Markets, Stablecoin, Citi, U.S. Treasurys, Regulation, News Stablecoin issuers may change into one of many high U.S. Treasury holders, surpassing main sovereign nations, the report projected.

Global financial institution Citi has predicted 2025 may very well be a attainable inflection level for blockchain adoption pushed by stablecoins, akin to the breakout yr synthetic intelligence (AI) had with fashionable utility ChatGPT.

“2025 has the potential to be blockchain’s ‘ChatGPT’ moment,” the financial institution’s analysts stated in a report printed earlier this week.

At the middle of the Citi’s projection are stablecoins, a category of cryptocurrencies pegged to conventional currencies just like the U.S. greenback. These tokens, led by Tether’s $145 billion USDT and Circle’s $60 billion USDC, have seen super development not too long ago and are more and more getting used for funds and remittances globally.

Citi sees the asset class probably rising to $1.6 trillion by 2030 in its base case from the present $230 billion, with the caveat that regulatory assist and institutional integration take maintain. In the financial institution’s extra optimistic situation, the market may balloon to $3.7 trillion, although lingering structural challenges may preserve the quantity nearer to $500 billion within the financial institution’s bear case.

A serious catalyst is the supportive regulatory stance within the U.S., with a current presidential government order directing the formation of a federal framework for digital belongings, the report stated. The readability round stablecoin guidelines may permit these tokens to be extra deeply embedded within the monetary system, providing quicker funds, improved transparency and extra environment friendly asset settlement.

“This could lead to greater adoption of blockchain-based money and spur other use cases, financial and beyond, in the U.S. private and public sector,” the authors famous.

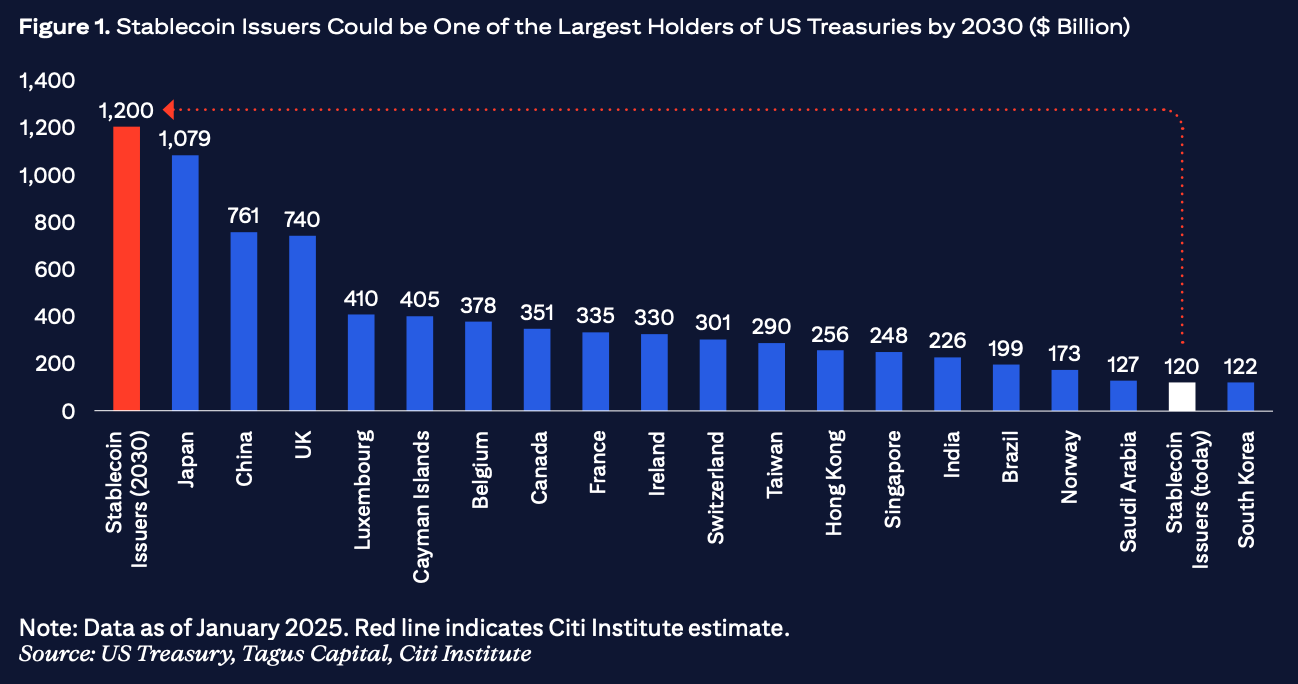

Stablecoin issuers to change into main U.S. Treasury holders

Stablecoins are anticipated to stay closely dollar-denominated sooner or later. The report anticipates that round 90% of stablecoins in circulation in 2030 will nonetheless be tied to the U.S. greenback, cementing its dominance.

This has main implications for the worldwide monetary system. Dollar stablecoin issuers may change into one of many largest consumers of U.S. Treasuries, assuming that rules push towards backing tokens with low-risk, extremely liquid conventional monetary belongings like authorities bonds. Citibank estimated issuers may maintain $1.2 trillion in U.S. authorities debt by the tip of the last decade, probably surpassing all main overseas sovereign holders.

Meanwhile, the central banks of nations in Europe and Asia will probably promote their very own digital currencies, or CBDCs, the report famous.

The report pointed to a number of dangers that might hamper the expansion. Stablecoins de-pegged practically 1,900 instances in 2023 alone, together with greater than 600 situations involving main tokens, the report’s authors wrote, citing Moody’s information.

In excessive instances, mass redemptions—like these following the collapse of Silicon Valley Bank (SVB) that consequently hit USDC—can disrupt crypto liquidity, pressure automated selloffs and ripple via monetary markets, the authors added.

CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data Read More