Finance, Market Manipulation, Price Manipulation, Exclusive, Bitcoin, market evaluation, News Despite elevated scrutiny, spoofing stays a problem in crypto, highlighting the necessity for higher surveillance and stricter rules.

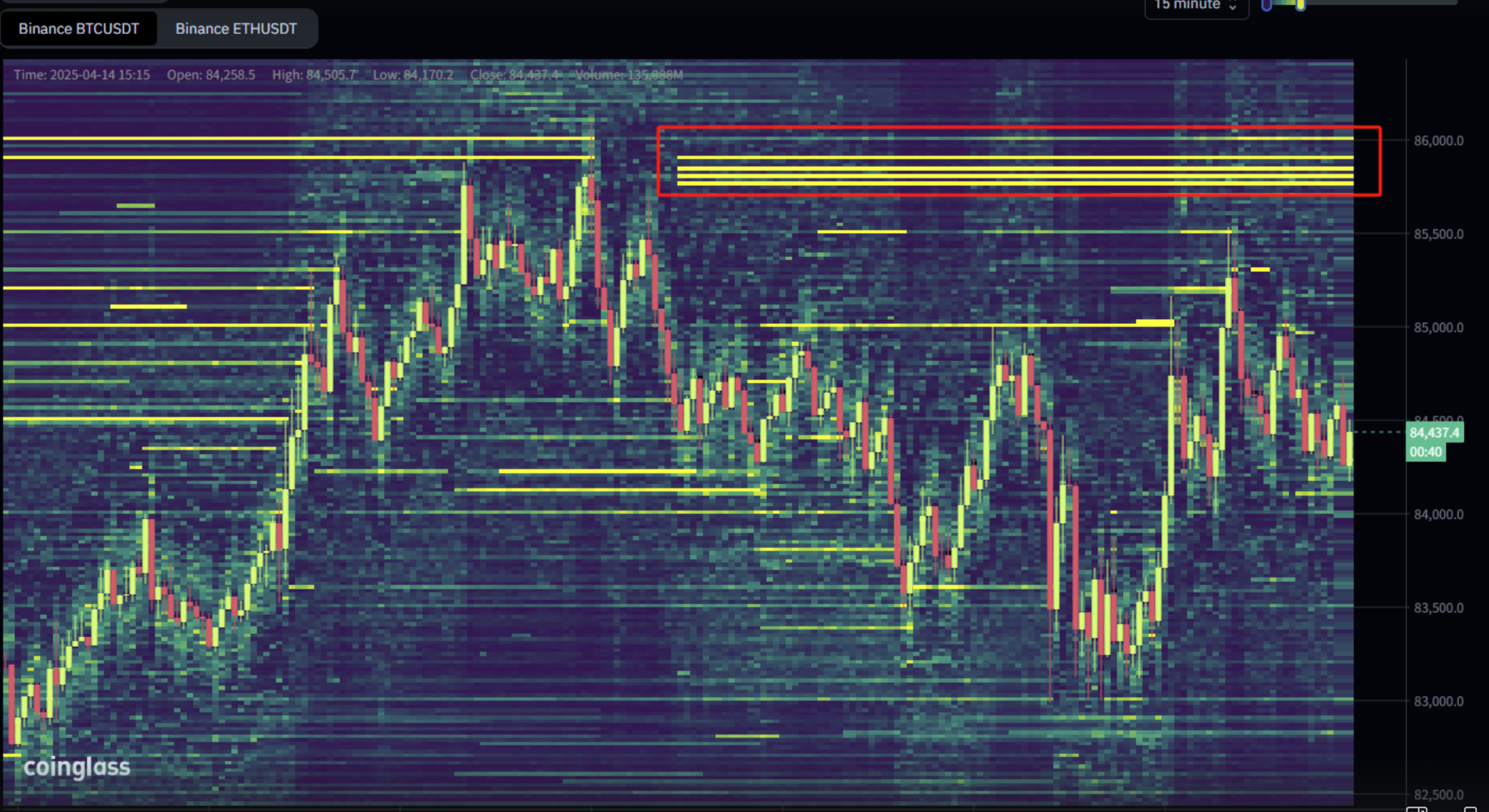

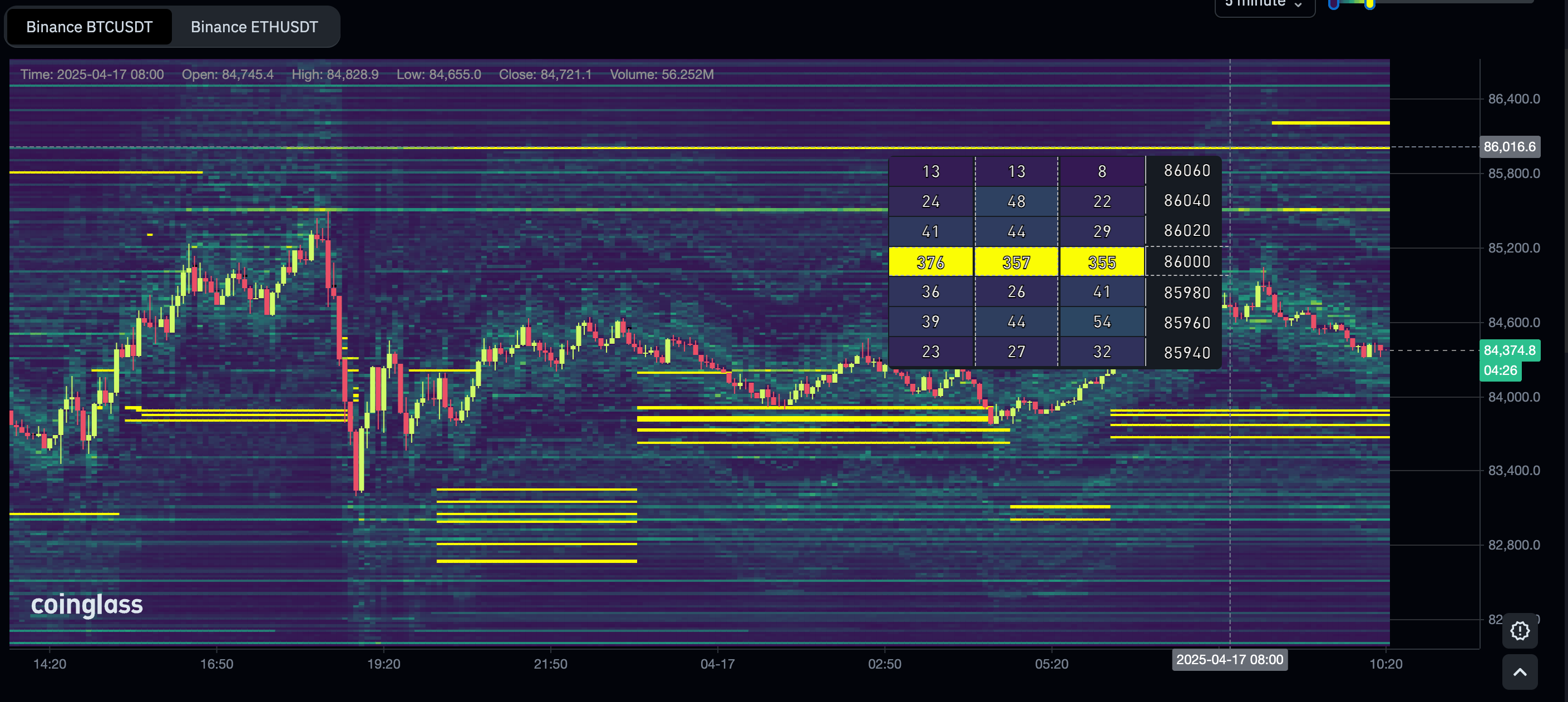

On April 14, somebody put in a promote order for two,500 bitcoin, price roughly $212 million, on the Binance order ebook at $85,600, round 2-3% above the spot costs buying and selling on the time.

Seeing such a big order, the bitcoin value began to gravitate to this degree at round 17:00 UTC.

Suddenly, the order was gone, as seen utilizing Coin Glass data, which triggered a quick second of market apathy as bulls and bears tussled to fill a void in liquidity.

The bitcoin value on the time, nonetheless, was already on shaky floor as a consequence of geopolitical considerations. Subsequently, it went decrease after the vanishing order triggered chaos for the merchants.

So what occurred?

One reply might be an unlawful approach that entails inserting a big restrict order to rile buying and selling exercise after which eradicating the order as soon as the value comes near filling it. This is known as “order spoofing,” outlined by the 2010 U.S. Dodd-Frank Act as “the illegal practice of bidding or offering with the intent to cancel before execution.”

