Markets, Scott Bessent, Bitcoin, China, Markets, News Wednesday’s crypto rally stalled as Bessent reiterated the difficulties in making a cope with China.

The crypto market’s rally stalled on Wednesday after U.S. Secretary of Treasury Scott Bessent reiterated {that a} correct commerce deal between Washington and Beijing would take years to ink out.

Bitcoin (BTC) is up 2.6% within the final 24 hours and 12.2% within the final seven days, buying and selling at $93,600 for the primary time for the reason that starting of March. The largest cryptocurrency was outperformed by massive swaths of the market, with the CoinDesk 20 — an index of the highest 20 cash, excluding stablecoins, memecoins and trade tokens — rose 4.2% within the final 24 hours. Sui (SUI) jumped 24% in that time frame, whereas Cardano’s ADA and Chainlink’s LINK each noticed 7% positive aspects.

Crypto shares, which opened sturdy, noticed their efficiency dampen because the day unfolded. Miners similar to Bitdeer (BTDR) and Core Scientific (CORZ) fell again from double-digit positive aspects, closing the day up roughly 4%. Coinbase (COIN) and Strategy (MSTR) are up 2.1% and 1.4%, respectively.

U.S. President Donald Trump gave the impression to be dialing down the stress on China in the previous few days, saying that tariffs on the Middle Kingdom would “come down substantially” on Tuesday. Bessent, nonetheless, stated on Wednesday that the White House had not made a unilateral provide to chop tariffs on China, and {that a} deal between the 2 nations would take two to 3 years to realize.

“A meaningful thaw in relations may not materialize until substantive news emerges from the upcoming Xi-Trump meeting,” stated Paul Howard, director at crypto buying and selling agency Wincent. Markets priced within the preliminary robust stances and tariff threats, which saved a lid on threat urge for food over the previous two months, he stated.

“History suggests that once the opening volleys pass, more constructive developments and easing volatility typically follow,” Howard stated, which may help threat belongings similar to crypto.

BTC ETF flows return

In an indication of renewed investor demand, U.S.-listed spot BTC exchange-traded funds (ETFs) have recorded practically $1.3 billion in internet inflows this week up to now, in response to SoSoValue data. The funds booked their strongest day on Tuesday since mid-January.

“This [crypto] rally isn’t retail-driven hype—it’s institutional capital positioning ahead of what many see as a new monetary and political regime,” stated Matt Mena, crypto analysis strategist at digital asset supervisor 21Shares. “More investors are turning to it not just as a speculative asset, but as a flight to safety amid rising uncertainty across traditional markets.”

Despite the sturdy value motion, Mena added that BTC is going through resistance at across the $95,000 degree within the quick time period and will pull again.

Bitcoin to catch as much as gold

Gold, in the meantime, is down 2.5% in the present day, buying and selling at $3,290 per ounce after a run that noticed the dear metallic rise 35% to $3,500 within the span of 4 months, presumably hinting that the market may very well be transferring previous peak uncertainty.

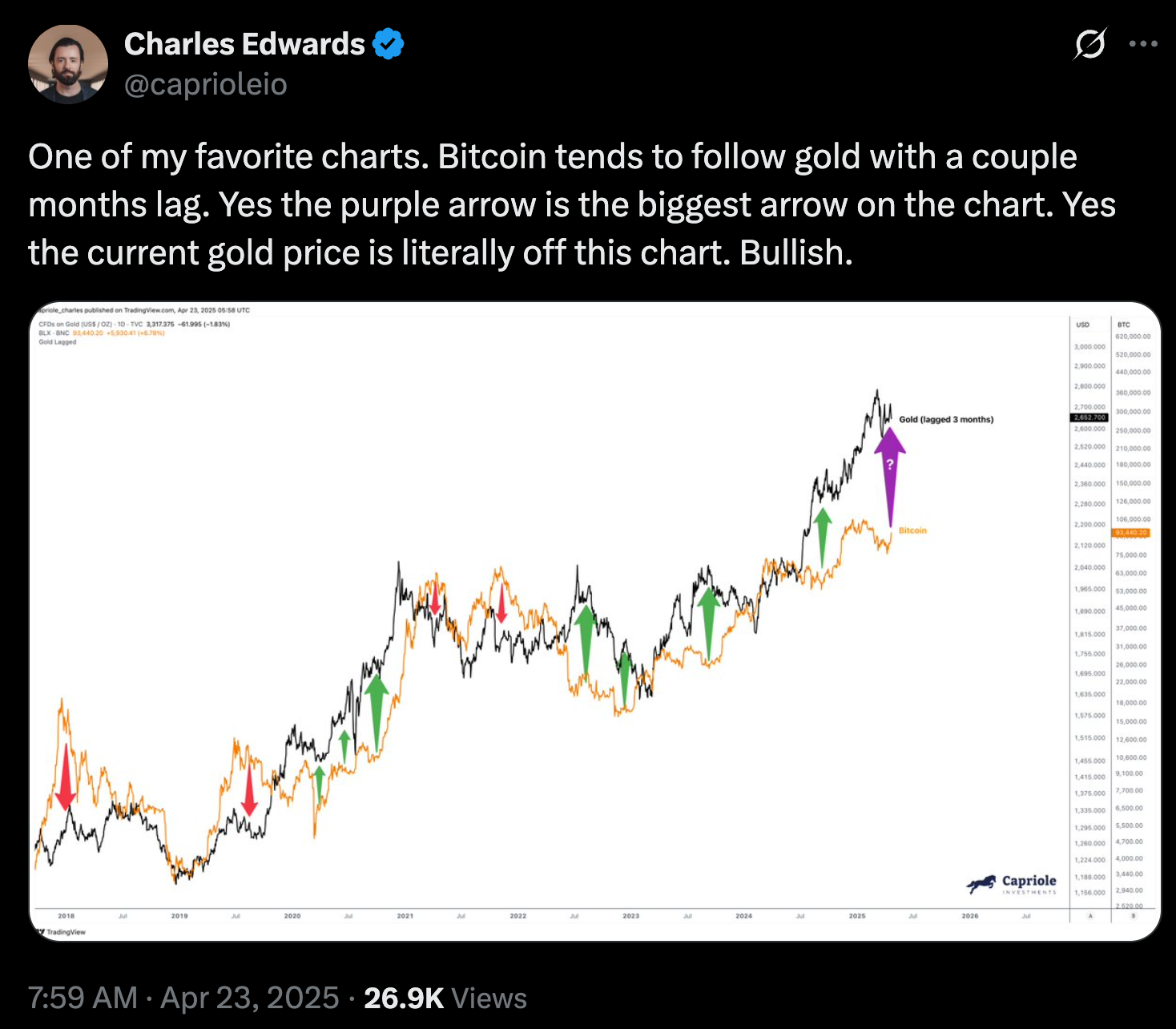

Gold stalling after an enormous rally may bode nicely for bitcoin, stated Charles Edwards, founding father of bitcoin-focused hedge fund Capriole Investments. Posting a chart on X on Wednesday, he famous that BTC traditionally adopted gold’s positive aspects with a few-month lag.

“Bitcoin is showing significant strength,” Edwards stated in an X post. “We have decoupled from risk assets and the market is now starting to front-run the fact that bitcoin is digital gold. If risk assets were to decay further from here, BTC is the ultimate QE [quantitative easing] hedge.”

Read extra: Bitcoin Breaches ‘Ichimoku Cloud’ to Flash Bullish Signal While Altcoins Lag: Technical Analysis

CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data Read More