Crypto Daybook Americas, Crypto Daybook Americas, News Your day-ahead search for April 29, 2025

By James Van Straten (All occasions ET except indicated in any other case)

Bitcoin (BTC) stays caught close to the $95,000 mark, apparently unfazed by the Canadian election result, which noticed the crypto-friendly candidate for prime minister lose his seat. Key macroeconomic information due later this week may function a catalyst for bitcoin’s subsequent transfer, with the standout being Friday’s non-farm payrolls report.

In the meantime, the most important cryptocurrency is reaching a collection of upper lows and decrease highs, forming a symmetrical triangle consolidation sample. This setup following a powerful uptrend usually implies a continuation. A decisive breakout above $95,500 may spark the following leg increased, whereas a drop beneath assist would point out a possible reversal.

On the technical entrance, bitcoin’s hashrate, which has surged over latest months and is now about 10% away from its document, is starting to decelerate. A downward issue adjustment of greater than 5% is anticipated in 4 days and can present some much-needed reduction to miners, who’ve been grappling with hashprice ranges close to five-year lows.

The week’s macroeconomic information embrace private spending and GDP development figures on Wednesday, although Friday’s jobs report takes middle stage. Economists forecast a drop in new jobs to 135,000 throughout April, down from March’s 228,000 determine, which was the strongest in three months.

The unemployment fee is projected to have held regular at 4.2%, underscoring a persistently tight labor market. The CME FedWatch Tool at the moment signifies a 91% likelihood of the Fed funds fee being held at at 4.25%–4.50% on the May 7 FOMC assembly.

Also within the combine, earnings season is heating up, significantly among the many “Magnificent Seven” tech shares. Microsoft (MSFT) and Meta (META) report after the market shut on Wednesday, adopted by Apple (AAPL), Amazon (AMZN) and Strategy (MSTR) on Thursday. Stay alert!

What to Watch

- Crypto:

- April 30, 9:30 a.m.: ProShares will debut three ETFs that can present leveraged and inverse publicity to XRP: the ProShares Ultra XRP ETF, the ProShares Short XRP ETF and the ProShares UltraShort XRP ETF.

- April 30, 10:03 a.m.: Gnosis Chain (GNO), an Ethereum sister chain, will activate the Pectra exhausting fork on its mainnet at slot 21,405,696, epoch 1,337,856.

- May 1: Coinbase Asset Management will introduce the Coinbase Bitcoin Yield Fund (CBYF), which is aimed toward non-U.S. buyers.

- May 1: Hippo Protocol starts up its personal layer-1 blockchain mainnet constructed on Cosmos SDK and completes a migration from Ethereum’s ERC-20 HPO token to its native HP token, enabling staking and governance.

- May 1, 9 a.m.: Constellation Network (DAG) activates the Tessellation v3 improve on its mainnet, introducing delegated staking, node collateral, token locking and new transaction varieties to reinforce community safety, scalability and performance.

- May 1, 11 a.m.: THORChain activates its v3.5 mainnet improve, including the TCY token to transform $200 million in debt into fairness. TCY holders earn 10% of community income, whereas native RUNE stays the protocol’s safety and governance token. TCY prompts May 5.

- Macro

- April 29, 10 a.m.: The U.S. Bureau of Labor Statistics releases March JOLTs report (job openings, hires, and separations).

- Job Openings Est. 7.5M vs. Prev. 7.568M

- Job Quits Prev. 3.195M

- April 29, 10 a.m.: U.S. House Financial Services Committee hearing titled “Regulatory Overreach: The Price Tag on American Prosperity.” Livestream link.

- April 30, 8 a.m.: Brazil’s Institute of Geography and Statistics (IBGE) releases March unemployment fee information.

- Unemployment Rate Prev. 6.8%

- April 30, 8 a.m.: Mexico’s National Institute of Statistics and Geography releases (preliminary) Q1 GDP development information.

- GDP Growth Rate QoQ Prev. -0.6%

- GDP Growth Rate YoY Prev. 0.5%

- April 30, 8:30 a.m.: The U.S. Bureau of Economic Analysis (BEA) releases (advance) Q1 GDP development information.

- GDP Growth Rate QoQ Est. 0.4% vs. Prev. 2.4%

- April 30, 10 a.m.: The U.S. Bureau of Economic Analysis (BEA) releases March client revenue and expenditure information.

