 224K vs. Prev. 220K

Continuing Jobless Claims Est. 1890K vs. Prev. 1870K

March 20, 3:00 p.m.: Argentina’s National Institute of Statistics and Census releases This fall employment knowledge.

Unemployment Rate Prev. 6.9%

March 20, 7:30 p.m.: Japan’s Ministry of Internal Affairs & Communications releases February shopper value index (CPI) knowledge.

Core Inflation Rate YoY Est. 2.9% vs. Prev. 3.2%

Inflation Rate MoM Prev. 0.5%

Inflation Rate YoY Prev. 4%

March 21, 6:30 a.m.: The Bank of Russia is predicted to announce its rate of interest resolution.

Key Rate Est. 21% vs. Prev. 21%

Earnings (Estimates based mostly on RealitySet knowledge)

March 27: KULR Technology Group (KULR), post-market, $-0.02

March 28: Galaxy Digital Holdings (GLXY), pre-market, C$0.38

Token Events

Governance votes & calls

DYdX DAO is voting on implementing a buyback program that will allocate 25% of the dYdX protocol income to it.

Balancer DAO is discussing migrating the ProtocolFeeController to introduce off-chain protocol charge monitoring, improved contract storage and resolve different shortcomings.

March 21, 11:30 a.m.: Flare to host an X Spaces session on Flare 2.0.

March 25, 1 a.m.: Crypto.com to hold an Ask Me Anything (AMA) session with co-founder and CEO Kris Marszalek.

Unlocks

March 21: Immutable (IMX) to unlock 1.39% of circulating provide value $14.13 million.

March 23: Metars Genesis (MRS) to unlock 11.87% of its circulating provide value $240.90 million.

March 31: Optimism (OP) to unlock 1.93% of its circulating provide value $28.06 million.

April 1: Sui (SUI) to unlock 2.03% of its circulating provide value $158.56 million.

April 3: Wormhole (W) to unlock 47.64% of its circulating provide value $117.81 million.

April 7: Kaspa (KAS) to unlock 0.59% of its circulating provide value $12.31 million.

Token Listings

March 20: Jupiter (JUP) to be listed on Binance.US.

March 31: Binance to delist USDT, FDUSD, TUSD, USDP, DAI, AEUR, UST, USTC, and PAXG.

Conferences

CoinDesk’s Consensus is going down in Toronto on May 14-16. Use code DAYBOOK and save 15% on passes.

Day 3 of three: Digital Asset Summit 2025 (New York)

Day 3 of three: Fintech Americas Miami 2025

Day 2 of two: Next Block Expo (Warsaw)

March 24-26: Merge Buenos Aires

March 25-26: PAY360 2025 (London)

March 25-27: Mining Disrupt (Fort Lauderdale, Fla.)

March 26: Crypto Assets Conference (Frankfurt)

March 26: DC Blockchain Summit 2025 (Washington)

March 26-28: Real World Crypto Symposium 2025 (Sofia, Bulgaria)

March 27: Building Blocks (Tel Aviv)

March 27: Digital Euro Conference 2025 (Frankfurt)

March 27: WIKI Finance EXPO Hong Kong 2025

March 27-28: Money Motion 2025 (Zagreb, Croatia)

Token Talk

By Shaurya Malwa

Frog-themed tokens jumped Thursday, with a KEKIUS MAXIMUS token zooming 96% after Elon Musk posted an image housing a “Kekius Maximus” portrait on X.

He responded “ok” to a person’s suggestion that he change his show identify to “Kekius Maximus,” amplifying consideration on frog-related memes and tokens. The identify is linked to present frog-themed cash like pepe, that includes a frog dressed up as a Roman gladiator.

Musk’s endorsement sparked hypothesis about whether or not he’s hinting at backing the prevailing KEKIUS token or simply becoming a member of the day’s festivities — albeit creating volatility in such tokens.

The phrase surged in visibility when Musk first made Kekius Maximus his show identify on X on Dec. 31.

