Markets, Bitcoin, Gold Charlie Morris, founding father of ByteTree, likens this gold rally to a “proper gold rush”.

Gold has surged to a brand new all-time excessive, surpassing $3,025 per ounce to mark a rise of over 15% in for the reason that flip of the 12 months. Meanwhile, bitcoin is lagging (BTC), down 10% year-to-date.

Several elements have contributed to gold’s rally, together with important inflows into gold ETFs and its conventional position as a safe-haven asset throughout geopolitical uncertainty.

Additionally, discussions of recent tariffs within the U.S. underneath President Trump have additional fueled demand for U.S. equities. Gold’s historic rally has pushed its value up 40% year-over-year, far outpacing Bitcoin’s 16% achieve.

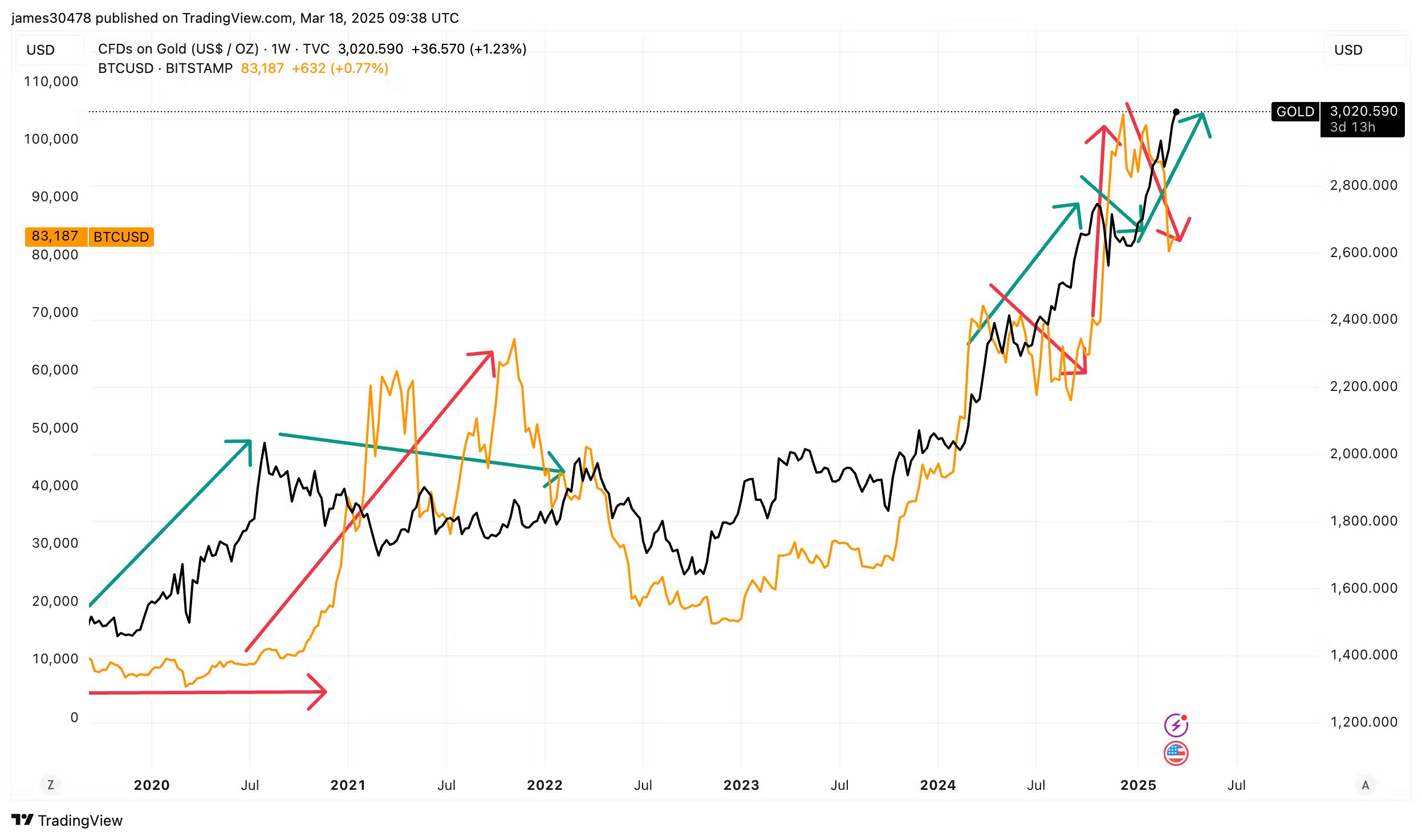

Historically, when gold enters a bull market, bitcoin usually stagnates or declines. The two property not often transfer in tandem, although there are occasional durations when each rise or fall concurrently.

Between 2019 and Q3 2020, gold skilled a robust rally whereas bitcoin remained largely flat, coinciding with the covid-19 pandemic. In distinction, bitcoin noticed its bull run in 2021 whereas gold stagnated. By 2022, as international rates of interest started to rise, each property confronted strain earlier than rebounding in 2023 and 2024. Now, in 2025, the market is witnessing a renewed divergence between the 2.

ByteTree founder Charlie Morris has described this gold rally as a “proper gold rush”—one thing the market hasn’t seen since 2011.

“Gold above $3,000, silver above $24, and gold stocks gaining momentum—it struck me that the crypto crowd has never witnessed a true gold rush. The last time this happened was in 2011, when Bitcoin was just emerging at $20. They will now.”

CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data Read More

CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data Read More