Crypto Daybook Americas, Crypto Daybook Americas, News Your day-ahead look for Aug. 4, 2025

By Omkar Godbole (All times ET unless indicated otherwise)

In the world of rock climbing, athletes don’t simply grab a new ledge and reach out for the next one. First, they put their full weight on the new ledge to ensure it’s solid before aiming higher.

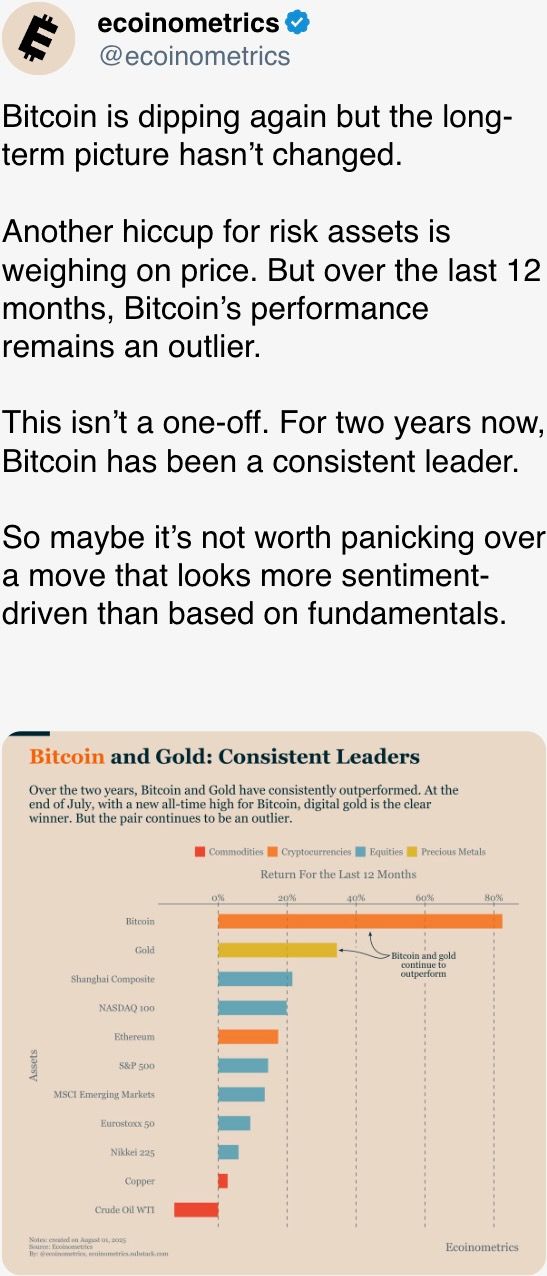

Bitcoin (BTC) has followed a similar pattern since Friday’s U.S. jobs data, which triggered concerns of a recession in the world’s largest economy. The cryptocurrency’s price came under pressure, dropping almost to $111,965, testing support at the then-record high set in May, over the weekend. It recovered to trade recently around $114,700.

The decline resulted in roughly $670 million in losses on perpetual futures positions, of which over $550 million were long positions, according to Coinglass. The crowding out of the excess leverage could mean a more sustainable upswing in prices.

John Glover, the chief investment officer at Ledn, said he now expects BTC to rally to around $140,000 by year-end. 10x Research recently identified the $111,965 level as an attractive risk-reward entry point for traders. The price rebound suggests some may have followed that advice to join the bull run.

Canary Capital CEO Stephen McClurg argued that bitcoin is rapidly positioning itself as a turbocharged risk asset, aligned with Nasdaq trends, but with greater volatility. He called stablecoins digital cousins of money market funds.

On the macro front, the nonfarm payrolls data revealed a sharp slowdown in the labor market, reviving prospects of a Fed interest-rate cut in September. Still, with the expectations being spurred by economic pain, they may not necessarily bode well for risk assets. This week’s U.S. CPI and PPI inflation readings will help solidify the outlook.

Ryan Lee, the chief analyst at crypto exchange Bitget, said BTC is likely to consolidate around $112,000-$118,000 this week, supported by strong technicals and ether to trade in the $3,300-$3,800 range driven by ETF inflows and institutional interest.

