Markets, XMR, Monero, btc, Bitcoin, News Trading volumes for XMR zoomed from a median of $50 million on a 7-day rolling foundation to over $220 million prior to now 24 hours

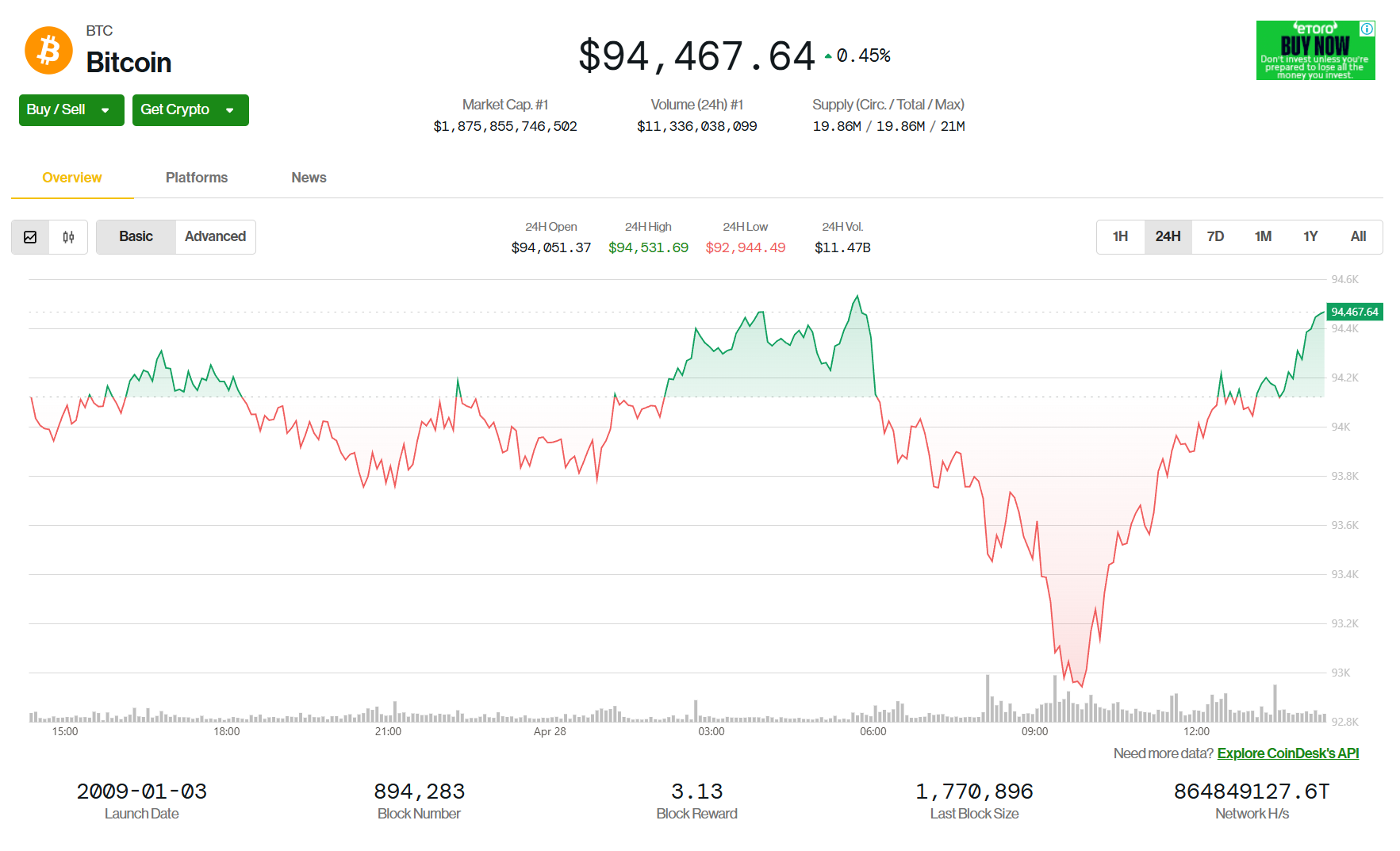

Crypto markets traded flat through the Asia morning hours, with bitcoin (BTC) buying and selling above $94,000 and the CoinDesk 20, a measure of the efficiency of the biggest cryptocurrencies flat.

XRP led majors positive aspects with a 4% transfer greater from the previous day, driven by a ProShares ETF approval that may see three futures-tracked merchandise go dwell on April 30. Cardano’s ADA, BNB Chain’s BNB and ether (ETH) confirmed strikes between 1-3%.

One exception to the comparatively dormant market has been privateness coin Monero (XMR), up greater than 40% prior to now 24 hours. It traded over $320 in Asian morning hours Monday, a stage final seen in May 2021.

Trading volumes zoomed from a median of $50 million on a 7-day rolling foundation to over $220 million prior to now 24 hours.

“There appears to be no clear catalyst behind $XMR’s recent rally,” Min Junng, a research analyst at Presto told CoinDesk in a Telegram message, Network activity remains consistent with typical levels, suggesting the move may be more speculative in nature.”

The privacy-centric token is predicated on the CryptoNotice protocol, which ensures that every one its transactions are unlinkable and untraceable.

Sentiment amongst merchants carries over from final week with a near-term bullish view intact however with a cautious perspective as macroeconomic headwinds stay.

“Bitcoin has maintained a relatively stable range above $92k as Trump’s administration soften tariff policies of the crypto industry,” Jupiter Zheng, Partner, Liquid Fund and Research, HashKey Capital, instructed CoinDesk in a Telegram message. “This crypto-friendly perspective can enhance Bitcoin and different cryptocurrencies to develop their very own market path, much less correlated with US equities, and allow extra progress and innovation within the business.”

Broader fairness markets confirmed blended actions on Monday. A regional gauge superior 0.6% whereas futures for the S&P 500 declined 0.6%, indicating a four-day US equities rally might snap. Gold pared final week’s positive aspects after a record-breaking rally. Hong Kong’s Hang Seng index was additionally flat as have been different main indices round Asia.

CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data Read More