Markets, Bitcoin, Federal Reserve, Bofa The anticipated finish of quantitative tightening may bode properly for BTC and different threat belongings, however positive aspects could also be tempered by stagflationary changes in financial projections.

As bitcoin (BTC) seems to get well from its recent downturn, observers wish to Wednesday’s Federal Reserve (Fed) price resolution to supply assist, with some saying that an announcement to finish the steadiness sheet runoff program, often called quantitative tightening, might be optimistic information for the market.

The Fed will announce its price evaluate at 18:00 UTC, adopted by Chairman Jerome Powell’s press convention half an hour later.

The financial institution is unlikely to supply any surprises on the rate of interest entrance, retaining the current vary of 4.25% to 4.50%. Therefore, the main target will probably be on how policymakers plan to proceed with the quantitative tightening program, given the considerations that it may have an effect on liquidity within the system whereas the Treasury grapples with the continuing debt ceiling concern. Plus, the abstract of financial projections will probably be watched out by markets.

Since June 2022, the Fed, underneath the QT program, has been slowly shrinking its steadiness sheet, which had zoomed to a document of $9 trillion put up COVID when the financial institution purchased trillions of {dollars} price of belongings, together with bonds, to assist markets.

The minutes of the January Fed assembly confirmed policymakers mentioned pausing or slowing the reversal of the steadiness sheet enlargement that greased the crypto bull market of 2020-21. So, the potential for Powell hinting the identical later at the moment can’t be dominated out.

“Late last year, Fed Chair Powell hinted that the end of QT was coming in 2025. If he mentions it in tomorrow’s [Wednesday’s] statement or press conference (I imagine someone will ask him), that would end up signalling that we’re in a new monetary regime, and that the Fed stands ready to resume additional debt purchases should QE become necessary again,” Noelle Acheson, writer of the Crypto Is Macro Now newsletter stated in Tuesday’s version.

“While renewed QE [quantitive easing] unlikely any time soon, the additional liquidity from a large buyer (the Fed) coming back into the market to replace maturing holdings would be good news,” Acheson added, noting that the top of QT can be a well timed transfer to keep away from liquidity glitches within the Treasury market that faces $9 trillion in debt maturity this yr.

New York Life Investments’ Economist Lauren Goodwin voiced a similar opinion, saying a barely earlier finish to the steadiness sheet runoff may present the market with a dovish sign it’s searching for.

