Markets, Market Wrap, Bitcoin, David duong, Ledn, News SUI, BCH and Hedera’s HBAR led Friday positive aspects within the CoinDesk 20 Index, with one analyst saying this week’s crypto rally is probably going the start of BTC’s climb to contemporary file costs.

Bitcoin (BTC) continued its spring rally on Friday and is on observe for its strongest weekly exhibiting since Trump’s election victory.

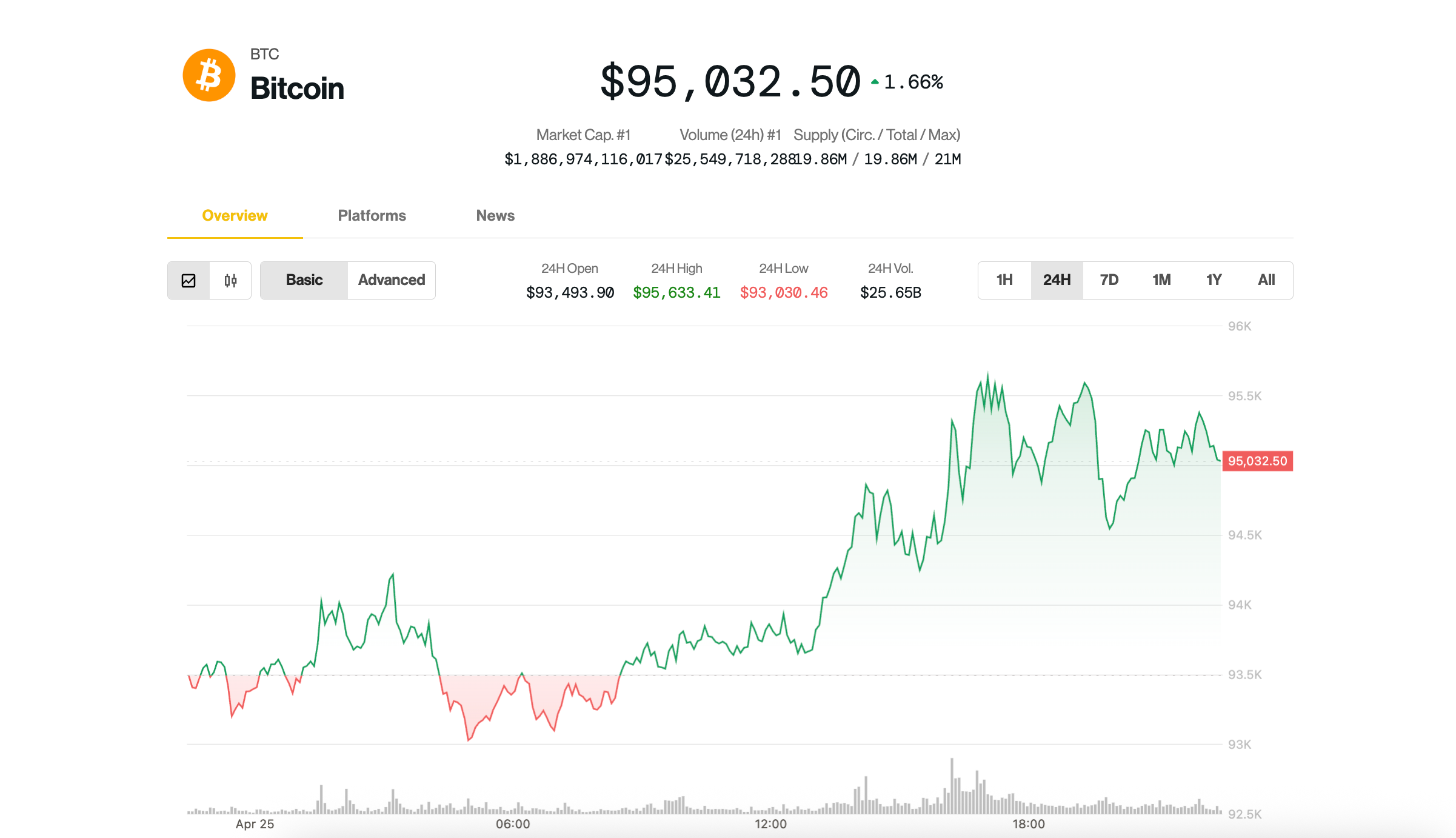

The largest and oldest cryptocurrency held round $95,000 throughout U.S. afternoon hours, up 1.8% over the previous 24 hours. Ethereum’s ether (ETH) adopted intently, gaining 2% to hover simply over $1,800. Sui’s native (SUI), Bitcoin Cash (BCH), and Hedera’s HBAR led positive aspects within the broad-market crypto benchmark CoinDesk 20 Index.

Today’s positive aspects cap an distinctive momentum for crypto markets recovering from the early April lows amid tariff turmoil. BTC is up over 11% since Monday, placing it at its largest weekly achieve since November 2024, when Donald Trump clinched the U.S. presidency, kickstarting a broad-market crypto rally.

Read extra: Bitcoin Traders Target $95K in Near Term; SUI Continues Multiday Rally

Investor urge for food from ETF traders additionally bounced again strongly: U.S.-listed spot bitcoin ETFs recorded $2.68 billion in web inflows this week to date, the biggest since December, in keeping with SoSoValue data. (Friday influx knowledge can be revealed later.)

BTC decoupling

Bitcoin’s current power relative to U.S. shares and gold underscores BTC’s decoupling from conventional macro property, stated David Duong, Coinbase Institutional’s international head of analysis.

“It’s rare to witness market inflection points in real time, as we only tend to recognize major regime shifts with the benefit of time and reflection,” Duong stated in a Friday report. “This week’s decoupling of bitcoin’s performance from that of traditional macro assets may be as close as we come to such a moment.”

“In our view, this divergence highlights bitcoin’s maturing role as a store-of-value asset—one that is increasingly being viewed by institutional and retail investors alike as resilient against the macroeconomic forces affecting risk assets more broadly,” he wrote.

