Markets, Bitcoin, Options, Deribit Traders go for a extra conservative wager, reassessing their expectations within the wake of the latest worth sell-off.

The latest crypto market downturn has triggered the once-popular $120,000 bitcoin (BTC) choices wager to lose its crown to the $100,000 wager in an indication that merchants are reassessing their bullish expectations.

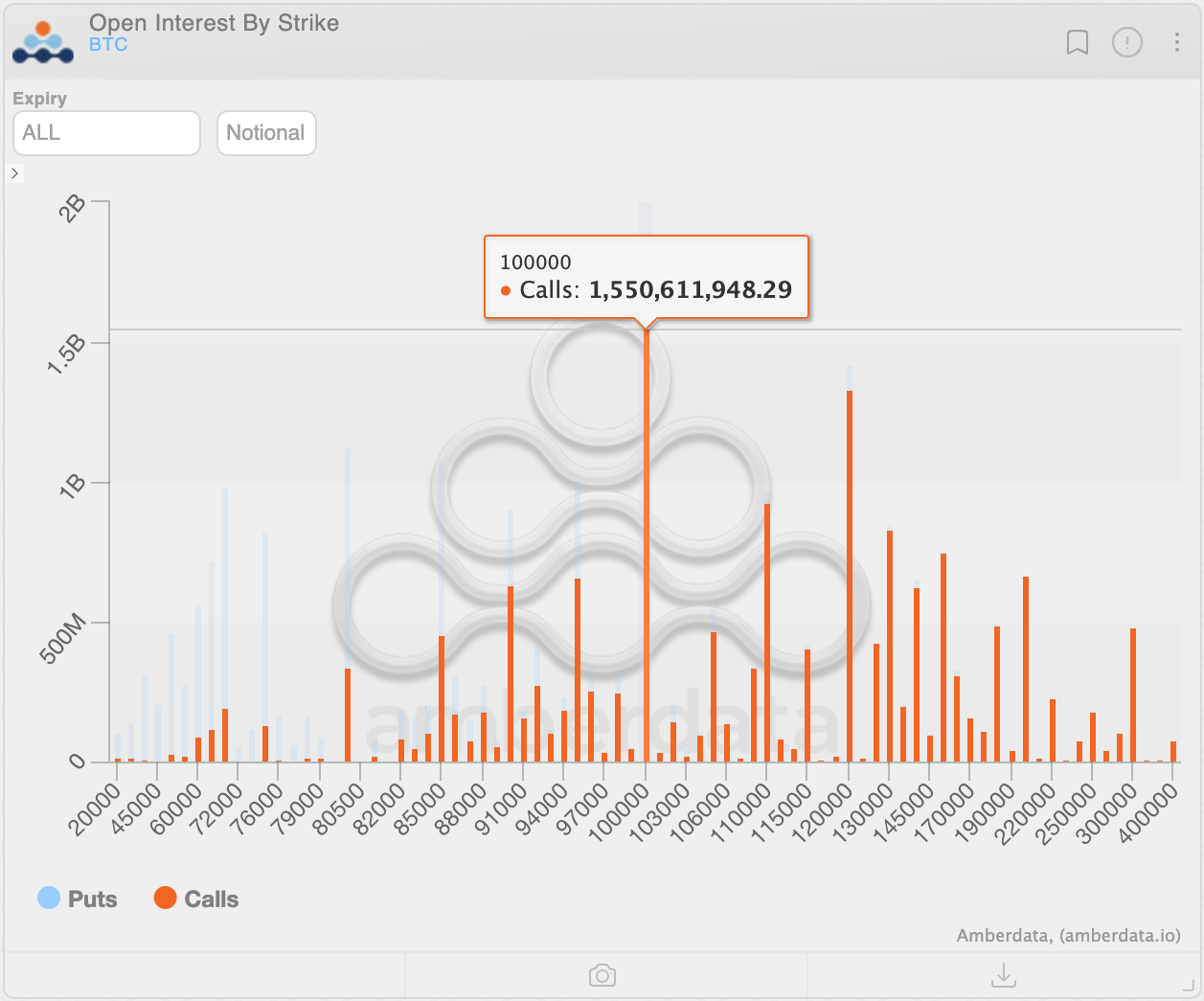

At press time, the $100,000 name was the most well-liked BTC choices contract on the change, boasting a notional open curiosity of $1.55 billion. The notional open curiosity represents the greenback worth of the variety of lively choice contracts at a given time.

