Crypto Daybook Americas, Crypto Daybook Americas, News Your day-ahead search for April 25, 2025

By Omkar Godbole (All occasions ET until indicated in any other case)

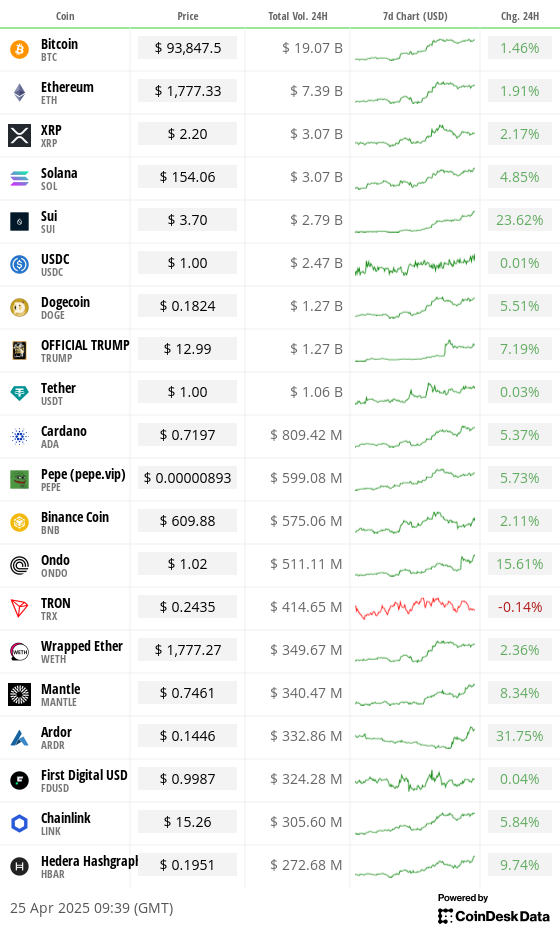

Bitcoin (BTC) is taking a breather close to $94,000, having dropped to $92,000 previously two days. The cryptocurrency chalked out a bullish breakout above key resistance early this week, shifting focus to the $100,000 degree and leaving main altcoins like XRP, ETH, SOL, ADA and DOGE behind.

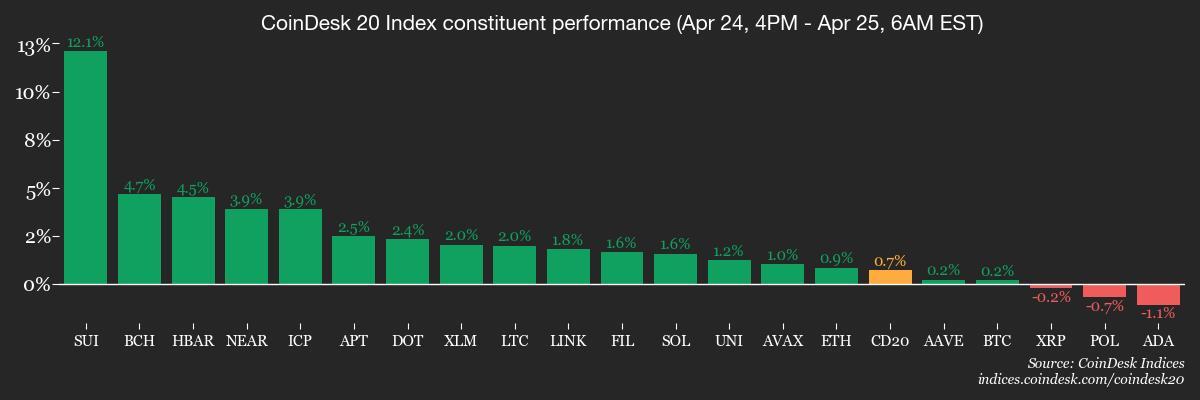

However, smaller cash like STX, SUI, ONDO and GRT put in double-digit features previously 24 hours, outperforming each BTC and the broader market: The CoinDesk 20 Index (CD20) has gained about 3%.