As seen within the liquidity heatmap within the picture above, on the floor, the order with a value of $85,600 appeared like a key space of resistance, which is why market costs began to gravitate in the direction of it. However, in actuality, that order and liquidity have been probably spoofed, giving merchants the phantasm of a stronger market.

Liquidity heatmaps visualize an order ebook on an alternate and present how a lot of an asset rests on the ebook at every value level. Traders will use a heatmap to determine areas of help and resistance and even to focus on and squeeze under-pressure positions.

In this specific case, the dealer appeared to have positioned a potential spoof order when the U.S. fairness market was closed, often a time interval of low liquidity for the 24/7 bitcoin market. The order was then eliminated when the U.S. market opened as the value moved in the direction of filling it. This might nonetheless have had the specified impact, as, as an illustration, a big order on one alternate would possibly spur merchants or algorithms on one other alternate to take away their order, making a void in liquidity and subsequent volatility.

Another purpose might be that the dealer inserting a $212 million promote order on Binance wished to create short-term promote stress to get crammed on restrict buys, after which they eliminated that order as soon as these buys have been crammed.

Both choices are believable, albeit nonetheless unlawful.

‘Systemic Vulnerability’

Former ECB analyst and present managing director of Oak Security, Dr. Jan Philipp, instructed CoinDesk that manipulative buying and selling habits is a “systemic vulnerability, especially in thin, unregulated markets.”

“These tactics give sophisticated actors a consistent edge over retail traders. And unlike TradFi, where spoofing is explicitly illegal and monitored, crypto exists in a gray zone.”

He added that “spoofing needs to be taken seriously as a threat as it helped trigger the 2010 Flash Crash in traditional markets, which erased almost $1 trillion in market value.”

Binance, in the meantime, insists that it’s taking part in its half in stopping market manipulation.

“Maintaining a fair and orderly trading environment is our top priority and we invest in internal and external surveillance tools that continuously monitor trading in real-time, flagging inconsistencies or patterns that deviate from normal market behavior,” a Binance spokesperson instructed CoinDesk, with out immediately addressing the case of the vanishing $212 million order.

The spokesperson added that if anybody is discovered manipulating markets, it is going to freeze accounts, report suspicious exercise to regulators, or take away unhealthy actors from its platform.

Crypto and spoofing

Spoofing, or a method that mimics a pretend order, is unlawful, however for a younger business corresponding to crypto, historical past is rife with such examples.