Doung famous that the thesis is gaining traction with extra corporations adopting BTC company treasuries. Following the success of Michael Saylor’s Strategy, Twenty One Capital, a brand new agency backed by Tether, Bitfinex, SoftBank, and a Cantor Fitzgerald affiliate, additionally plans to carry 42,000 BTC at launch.

Due partly to current accumulation, liquidity within the spot BTC market has been “significantly drained,” Dr. Kirill Kretov, lead strategist at buying and selling automation platform CoinPanel, stated in a Telegram notice. According to the agency’s proprietary blockchain evaluation, a big portion of bitcoin liquidity has been withdrawn from actively transacting addresses, together with exchanges, since November 2024, exposing markets to risky worth swings.

“The market is skinny, susceptible, and simply moved by massive gamers,” Kretov said. “Sharp swings of 10% up or down are more likely to stay the norm for now.”

Bitcoin’s path to contemporary information

While the route could possibly be uneven, this week’s rally is probably going the early innings of bitcoin’s subsequent leg larger to new information, stated John Glover, chief funding officer of crypto lender Ledn.

Based on his technical evaluation utilizing Elliott Waves, he stated BTC started the fifth and remaining wave of its multi-year bull market.

Elliott Wave idea suggests asset costs transfer in predictable patterns referred to as waves, pushed by collective investor psychology. These patterns usually unfold in five-wave developments, during which the primary, third, and fifth waves are impulsive rallies, whereas the second and fourth waves are corrective phases.

While retesting this month’s low at $75,000 can’t be dominated out, Glover sees BTC climbing to a cycle prime round late 2025, early 2026.

“My expectations proceed to be for a rally to $133-$136k into the top of this yr, starting of subsequent,” he stated.

Read extra: Bitcoin Whales Return in Force, Buy the BTC Price Rally, On-Chain Data Show

CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data Read More