Markets, Market Wrap, Bitcoin, CryptoQuant, QCP Capital, News Altcoins led by ETH, DOGE, SUI adopted BTC larger as Treasury Secretary Bessent’s feedback on U.S.-China commerce boosted danger urge for food.

Bitcoin (BTC) surged previous $91,000 on Tuesday, climbing almost 5% amid renewed investor optimism and recent hopes of a thaw in U.S.-China commerce tensions, however headwinds persist that might cap additional upside, analytics agency CryptoQuant cautioned.

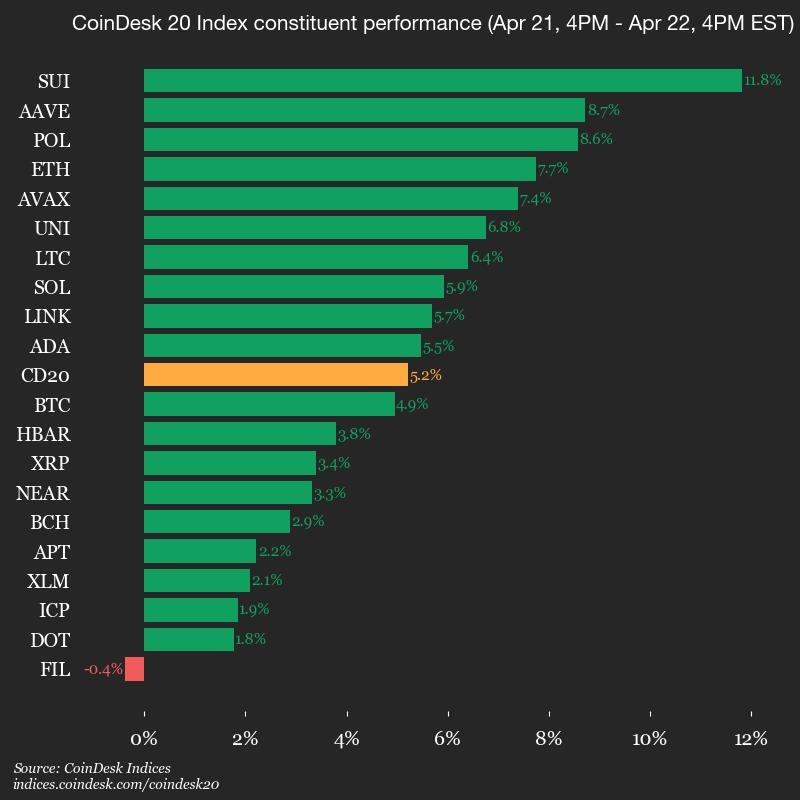

The largest crypto by market capitalization hit $91,700 within the U.S. afternoon, its strongest value since early March. Altcoins adopted BTC larger, with Ethereum’s ether (ETH) rising 8% over the previous 24 hours above $1,700, and dogecoin (DOGE) and Sui’s native token (SUI) gaining 8.6% and 11.7%, respectively. The broad-market crypto benchmark CoinDesk 20 Index superior 5.2%.

Markets have been buoyed by remarks from U.S. Treasury Secretary Scott Bessent, who reportedly instructed buyers at a closed-door JPMorgan occasion that the tariff standoff with China was unsustainable. Bessent mentioned de-escalation would come “in the very near future,” characterizing present situations as a “trade embargo.” However, he cautioned {that a} extra complete deal between the 2 nations may take even years.

Stocks recovered from yesterday’s decline, with the S&P 500 and the tech-heavy Nasdaq ending the session 2.5% and a couple of.7% larger, respectively. Gold, in the meantime, sharply reversed from its report value of $3,500 in the course of the day and was down 1%.

“As capital rotates into safe-haven and inflation-hedging assets, BTC and gold are proving to be key beneficiaries of the exodus from USD risk,” analysts at hedge fund QCP Capital mentioned in a Telegram broadcast.

They highlighted rejuvenating inflows to identify U.S.-listed BTC ETFs and the return of the so-called Coinbase value premium, suggesting demand from American institutional buyers. BTC ETF booked over $381 million web inflows on Monday including to Thursday’s $107 million, in line with Farside Investors information.

But not all indicators level to a sustained breakout.

Despite the value leap, on-chain information factors to fragility beneath the floor, CryptoQuant analysts mentioned in a Tuesday report. Bitcoin’s obvious demand has decreased by 146,000 BTC over the previous 30 days—an enchancment from the sharp drop in March, however nonetheless adverse. CryptoQuant’s demand momentum metric, which tracks new investor curiosity, has deteriorated additional to its essentially the most bearish degree since October 2024, the report famous.

Market liquidity stays gentle, with the report utilizing USDT’s market cap development as a proxy for crypto liquidity. USDT grew $2.9 billion over the previous two months, under its 30-day common. Historically, BTC rallies coincided with USDT development above $5 billion and above development — a threshold not but met.

Adding to the warning, bitcoin is now dealing with a key resistance zone between $91,000 and $92,000 at across the “Trader’s On-chain Realized Price” metric, a degree that has usually served as resistance in bearish situations. CryptoQuant’s on-chain bull rating categorized present market situations as bearish, suggesting a pause or pullback may observe if sentiment weakens.

CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data Read More