Markets, Bitcoin, short-selling, short squeeze, News The action suggests bitcoin’s recent range — capped at around $110,000 to the upside — could continue.

Crypto traders are exhibiting bearish behavior despite bitcoin BTC trading above $110,000 and possibly taking aim at a new record high above $112,000.

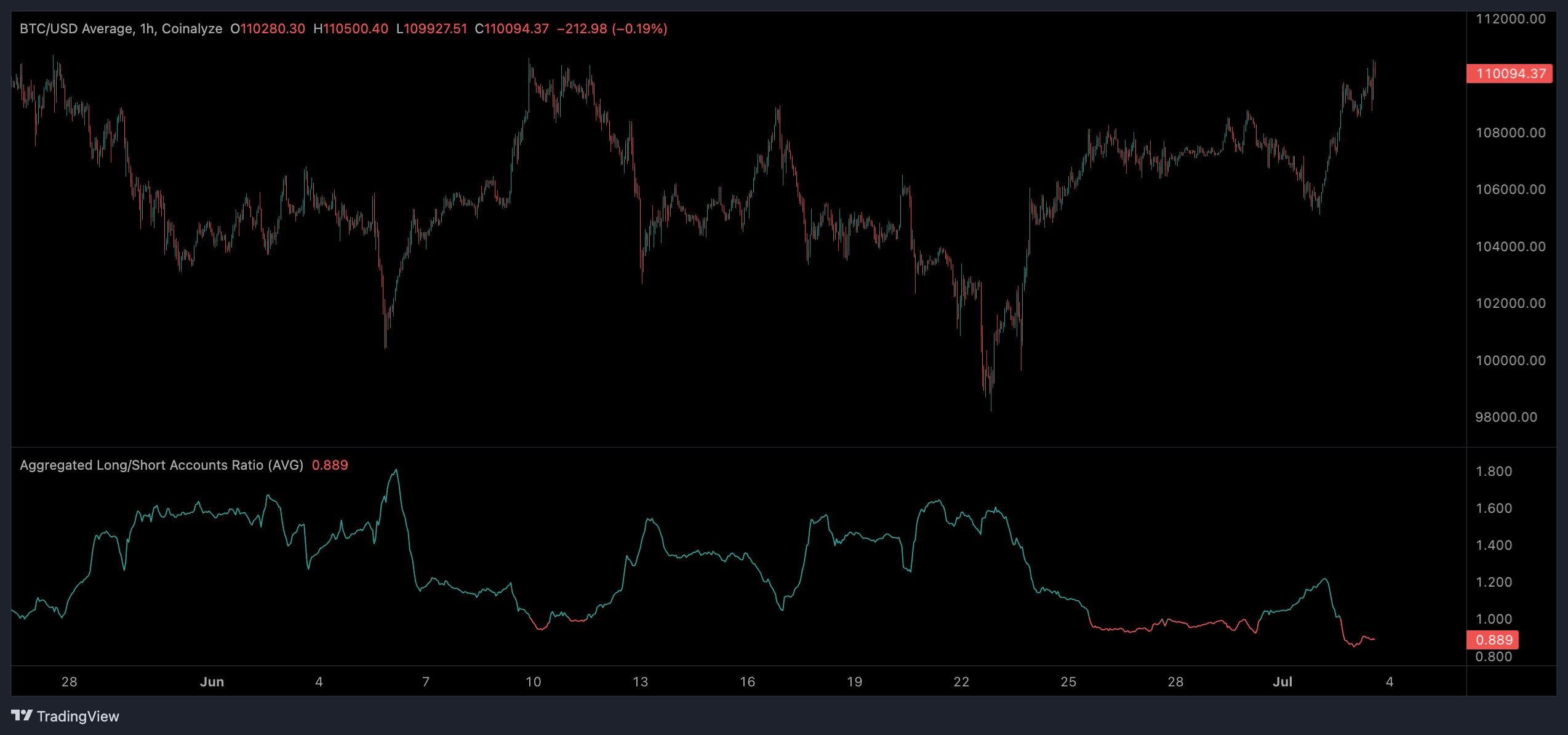

Data from Coinalyze shows that during bitcoin’s move this week from $106,000 to $110,000, the long/short ratio fell from 1.223 in favor of longs to 0.858 in favor of shorts.

Open interest also rose from $32 billion to $35 billion during this period, indicating that significant capital is being pumped into shorting bitcoin.

Bitcoin has been trapped in a relatively tight range since early May, trading between $100,000 and $110,000 with three tests of each level of support and resistance.

Technical indicators like relative strength index (RSI) continue to paint a bearish image with several drives of bearish divergence, with RSI weakening on each test of $110,000.

The recent influx of short positions could well be lower timeframe traders capitalizing on the range, shorting resistance before reversing their trade at each test of $100,000.

This rang true on June 22 when the long/short ratio shot up to 1.68 as bitcoin momentarily slumped through $100,000 before bouncing.

There is a potential bull case with the increase in short positions: a short squeeze. This would occur if bitcoin begins to trigger liquidation points and stop losses above a record high, which would cause an impulse in buy pressure and continuation to the upside.

CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data Read More