BTC’s $20,000 surge since April 7 has been underpinned by elevated on-chain accumulation by whales and vital inflows by way of spot ETFs, with the 11 U.S.-listed funds amassing nearly $1.5 billion in internet inflows over the previous three days, in keeping with Farside Investors.

Market features have been bolstered by coverage developments within the U.S. Late Thursday, the Federal Reserve lifted its restrictive crypto steerage, saying state member banks now not want to offer advance discover earlier than participating in crypto-related actions.

“Market internals currently suggest a consolidation phase — our base case projects accumulation between $90,000 and $95,000, with potential pullbacks to $87,000, ahead of a possible breakout toward $100,000 or more in the coming weeks,” mentioned Valentin Fournier, the lead analysis analyst at BRN.

QCP Capital echoed the sentiment, noting {that a} decisive catalyst is required to push costs above $100,000.

Later as we speak, the University of Michigan will publish its remaining survey-based inflation expectations report for April. President Donald Trump’s commerce battle has stoked Main Street inflation considerations, so the report is likely to point out a rise. The market, nonetheless, doubtless priced in these fears early this month and might be specializing in subsequent week’s U.S. jobs information.

“The next big chapter here will be whether all this volatility has hit real world decisions — especially in the U.S. jobs market. There is plenty of U.S. jobs data released next week and any deterioration here could trigger another round of dollar losses — albeit a more benign dollar decline on the view that the Federal Reserve would be riding to the rescue after all,” ING mentioned.

“In terms of Fed pricing, the market now seems comfortable to price the first cut in July — potentially once we all know whether the 90-day pause in Liberation Day tariffs is temporary or longer lasting,” it mentioned. Stay alert!

What to Watch

- Crypto:

- April 25, 1 p.m.: U.S. Securities and Exchange Commission (SEC) Crypto Task Force Roundtable on “Key Considerations for Crypto Custody“.

- April 28: Enjin Relaychain increases active validator slots to 25 from 15 to boost decentralization.

- April 29, 1:05 a.m.: BNB Chain (BNB) — BSC mainnet hardfork.

- April 30, 9:30 a.m.: ProShares expects its XRP ETF, providing publicity by way of futures and swap agreements, to start buying and selling on NYSE Arca.

- April 30, 10:03 a.m.: Gnosis Chain (GNO), an Ethereum sister chain, will activate the Pectra onerous fork on its mainnet at slot 21,405,696, epoch 1,337,856.

- Macro

- Day 5 of 6: World Bank (WB) and the International Monetary Fund (IMF) spring meetings in Washington.

- April 25, 8:30 a.m.: Statistics Canada releases (Final) February retail gross sales information.

- Retail Sales Ex Autos MoM Est. -0.4% vs. Prev. 0.2%

- Retail Sales MoM Est. -0.4% vs. Prev. -0.6%

- Retail Sales YoY Prev. 4.2%

- April 25, 10:00 a.m.: The University of Michigan releases (Final) April U.S. client sentiment information.

- Michigan Consumer Sentiment Est. 50.8 vs. Prev. 57

- April 28: Canadian federal election.

- Earnings (Estimates primarily based on FactSet information)

Token Events

- Governance votes & calls

- Lido DAO is voting to extend its delegate incentivization program (DIP) by way of This fall with a $225,000 LDO price range. Voting ends April 28.

- Uniswap DAO will vote on establishing a licensing and deployment framework for Uniswap v4 to speed up its adoption throughout a number of chains. The proposal grants the Uniswap Foundation a blanket exemption to deploy v4 on any DAO-approved chain and offers the Uniswap Accountability Committee authority to replace deployment information. Voting is April 24-30.

- April 30, 12 p.m.: Helium to host a community call meeting.

- Unlocks

- April 30: Optimism (OP) to unlock 1.89% of its circulating provide value $23.45 million.

- May 1: Sui (SUI) to unlock 2.28% of its circulating provide value $221.99 million.

- May 1: ZetaChain (ZETA) to unlock 5.67% of its circulating provide value $11.28 million.