- Core PCE Price Index MoM Est. 0.1% vs. Prev. 0.4%

- Core PCE Price Index YoY Est. 2.6% vs. Prev. 2.8%

- PCE Price Index MoM Est. 0% vs. Prev. 0.3%

- PCE Price Index YoY Est. 2.2% vs. Prev. 2.5%

- Personal Income MoM Est. 0.4% vs. Prev. 0.8%

- Personal Spending MoM Est. 0.6% vs. Prev. 0.4%

- April 29, 10 a.m.: The U.S. Bureau of Labor Statistics releases March JOLTs report (job openings, hires, and separations).

- Earnings (Estimates primarily based on FactSet information)

Token Events

- Governance votes & calls

- Uniswap DAO is voting on a proposal to renew the Uniswap Accountability Committee (UAC) for Season 4, extending its mandate till the tip of 2025. Voting ends April 29.

- Balancer DAO is voting on allocating $250,000 worth of ARB to a multisig managed by contributors to fund testing of latest automated market maker (AMM) pool fashions.

- April 30, 2 a.m.: NEO to host an Ask Me Anything (AMA) session with its founder, Da Hongfei.

- April 30, 12 p.m.: Helium to host a community call meeting.

- May 5, 4 p.m.: Livepeer (LPT) to host a Treasury Talk session on Discord.

- Unlocks

- April 30: Optimism (OP) to unlock 1.89% of its circulating provide value $24.75 million.

- May 1: Sui (SUI) to unlock 2.28% of its circulating provide value $267.86 million.

- May 1: ZetaChain (ZETA) to unlock 5.67% of its circulating provide value $12.10 million.

- May 2: Ethena (ENA) to unlock 0.73% of its circulating provide value $13.44 million.

- May 7: Kaspa (KAS) to unlock 0.56% of its circulating provide value $14.01 million.

- May 9: Movement (MOVA) to unlock 2.04% of its circulating provide value $12.35 million.

- Token Launches

- April 29: MilkyWay (MILK) to be listed on Bybit.

- April 29: Virtual (VIRTUAL) to be listed on Binance.US.

- May 2: Binance to delist Alpaca Finance (ALPACA), PlayDapp (PDA), Viberate (VIB), and Wing Finance (WING).

- May 5: Sonic (S) to be listed on Kraken.

Conferences

CoinDesk’s Consensus is happening in Toronto on May 14-16. Use code DAYBOOK and save 15% on passes.

- Day 3 of 4: Web Summit Rio 2025

- Day 2 of two: Staking Summit Dubai

- April 29: El Salvador Digital Assets Summit 2025 (San Salvador, El Salvador)

- April 29: IFGS 2025 (London)

- April 30-May 1: TOKEN2049 (Dubai)

- May 6-7: Financial Times Digital Assets Summit (London)

- May 11-17: Canada Crypto Week (Toronto)

- May 12-13: Dubai FinTech Summit

- May 12-13: Filecoin (FIL) Developer Summit (Toronto)

- May 12-13: Latest in DeFi Research (TLDR) Conference (New York)

- May 12-14: ACI’s 9th Annual Legal, Regulatory, and Compliance Forum on Fintech & Emerging Payment Systems (New York)

- May 13: Blockchain Futurist Conference (Toronto)

- May 13: ETHWomen (Toronto)

Token Talk

By Shaurya Malwa

- BNB Chain’s Lorentz improve went dwell earlier Tuesday, boosting BNB token fundamentals by making the community quicker and extra environment friendly.

- The improve improved the way in which validators alternate information, making the method faster and smoother to cut back delays and velocity up transaction processing.

- It additionally added a way permitting validators to obtain a number of blocks directly, as an alternative of one after the other.

- The time it takes to create a brand new block is diminished to about 1.5 seconds and will fall to as little as 0.75 seconds. Faster block occasions imply transactions are confirmed extra shortly, making the community really feel snappier for customers.

- The replace makes decentralized apps (dapps) like video games or monetary instruments run quicker and smoother. Developers can preserve constructing apps the identical approach as a result of the replace doesn’t change how the community works with their code.

- A quicker, extra environment friendly community attracts extra customers and builders, which might improve demand for BNB and make it extra worthwhile over time.

