Markets, Bitcoin, Markets, Options, market evaluation, News “There are always folks that want the hyperinflation hedge,” one observer stated, explaining the stable open curiosity construct up within the $300K name possibility expiring on June 26.

In the crypto market, daring predictions aren’t simply discuss – they’re backed by actual {dollars}, usually by way of possibility performs that resemble lottery tickets providing outsized upside for comparatively small prices.

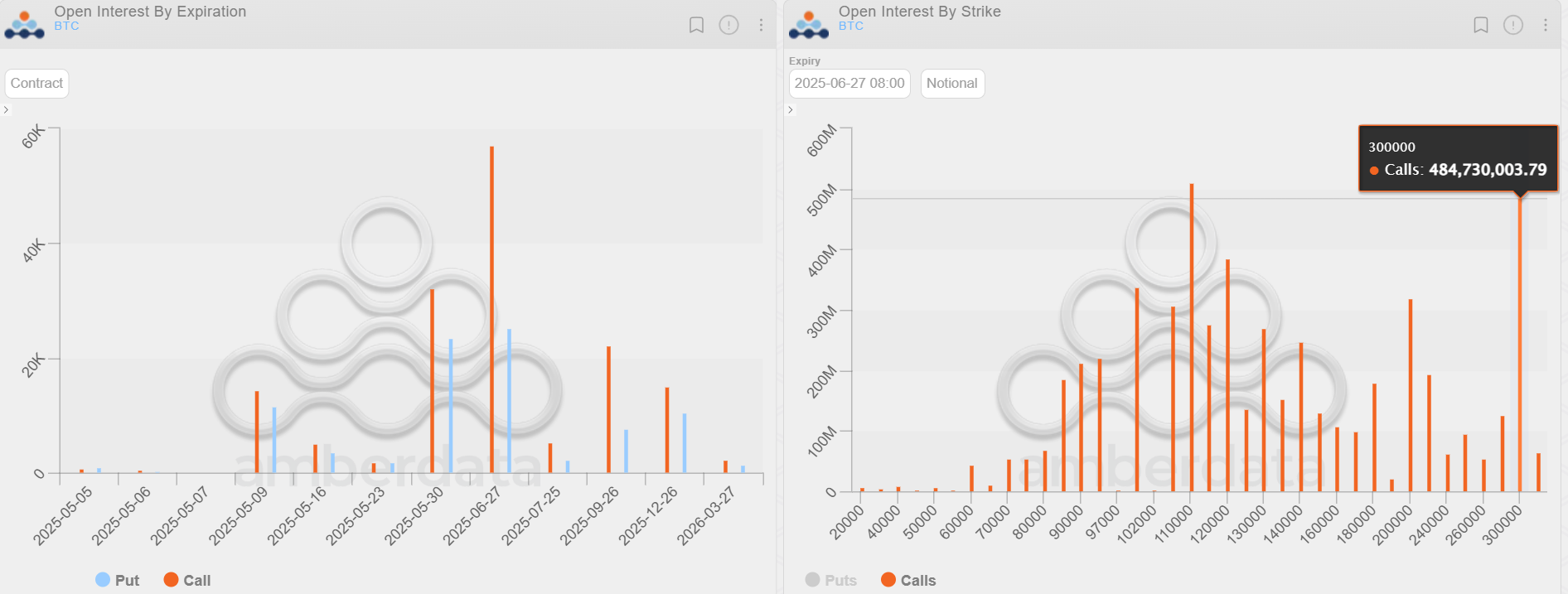

The stand-out as of writing is the Deribit-listed $300,000 strike bitcoin name possibility expiring on June 26. Theoretically, this name is a guess that BTC’s spot worth will triple to over $300,000 by the top of the primary half of the 12 months.

Over 5,000 contracts have been lively within the June $300K name at press time, with a notional open curiosity of $484 million. That makes it the second-most in style possibility guess within the essential June expiry, trailing solely the $110K name.

Deribit is the world’s main crypto choices change, accounting for over 75% of the worldwide choices exercise. On Deribit, one choices contract represents 1 BTC. Quarterly expiries, such because the one due on June 26, drive heightened market exercise and volatility, with merchants utilizing these deadlines to hedge positions, lock in features, or speculate on the following worth strikes.

“Perhaps, people like buying lottery tickets. As evidenced by the call skew, there are always folks that want the hyperinflation hedge,” Spencer Hallarn, a derivatives dealer at crypto market maker GSR, stated, explaining the excessive open curiosity within the so-called out-of-the-money (OTM) name on the $300K strike.

Deep OTM calls, additionally referred to as wings, require a big transfer within the underlying asset’s worth to change into worthwhile and, therefore, are considerably cheaper in comparison with these nearer to or under the asset’s going market charge. However, the payoff is big if the market rallies, which makes them just like shopping for lottery tickets with slim odds however potential for an enormous payout.

Deribit’s BTC choices market has skilled related flows throughout earlier bull cycles, however these bets hardly ever gained sufficient reputation to rank because the second-most most popular play in quarterly expiries.

The chart reveals that the June 26 expiry is the biggest amongst all settlements due this 12 months, and the $300K name has the second-highest open curiosity buildup within the June expiry choices.

Explaining the chunky notional open curiosity within the $300K name, GSR’s Trader Simranjeet Singh stated, “I suspect this is mostly an accumulation of relatively cheap wings betting on broader U.S. reg narrative being pro-crypto and the ‘wingy possibility’ (no pun intended) of a BTC strategic reserve that was punted around at the start of the administration.”

On Friday, Senator Cynthia Lummis stated in a speech that she’s “notably happy with President Trump’s help of her BITCOIN Act.

“The BITCOIN Act is the only solution to our nation’s $36T debt. I’m grateful for a forward-thinking president who not only recognizes this, but acts on it,” Lummis stated on X.

Who offered $300K calls?

According to Amberdata’s Director of Derivatives, notable promoting within the $300K name expiring on June 26 occurred in April as a part of the covered call strategy, which merchants use to generate further yield on prime of their spot market holdings.

“My thought is that the selling volume on April 23 came from traders generating income against a long position,” Magadini informed CoinDesk. “Each option sold for about $60 at 100% implied volatility.”

Selling greater strike OTM name choices and accumulating premium whereas holding a protracted place within the spot market is a well-liked yield-generating technique in each crypto and conventional markets.

Read extra: Bitcoin May Evolve Into Low-Beta Equity Play Reflexively, BlackRock’s Mitchnik Says

CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data Read More