Markets, btc, News A new report from CryptoQuant shows that, unlike BTC rallies of the past, there’s no sell pressure building as bitcoin moves past its prior all-time high.

Good Morning, Asia. Here’s what’s making news in the markets:

Welcome to Asia Morning Briefing, a daily summary of top stories during U.S. hours and an overview of market moves and analysis. For a detailed overview of U.S. markets, see CoinDesk’s Crypto Daybook Americas.

Asia’s trading day is starting with a bang as bitcoin (BTC) breached its all-time high during the U.S. trading day, and is currently changing hands above $115,300, according to CoinDesk market data.

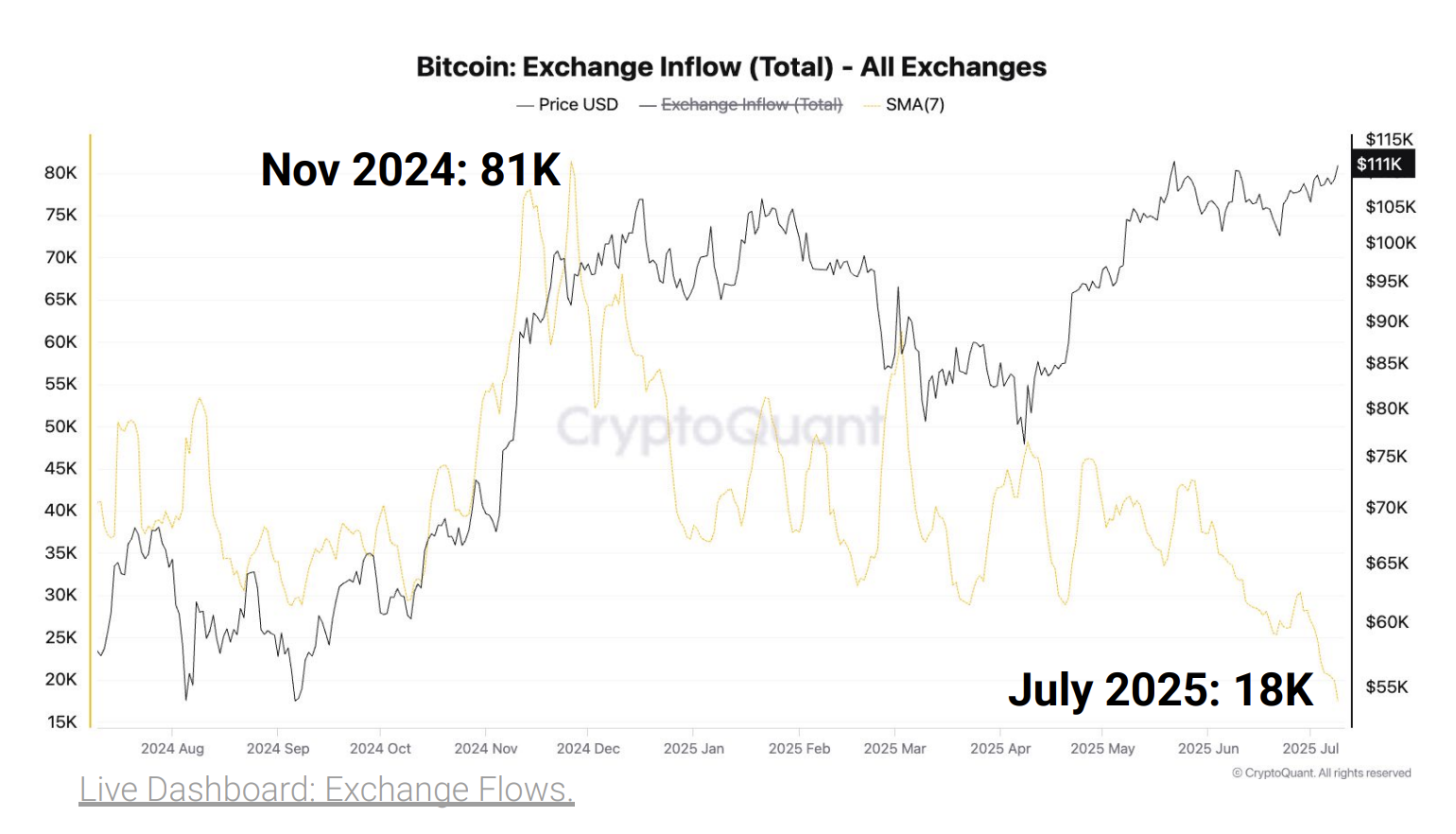

Bitcoin has experienced its share of rallies before, but on-chain data indicates that this time, things are different. Usually, when BTC has a rapid price appreciation, selling pressure increases accordingly. A new CryptoQuant report, however, shows that its HODLing season.

