Markets, Bitcoin, CME, Futures, Markets The market has doubtless moved previous the narrative {that a} pro-crypto President is helpful for the business, with macro correlations now driving the market.

The bullish sentiment seen after Donald Trump’s victory within the Nov. 5 Presidential elections has utterly fizzled out, in accordance with an indicator tied to the CME bitcoin (BTC) futures.

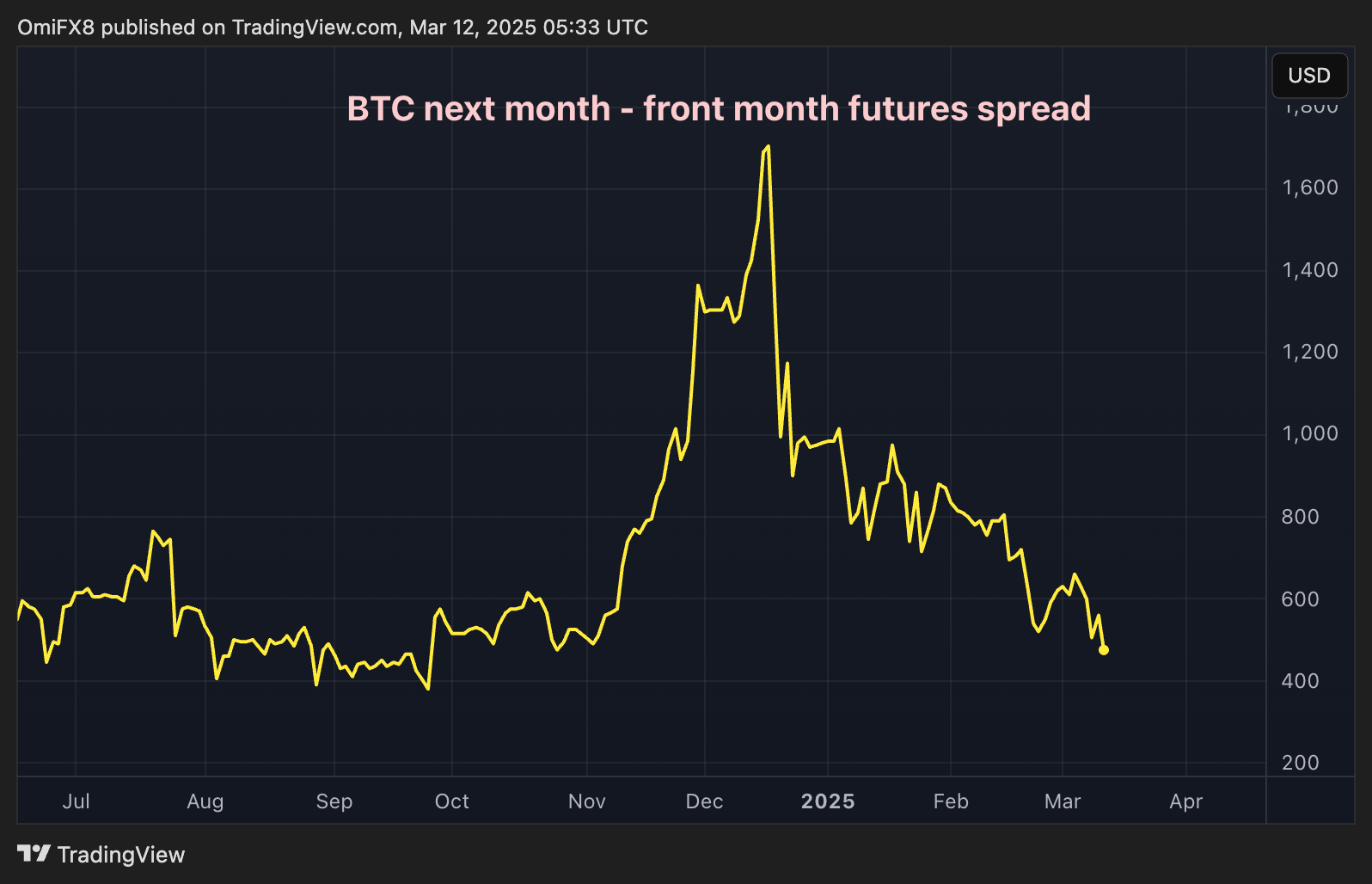

The indicator in consideration is the unfold between “continuous” subsequent month and front-month commonplace BTC futures buying and selling on the worldwide derivatives big. A steady contract is a calculated illustration of a collection of successively expiring futures contracts, permitting for a steady historic information collection for evaluation.

The unfold has narrowed to $495, the bottom since Nov. 5, having peaked at $1,705 on Dec. 17, in accordance with information supply TradingView. In different phrases, it has utterly reversed the Trump bump in an indication of weakening bullish sentiment out there.

“The narrowing spread between front-month and next-month CME Bitcoin futures could suggest traders are tempering their price expectations,” Thomas Erdösi, head of product at CF Benchmarks, advised CoinDesk.

The unwinding of the Trump bump doubtless means the market has moved previous the narrative {that a} pro-crypto President within the White House is sweet for the business, and macro correlations are again within the driver’s seat.

“What we can see is that the front contract basis has repriced lower substantially since the beginning of March, signalling moderating near term expectations that the primary catalyst for the recent rally—the election of President Trump—has been fully priced in,” Erdosi mentioned.

That’s already occurring. Both BTC and Wall Street’s tech-heavy index, Nasdaq, have dropped 20% and eight%, respectively, since early February on a myriad of things, together with geopolitical uncertainty, Trump tariffs and the outlook for inflation and financial development.

Additionally, the bitcoin market needed to digest disappointment over the shortage of contemporary purchases in Trump’s strategic digital asset reserve plan. Last week, Trump signed an government order, directing a creation of a strategic reserve that features BTC seized in enforcement actions.

“The announcement about the Strategic Bitcoin Reserve is not what the market was hoping for. Many expected the Reserve to buy new Bitcoin, but instead, they stated they would not sell any of their existing Bitcoin or confiscated Bitcoin. While this is a positive move, it caused a sharp decline in Bitcoin’s price,” Ian Balina, founder and CEO of Token Metrics, advised CoinDesk in an e mail.

Futures are nonetheless in contango

While the unfold between subsequent month and entrance month CME futures contracts has narrowed, all the curve stays in contango, the place far-dated futures contracts (with longer maturities) commerce at a premium to near-dated.

That’s the way it often is in all markets resulting from components like storage, financing, insurance coverage prices, and expectations of rising costs over coming weeks or months.

“The fact that perpetual funding rates remain positive and the futures basis is still in contango suggests the recent move is driven by unlevered spot longs being squeezed, rather than broader market contagion,” Erdösi famous.

CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data Read More