Markets, Bitcoin, S&P 500, losses Over the previous three months, weekends have underperformed weekdays, attributable to world uncertainty.

Bitcoin (BTC) traders want to transfer previous 4 consecutive Monday losses.

Over the previous few weekends, the most important cryptocurrency has skilled vital worth volatility, pushed by macroeconomic uncertainty together with geopolitical tensions, tariffs and rising world bond yields. The weekend nervousness seems to have carried over into Mondays.

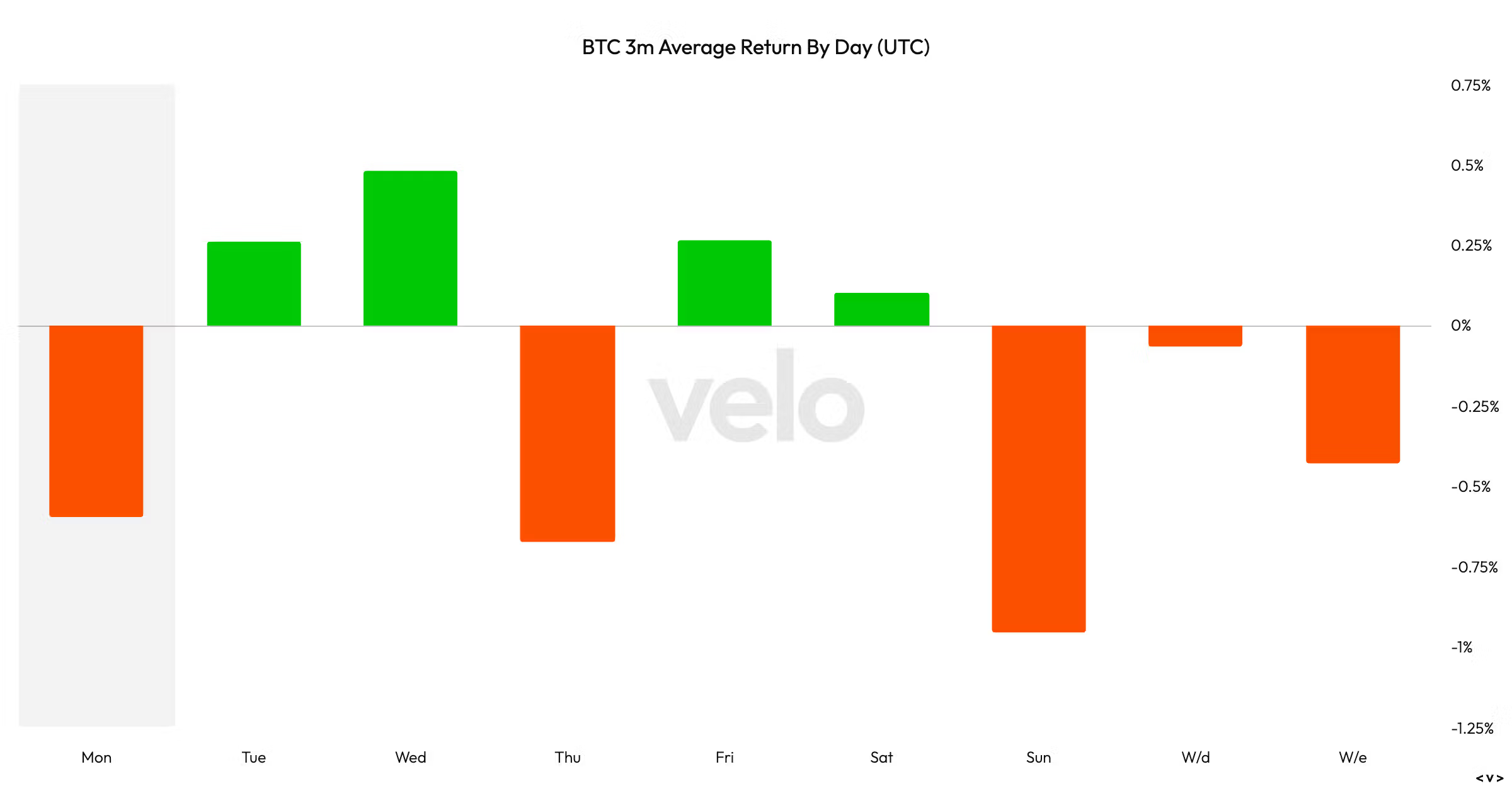

Data from Velo reveals the over the previous three months Mondays and Thursdays have been probably the most destructive days of the common workweek. Sunday, nevertheless, stands out because the worst-performing day of the week total, with a median worth decline of 1%. Overall, weekends carry out barely worst than weekdays when it comes to efficiency.

Bitcoin has fallen the previous 4 Mondays, Coinglass knowledge reveals. It misplaced 0.31% on Feb. 17, 4.6% on Feb. 24, 8.5% on March 3 and a couple of.6% on March 10. It has dropped 30% decline from its all-time excessive in late January, coinciding with a ten% slide within the S&P 500.

The S&P 500 has additionally skilled three consecutive Mondays of losses. It didn’t commerce on Feb. 17 attributable to a U.S. vacation.

Bitcoin is buying and selling simply 1.4% greater over 24 hours, whereas S&P 500 futures have turned barely destructive. What occurs subsequent is anybody’s guess.

CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data Read More