Markets, Bitcoin, Markets, Technical Analysis The double high sample usually requires affirmation via a decisive drop under the “neckline,” the help degree between the 2 peaks, which lies round $80,000 to $84,000 primarily based on latest value motion.

Bitcoin’s (BTC) restoration appears to have run out of steam with an emergence of a double high bearish reversal sample on the quick length value charts.

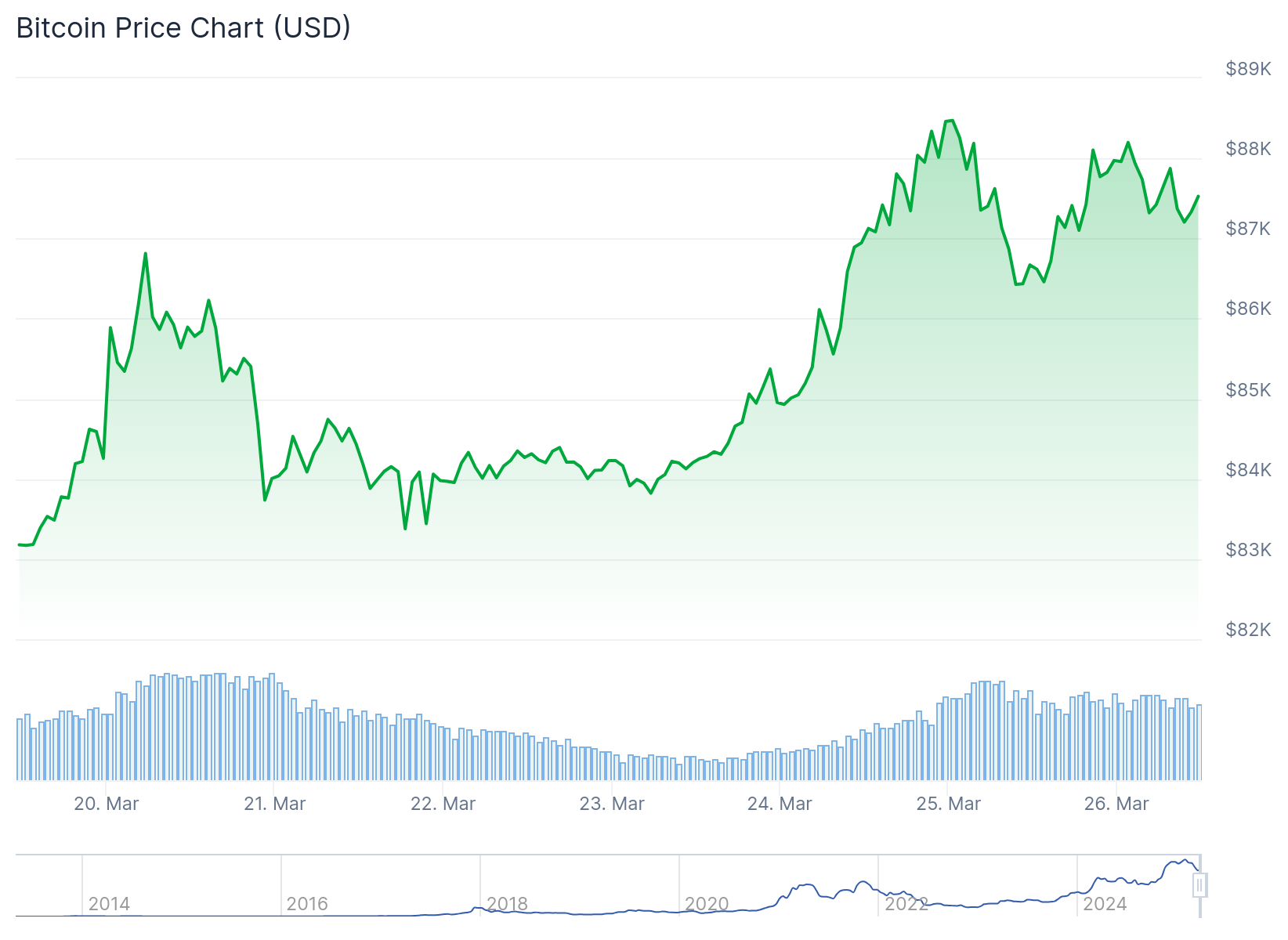

BTC peaked close to $87,400 final week, with costs pulling again to round $84,000 on Friday and staging a restoration to above $87,000 earlier than stalling once more. This sequence of two outstanding peaks at roughly the identical degree, separated by a trough, hints at a traditional double high formation. This bearish sample usually indicators the top of an uptrend.

The double high sample usually requires affirmation via a decisive drop under the “neckline,” the help degree between the 2 peaks, which lies at round $86,000.

Should this happen, BTC might decline towards $75,000 or decrease within the quick time period. However, long-term charts proceed to point the asset stays in an ascending vary.

Traders reacted positively to the U.S. Federal Reserve’s dovish stance on inflation and a cooldown in considerations across the upcoming U.S. tariffs, which have supported beneficial properties up to now week.

However, the dearth of altcoin correlation with BTC’s latest strikes hints that the present value motion may lack broad market help, elevating the potential for a “fakeout” rally.

A possible drop in BTC will possible unfold over to main tokens, denting latest beneficial properties and hopes of an enduring rally. Dogecoin (DOGE), closely influenced by market sentiment and speculative buying and selling, might see amplified losses if bitcoin’s bearish sample performs out, whereas XRP may see decreased momentum, particularly given its sensitivity to market sentiment and regulatory developments.

Solana might be significantly delicate as a consequence of its latest volatility and technical indicators — with it coming near forming a “death cross” (a bearish sign the place the 50-day shifting common crosses under the 200-day) in mid-April, a sample that traditionally results in deeper losses.

For now, bitcoin hovers in a vital zone. A weekly shut under $84,000 might verify the bearish double high state of affairs, whereas a push above $87,500 may invalidate it, doubtlessly reigniting bullish momentum.

CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data Read More