- May 2: Ethena (ENA) to unlock 0.73% of its circulating provide value $13.69 million.

- May 7: Kaspa (KAS) to unlock 0.56% of its circulating provide value $13.91 million.

- May 9: Movement (MOVA) to unlock 2.04% of its circulating provide value $11.33 million.

- Token Launches

- May 2: Binance to delist Alpaca Finance (ALPACA), PlayDapp (PDA), Viberate (VIB) and Wing Finance (WING).

- May 5: Sonic (S) to be listed on Kraken.

Conferences:

CoinDesk’s Consensus is happening in Toronto on May 14-16. Use code DAYBOOK and save 15% on passes.

- April 26: Crypto Vision Conference 2025 (Manilla)

- April 26-27: Harvard Blockchain in Action Conference (Cambridge, Mass.)

- April 27: N Crypto Conference 2025 (Kyiv)

- April 27-30: Web Summit Rio 2025

- April 28-29: Blockchain Disrupt 2025 (Dubai)

- April 28-29: Staking Summit Dubai

- April 29: El Salvador Digital Assets Summit 2025 (San Salvador, El Salvador)

- April 29: IFGS 2025 (London)

- April 30-May 1: TOKEN2049 (Dubai)

Token Talk

By Shaurya Malwa

- Stablecoin provide on Solana hit a file $12.8 billion on Thursday, buoyed by Circle minting $1.75 billion of its USDC stablecoin within the current weeks.

- The minting alerts robust demand and liquidity progress in Solana’s ecosystem regardless of a market lull.

- Supply of Tether’s USDT on Tron crossed the $70 billion mark on Thursday.

- Rollup builder Initia’s new INIT tokens climbed to 92 cents after a Thursday issuance at an preliminary value of 60 cents. The token was airdropped to customers primarily based on their exercise on the Initia community.

- Content coin creation platform Zora’s ZORA dropped 17% regardless of being added to the Coinbase itemizing roadmap (which is traditionally bullish for tokens) after failing to grab demand amongst retail merchants.

Derivatives Positioning

- SUI, ONDO, UNI and HBAR are have proven probably the most progress in perpetual futures open curiosity previously 24 hours.

- Open curiosity in BTC and ETH futures has flatlined.

- Perpetual funding charges for many main tokens stay reasonably constructive, highlighting bullish sentiment.

- The CME bitcoin futures foundation nonetheless stays under 10%.

- In choices, merchants purchased ETH places by way of OTC platform Paradigm whereas the BTC name possibility at $95K dominated the move.

Market Movements

- BTC is up 0.23% from 4 p.m. ET Thursday at $93,701.46 (24hrs: +1.32%)

- ETH is up 0.62% at $1,774.26 (24hrs: +1.92%)

- CoinDesk 20 is up 0.45% at 2,750.46 (24hrs: +2.79%)

- Ether CESR Composite Staking Rate is up 1 bps at 3.13%

- BTC funding fee is at 0.0024% (2.6608% annualized) on Binance

- DXY is up 0.26% at 99.63

- Gold is up 0.9% at $3,304.78/oz

- Silver is down 0.45% at $33.38/oz

- Nikkei 225 closed +1.9% at 35,705.74

- Hang Seng closed +0.32% at 21,980.74

- FTSE is up 0.15% at 8,419.93

- Euro Stoxx 50 is up 0.68% at 5,149.61

- DJIA closed on Thursday +1.23% at 40,093.40

- S&P 500 closed +2.03% at 5,484.77

- Nasdaq closed +2.74% at 17,166.04

- S&P/TSX Composite Index closed +1.04% at 24,727.53

- S&P 40 Latin America closed +1.83% at 2,521.21

- U.S. 10-year Treasury fee is down 2 bps at 4.3%

- E-mini S&P 500 futures are up 0.24% at 5,524.75

- E-mini Nasdaq-100 futures are up 0.26% at 19,373.00

- E-mini Dow Jones Industrial Average Index futures are down 0.11% at 40,219.00

Bitcoin Stats:

- BTC Dominance: 64.18 (-0.37%)

- Ethereum to bitcoin ratio: 0.01902 (1.01%)

- Hashrate (seven-day transferring common): 815 EH/s

- Hashprice (spot): $48.25 PH/s

- Total Fees: 8.97 BTC / $834,273

- CME Futures Open Interest: 139,505 BTC

- BTC priced in gold: 28.1 oz

- BTC vs gold market cap: 7.98%

Technical Analysis

- Bitcoin layer-2 protocol Stacks’ native token, STX, has crossed above the Ichimoku cloud to counsel a bullish shift in momentum.

