Markets, Solana, market analysis, News Solana has positive realized cap inflows after weeks of bleeding, a potential early signal of revived market conviction.

Solana (SOL) is starting to see capital flow back in after several weeks of outflows.

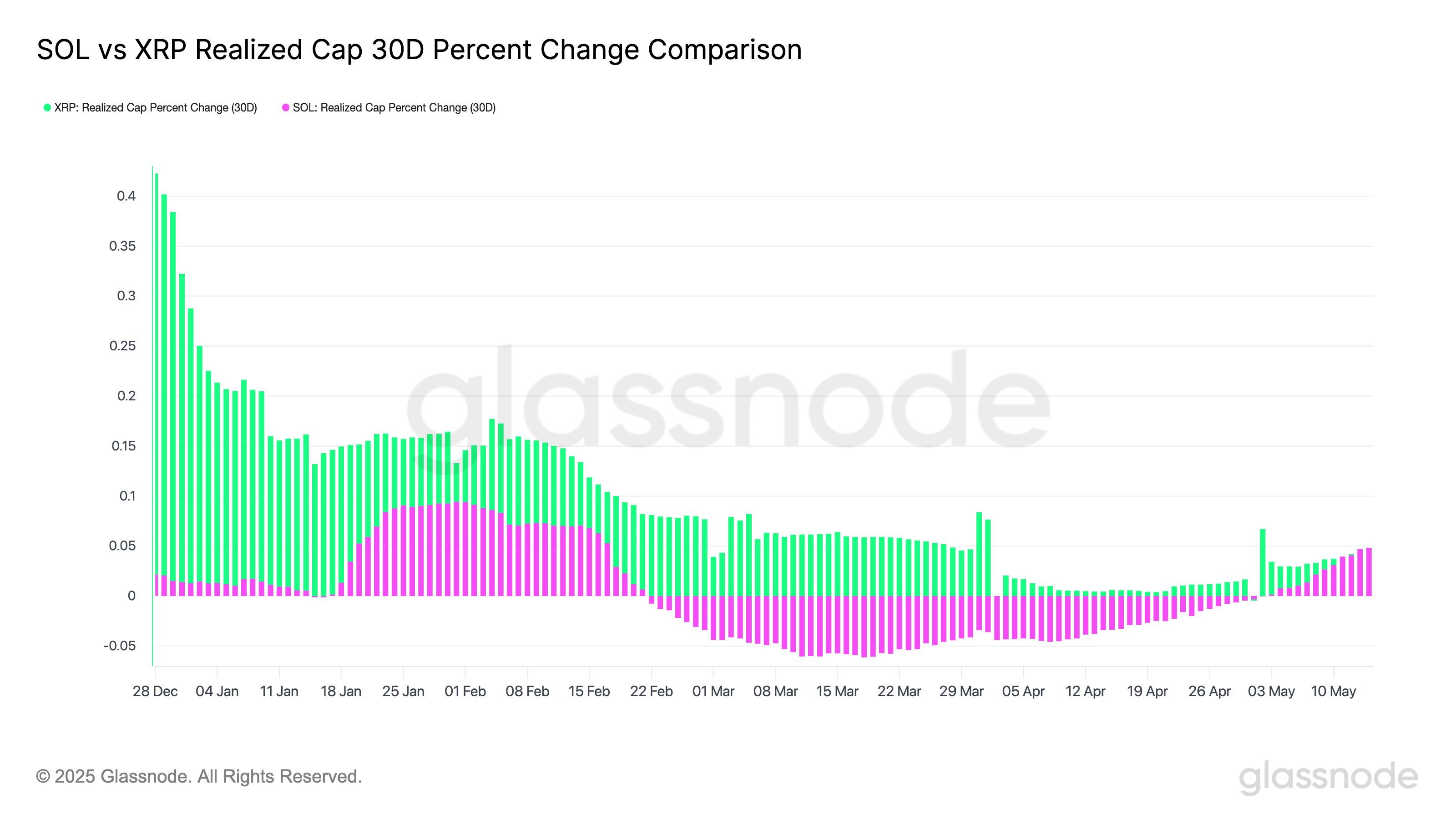

Glassnode data shows SOL’s 30-day realized cap inflows are now firmly back in positive territory, growing at a pace of 4–5%, a level that puts it on par with XRP.

While the inflows are relatively modest compared to frenzied periods in December and January, the move marks a trend reversal following a prolonged stretch of realized losses and capital outflows that reflected investor exit and fading conviction.

Realized cap inflow is a metric used to gauge actual capital entering or exiting an asset, based on the USD value of coins as they last moved on-chain. It filters out noise from speculative price spikes and instead tracks where holders are actually deploying capital.

For Solana, that number turning green again could indicate that buy-side pressure is finally returning, even if price action hasn’t fully reflected it.

Inflows into realized cap often serve as a leading indicator, suggesting some traders are positioning ahead of a potential bounce, or at the very least, a sign that capitulation has run its course.

CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data Read More