The Kek connection additionally nods to the “Cult of Kek,” a tongue-in-cheek web phenomenon linking the time period to an historic Egyptian frog-headed deity of chaos and darkness.

The eponymous token issued on the time jumped to a market capitalization of practically $200 million shortly after issuance solely to crater greater than 95% after the preliminary hype subsided.

Memecoins are inclined to surge when Musk references them resulting from his large affect and cult-like following. Such tokens are sometimes sentiment-driven and thrive on such consideration turning Musk’s playful nods — like a mere point out — into value catalysts.

Derivatives Positioning

BTC world futures open curiosity has elevated to $13.3 billion, the very best since March 4, Coinglass knowledge present. ETH open curiosity stays beneath $2 billion.

Basis within the CME’s BTC one-month futures has dropped beneath an annualized 5% regardless of in a single day value good points, suggesting a scarcity of participation from institutional merchants. ETH foundation stays round 5%.

DOGE, APT, XMR, BCH, XRP, LTC, ADA and NEAR see unfavourable cumulative quantity delta, implying web promoting amid the worth bounce.

Deribit’s BTC choices have flipped bullish, with entrance and near-dated calls now buying and selling pricier than places. ETH, nonetheless, lags in sentiment.

Market Movements:

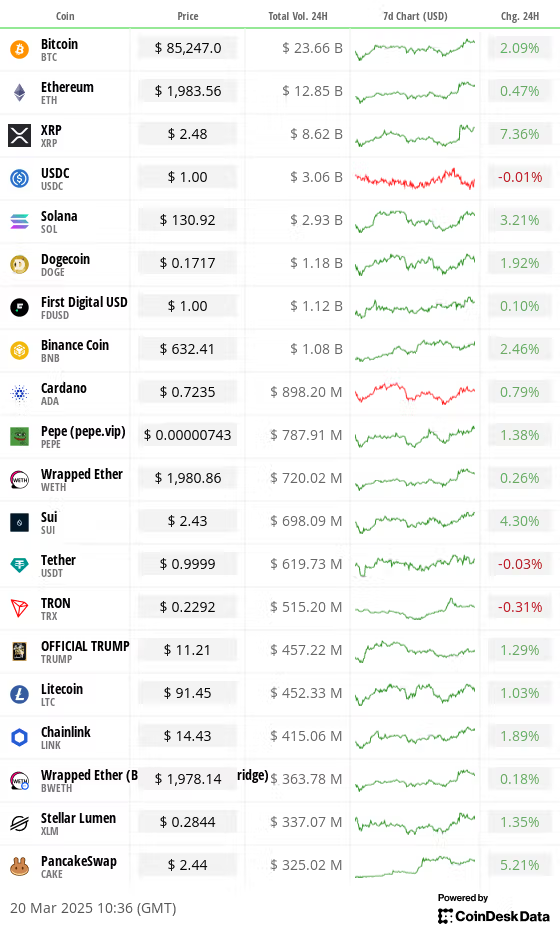

BTC is down 0.26% from 4 p.m. ET Wednesday at $83,576.60 (24hrs: +2.07%)

ETH is down 2.85% at $1,980.15 (24hrs: +0.3%)