“Bitcoin selling pressure remains low despite the price reaching a fresh all-time high of $112.2K yesterday,” the firm wrote, adding that “a declining amount of Bitcoin flowing into exchanges indicates less selling pressure from new capital flows.”

BTC exchange inflows have dropped to just 18,000 BTC per day, the lowest level since April 2015.

That lack of sell pressure isn’t just limited to retail-sized wallets. The report shows that large holders, wallets sending 100 or more BTC, have also pulled back sharply.

“The daily amount of Bitcoin sent to exchanges in batches of 100 or more BTC has declined from 62K Bitcoin on November 26, 2024, to 7K BTC today,” CryptoQuant wrote.

Other major tokens show a similar trend. Ethereum (ETH) inflows are down from 1.57 million ETH in February to just 584,000, a drop that coincided with an 87% rally since April.

Meanwhile, XRP whales have “remained on the sidelines,” with daily inflows falling 85% from 1.1 billion XRP in February to 169 million today.

Even smaller altcoins reflect the same behavior. Daily altcoin inflow transactions, a proxy for broad retail activity, are just 21,000, compared to 120,000 during market tops in March and December 2024. The report notes this reinforces “the prevailing low-pressure environment.”

For now, the data shows this is not a typical top.

It’s a breakout with no rush to exit.

HODLing season.

BTC Now Has a Higher Market Cap Than Google

Bitcoin (BTC) is now the sixth most valuable asset in the world, trading at $115,595 with a market capitalization of $2.298 trillion, having overtaken Alphabet (Google) and inching closer to Amazon at $2.359 trillion.

This milestone marks a return to territory BTC briefly held in May, when it surpassed Amazon with a $2.16 trillion valuation after rallying to a then-record high of $109,400. Though the market briefly consolidated lower, recent strength, driven by macro tailwinds and institutional demand, has pushed bitcoin even higher, rewriting the leaderboard once again.

One key driver behind this resurgence: spot bitcoin ETFs. After net outflows in February and March totaling over $4.3 billion, the market has rebounded strongly. May saw $5.23 billion in net inflows, followed by $4.6 billion in June and $1.18 billion so far in July. Cumulative net inflows now exceed $50 billion, according to SoSoValue.

With total ETF net assets approaching $140 billion, this institutional presence is no longer just a narrative, it’s reshaping market structure. The next psychological milestone? A clean flip of Amazon and a potential march toward Apple ($3.17T) and Microsoft ($3.72T).

Market Movements:

BTC: Bitcoin surged past $116,000 on Thursday, setting a new all-time high and nearly doubling over the past year, while triggering $950 million in short liquidations, the largest single-day wipeout of bearish bets in 2025, according to CoinGlass.

ETH: Ethereum’s ETH surged to nearly $3,000, its highest in over four months, as strong ETF inflows, growing adoption in tokenization and corporate treasuries, with shifting market sentiment fueling a strong rally.

Gold: Gold is down about 4% from its June 13 high of $3,432.56, recently trading around $3,294.71, marking a modest pullback that some investors see as a buying opportunity amid forecasts that the metal could climb to $4,000 sooner than expected.

Nikkei 225: Asia-Pacific markets traded mixed Friday after President Trump announced 35% tariffs on Canada and signaled plans for broad 15–20% tariffs on most U.S. trade partners.

S&P 500: U.S. stocks closed at fresh record highs Thursday as Nvidia edged up and bitcoin surged, with the S&P 500 hitting 6,280.46 and the Nasdaq logging a second consecutive all-time high despite renewed tariff threats from President Trump.

Elsewhere in Crypto

- Former Bitfury Exec Gould Confirmed to Take Over U.S. Banking Agency OCC (CoinDesk)

- Securities On-Chain? There’s Only One True Way, Says BlackRock-Backed Firm’s CEO (Decrypt)

- MARA Holdings Names Ex-Blue River Exec as CPO to Lead Productization of Energy Tech (CoinDesk)

CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data Read More