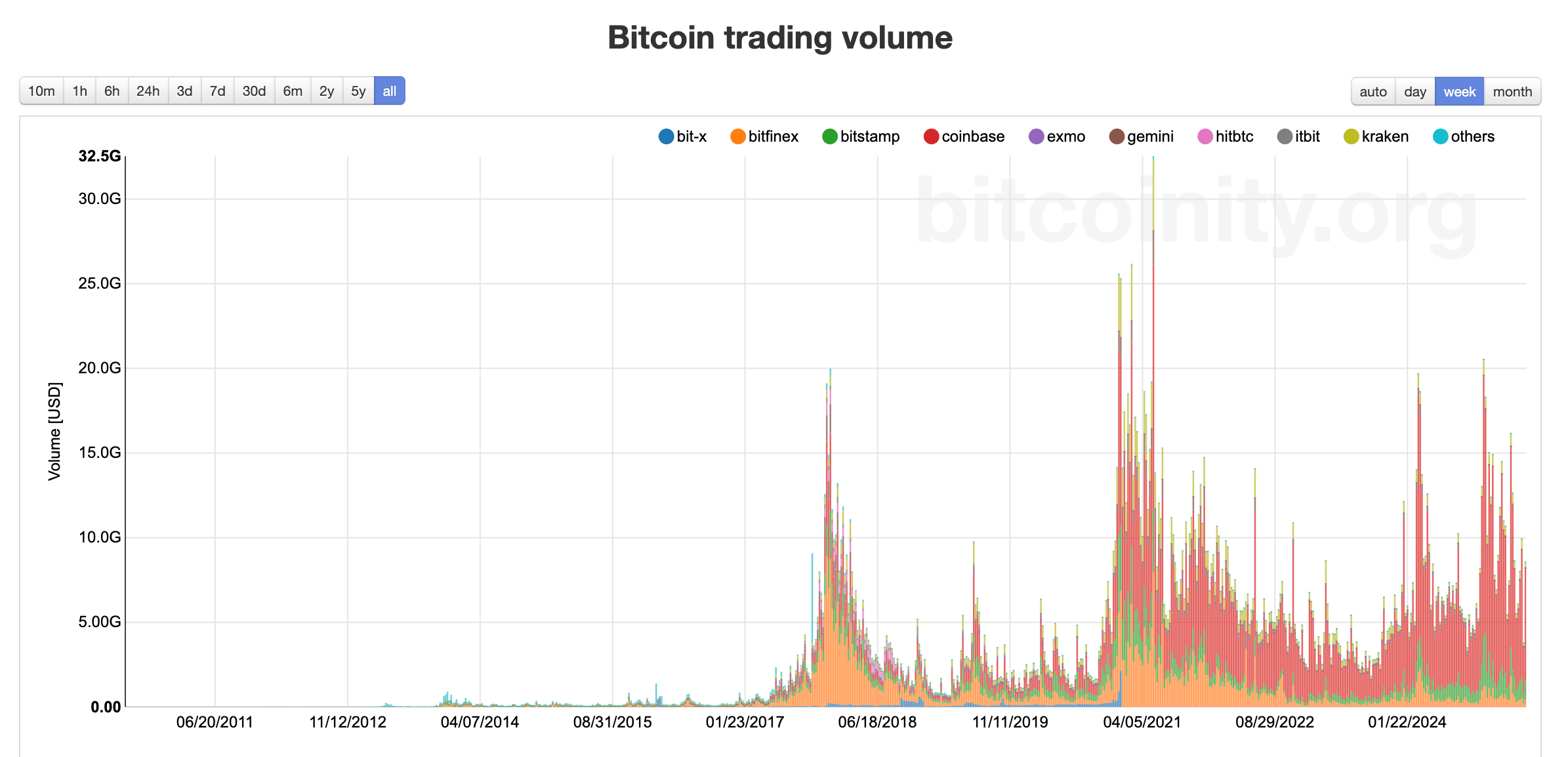

During 2014, when there was little to no regulatory oversight, the vast majority of buying and selling quantity came about on bitcoin-only exchanges from retail merchants and cypherpunks, opening the business to such practices.

During 2017’s ICO section, when buying and selling quantity skyrocketed, ways corresponding to spoofing have been additionally anticipated, as establishments have been nonetheless skeptical in regards to the asset class. In 2017 and 2018, merchants often positioned nine-figure positions that they’d no intention of filling, solely to drag the order shortly after.

BitMEX founder Arthur Hayes stated in a 2017 blog post that he “found it incredible” that spoofing was unlawful. He argued that if a wise dealer wished to purchase $1 billion of BTC, they’d bluff a $1 billion promote order to get it crammed.

However, because the 2021 bull market, the crypto market has skilled waves of institutional adoption, corresponding to Coinbase (COIN) going public, Strategy (previously MicroStrategy) going all-in on bitcoin, and BlackRock launching exchange-traded funds (ETFs).

At the time of writing, there aren’t any such massive orders that point out additional spoofing makes an attempt, and spoofing makes an attempt have appeared to have change into much less blatant. However, even with billions traded by TradFi companies, examples of such a method nonetheless exist throughout many crypto exchanges, notably on low-liquidity altcoins.

For instance, final month, cryptocurrency alternate MEXC introduced that it had reined in an increase in market manipulation. An inside investigation discovered a 60% increase in market manipulation attempts from This autumn of 2024 to this primary quarter of this yr.

In February, a trader manipulated the HyperLiquid JELLY market by tricking a pricing oracle, and HyperLiquid’s response to the exercise was met with skepticism and a subsequent outflow of capital.

How does the crypto market fight spoofing?

The burden in the end lies with the exchanges and regulators.

“Regulators should set the baseline,” Dr. Jan Philipp instructed CoinDesk.” [Regulators] should define what counts as manipulation, specify penalties and outline how platforms must respond.”

The regulators have definitely tried to clamp down on such schemes. In 2020, rogue dealer Avi Eisenberg was found guilty of manipulating decentralized alternate Mango Markets in 2022, however the circumstances have been few and much between.

However, crypto exchanges should additionally “step up their surveillance systems” and use circuit breakers whereas using stricter itemizing necessities to clamp down on market manipulation, Philipp stated.

“Retail users won’t stick around if they keep getting front-run, spoofed and dumped on. If crypto wants to outgrow its casino phase, we need infrastructure that rewards fair participation, not insider games,” Philipp concluded.

Read extra: Crypto Traders Apparently Spam Truth Terminal Into Pumping Coin Associated With Brian Armstrong’s Dog

CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data Read More