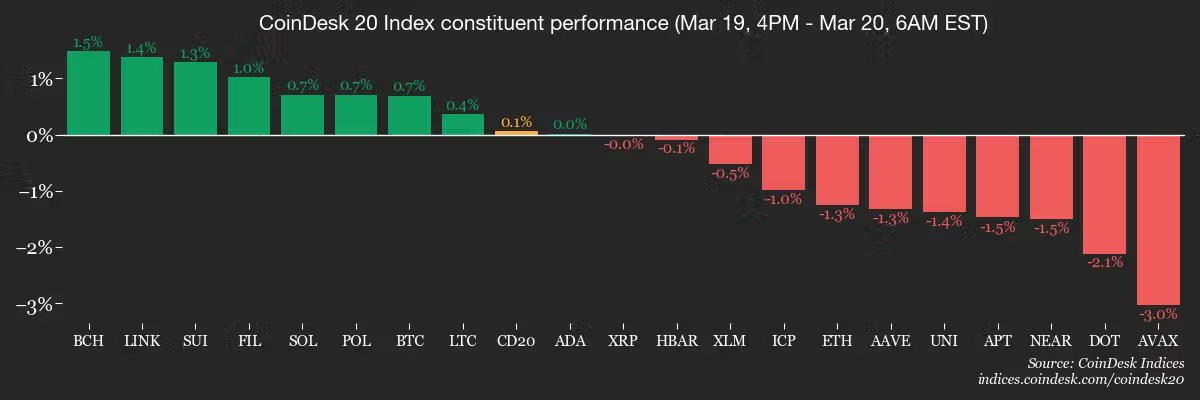

CoinDesk 20 is down 0.96% at 2,711.65 (24hrs: +3.04%)

Ether CESR Composite Staking Rate is up 5 bps at 3.02%

BTC funding price is at 0.0043% (4.74% annualized) on Binance

DXY is up 0.46% at 103.90

Gold is up 0.19% at $3,039.20/oz

Silver is down 0.19% at $33.49/oz

Nikkei 225 closed on Wednesday -0.25% at 37,751.88

Hang Seng closed on Thursday -2.23% at 24,219.95

FTSE is down 0.33% at 8,678.09

Euro Stoxx 50 is down 0.92% at 5,456.82

DJIA closed on Wednesday +0.92% at 41,964.63

S&P 500 closed +1.08% at 5,675.29

Nasdaq closed +1.41% at 17,750.79

S&P/TSX Composite Index closed +1.47% at 25,069.21

S&P 40 Latin America closed +0.77% at 2,495.85

U.S. 10-year Treasury price is down 2 bps at 4.22%

E-mini S&P 500 futures are down 0.1% at 5,724.00

E-mini Nasdaq-100 futures are down 0.16% at 19,919.00

E-mini Dow Jones Industrial Average Index futures are unchanged at 42,290.00

Bitcoin Stats:

BTC Dominance: 61.60 (0.04%)

Ethereum to bitcoin ratio: 0.02327 (-1.90%)

Hashrate (seven-day shifting common): 804 EH/s

Hashprice (spot): $48.76

Total Fees: 5.28 BTC / $453,536

CME Futures Open Interest: 154,690 BTC

BTC priced in gold: 27.9 oz

BTC vs gold market cap: 7.91%

Technical Analysis

Nvidia (NVDA), the Nasdaq heavyweight, has triggered a head-and-shoulders breakdown, hinting at a bullish-to-bearish development change.

The breakdown provides bearish cues to danger belongings.

The 90-day correlation between NVDA and bitcoin is 0.6.

Crypto Equities

Strategy (MSTR): closed on Wednesday at $304.23 (+7.43%), down 2.58% at $296 in pre-market

Coinbase Global (COIN): closed at $189.75 (+4.75%), down 2.16% at $185.20

Galaxy Digital Holdings (GLXY): closed at C$17.70 (+3.57%)

MARA Holdings (MARA): closed at $12.53 (+3.81%), down 1.68% at $12.32

Riot Platforms (RIOT): closed at $7.78 (+5.14%), up 0.39% at $7.75

Core Scientific (CORZ): closed at $8.68 (+8.23%), down 0.12% at $8.67

CleanSpark (CLSK): closed at $8.01 (+5.53%), down 1.12% at $7.92

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $15.20 (+6.67%), down 6.12% at $14.27

Semler Scientific (SMLR): closed at $40.04 (+12.82%), down 3.25% at $38.74

Exodus Movement (EXOD): closed at $40.75 (+34.67%)

ETF Flows

Spot BTC ETFs:

Daily web movement: $11.8 million

Cumulative web flows: $35.88 billion

Total BTC holdings ~ 1,119 million.

