Markets, Tokenized Assets, Real World Assets, Tokenization Ondo Finance, BlackRock-Securitize and Superstate gained essentially the most among the many bigger issuers, whereas Hashnote’s USYC declined.

As cryptocurrencies have been battered in a broad-market correction over the previous weeks, digital asset buyers sought refuge in tokenized U.S. Treasury merchandise.

Since late January, the mixed market capitalization of Treasury-backed tokens grew $800 million to hit a contemporary all-time document of $4.2 billion on Wednesday, information supply rwa.xyz reveals.

Real-world asset platform Ondo Finance’s (ONDO) merchandise, the short-term bond-backed OUSG and USDY tokens, climbed to simply shy of $1 billion mixed, a 53% surge in market worth over the previous month. BUIDL, the token issued collectively by asset supervisor BlackRock and tokenization agency Securitize, gained 25% throughout the identical interval to surpass $800 million. Asset supervisor Franklin Templeton’s BENJI token expanded to $687 million, a 16% improve, whereas Superstate’s USTB hit $363 million, up greater than 63%.

A notable outlier was Hashnote’s USYC, shedding over 20% of its market cap to $900 million, predominantly because of DeFi protocol Usual’s decline after investor backlash. The token is the principle backing asset of Usual’s USD0 stablecoin, which plummeted under $1 billion provide from its January peak of $1.8 billion.

“We believe the growth of the tokenized treasury market cap during the recent crypto downturn reflects a flight to quality, similar to how traditional investors shift from equities to U.S. Treasuries during economic uncertainty,” Brian Choe, head of analysis at rwa.xyz, advised CoinDesk.

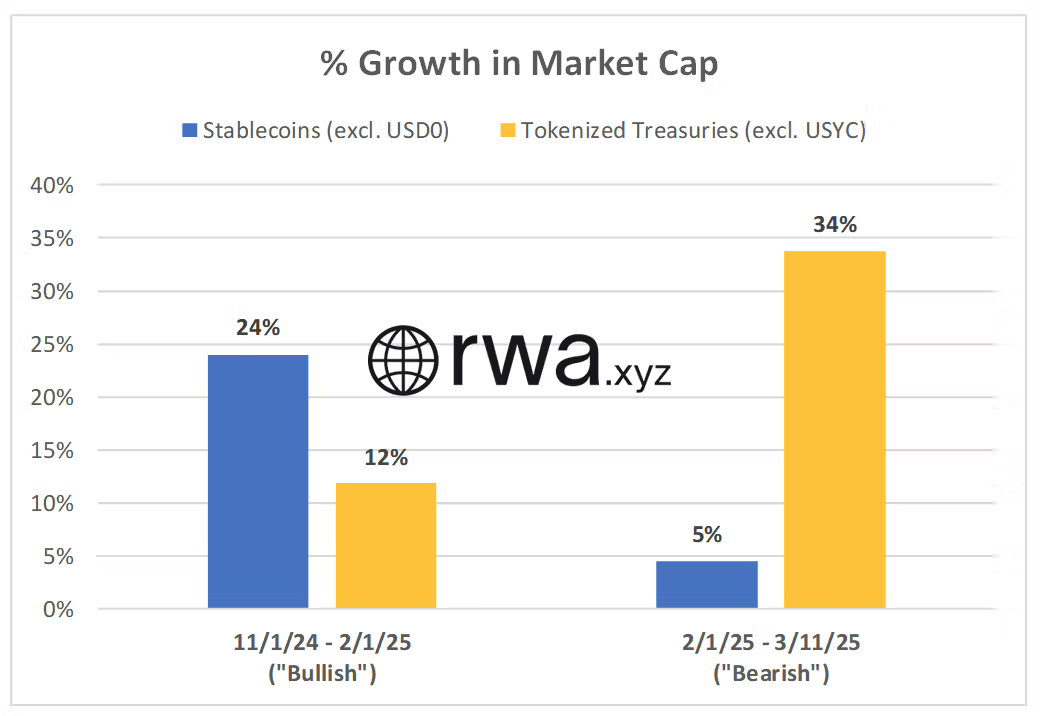

Choe primarily based his evaluation on evaluating the market cap development of tokenized treasuries with stablecoins between November and January, when crypto markets rallied, and from February when costs corrected.

During the latest bearish interval, tokenized treasuries grew sooner than stablecoins, opposite to the bullish part, when stablecoin development outpaced the treasury token market.

“This signals some investors aren’t exiting the ecosystem but rather rotating capital into safer, yield-bearing assets until market conditions improve,” Choe stated.

CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data Read More