“Rising ETH adoption and on-chain activity could fuel outperformance, but bitcoin’s dominance may cap significant altcoin gains unless broader market sentiment shifts further toward risk-on behavior,” Lee told CoinDesk in an email.

Speaking of ether, a whale conducted a large buy-the-dip operation over the weekend, snapping up millions in ETH in a sign of their long-term conviction.

In other news, Base now leads Solana in daily token introductions, driven by the rise of Zora’s Creator Coins, according to Dune Analytics. Lido, the liquid staking platform, laid off 15% of its workforce.

“While it may seem counterintuitive amid a market upswing, the move reflects a deliberate commitment to sustainable growth, operational focus, and alignment with the priorities of LDO tokenholders,” Lido DAO’s Vasiliy Shapovalov said on X.

In traditional markets, futures tied to the S&P 500 rose over 0.5% while the dollar index added 0.2%. Morgan Stanley called Friday’s dip in stocks a buy-the-dip opportunity. Stay alert!

What to Watch

- Crypto

- Aug. 4: Solana Mobile begins worldwide shipping of its Seeker Web3 mobile device.

- Aug. 15: Record date for the next FTX distribution to holders of allowed Class 5 Customer Entitlement, Class 6 General Unsecured and Convenience Claims who meet pre-distribution requirements.

- Aug. 18: Coinbase Derivatives will launch nano SOL and nano XRP U.S. perpetual-style futures.

- Macro

- Aug. 5, 2 p.m.: Uruguay’s National Institute of Statistics releases July inflation data.

- Annual Inflation Rate Prev. 4.59%

- Aug. 6: U.S. tariff of 50% kicks in on most Brazilian imports.

- Aug. 6, 2 p.m.: Fed Governor Lisa D. Cook will deliver a speech titled “U.S. and Global Economy”. Livestream link.

- Aug. 7: New U.S. reciprocal tariffs outlined in President Trump’s July 31 executive order become effective for a broad range of trading partners that did not secure deals by the Aug. 1 deadline. These tariffs range from 15% to 41%, depending on the country.

- Aug. 8: Federal Reserve Governor Adriana D. Kugler’s resignation becomes effective, creating an early vacancy on the Board of Governors that allows President Trump to nominate a successor.

- Aug. 5, 2 p.m.: Uruguay’s National Institute of Statistics releases July inflation data.

- Earnings (Estimates based on FactSet data)

- Aug. 4: Semler Scientific (SMLR), post-market, -$0.22

- Aug. 5: Galaxy Digital (GLXY), pre-market, $0.19

- Aug. 7: Block (XYZ), post-market, $0.67

- Aug. 7: Cipher Mining (CIFR), pre-market

- Aug. 7: CleanSpark (CLSK), post-market, $0.19

- Aug. 7: Coincheck (CNCK), post-market

- Aug. 7: Hut 8 (HUT), pre-market, -$0.08

- Aug. 8: TeraWulf (WULF), pre-market, -$0.06

- Aug. 11: Exodus Movement (EXOD), post-market

- Aug. 12: Bitfarms (BITF), pre-market

- Aug. 12: Fold Holdings (FLD), post-market

- Aug. 27: NVIDIA (NVDA), post-market, $1.00

Token Events

- Governance votes & calls

- Compound DAO is voting to select its next Security Service Provider (SSP). Delegates are choosing between ChainSecurity & Certora and Cyfrin. Voting ends Aug. 5.

- Balancer DAO is voting on creating “Balancer Business,” a for-profit BVI subsidiary of Balancer OpCo Ltd. This new legal entity would formalize protocol fee management and on-chain operations, replacing the current DAO multisig model. Voting ends Aug. 5.

- Arbitrum DAO is voting to renew its partnership with Entropy Advisors for two more years starting September. The proposal includes $6 million in funding and 15 million ARB in incentives for Entropy to focus on treasury management, incentive design, data infrastructure and ecosystem growth. Voting ends Aug. 7.

