Finance, Coinbase, Ethereum, Base Standard Chartered’s Geoffrey Kendrick stated Base’s earnings led to Ethereum gross sales somewhat than long-term accumulation, a declare dismissed by the crypto change.

Coinbase (COIN) offered 12,652 ether ($25 million on the present value) within the fourth quarter, when it was valued about double the extent now, in keeping with Geoffrey Kendrick, the worldwide head of digital belongings analysis at Standard Chartered Bank.

In a observe, Kendrick stated he analyzed the crypto change’s quarterly filings, which present it holds ether (ETH) beneath completely different classes, together with funding and operational functions. He estimates that about 80% of income generated by Base, Coinbase’s Ethereum layer-2 blockchain, is revenue.

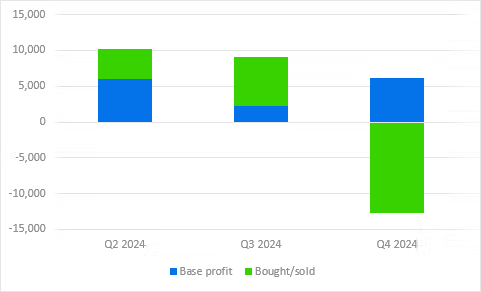

Notably, the timing of the corporate’s trades aligns with value actions, he stated. Coinbase web purchased within the third quarter, when ETH was buying and selling at round $2,500, and web offered within the fourth, when the second-largest cryptocurrency reached $4,000. It’s now about $2,000.

“The fact that they net bought in Q3 (when prices were low on average) and net sold in Q4 (higher average prices) tells me Coinbase acts like any risk-adjusting profit maximiser would do,” Kendrick wrote.

Coinbase stated it offered some ether to fund operations, with out saying how a lot was concerned.

“Base earns ETH from sequencer fees, and the ETH we earn is primarily held for long term investment or used for operational expenses, including tax liabilities and reinvesting in growth via things like salaries, grants, acquisitions, and public goods funding,” a spokesperson stated in an e mail.

According to Kendrick’s calculations, over the previous three quarters, web ETH gross sales totaled 1,558, implying a sample of strategic promoting somewhat than accumulation. He reached his conclusion by subtracting Base’s earnings in ETH from adjustments in Coinbase’s ETH holdings.

The spokesperson reiterated that the corporate does not usually participate in buying and selling actions.

“As shared in our 10K: ‘Crypto belongings held for funding are primarily held long run … we don’t have interaction in common buying and selling of those belongings however might lend them by way of Prime Financing or stake them.’ Our ETH held for funding grew 20% over the course of 2024,” the spokesperson stated.

This is not the primary time Coinbase has had to reply to strategies it’s promoting the ether generated by Base. Last month a member of Base rejected speculation surrounding potential ETH sales saying the change had “accumulated $300M+ in ETH, which is more than 2x all of Base’s ETH earnings over time.”

CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data Read More