- The ascending 5- and 10-day easy transferring averages (SMAs) counsel the identical, with $1.05, the August 2024 low, as quick resistance.

Crypto Equities

- Strategy (MSTR): closed on Thursday at $350.34 (+1.33%), up 0.19% at $351 in pre-market

- Coinbase Global (COIN): closed at $203.87 (+4.66%), up 1.8% at $205.67

- Galaxy Digital Holdings (GLXY): closed at C$20.68 (+10.41%)

- MARA Holdings (MARA): closed at $14.01 (-0.85%), up 0.71% at $14.11

- Riot Platforms (RIOT): closed at $7.79 (+3.87%), unchanged in pre-market

- Core Scientific (CORZ): closed at $7.53 (+5.76%)

- CleanSpark (CLSK): closed at $8.86 (-0.11%), unchanged in pre-market

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $14.06 (+4.07%)

- Semler Scientific (SMLR): closed at $34.44 (+0.47%), up 2.47% at $35.29

- Exodus Movement (EXOD): closed at $45.21 (+2.54%), down 0.44% at $45.01

ETF Flows

Spot BTC ETFs:

- Daily internet move: $442 million

- Cumulative internet flows: $38.13 billion

- Total BTC holdings ~ 1.14 million

Spot ETH ETFs

- Daily internet move: $63.5million

- Cumulative internet flows: $2.32 billion

- Total ETH holdings ~ 3.32 million

Source: Farside Investors

Overnight Flows

Chart of the Day

- The variety of BTC held in wallets tied to centralized exchanges continues to slip, hitting the bottom in 5 years.

- “Historically, such declines have often preceded price increases, as shown in the chart,” CryptoRank mentioned.

While You Were Sleeping

- ARK Invest Raises 2030 Bitcoin Price Target to as High as $2.4M in Bullish Scenario (CoinDesk): ARK’s revised bitcoin outlook sees a 2030 bull-case value 60% above final yr’s estimate, with base and bear eventualities projecting $1.2 million and $500,000, respectively.

- Stacks’ STX Is Week’s Best Performer as Bitgo Link Seen Boosting Institutional Use (CoinDesk): BitGo opened the door for its clients to discover yield-generating alternatives on Stacks by integrating sBTC, an artificial by-product that represents bitcoin in a 1:1 ratio on the Stacks blockchain.

- Nvidia Continues to Keep Crypto at Arm’s Length (CoinDesk): A final-minute halt on a crypto announcement underscores how Nvidia nonetheless excludes blockchain initiatives from its flagship applications, regardless of continued outreach from the sector.

- China May Exempt Some U.S. Goods From Tariffs as Costs Rise (Bloomberg): China is reviewing tariff aid for choose U.S. imports, together with medical gadgets, ethane, industrial chemical compounds, semiconductor inputs and aircraft leases as officers reply to mounting stress from affected sectors.

- Ukraine May Have to Give Up Land for Peace – Kyiv Mayor Klitschko (BBC): Speaking hours after a Russian strike on Kyiv killed 12, Klitschko mentioned President Volodymyr Zelensky might settle for territorial concessions for short-term peace, although Ukrainians would by no means settle for Russian occupation.

- American Companies Shred Outlooks Over Tariff Uncertainty (The Wall Street Journal): Business leaders say shifting commerce levies stall hiring, blur earnings projections and postpone capital spending, forcing continuous forecast revisions throughout airways, producers and client manufacturers.

In the Ether

CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data Read More

CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data Read More