- BendDAO is voting on a plan to stabilize BEND by burning 50% of treasury tokens, restarting lender rewards and launching monthly buybacks using 20% of protocol revenue. Voting ends Aug. 10

- Unlocks

- Aug. 9: Immutable (IMX) to unlock 1.3% of its circulating supply worth $12.30 million.

- Aug. 12: Aptos (APT) to unlock 1.73% of its circulating supply worth $48.18 million.

- Aug. 15: Avalanche (AVAX) to unlock 0.39% of its circulating supply worth $36.65 million.

- Aug. 15: Starknet (STRK) to unlock 3.53% of its circulating supply worth $14.84 million.

- Aug. 15: Sei (SEI) to unlock 0.96% of its circulating supply worth $15.80 million.

- Token Launches

- Aug. 4: Cycle Network (CYC) to be listed on Binance Alpha, Bitget, MEXC, KuCoin and others.

- Aug. 5: Keeta (KTA) to be listed on Kraken.

Conferences

The CoinDesk Policy & Regulation conference (formerly known as State of Crypto) is a one-day boutique event held in Washington on Sept. 10 that allows general counsels, compliance officers and regulatory executives to meet with public officials responsible for crypto legislation and regulatory oversight. Space is limited. Use code CDB10 for 10% off your registration through Aug. 31.

- Aug. 6-7: Blockchain.Rio 2025 (Rio de Janeiro, Brazil)

- Aug. 6-10: Rare EVO (Las Vegas)

- Aug. 7-8: bitcoin++ (Riga, Latvia)

- Aug. 9-10: Baltic Honeybadger 2025 (Riga, Latvia)

- Aug. 9-10: Conviction 2025 (Ho Chi Minh City, Vietnam)

- Aug. 11: Paraguay Blockchain Summit 2025 (Asuncion)

- Aug. 11-13: AIBB 2025 (Istanbul)

- Aug. 11-17: Ethereum NYC (New York)

- Aug. 13-14: CryptoWinter ‘25 (Queenstown, New Zealand)

- Aug. 15: Bitcoin Educators Unconference (Vancouver)

- Aug. 17-21: Crypto 2025 (Santa Barbara, California)

- Aug. 18-21: Wyoming Blockchain Symposium 2025 (Jackson Hole, Wyoming)

- Aug. 21-22: Coinfest Asia 2025 (Bali, Indonesia)

Token Talk

By Shaurya Malwa

- Base has surpassed Solana in daily token introductions, launching 54,341 on July 27, more than double Solana’s 25,460, according to Dune Analytics.

- Daily launches on Base have skyrocketed from 6,649, driven by the integration of Zora and Farcaster into the rebranded Base App.

- Zora posts are now instantly minted into ERC-20 tokens, each with a 1 billion supply and a Uniswap pool, with creators earning 1% of all trading fees in ZORA.

- Farcaster’s decentralized social graph amplifies token distribution and engagement by letting users share and trade tokenized Zora posts across the network.

- As of Aug. 2, Zora-powered launches made up 64.6% of all token launches across both Base and Solana, notching up 39,778 new Base tokens that day.

- Solana, however, still dominates trading volume, especially via launchpads like Pump.fun and LetsBonk.

- The surge positions Base as the new frontier for social token experiments, while Solana retains its edge in memecoin liquidity and market depth.

Derivatives Positioning

- Futures open interest (OI) in most majors cryptocurrencies, including BTC and ETH, dropped slightly in the past 24 hours, indicating a lack of participation in the price recovery. XRP and SUI saw a small increase in OI.

- BTC’s cumulative open interest has pulled back to 690K BTC from the high of 742K BTC on July 26. The ether market also cooled, with OI declining to 13.5M ETH from the record high of 15.3M on July 29.

- On the CME, the annualized three-month basis in BTC and ETH futures dropped to around 6%-7% from the high of 10% last week.

- On Deribit, short-tenor BTC and ETH puts trade at a premium to the spot price, reflecting persistent downside concerns.

- Some traders have snapped up higher strike call options in the past 24 hours, positioning for a tactical rebound to new highs above $124K.