Derivatives Positioning

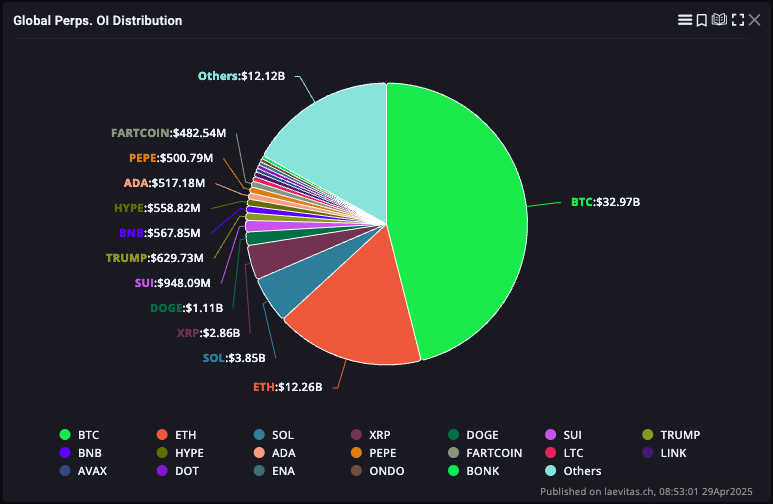

- Total open curiosity (OI) throughout perpetuals, choices and futures now stands at $122 billion globally, in line with information from Laevitas.

- SUI has seen a pointy surge in derivatives exercise, with its share of world perpetuals quantity peaking at 5.06% ($7.12 billion) on April 25.

- It has since sustained quantity dominance above 3.5%, considerably increased than its historic common of underneath 2%, suggesting renewed speculative urge for food pushed by latest venture bulletins.

- According to Coinalyze, the highest OI gainers previously 24 hours amongst tokens with market caps over $100 million are:

- SAFE: +123%

- RAY: +92%

- MOCA: +68%

Market Movements:

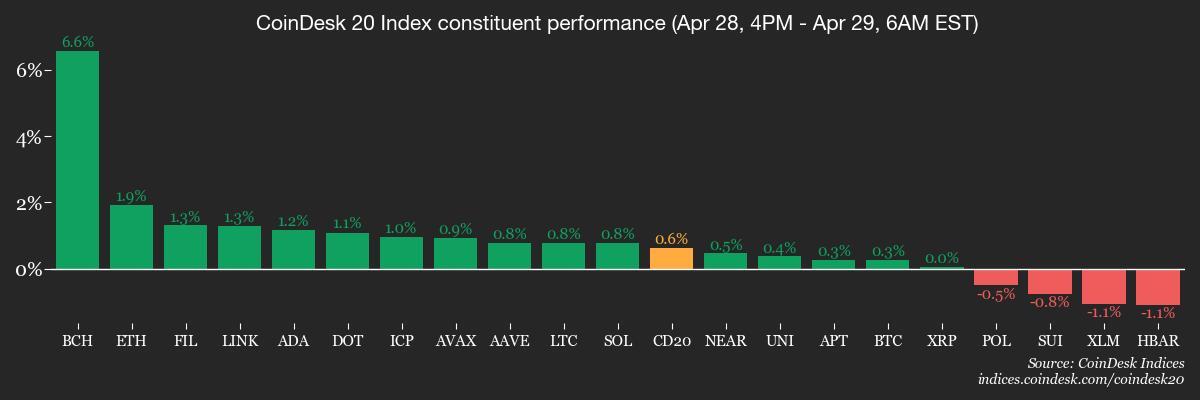

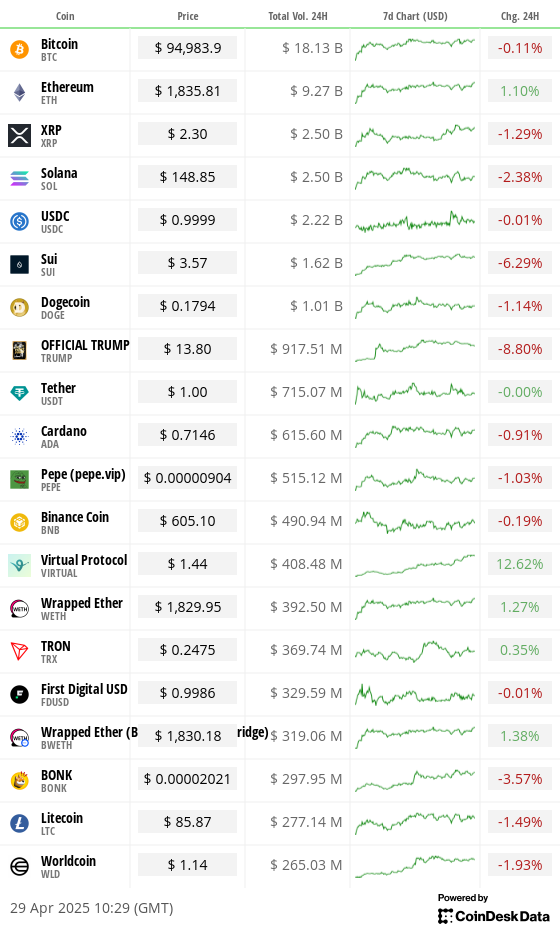

- BTC is up 0.43% from 4 p.m. ET Monday at $95,009.93 (24hrs: +0.33%)