Spot ETH ETFs

Daily web movement: -$11.7 million

Cumulative web flows: $2.46 billion

Total ETH holdings ~ 3.450 million.

Source: Farside Investors

Overnight Flows

Chart of the Day

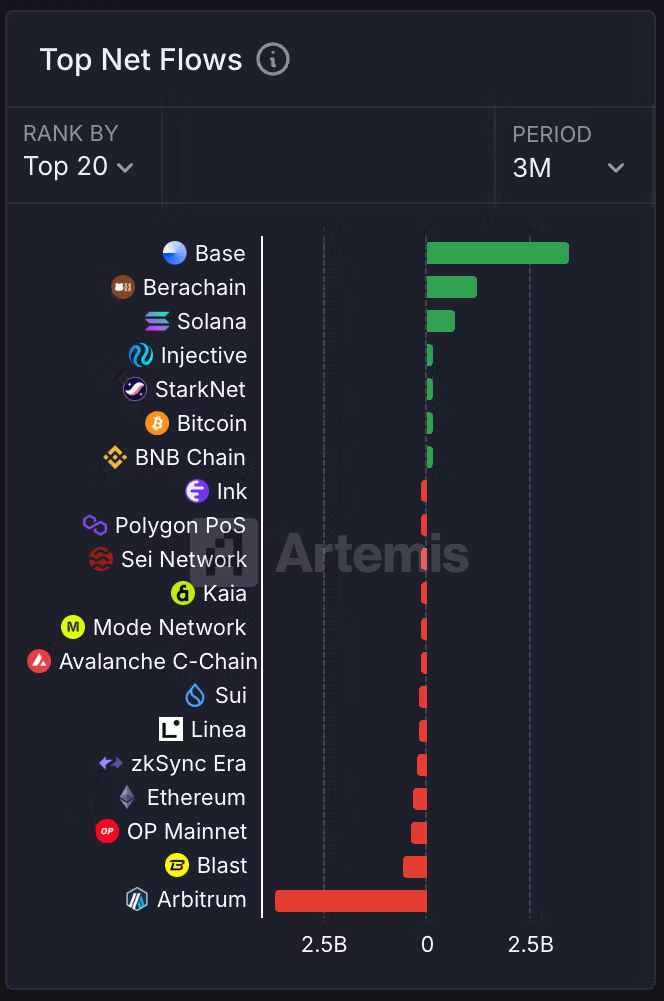

Coinbase’s layer 2 scaling resolution Base maintains its lead over different chains because the platform with the very best greenback worth of cash obtained by way of crypto bridges.

Berachain and Solana take the No. 2 and No. 3 positions with Arbitrum on the backside with most outflows.

While You Were Sleeping

Bitcoin Traders Seek Topside Option Plays After Powell Remark, Ether Lags in Sentiment (CoinDesk): Bitcoin choices sign renewed bullishness after the Fed resolution, whereas ether choices keep cautious.

XRP Whales Boost Coin Stash by Over 6% in Two Months, Blockchain Data Shows (CoinDesk): XRP fell 20% to $2.45 in two months, but Santiment knowledge reveals massive merchants elevated holdings by 6.5% to 46.4 billion XRP. Network exercise surged sixfold in March.

Lagarde Says Rising Uncertainty Means ECB Can’t Commit on Rates (Bloomberg): The ECB president stated a 25% U.S. tariff on European imports may weaken eurozone development and create inflation uncertainty, as retaliation and a weaker euro might push costs increased.

Trump Considers Extending Chevron License to Pump Oil in Venezuela (The Wall Street Journal): The Trump administration is reportedly engaged on a plan to permit Chevron to remain in Venezuela whereas penalizing international locations that purchase oil from the South American nation.

Berlin Debt Splurge Turns Screws on Flagging German Property (Reuters): Germany’s 500 billion euro ($540 billion) borrowing plan is pushing up bond yields, worsening financing situations for property corporations already hit by falling costs and weak demand.

In the Ether

CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data Read More

CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data Read More