Market Movements

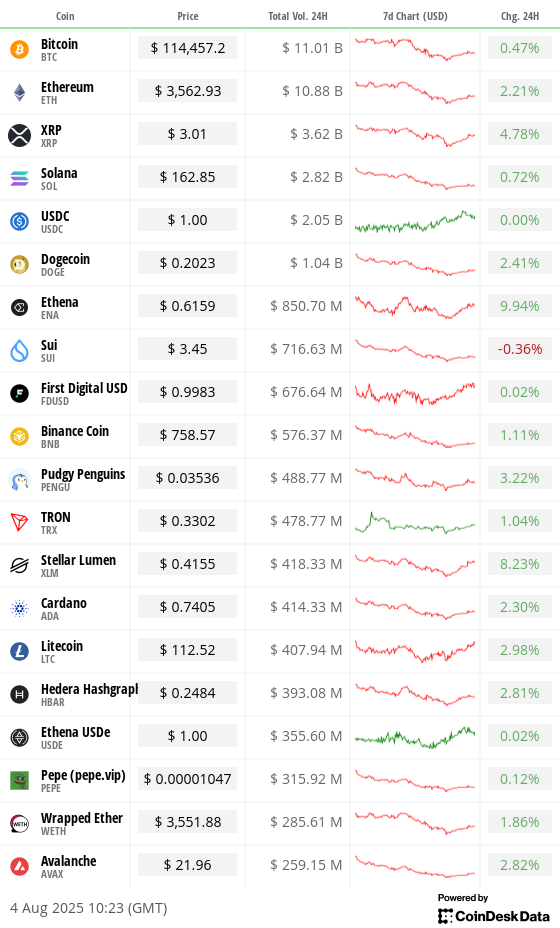

- BTC is up 0.19% from 4 p.m. ET Sunday at $114,393 (24hrs: +0.57%)

- ETH is up 1.82% at $3,556.82 (24hrs: +2.38%)

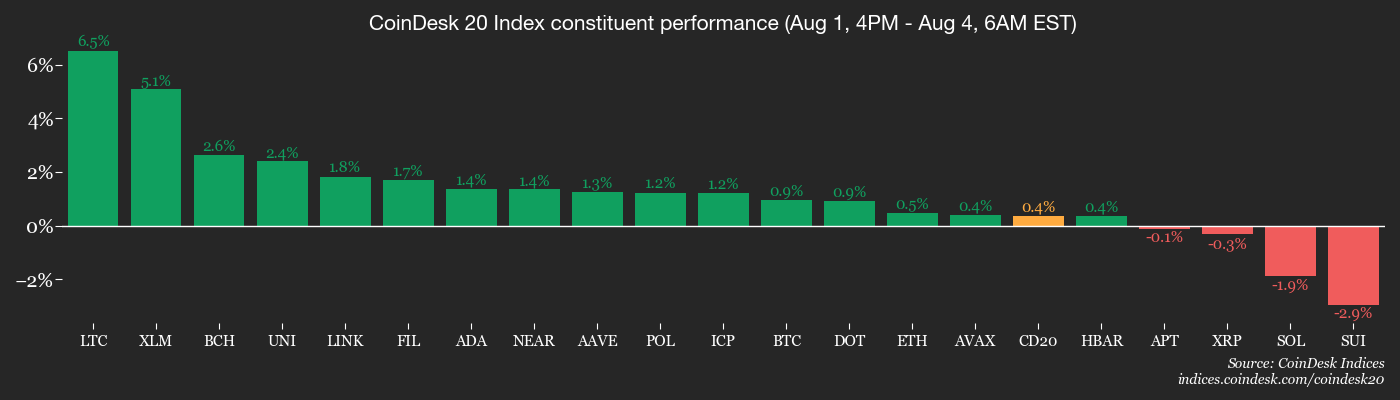

- CoinDesk 20 is up 1.40% at 3,766.02 (24hrs: +2.03%)

