Crypto Daybook Americas, Crypto Daybook Americas, News Your day-ahead search for April 24, 2025

By Francisco Rodrigues (All instances ET except indicated in any other case)

Bitcoin’s (BTC) standing as a haven within the context of broader monetary markets could also be up for debate, however inside crypto it’s hardly questionable. Cryptocurrency costs have fallen throughout the board during the last 24 hours, but bets on BTC’s dominance continue to grow.

The market’s sell-off comes amid profit-taking and conflicting messages from the Trump administration over its commerce conflict with China.

Those feedback cooled a rally that began after President Donald Trump signaled he wouldn’t take away Federal Reserve Chair Jerome Powell and advised a softer stance on commerce with China. That helped the worth of bitcoin to strategy $95,000 earlier than it dropped again to $92,200.

The pullback adopted feedback from Treasury Secretary Scott Bessent, who mentioned there’s no unilateral plan to raise U.S. tariffs on Chinese items, contradicting Trump’s suggestion that tariff charges might drop within the coming weeks. Investors struggled to interpret the coverage path as Trump additionally hinted at a “fair deal” with the world’s second-largest financial system.

The uncertainty revealed a shift towards bitcoin within the crypto house. The broader CoinDesk 20 (CD20) index misplaced 3.75% of its worth during the last 24 hours, in contrast with BTC’s 2% drop.

Institutional merchants’ choice for BTC is proven by a Binance futures contract monitoring the cryptocurrency’s dominance. It’s traded at a 76% premium for the one-year ahead, indicating merchants anticipate BTC to retain an edge over altcoins within the coming months, in keeping with an emailed assertion from Jake O., an OTC dealer at Wintermute.

Options buying and selling additional illustrates this positioning. Large bets have been positioned on bitcoin hitting $110,000 by June, in keeping with Jake O., with merchants concurrently promoting calls at $140,000 and $170,000 for September and December — a calendar unfold that alerts short-term optimism and long-term warning.

Similar exercise emerged in May $110,000 calls, the place rising gamma publicity factors to rising sensitivity available in the market to cost swings. Still, long-term crypto holders stay unfazed as data shows they keep accumulating.

For now, the markets stay reactive to the alerts popping out of Washington, which given their softer stance additionally led to a gold dropping to $3,350 per ounce from greater than $3,500. Stay alert!

What to Watch

- Crypto:

- April 25, 1 p.m.: U.S. Securities and Exchange Commission (SEC) Crypto Task Force Roundtable on “Key Considerations for Crypto Custody“.

- April 28: Enjin Relaychain increases active validator slots to 25 from 15 to reinforce decentralization.

- April 29, 1:05 a.m.: BNB Chain (BNB) — BSC mainnet hardfork.

- April 30, 9:30 a.m.: ProShares expects its XRP ETF, providing publicity by futures and swap agreements, to start buying and selling on NYSE Arca.

- April 30, 10:03 a.m.: Gnosis Chain (GNO), an Ethereum sister chain, will activate the Pectra onerous fork on its mainnet at slot 21,405,696, epoch 1,337,856.

- Macro

- Day 4 of 6: World Bank (WB) and the International Monetary Fund (IMF) spring meetings in Washington.

- April 24, 8:30 a.m.: The U.S. Census Bureau releases March manufactured sturdy items orders information.

- Durable Goods Orders MoM Est. 2% vs. Prev. 0.9%

- Durable Goods Orders Ex Defense MoM Est. 0.2% vs. Prev. 0.8%

- Durable Goods Orders Ex Transp MoM Est. 0.2% vs. Prev. 0.7%

- April 24, 8:30 a.m.: The U.S. Department of Labor releases unemployment insurance coverage information for the week ended April 19.

- Initial Jobless Claims Est. 221K vs. Prev. 215K

- April 25, 10:00 a.m.: The University of Michigan releases (Final) April U.S. shopper sentiment information.

- Michigan Consumer Sentiment Est. 50.8 vs. Prev. 57

- Earnings (Estimates primarily based on FactSet information)

Token Events

- Governance votes & calls

- Lido DAO is voting to extend its delegate incentivization program (DIP) by This autumn with a $225,000 LDO funds. Voting ends April 28.