- ETH is up 2.81% at $1,838.46 (24hrs: +1.9%)

- CoinDesk 20 is up 0.85% at 2,792.69 (24hrs: -0.08%)

- Ether CESR Composite Staking Rate is up 28 bps at 2.975%

- BTC funding fee is at 0.0005% (0.5749% annualized) on Binance

- DXY is up 0.27% at 99.28

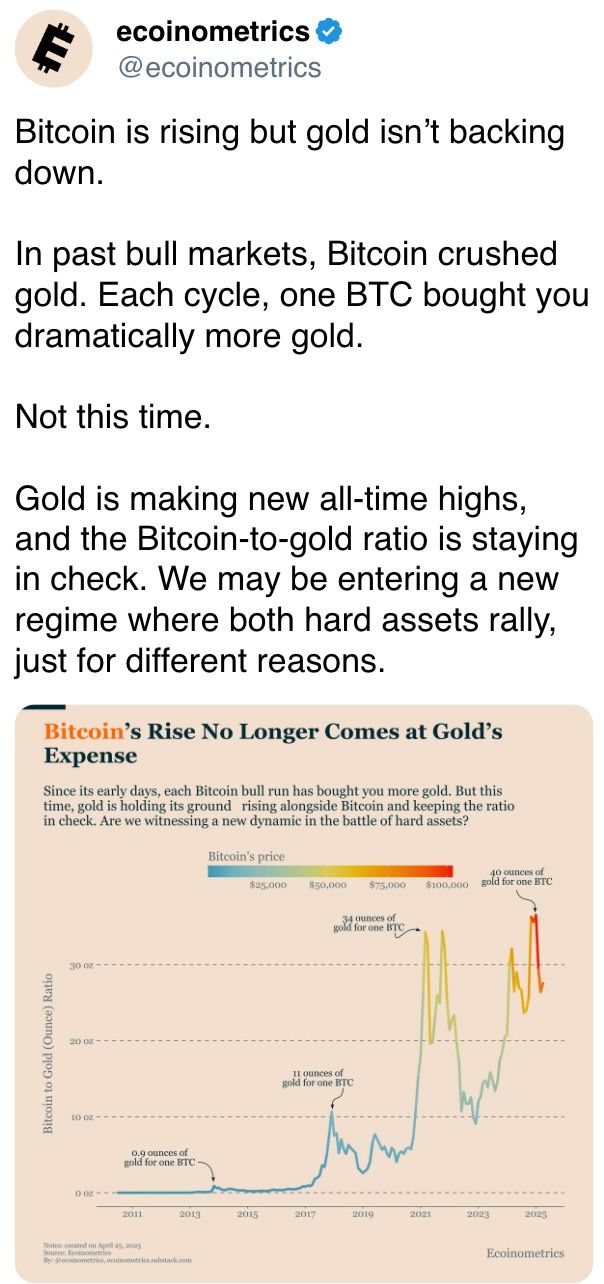

- Gold is down 1.11% at $3,306.08/oz

- Silver is up 0.41% at $33.28/oz

- Nikkei 225 closed +0.38% at 35,839.99

- Hang Seng closed +0.16% at 22,008.11

- FTSE is up 0.16% at 8,430.89

- Euro Stoxx 50 is unchanged at 5,168.63

- DJIA closed on Monday 0.28% at 40,227.59

- S&P 500 closed +0.06% at 5,528.75

- Nasdaq closed -0.1% at 17,336.13

- S&P/TSX Composite Index closed +0.36% at 24,798.59

- S&P 40 Latin America closed +0.74% at 2,549.44

- U.S. 10-year Treasury fee is down 6 bps at 4.21%

- E-mini S&P 500 futures are up 0.14% at 5,561.00

- E-mini Nasdaq-100 futures are up 0.15% at 190557.75

- E-mini Dow Jones Industrial Average Index futures are up 0.36% at 40,515.00

Bitcoin Stats:

- BTC Dominance: 64.24 (-0.24%)

- Ethereum to bitcoin ratio: 0.01928 (1.80%)

- Hashrate (seven-day transferring common): 842 EH/s

- Hashprice (spot): $48.7 PH/s

- Total Fees: 6.98 BTC / $651,628

- CME Futures Open Interest: 132, 750 BTC

- BTC priced in gold: 28.6 oz

- BTC vs gold market cap: 8.10%

Technical Analysis

- Ether (ETH) is displaying indicators of restoration after reclaiming the worth space (outlined by the 2 blue dotted strains), suggesting a return to its high-volume worth zone established because the October 2023 rally.