- Ether CESR Composite Staking Rate is down 19 bps at 2.86%

- BTC funding rate is at 0.0047% (5.185% annualized) on Binance

- DXY is down 0.30% at 98.85

- Gold futures are up 0.32% at $3,410.80

- Silver futures are up 0.94% at $37.28

- Nikkei 225 closed down 1.25% at 40,290.70

- Hang Seng closed up 0.92% at 24,733.45

- FTSE is up 0.35% at 9,100.13

- Euro Stoxx 50 is up 1.28% at 5,231.91

- DJIA closed on Friday down 1.23% at 43,588.58

- S&P 500 closed down 1.60% at 6,238.01

- Nasdaq Composite closed down 2.24% at 20,650.13

- S&P/TSX Composite closed down 0.88% at 27,020.43

- S&P 40 Latin America closed down 0.39% at 2,553.89

- U.S. 10-Year Treasury rate is up 1.9 bps at 4.239%

- E-mini S&P 500 futures are up 0.64% at 6,304.75

- E-mini Nasdaq-100 futures are up 0.76% at 23,057.75

- E-mini Dow Jones Industrial Average Index are up 0.65% at 43,995.00

Bitcoin Stats

- BTC Dominance: 61.98% (-0.32%)

- Ether-bitcoin ratio: 0.03105 (1.4%)

- Hashrate (seven-day moving average): 906 EH/s

- Hashprice (spot): $56.80

- Total fees: 2.94 BTC / $334,645

- CME Futures Open Interest: 138,445 BTC

- BTC priced in gold: 34.0 oz.

- BTC vs gold market cap: 9.63%

Technical Analysis

- The chart shows daily price movements in BlackRock’s spot bitcoin ETF (IBIT) in a candlestick format.

- The fund fell over 3% Friday, carving out a “bearish marubozu” candle. This pattern is identified by a prominent red body and little-to-no wicks, indicating seller dominance throughout the trading session.

- The occurrence of this candlestick pattern is taken to represent more losses ahead.

Crypto Equities

- Strategy (MSTR): closed on Friday at $366.63 (-8.77%), +2.32% at $375.14 in pre-market.

- Coinbase Global (COIN): closed at $314.69 (-16.7%), +1.98% at $320.91.

- Circle (CRCL): closed at $168.1 (-8.4%), +1.78% at $171.16.

- Galaxy Digital (GLXY): closed at $26.88 (-5.4%), +3.05% at $27.7.

- MARA Holdings (MARA): closed at $15.5 (-3.61%), +2.19% at $15.84.

- Riot Platforms (RIOT): closed at $11.03 (-17.75%), +3.26% at $11.39.

- Core Scientific (CORZ): closed at $12.65 (-6.57%), +1.90% at $12.89

- CleanSpark (CLSK): closed at $10.44 (-8.18%), +2.59% at $10.71.

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $23.42 (-7.28%)

- Semler Scientific (SMLR): closed at $34.46 (-3.88%)

- Exodus Movement (EXOD): closed at $28.38 (-7.98%), +0.88% at $28.63

- SharpLink Gaming (SBET): closed at $17.14 (-8.88%), +5.89% at $18.15.