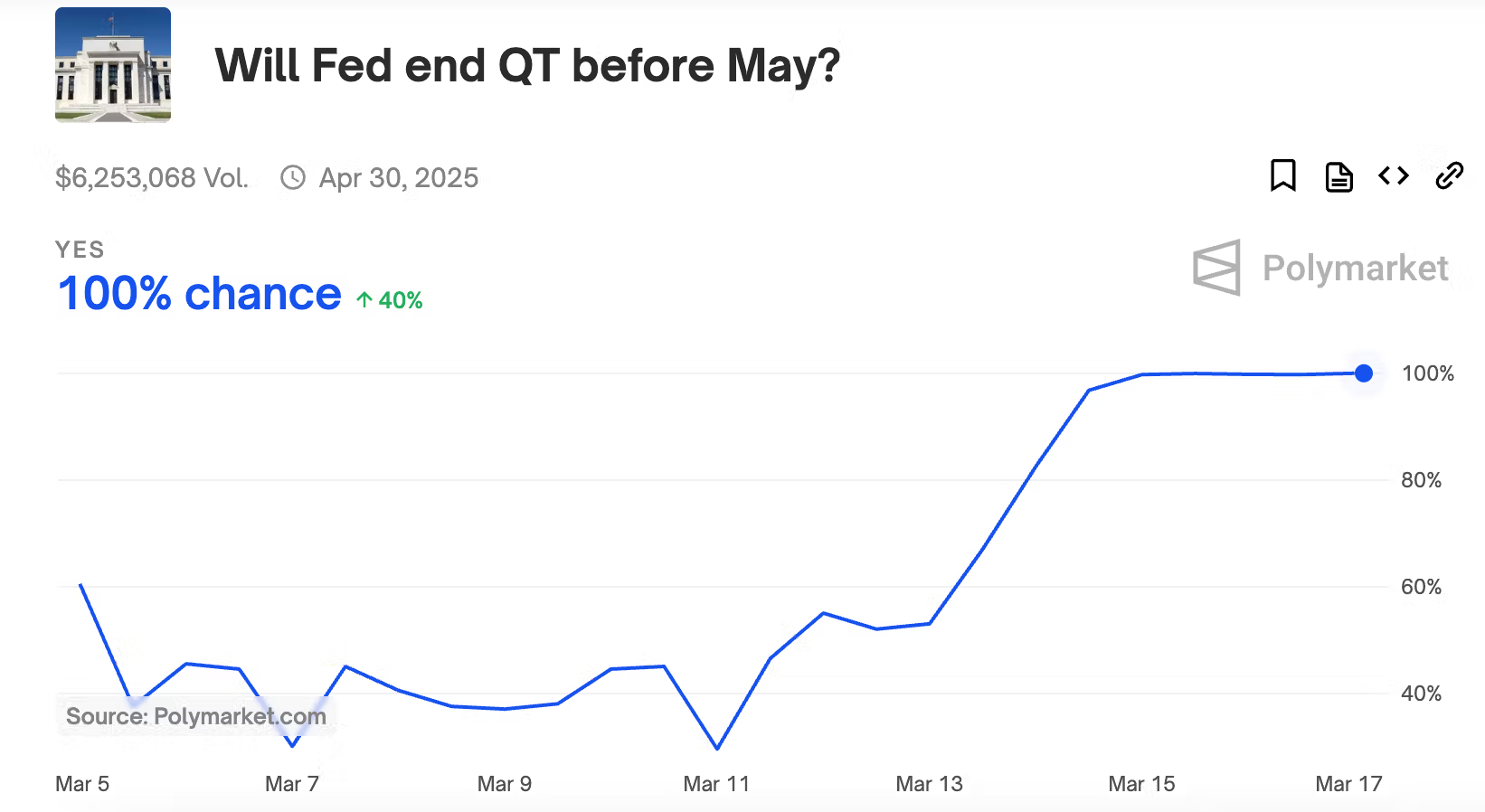

Traders over decentralized betting platform Polymarket see a 100% likelihood that the Fed will finish the QT program earlier than May. The betting on the identical will resolve in “Yes” if the central financial institution will increase the quantity of securities it holds outright week-over-week by the top of April.

Bank of America predicts finish of QT

Several funding banks, together with Bank of America, count on the Fed to finish QT in a gathering characterised by unsure financial outlook primarily stemming from President Donald Trump’s commerce tariffs.

“Our rates strategists expect the statement to indicate that the Fed is pausing QT until the debt ceiling is resolved, as suggested in the January meeting minutes. They do not expect to restart after the debt ceiling is addressed, but the announcement won’t be made until later this year,” Bank of America’s March 14 consumer be aware stated.

A pause in QT may put downward stress on the yield on the 10-year U.S. Treasury be aware, the so-called risk-free price, galvanizing demand for riskier belongings.

Watch out for stagflation hints

Trump’s tariffs have revved up inflation dangers whereas posing dangers to financial progress, a stagflationary situation, and the Fed’s abstract of financial projections (SEP) may replicate that. A nod to stagflation may imply a delay in additional price cuts, probably limiting bitcoin positive aspects from a QT pause announcement.

According to Acheson, probabilities of a stagflationary adjustment within the SEP – decrease GDP projections and better core PCE estimates, with extra policymakers citing upside dangers to inflation – are excessive.

“If, indeed, we get that stagflationary shift in official projections, the market is unlikely to be happy. To some extent, these are starting to be priced in – but confirmation that the Fed is likely to push rate cuts even further out could startle those counting on liquidity injections,” Acheson stated.

The lately launched U.S. retail gross sales and regional manufacturing indices revealed indicators of financial weak spot, Meanwhile, forward-looking inflation metrics have been rising, doubtless adjusting to Trump’s tariffs.

Bank of America put it greatest: “The combination of signal from the latest data and policies enacted to date should result in the Fed downgrading growth and upgrading inflation this year, a small nod to stagflation.”

“The dot plot should still show two cuts in ’25 and ’26,” the funding financial institution added.

CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data Read More