Meanwhile, the $120,000 name, the former leader up until last month, stood on the quantity two place, with a notional open curiosity of $1.33 billion.

A name provides the purchaser the proper however not the duty to buy the underlying asset at a predetermined worth at a later date. A name purchaser is implicitly bullish available on the market. Hence, a major built-up of open curiosity in larger strike out-of-the-money calls, similar to $100,000 and $120,000, displays bullish expectations.

The shift decrease in probably the most most well-liked name to the $100,000 strike probably exhibits merchants choosing a extra conservative wager within the wake of the latest worth crash to below $80,000. Additionally, it might sign a broader reassessment of bullish sentiment.

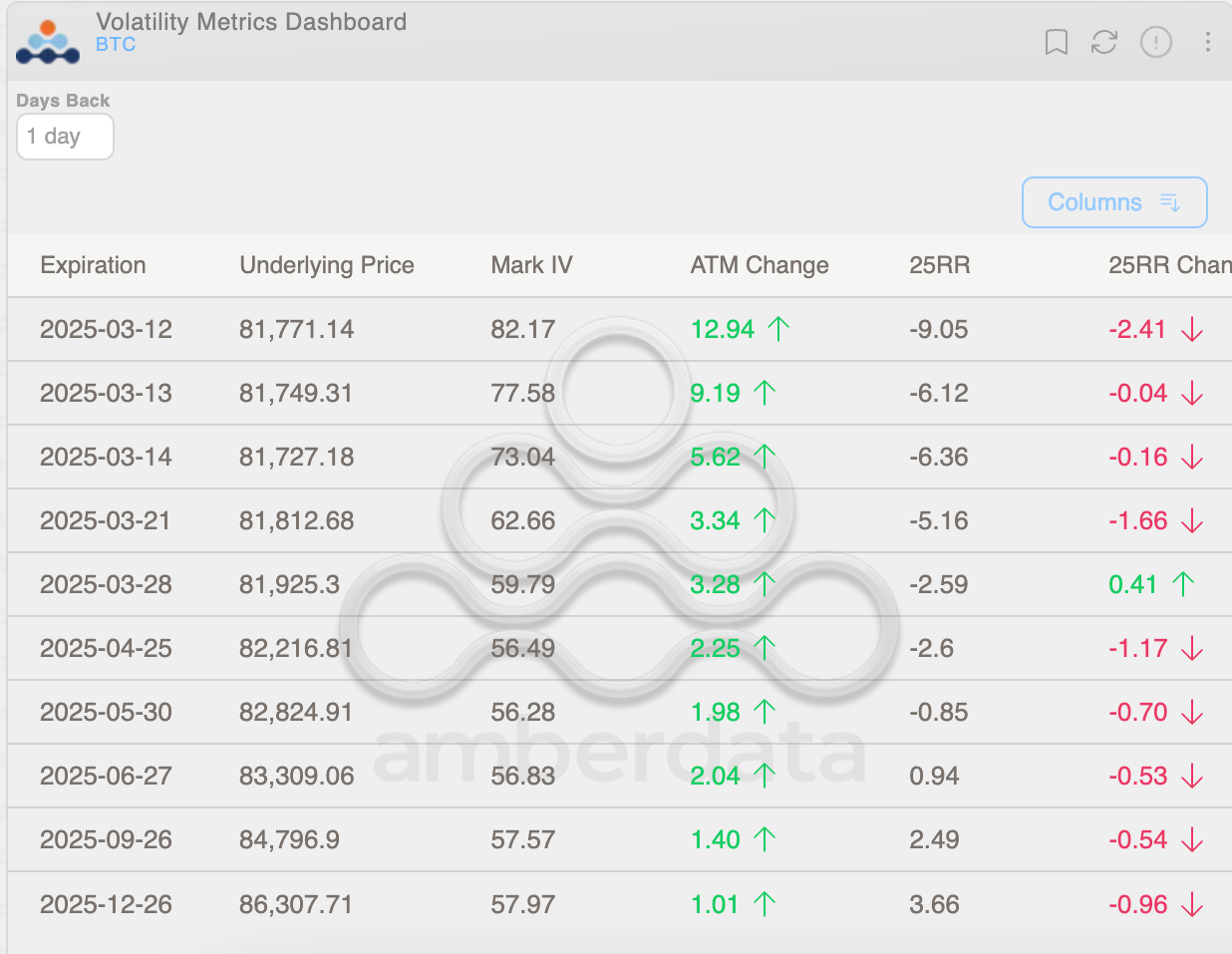

The 25-delta threat reversals, which measure the distinction between implied volatility (demand) for larger strike calls relative to decrease strike places, present detrimental readings or bias for protecting put choices out to the May finish expiry. It’s consultant of fears of an prolonged worth slide out there.