- Uniswap DAO will vote on establishing a licensing and deployment framework for Uniswap v4 to speed up its adoption throughout a number of chains. The proposal grants the Uniswap Foundation a blanket exemption to deploy v4 on any DAO-approved chain and offers the Uniswap Accountability Committee authority to replace deployment information. Voting happens April 24-April 30.

- April 24, 8 a.m.: Alchemy Pay to host an Ask Me Anything (AMA) session on its 2025 roadmap.

- April 24, 9 a.m.: IOTA to host an X spaces session on staking, validators and the mainnet launch.

- April 24, 8 a.m.: Ronin to host a town hall meeting.

- April 30, 12 p.m.: Helium to host a community call meeting.

- Unlocks

- April 30: Optimism (OP) to unlock 1.89% of its circulating provide price $23.45 million.

- May 1: Sui (SUI) to unlock 2.28% of its circulating provide price $221.99 million.

- May 1: ZetaChain (ZETA) to unlock 5.67% of its circulating provide price $11.28 million.

- May 2: Ethena (ENA) to unlock 0.73% of its circulating provide price $13.69 million.

- May 7: Kaspa (KAS) to unlock 0.56% of its circulating provide price $13.91 million.

- May 9: Movement (MOVA) to unlock 2.04% of its circulating provide price $11.33 million.

- Token Launches

- April 24: Initia (INIT) to be listed on Binance, CoinW, WEEX, KuCoin, MEXC and others.

- May 2: Binance to delist Alpaca Finance (ALPACA), PlayDapp (PDA), Viberate (VIB) and Wing Finance (WING).

- May 5: Sonic (S) to be listed on Kraken.

Conferences:

CoinDesk’s Consensus is going down in Toronto on May 14-16. Use code DAYBOOK and save 15% on passes.

- Day 3 of three: Money20/20 Asia (Bangkok)

- Day 2 of two: Blockchain Forum 2025 (Moscow)

- Day 2 of three: Semafor’s World Economy Summit 2025 (Washington)

- April 24: Bitwise’s Investor Day for Bitcoin Standard Corporations (New York)

- April 26: Crypto Vision Conference 2025 (Manilla)

- April 26-27: Harvard Blockchain in Action Conference (Cambridge, Mass.)

- April 27: N Crypto Conference 2025 (Kyiv)

- April 27-30: Web Summit Rio 2025

- April 28-29: Blockchain Disrupt 2025 (Dubai)

- April 28-29: Staking Summit Dubai

- April 29: El Salvador Digital Assets Summit 2025 (San Salvador, El Salvador)

- April 29: IFGS 2025 (London)

- April 30-May 1: TOKEN2049 (Dubai)

Token Talk

By Shaurya Malwa

- Infrared, a liquid staking platform on Berachain, late Wednesday launched a factors program to reward customers earlier than its token debuts within the third quarter.

- Points haven’t any mounted provide and are earned by actions like staking or offering liquidity.

- Users earn factors by contributing to Infrared’s liquidity vaults, offering liquidity on exchanges like Kodiak and BEX, or staking iBGT and iBERA tokens. Longer participation will increase factors.

- Infrared leads Berachain’s ecosystem with $1.5 billion in complete worth locked.

- The program contains retroactive rewards since Infrared’s February launch, and can run for about three months. Users can monitor factors in actual time on a dashboard, with further rewards by companions like Pendle. Points will convert to Infrared’s native token at a ratio to be introduced nearer to the token launch.

Derivatives Positioning

- Notional open curiosity in bitcoin CME choices has climbed to $5 billion, probably the most since November.

- Open curiosity within the CME futures has bounced to over $12 billion, however stays effectively beneath the December peak of $22.7 billion, pointing to persistent warning.

- BTC CME futures foundation suggests the identical, nonetheless hovering below an annualized 10%.

- On offshore exchanges, open curiosity in perpetual futures exchanges has dropped with the in a single day BTC value pullback. This suggests the weak spot is probably going led by profit-taking moderately than an inflow of contemporary shorts.

- In altcoins, NEAR, UNI and PEPE futures have seen probably the most improve in open curiosity up to now 24 hours.