ETF Flows

Spot BTC ETFs

- Daily net flows: -$812.3 million

- Cumulative net flows: $54.15 billion

- Total BTC holdings ~1.3 million

Spot ETH ETFs

- Daily net flows: -$152.3 million

- Cumulative net flows: $9.51 billion

- Total ETH holdings ~5.74 million

Source: Farside Investors

Overnight Flows

Chart of the Day

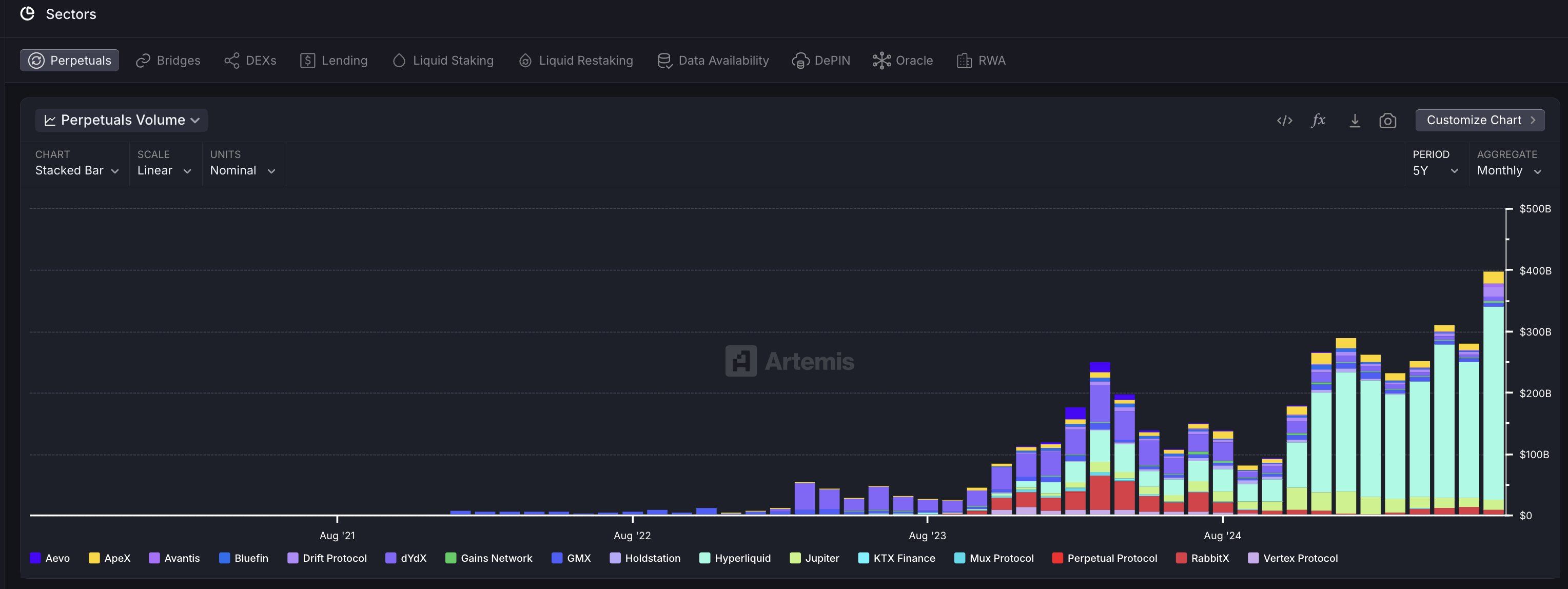

- Cumualtive volume in on-chain crypto perpetual futures protocols hit a record high of $400 billion in July, with Hyperliquid accounting for over 70% of the tally.

- The figures are a sign of growing investor interest in trading leveraged instruments on blockchain.

While You Were Sleeping

- Coinbase Slides Nearly 20% in Worst Weekly Performance Since September 2024 (CoinDesk): Disappointing second-quarter revenue and operating earnings drove up demand for COIN put options and added weight to analyst warnings that the company’s valuation had outpaced its fundamentals.

- Citi’s Gold Bears Turn Bullish on U.S. Growth, Inflation Concerns (Bloomberg): Analysts expect gold to trade between $3,300 and $3,600 in next few months as tariffs and recession fears lift safe-haven demand, in contrast to the sub-$3,000 prediction they made in June.

- Bitcoin Still on Track for $140K This Year, but 2026 Will Be Painful: Elliott Wave Expert (CoinDesk): Ledn CIO John Glover described the recent decline as a pause in a larger upward trend and said bitcoin remains in line with its expected price pattern.

- Binance Opens ‘Bitcoin Options Writing’ to All Users (CoinDesk): The move allows users who pass a suitability assessment to earn income by selling bitcoin options— collecting upfront premiums but risking losses if they misjudge BTC’s price direction or volatility.

- China Is Choking Supply of Critical Minerals to Western Defense Companies (The Wall Street Journal): U.S. defense contractors and drone startups are facing production delays, surging costs and invasive documentation demands, prompting them to seek alternative sources for these minerals.

- Cambodia and Thailand Begin Talks in Malaysia Amid Fragile Ceasefire (Reuters): Thailand accuses Cambodia of repositioning troops, while Cambodia demands the return of 18 captured soldiers ahead of Thursday’s defense ministers’ meeting.

In the Ether

CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data Read More

CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data Read More