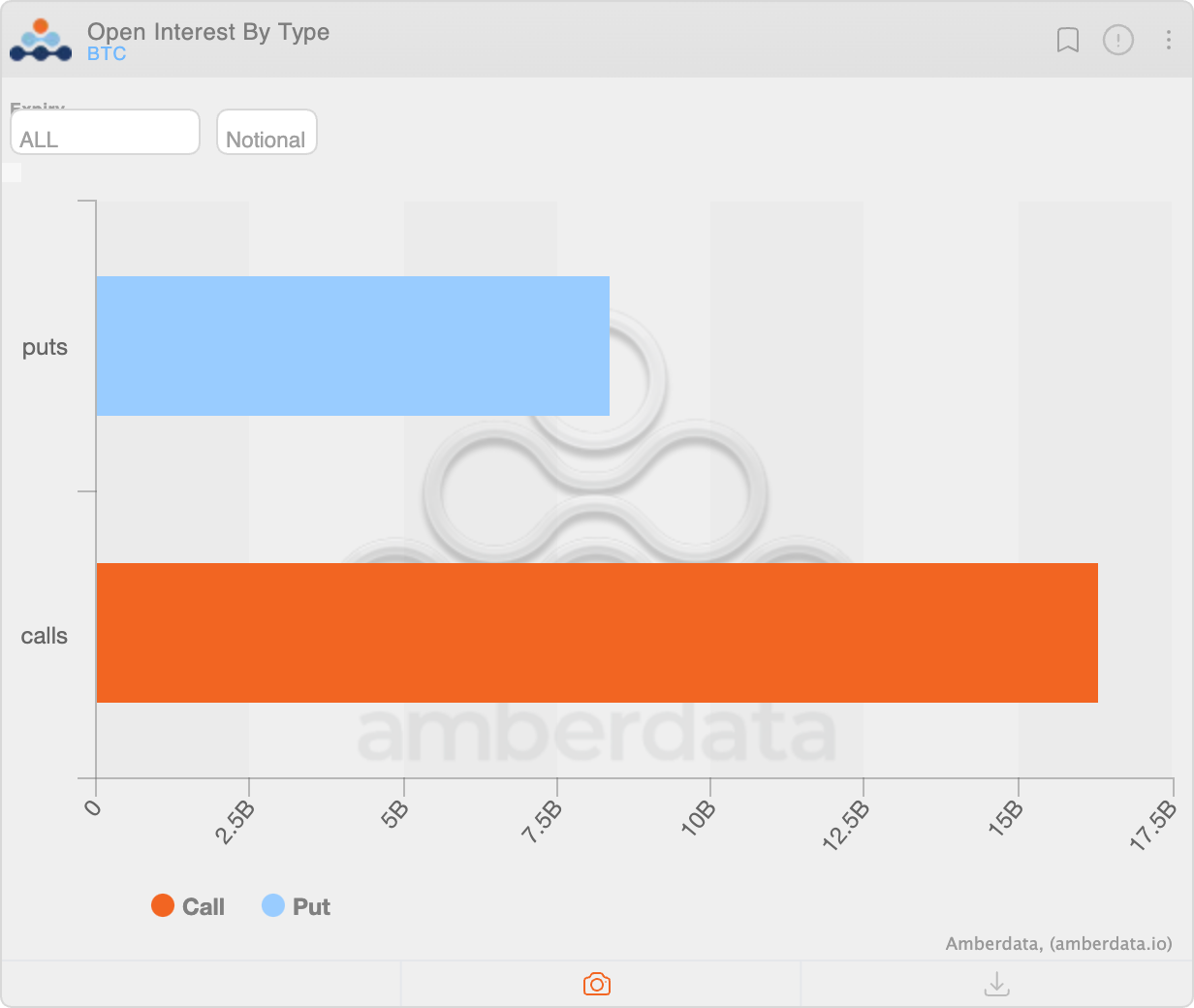

The pricing stays bullish in favor of name choices after May. Besides, the greenback worth of the entire variety of calls open at press time was over $16 billion – practically twice greater than $8.35 billion in put choices.

CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data Read More