- On Deribit, BTC, ETH skews proceed to point out a bias for calls throughout time frames. Traders are more and more promoting cash-secured put choices tied to BTC, Lin Chen, Deribit’s enterprise improvement head instructed CoinDesk.

Market Movements:

- BTC is down 1.36% from 4 p.m. ET Wednesday at $92,411.92 (24hrs: -1.76%)

- ETH is down 2.94% at $1,743.77 (24hrs: -2.66%)

- CoinDesk 20 is down 2.21% at 2,669.87 (24hrs: -3.02%)

- Ether CESR Composite Staking Rate is up 10 bps at 3.125%

- BTC funding fee is at 0.0069% (7.5873% annualized) on Binance

- DXY is down 0.45% at 99.40

- Gold is up 2.19% at $3,347.90/oz

- Silver is down 0.57% at $33.33/oz

- Nikkei 225 closed +0.49% at 35,039.15

- Hang Seng closed -0.74% at 21,909.76

- FTSE is down 0.3% at 8,378.12

- Euro Stoxx 50 is down 0.74% at 5,060.91

- DJIA closed on Wednesday +1.07% at 39,606.57

- S&P 500 closed +1.67% at 5,375.86

- Nasdaq closed +2.5% at 16,708.05

- S&P/TSX Composite Index closed +0.69% at 24,472.70

- S&P 40 Latin America closed +1.28% at 2,475.90

- U.S. 10-year Treasury fee is down 4 bps at 4.35%

- E-mini S&P 500 futures are down 0.62% at 5,368.00

- E-mini Nasdaq-100 futures are down 0.86% at 18,642.25

- E-mini Dow Jones Industrial Average Index futures are down 0.68% at 39,503.00

Bitcoin Stats:

- BTC Dominance: 64.56 (0.22%)

- Ethereum to bitcoin ratio: 0.01884 (-1.72%)

- Hashrate (seven-day shifting common): 823 EH/s

- Hashprice (spot): $48.61

- Total Fees: 11.29 BTC / $1,042,496

- CME Futures Open Interest: 140,610 BTC

- BTC priced in gold: 27.8 oz

- BTC vs gold market cap: 7.92%

Technical Analysis

- The chart exhibits XRP, at present at $2.15, stays caught in a downtrend that started in January.

- The Ichimoku cloud is capping the upside, threatening to derail the restoration rally seen since April 7.

- The quick help is at $2, adopted by the month’s lows close to $1.60.

- On the upper aspect, the cloud and the descending trendline are ranges to beat for the bulls.