- The Point of Control (PoC) stays close to $2,200, serving as a significant magnet for worth motion and a essential bullish goal.

- ETH can also be approaching the 50-day exponential transferring common (EMA), a possible inflection level which will spark volatility.

- The degree is especially notable as a result of many altcoins have crushed ether to reclaim their 50-day EMAs.

- Importantly, worth motion has now damaged above the descending trendline stemming from the December 2024 excessive, a key structural shift favoring bullish momentum.

- Upside targets embrace:

- $2,104 to substantiate the next excessive

- $2,200 (PoC), volume-weighted focus

- $2,480 (200-day EMA), long-term resistance

- To preserve its bullish bias, ETH should maintain above the decrease boundary of the worth space (~$1,745), or threat a return to bearish sentiment.

Crypto Equities

- Strategy (MSTR): closed Monday at $369.25 (+0.15%), up 0.30% at $370.34 in pre-market

- Coinbase Global (COIN): closed at $205.27 (-2.08%), up 0.58% at $206.47

- Galaxy Digital Holdings (GLXY): closed at $21.21 (2.81%)

- MARA Holdings (MARA): closed at $14.01 (-2.03%)

- Riot Platforms (RIOT): closed at $7.63 (-1.8%), up 0.39% at $7.66

- Core Scientific (CORZ) closed at $8.24 (-0.84%), up 1.21% at $8.34

- CleanSpark (CLSK): closed at $8.57 (-4.88%), up 0.12% at $8.58

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $14.33 (-1.58%)

- Semler Scientific (SMLR): closed at $35.37 (-3.99%), up 1.78% at $36.00

- Exodus Movement (EXOD): closed at $42.18 (-7.30%), up 1.92% at $42.99

ETF Flows

Spot BTC ETFs:

- Daily web move: $591.2 million

- Cumulative web flows: $38.99 billion

- Total BTC holdings ~ 1.14 million

Spot ETH ETFs

- Daily web move: $64.1 million

- Cumulative web flows: $2.48 billion

- Total ETH holdings ~ 3.40 million

Source: Farside Investors

Overnight Flows

Chart of the Day

- BTC dominates derivatives, with $32.97B in open curiosity (OI), over 40% of the full and greater than double ETH’s $12.26B.

- Memecoins like DOGE, TRUMP, PEPE and FARTCOIN every exceed $480M in OI, outperforming many large-cap belongings, displaying the energy of memecoins inside derivatives positioning.

- ETH + SOL mixed ($16.11B) stay fall far in need of BTC’s OI, underscoring bitcoin’s continued derivatives supremacy.

While You Were Sleeping

- Bitcoin-Friendly Poilievre Loses Seat as Carney’s Liberals Win 2025 Election (CoinDesk): Conservative Leader Pierre Poilievre misplaced his Ottawa-area seat as Mark Carney’s Liberal Party received sufficient seats to type no less than a minority authorities.

- Canadian Dollar Slips as Liberals Head for Only Narrow Victory (Bloomberg): Prime Minister Mark Carney faces strain to ease Canada’s reliance on its southern neighbor because the foreign money stays delicate to commerce negotiations and U.S. tariff dangers.

- DOJ Seeks 20-Year Sentence for Celsius Founder Alex Mashinsky (CoinDesk): Mashinsky pleaded responsible to intentionally deceptive prospects in regards to the security of their deposits whereas manipulating the CEL token for private acquire. Sentencing is about for May 8.

- Russia Hopes Warmer Weather Will Boost Flagging Spring Offensive (The Wall Street Journal): Ukrainian forces have stalled Russia’s advances this spring, however analysts warn hotter climate will harden floor and thicken cowl, making future assaults tougher to repel.

- Gold Prices Drop as Tariff Concerns Ease; US Data in Focus (Reuters): Growing threat urge for food, supported by U.S. Treasury Secretary Scott Bessent’s assertion that a number of main buying and selling companions have made robust proposals, is decreasing demand for gold.

- EU Faces Trade War on Many Fronts (Financial Times): European Commission President Ursula von der Leyen’s technique is to barter with Trump, strengthen commerce with different nations, and decrease inside market limitations to assist EU exporters.

In the Ether

CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data Read More

CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data Read More