Markets, Bitcoin, Ether, XRP, Dogecoin, Liquidations, Donald Trump, Elon Musk, market analysis, Top Stories, News Exchanges like Bybit and Binance saw the biggest hits, with Bybit alone accounting for nearly $354 million in liquidations.

A late-night Twitter spat between President Donald Trump and Elon Musk sparked fresh uncertainty in global markets, sending major cryptocurrencies tumbling and wiping out nearly $1 billion in leveraged bets.

Bitcoin BTC dropped below $101,000 overnight before bouncing modestly, with DOGE and ADA among the worst hit, down over 6% each in the past 24 hours. The CoinDesk 20 Index, which tracks the largest crypto assets, shed over 5%.

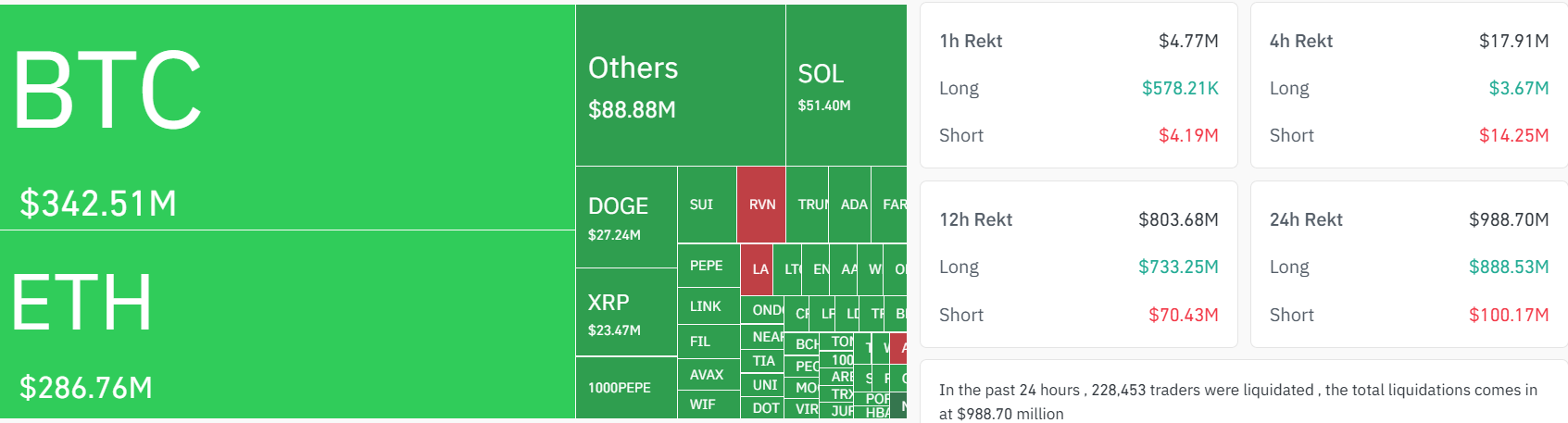

Data from CoinGlass shows that traders lost $988 million in liquidations — of which $888 million were long positions — indicative of a wipeout in bullish positions.

Exchanges like Bybit and Binance saw the biggest hits, with Bybit alone accounting for nearly $354 million in liquidations.

The liquidations largely hit major tokens, with bitcoin leading the pack at over $342 million liquidated in the past 24 hours, according to CoinGlass data.

Ether ETH followed with $286 million, reflecting the sharp sell-offs across the broader market.

Other tokens like Solana’s SOL and Dogecoin DOGE saw $51 million and $27 million liquidated, respectively, as altcoin traders found themselves on the wrong side of the sudden downturn.

XRP XRP wasn’t spared either, with $23 million in positions wiped out. The data also shows that high-leverage plays on memecoins, such as 1000PEPE, added to the volatility, as traders rushed to exit.

Liquidations to the forced closure of a trader’s leveraged position when they can no longer meet the margin requirements. This typically occurs when the price of the underlying asset moves against their position, causing them to lose a large portion, or all, of their initial investment.

A cascade of liquidations often indicates market extremes, where a price reversal could be imminent as market sentiment overshoots in one direction.

The sell-off comes as Trump accused Musk of going “crazy” and threatened to terminate government contracts with his companies, while Musk lashed back by linking Trump to Jeffrey Epstein’s files.

The clash overshadowed what had been a mostly bullish trend for crypto markets in recent weeks, intensifying a profit-taking bout from the start of this week.

CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data Read More