Crypto Equities

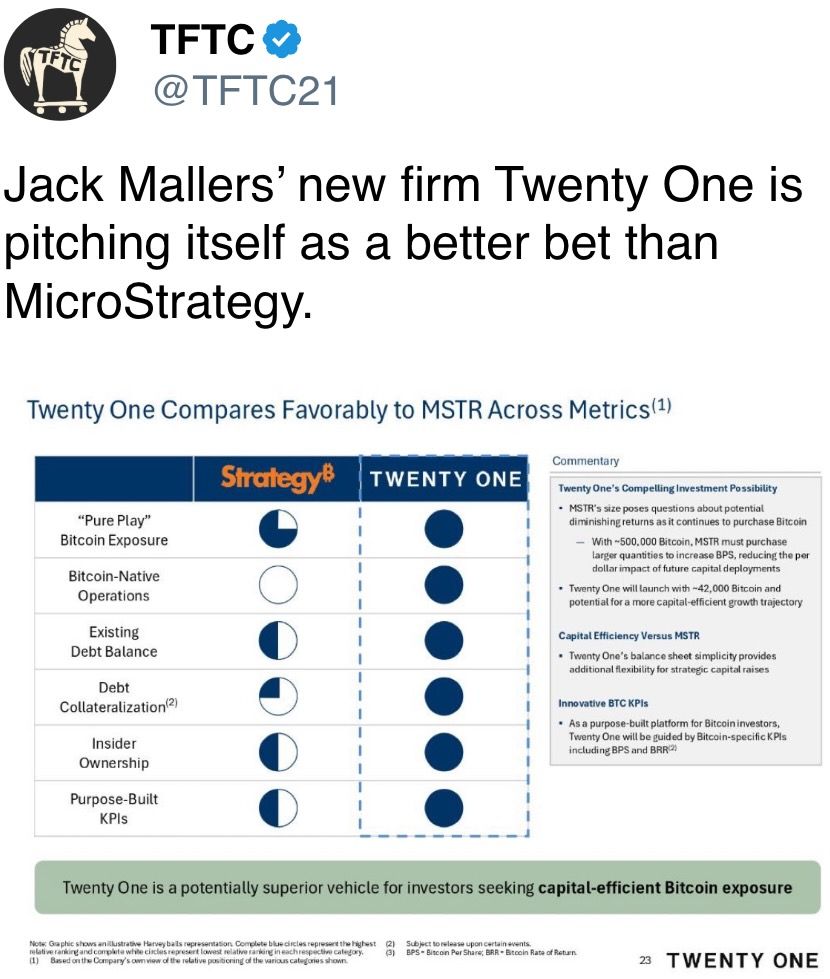

- Strategy (MSTR): closed on Wednesday at $345.73 (+0.79%), down 1.85% at $339.33 in pre-market

- Coinbase Global (COIN): closed at $194.80 (+2.53%), down 1.53% at $191.82

- Galaxy Digital Holdings (GLXY): closed at C$18.73 (+2.86%)

- MARA Holdings (MARA): closed at $14.13 (+0.5%), down 2.55% at $13.77

- Riot Platforms (RIOT): closed at $7.50 (+5.34%), down 2.4% at $7.32

- Core Scientific (CORZ): closed at $7.12 (+2.89%), down 1.12% at $7.04

- CleanSpark (CLSK): closed at $8.87 (+1.14%), down 1.92% at $8.70

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $13.51 (+3.13%), down 2.59% at $13.16

- Semler Scientific (SMLR): closed at $34.28 (+3%), down 1.6% at $33.73

- Exodus Movement (EXOD): closed at $44.09 (+12.5%), up 0.7% at $44.40

ETF Flows

Spot BTC ETFs:

- Daily web stream: $917 million

- Cumulative web flows: $37.68 billion

- Total BTC holdings ~ 1.13 million

Spot ETH ETFs

- Daily web stream: -$23.9 million

- Cumulative web flows: $2.25 billion

- Total ETH holdings ~ 3.33 million

Source: Farside Investors

Overnight Flows

Chart of the Day

- The chart exhibits the greenback worth of the variety of lively or open ether choices contracts on Deribit.

- The $2,000 strike name is the preferred guess, with an open curiosity of over $260 million.

- Strikes with giant open curiosity typically act as magnets, which means ether might rise to $2,000 within the coming days.

While You Were Sleeping

- Russia Reserves Right to Use Nuclear Arms in Event of Western Aggression — Shoigu (TASS News Agency): Russia’s Security Council secretary warned that the nation’s protection coverage permits a nuclear response to traditional assaults, together with when overseas powers provide help by territory or logistics.

- Why Gold Became the Safe Haven of Choice as U.S. Treasuries and Dollar Sold Off (CNBC): Analysts attribute gold’s power to its inflation-hedging enchantment, insulation from fiscal and financial coverage, a weaker greenback and robust shopping for by rising market central banks.

- Bitcoin’s April Rally Driven by Institutions, While Retail Flees ETFs: Coinbase Exec (CoinDesk): Bitcoin’s surge to $93,000 has been pushed by institutional and sovereign wealth fund accumulation, not retail ETF flows, in keeping with Coinbase Institutional’s John D’Agostino.

- The Dollar Has Further to Fall (Financial Times): Goldman’s chief economist says the greenback is overvalued by historic requirements and a cooling U.S. financial system will curb overseas urge for food for American property, weakening demand for the foreign money.

- Bitcoin Traders Eye Long Term BTC Accumulation by Selling Put Options

(CoinDesk): Traders are utilizing a cash-secured strategy by holding stablecoins, making certain they’ll purchase bitcoin if costs drop and places are exercised on the larger strike value. - Long-Term Bitcoin Holders Show Commitment, Buy More BTC Than Short-Term Holders Sell (CoinDesk): Long-term buyers’ holdings have elevated by 635,340 BTC since January, absorbing greater than what’s been distributed by short-term holders at a 1.38:1 accumulation ratio.

In the Ether

CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data Read More

CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data Read More